Last Week's CoreWeave (CRWV) Stock Price Movement: A Detailed Look

Table of Contents

Factors Influencing Last Week's CRWV Stock Price Changes

Several factors likely influenced last week's CoreWeave (CRWV) stock price changes. Understanding these contributing elements is crucial for assessing future CRWV stock volatility and market performance. These include:

-

Analyst Ratings: Several reputable financial analysts issued rating updates on CoreWeave last week. For instance, [Analyst Firm A] upgraded their rating from "Hold" to "Buy," citing [reason for upgrade – e.g., strong Q3 earnings projections and positive market sentiment within the cloud computing sector]. Conversely, [Analyst Firm B] maintained a "Sell" rating, expressing concerns about [reason for maintaining sell rating – e.g., increased competition and potential market saturation]. These differing opinions likely impacted investor sentiment and contributed to CRWV stock fluctuations. [Link to Analyst Report 1] [Link to Analyst Report 2]

-

Market-wide Tech Sector Correction: The broader technology sector experienced a slight downturn last week, potentially impacting CRWV stock performance. A general negative market sentiment often affects even strong-performing companies like CoreWeave. [Link to relevant market analysis]

-

Increased Institutional Investment: News broke that a major institutional investor increased its stake in CRWV. This influx of institutional capital could have driven demand and supported a temporary price increase. [Link to news source if available]

Technical Analysis of CRWV Stock Price Movement

Analyzing the technical aspects of the CRWV stock price movement provides further insights into the price fluctuations.

Chart Patterns and Indicators

The daily CRWV chart showed a period of consolidation followed by a significant upward move. The Relative Strength Index (RSI) showed the stock was oversold before the price surge, suggesting a potential reversal. The Moving Average Convergence Divergence (MACD) indicator also displayed a bullish crossover during this period, further supporting the upward price movement. [Insert chart showing RSI, MACD and price action]. <br> Alt text for image: CRWV daily chart showing RSI, MACD, and price action indicating a potential bullish reversal.

Support and Resistance Levels

The CRWV stock price encountered significant support around $[Support Level], which prevented a more substantial decline. Conversely, resistance was met at $[Resistance Level], temporarily capping further price appreciation. [Insert chart showing support and resistance levels]. <br> Alt text for image: CRWV daily chart showing key support and resistance levels.

Sentiment Analysis and Investor Behavior

Understanding investor sentiment and behavior is vital for interpreting CRWV stock fluctuations.

Social Media Sentiment

Social media sentiment regarding CRWV was mixed last week. While some positive comments highlighted the company's growth potential and recent partnerships, others expressed concerns over the competitive landscape. A sentiment analysis of Twitter and StockTwits reveals a slight positive bias overall, but the sentiment was highly volatile, reflecting the price fluctuations.

News Media Coverage

News coverage of CoreWeave last week was generally positive, focusing on the company's technological advancements and partnerships. However, some articles also addressed the challenges faced by the cloud computing industry, leading to a balanced overall media portrayal of CRWV.

Trading Volume

Trading volume for CRWV increased significantly during periods of price volatility, suggesting a heightened level of investor activity and interest. High volume alongside price increases typically indicates strong buying pressure.

Comparison with Competitors and Market Trends

Compared to its competitors in the cloud computing sector, CoreWeave's performance last week was relatively strong. While some competitors experienced similar price drops due to the general tech sector correction, CRWV's recovery was faster and more pronounced. [Include data comparing CRWV’s performance to its main competitors]. This suggests that investor confidence in CoreWeave’s future growth prospects remains strong, even amidst market headwinds. Furthermore, the overall cloud computing market exhibited a period of consolidation last week, which may have influenced CRWV's price movement.

Conclusion: Key Takeaways and Call to Action

Last week's CoreWeave (CRWV) stock price movement was influenced by a combination of factors including analyst ratings, broader market trends, and positive institutional investment. Technical analysis revealed a period of consolidation followed by a strong upward move, supported by bullish indicators. Sentiment analysis showed a generally positive but volatile investor outlook. Comparing CRWV's performance with competitors and the overall market suggests a relatively robust position for the company within the cloud computing sector.

Stay informed about future CoreWeave (CRWV) stock price fluctuations by subscribing to our newsletter! We will continue to provide in-depth analysis on CoreWeave (CRWV) stock price movement and related topics.

Featured Posts

-

Tuerkiye Italya Askeri Isbirligi Nato Plani Detaylari

May 22, 2025

Tuerkiye Italya Askeri Isbirligi Nato Plani Detaylari

May 22, 2025 -

Solve Wordle 1384 April 3 2025 Hints Clues And The Answer

May 22, 2025

Solve Wordle 1384 April 3 2025 Hints Clues And The Answer

May 22, 2025 -

Wyoming Otter Management A Pivotal Shift In Conservation

May 22, 2025

Wyoming Otter Management A Pivotal Shift In Conservation

May 22, 2025 -

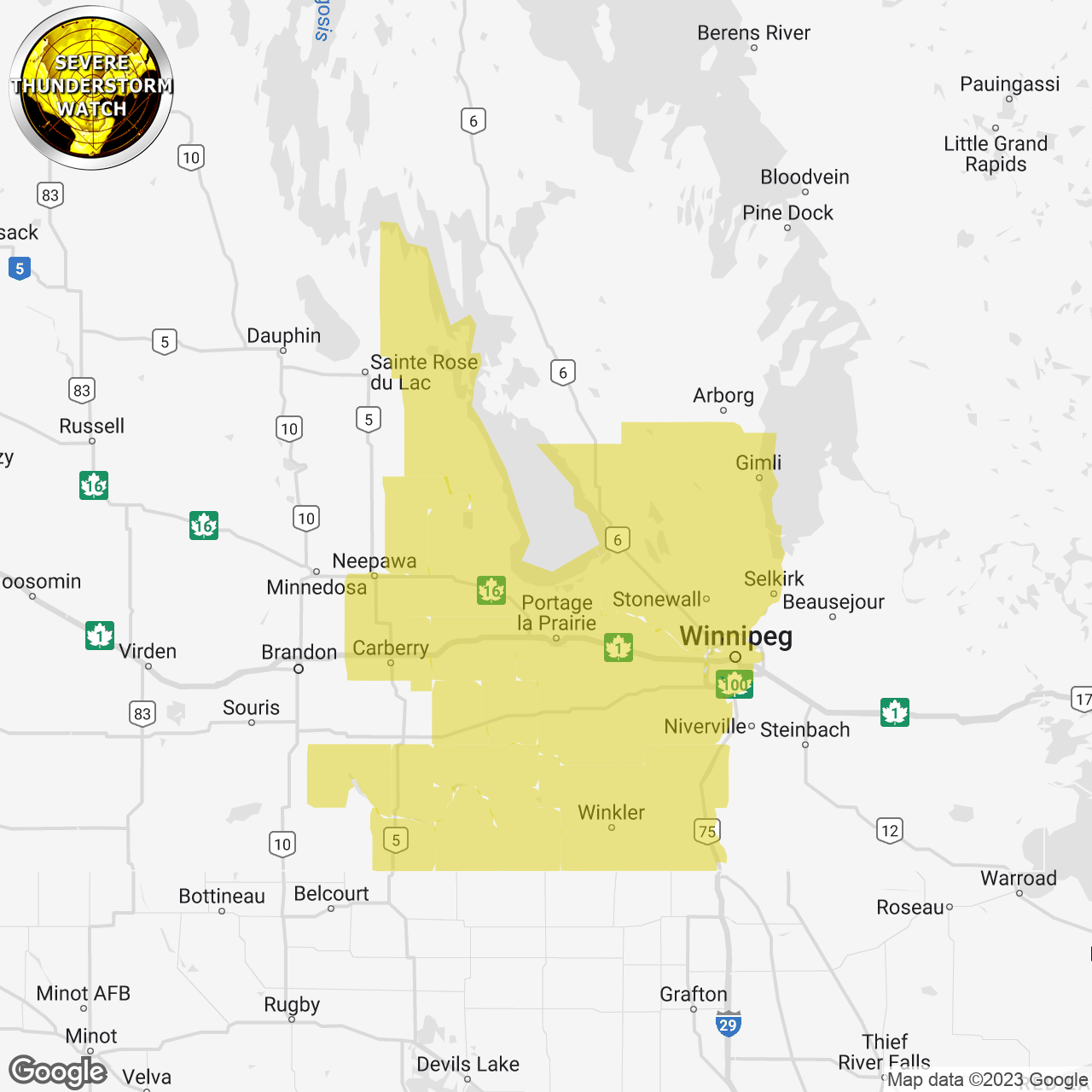

Severe Thunderstorm Watch South Central Pennsylvania

May 22, 2025

Severe Thunderstorm Watch South Central Pennsylvania

May 22, 2025 -

600 Year Old Chinese Tower Partially Collapses Tourists Scramble To Safety

May 22, 2025

600 Year Old Chinese Tower Partially Collapses Tourists Scramble To Safety

May 22, 2025

Latest Posts

-

What The Steelers Schedule Release Means Key Takeaways And Implications

May 22, 2025

What The Steelers Schedule Release Means Key Takeaways And Implications

May 22, 2025 -

Steelers Quarterback Needs Exploring A Trade From The Nfc

May 22, 2025

Steelers Quarterback Needs Exploring A Trade From The Nfc

May 22, 2025 -

Decoding The Steelers 2024 Schedule Important Takeaways For Fans

May 22, 2025

Decoding The Steelers 2024 Schedule Important Takeaways For Fans

May 22, 2025 -

Should The Steelers Make A Shocking Qb Trade Analyzing The Nfc Options

May 22, 2025

Should The Steelers Make A Shocking Qb Trade Analyzing The Nfc Options

May 22, 2025 -

Analyzing The Pittsburgh Steelers Interest In Nfl Draft Quarterbacks

May 22, 2025

Analyzing The Pittsburgh Steelers Interest In Nfl Draft Quarterbacks

May 22, 2025