Land Your Dream Private Credit Job: 5 Crucial Do's And Don'ts

Table of Contents

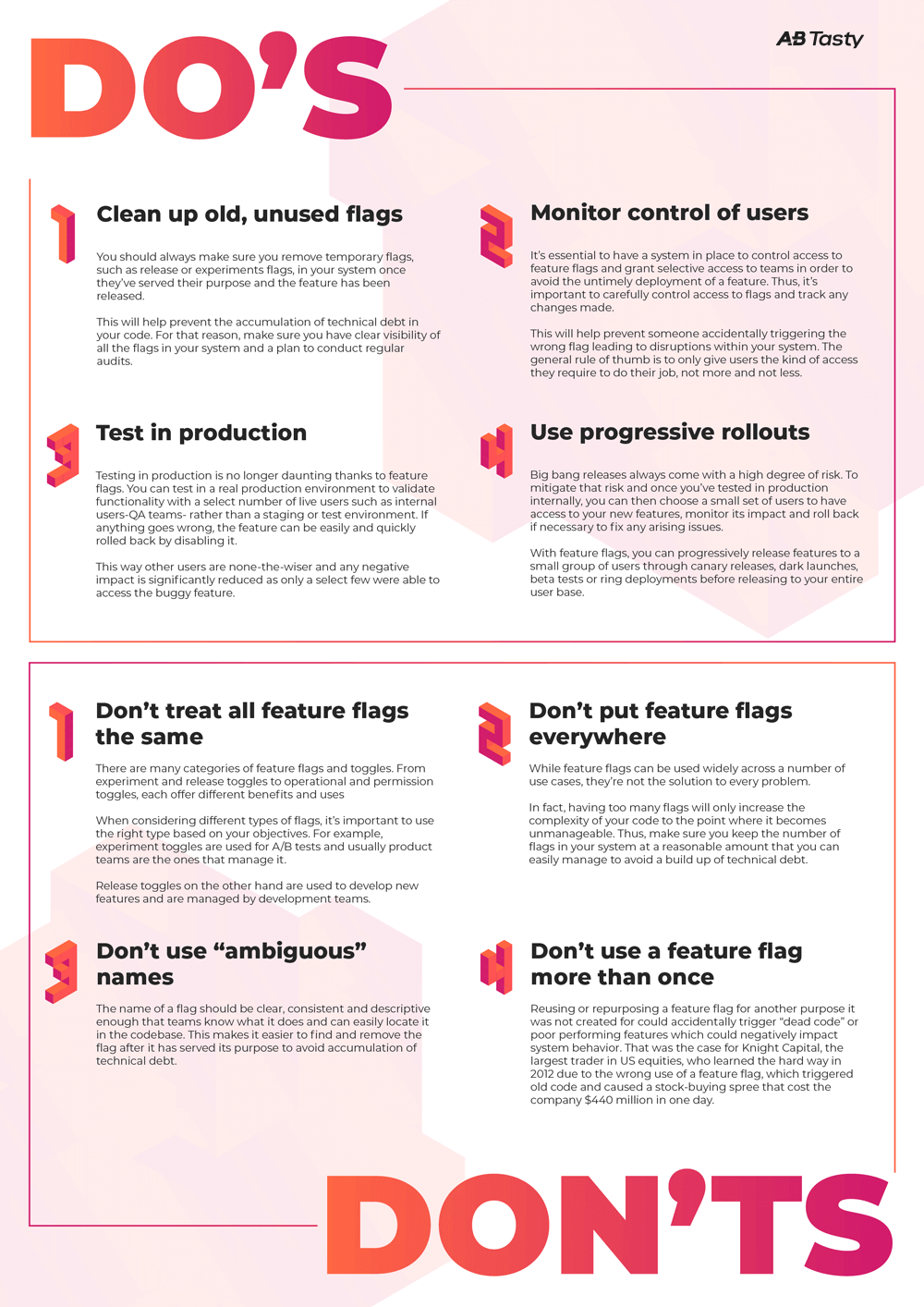

Do's:

Do Your Research: Understand the Private Credit Landscape.

Thoroughly researching different private credit firms is the first step to landing your dream job. The private credit market encompasses a diverse range of players, each with unique investment strategies and target markets.

- Explore Different Firm Types: Research various private credit firms, including hedge funds specializing in distressed debt, credit funds focused on middle-market lending, and direct lenders providing financing to specific sectors.

- Analyze Investment Strategies: Understand their investment strategies – are they focused on senior secured debt, mezzanine financing, or equity co-investments? What are their typical deal sizes and investment horizons?

- Target Market Research: Identify the industries and types of companies each firm targets. This will help you tailor your resume and cover letter to demonstrate relevant experience.

- Cultural Fit: Go beyond financial performance. Research firm culture using sites like Glassdoor and LinkedIn to assess whether the company's values align with your own.

- LinkedIn Deep Dive: Use LinkedIn to research specific individuals in your target roles and firms. Analyze their career paths and the types of projects they've worked on.

Keywords: Private credit firms, investment strategies, alternative lending, direct lending, credit fund, hedge fund, distressed debt, mezzanine financing, senior secured debt.

Craft a Compelling Resume and Cover Letter Highlighting Relevant Skills.

Your resume and cover letter are your first impression. They must showcase your skills and experience in a way that resonates with hiring managers in the private credit industry.

- Tailoring is Key: Don't use a generic resume. Tailor each application to the specific job description, highlighting the skills and experience most relevant to that particular role.

- Quantify Your Accomplishments: Instead of simply stating your responsibilities, quantify your achievements. For example, "Increased portfolio profitability by 15% through strategic asset allocation" is far more impactful than "Managed portfolio assets."

- Keyword Optimization: Use keywords from the job description throughout your resume and cover letter. This helps Applicant Tracking Systems (ATS) identify your application as a potential match.

- Showcase Relevant Experience: Highlight experience in financial modeling, due diligence, credit analysis, underwriting, portfolio management, and any other relevant skills.

- Strong Opening: Your cover letter should begin with a compelling statement that grabs the reader's attention and clearly states your interest in the specific role and firm.

Keywords: Resume, cover letter, financial modeling, credit analysis, due diligence, underwriting, portfolio management, Applicant Tracking Systems (ATS).

Network Strategically to Expand Your Private Credit Connections.

Networking is crucial in the private credit industry. Building relationships can open doors to unadvertised opportunities.

- Industry Events: Attend industry conferences, seminars, and networking events to meet professionals in private credit.

- Leverage LinkedIn: Use LinkedIn to connect with professionals in private credit, join relevant groups, and participate in discussions.

- Informational Interviews: Reach out to people working in private credit for informational interviews. These conversations can provide valuable insights and potentially lead to job opportunities.

- Recruiters: Build relationships with recruiters specializing in private credit placements. They often have access to unadvertised jobs.

- Alumni Networks: If applicable, leverage your alumni network to connect with professionals who work in private credit.

Keywords: Networking, private credit conferences, LinkedIn, informational interviews, recruiters.

Ace the Interview by Demonstrating Your Private Credit Expertise.

The interview is your chance to showcase your knowledge and personality. Thorough preparation is essential.

- Behavioral Questions (STAR Method): Prepare for behavioral questions using the STAR method (Situation, Task, Action, Result). This structured approach helps you provide concise and impactful answers.

- Technical Proficiency: Practice technical questions related to financial modeling, credit analysis, valuation, and different credit structures (e.g., senior secured, mezzanine, subordinated).

- Firm and Interviewer Research: Research the interviewers and the firm thoroughly. Understand their investment strategy, recent transactions, and the overall market landscape.

- Enthusiasm and Goals: Demonstrate your genuine passion for private credit and articulate your long-term career goals within the industry.

Keywords: Interview preparation, STAR method, financial modeling, credit analysis, valuation, credit structures.

Follow Up Professionally and Maintain Consistent Communication.

Following up after interviews is crucial. It demonstrates your interest and professionalism.

- Thank-You Notes: Send a personalized thank-you note to each interviewer within 24 hours of the interview.

- Appropriate Follow Up: Follow up appropriately with recruiters and hiring managers, but avoid being overly persistent.

- Professionalism: Maintain a professional and courteous demeanor throughout the entire process.

Keywords: Follow up, thank-you note, professional communication.

Don'ts:

Don't Neglect the Fundamentals of Finance and Credit Analysis.

A strong foundation in finance and accounting is non-negotiable. Mastering credit analysis is crucial for success in private credit.

- Finance and Accounting: Ensure you possess a strong understanding of financial statements, accounting principles, and valuation methodologies.

- Credit Analysis Techniques: Develop mastery of credit analysis techniques, including ratio analysis, cash flow analysis, and financial modeling.

- Industry Knowledge: Stay updated on industry trends, regulatory changes, and economic factors that impact private credit markets.

Keywords: Finance, accounting, credit analysis, financial modeling.

Don't Underestimate the Importance of Soft Skills.

Technical skills are important, but soft skills are equally crucial for success in private credit.

- Communication: Excellent written and verbal communication skills are essential for interacting with clients, colleagues, and investors.

- Teamwork and Collaboration: Private credit involves working collaboratively with team members, so strong teamwork skills are vital.

- Professionalism and Work Ethic: Demonstrate professionalism, a strong work ethic, and a commitment to excellence.

Keywords: Communication, interpersonal skills, teamwork, professionalism.

Don't Rush the Process or Settle for a Subpar Opportunity.

Finding the right private credit job takes time and patience. Don't settle for a role that doesn't align with your career goals.

- Patience and Persistence: Be patient and persistent in your job search. The ideal opportunity may not come immediately.

- Careful Evaluation: Evaluate each opportunity carefully, considering not only the compensation but also the firm's culture, growth potential, and long-term career prospects.

- Alignment with Goals: Don't accept a position that doesn't align with your aspirations and career trajectory.

Keywords: Job search, career goals, patience.

Don't Neglect Your Online Presence (LinkedIn Profile).

Your LinkedIn profile is often the first point of contact for potential employers. Make sure it represents you professionally.

- Professional Profile: Maintain a professional and updated LinkedIn profile that accurately reflects your skills and experience.

- Keyword Optimization: Use relevant keywords from the private credit industry to optimize your profile for searches.

- Recommendations: Request recommendations from former supervisors or colleagues to strengthen your profile's credibility.

Keywords: LinkedIn profile, online presence.

Don't Underprepare for Technical Questions.

Be ready to demonstrate your technical skills during the interview.

- Financial Modeling Practice: Practice financial modeling and valuation exercises using real-world case studies.

- Credit Metrics and Ratios: Understand various credit metrics and ratios (e.g., leverage ratios, coverage ratios, default probabilities).

- Credit Structures: Demonstrate a thorough understanding of different credit structures and their implications.

Keywords: Financial modeling, valuation, credit metrics, credit ratios, credit structures.

Conclusion:

Landing your dream private credit job requires dedication, preparation, and a strategic approach. By following these do's and don'ts, you'll significantly increase your chances of success. Remember to research thoroughly, network effectively, and present yourself confidently during the interview process. Don't settle for anything less than the perfect private credit job that aligns with your career ambitions. Start implementing these strategies today and begin your journey to securing your ideal private credit position!

Featured Posts

-

The Military Base At The Heart Of Us China Rivalry

Apr 26, 2025

The Military Base At The Heart Of Us China Rivalry

Apr 26, 2025 -

Mark Zuckerbergs Challenges In A Trump Led America

Apr 26, 2025

Mark Zuckerbergs Challenges In A Trump Led America

Apr 26, 2025 -

Saving Harvard A Conservative Academics Proposal

Apr 26, 2025

Saving Harvard A Conservative Academics Proposal

Apr 26, 2025 -

70 Million Hit Auto Carriers Projected Losses From Us Port Fees

Apr 26, 2025

70 Million Hit Auto Carriers Projected Losses From Us Port Fees

Apr 26, 2025 -

7 Fresh And Exciting Orlando Restaurants To Explore In 2025

Apr 26, 2025

7 Fresh And Exciting Orlando Restaurants To Explore In 2025

Apr 26, 2025

Latest Posts

-

Laid Off Federal Workers Finding State And Local Employment

Apr 28, 2025

Laid Off Federal Workers Finding State And Local Employment

Apr 28, 2025 -

Us Citizen Age 2 Faces Deportation Federal Judge Hearing Scheduled

Apr 28, 2025

Us Citizen Age 2 Faces Deportation Federal Judge Hearing Scheduled

Apr 28, 2025 -

Federal Judge To Hear Case Of 2 Year Old Us Citizens Deportation

Apr 28, 2025

Federal Judge To Hear Case Of 2 Year Old Us Citizens Deportation

Apr 28, 2025 -

Anchor Brewing Company Shuts Down After 127 Years Of Brewing

Apr 28, 2025

Anchor Brewing Company Shuts Down After 127 Years Of Brewing

Apr 28, 2025 -

After 127 Years Anchor Brewing Company Announces Closure

Apr 28, 2025

After 127 Years Anchor Brewing Company Announces Closure

Apr 28, 2025