Latest Canadian Employment Figures: Rosenberg Predicts BOC Rate Action

Table of Contents

Analysis of the Latest Canadian Employment Report

The July Canadian employment report painted a mixed picture of the nation's labor market. While the headline number—a significant net addition of 150,000 jobs—was undeniably positive, a closer examination reveals nuances that complicate the picture.

Job Growth Numbers

- Canadian Employment Rate: The unemployment rate dipped to 5.5%, a slight decrease from the previous month's 5.6%. This reflects strong job creation across various sectors.

- Job Creation: The increase in employment wasn't evenly distributed. The service sector experienced particularly robust growth, fueled by gains in hospitality and retail. Conversely, the manufacturing sector saw a slight decline.

- Unemployment Figures: While the headline number is encouraging, the participation rate (discussed below) offers additional context. Comparing July's figures to the previous year shows a solid increase in overall employment, highlighting continued growth.

Wage Growth and Inflation

The strong job growth has fueled concerns about wage inflation. Increased competition for employees is driving up wages, adding to inflationary pressure.

- Wage Inflation: Average hourly earnings rose by 0.5% in July, contributing to persistent inflation concerns within the BOC. This signifies a potential upward pressure on consumer prices.

- Inflationary Pressure: The combination of rising wages and already elevated consumer prices poses a significant challenge for the BOC in its efforts to maintain price stability.

- Real Wages: Despite nominal wage growth, real wages (adjusted for inflation) may remain stagnant or even decline, potentially impacting consumer spending in the long term.

Participation Rate

The labor force participation rate remained relatively stable in July, hovering around 65.2%. However, understanding this rate's implications is crucial.

- Labor Force Participation: A stable participation rate, in conjunction with strong job growth, suggests a healthy and dynamic labor market.

- Employment Participation Rate: While stable, any significant shifts in participation rate would offer further insight into the underlying health of the Canadian economy. For example, a rise might suggest increased confidence and job seeking.

- Potential Causes: Several factors influence participation rates, including demographics, educational attainment, and government policies.

Rosenberg's Predictions and Market Reaction

David Rosenberg, a renowned economist and market strategist, has voiced his concerns about the implications of the latest employment data. His predictions have significantly influenced market sentiment.

Rosenberg's Stance on Interest Rates

Rosenberg believes the BOC will likely maintain its current interest rate policy, or possibly even implement a further rate hike, due to persistent inflationary pressures fueled by strong employment growth.

- Rosenberg Prediction: He anticipates that the BOC will prioritize combating inflation, even at the risk of potentially slowing economic growth.

- Bank of Canada Interest Rate: His prediction is based on his analysis of the inflation figures and his belief that wage growth is unsustainable in the long term.

- Monetary Policy: Rosenberg suggests the BOC’s monetary policy will focus on cooling down the economy to tame inflation.

Market Response to Rosenberg's Analysis

Rosenberg's analysis has generated a mixed reaction in the market.

- Market Reaction: The Canadian dollar initially strengthened slightly following the employment report, but this was somewhat muted by Rosenberg’s cautious assessment.

- Canadian Dollar: The currency's value is often influenced by interest rate expectations. Higher rates generally attract foreign investment, strengthening the dollar.

- Bond Yields: Bond yields have fluctuated, reflecting investor uncertainty about the BOC's next move.

- Stock Market: The stock market reacted cautiously, reflecting concerns about the potential impact of further interest rate hikes on corporate profitability.

Alternative Perspectives

Not all economists share Rosenberg's pessimistic view. Some believe that the strong employment figures signal underlying economic strength that can withstand further interest rate increases.

- Economic Forecast: Other experts point to signs of easing inflationary pressures in some sectors as a reason for a more moderate approach by the BOC.

- Expert Opinion: This divergence in expert opinion highlights the uncertainty surrounding the BOC's future decisions.

Implications for the Canadian Economy

The BOC's response to the latest employment figures will have significant repercussions for the Canadian economy.

Impact on Consumer Spending

Higher interest rates could dampen consumer confidence and reduce spending, potentially slowing economic growth.

- Consumer Spending: Increased borrowing costs can make large purchases like homes and vehicles less affordable.

- Consumer Confidence: Uncertainty about future interest rate hikes can also lead consumers to delay purchases.

- Economic Growth: A decrease in consumer spending can have a ripple effect throughout the economy, impacting various sectors.

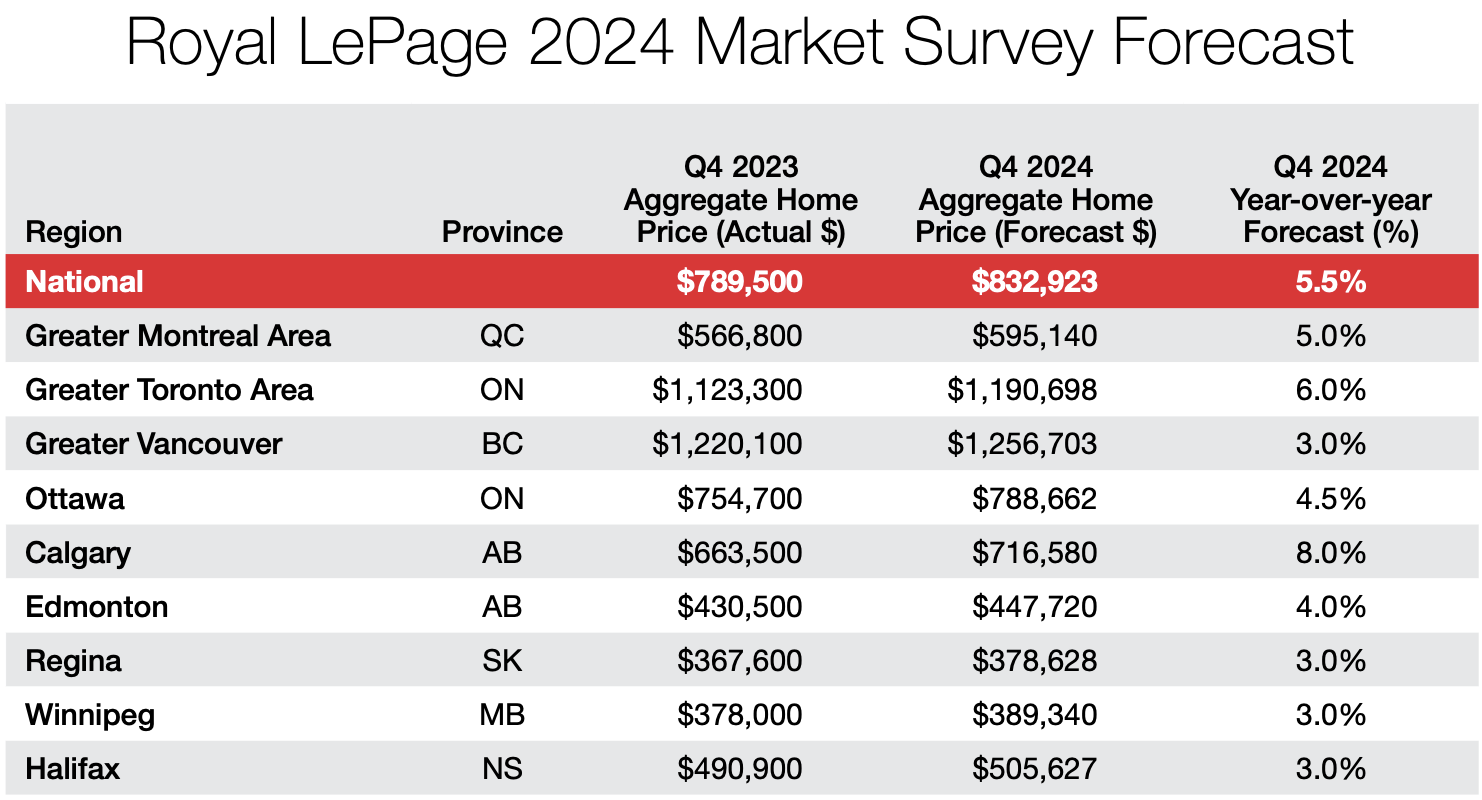

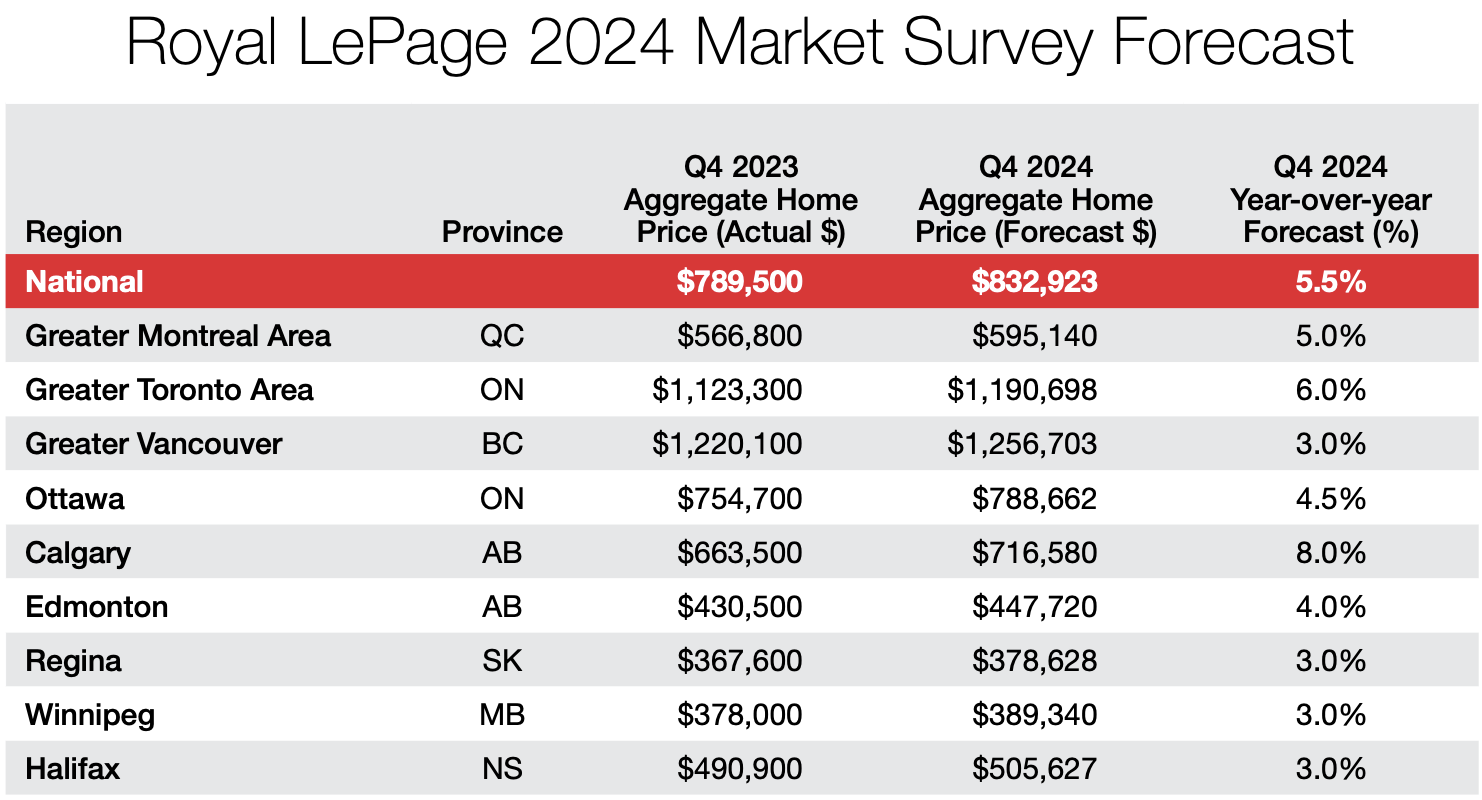

Housing Market Impact

The Canadian housing market is particularly vulnerable to interest rate changes.

- Housing Market: Higher mortgage rates make it more expensive to purchase a home, reducing demand.

- Mortgage Rates: Rising rates can lead to a decline in housing prices and potentially a correction in the overheated market.

- Real Estate: The real estate sector is likely to experience slower growth, if not a contraction.

Long-Term Economic Outlook

The long-term economic outlook for Canada depends on how effectively the BOC balances inflation control with maintaining economic growth.

- Economic Outlook: A successful navigation of this delicate balance will contribute to sustained, healthy growth.

- Long-Term Growth: However, a miscalculation could result in a recession or prolonged period of slow economic expansion.

Conclusion: Latest Canadian Employment Figures and the BOC's Next Move

The latest Canadian employment figures present a complex picture, with strong job growth juxtaposed against persistent inflationary pressures. David Rosenberg's prediction of a cautious approach by the BOC, potentially including further rate hikes, reflects a concern that inflation remains a significant threat. The market reacted with cautious optimism, reflecting uncertainty about the future path of interest rates and their impact on the Canadian economy. The BOC's next move will significantly impact consumer spending, the housing market, and the overall long-term economic outlook. Stay informed about future Canadian employment figures and BOC announcements by following updates on the latest Canadian employment figures and related economic news. We encourage you to share your thoughts and opinions in the comments section below.

Featured Posts

-

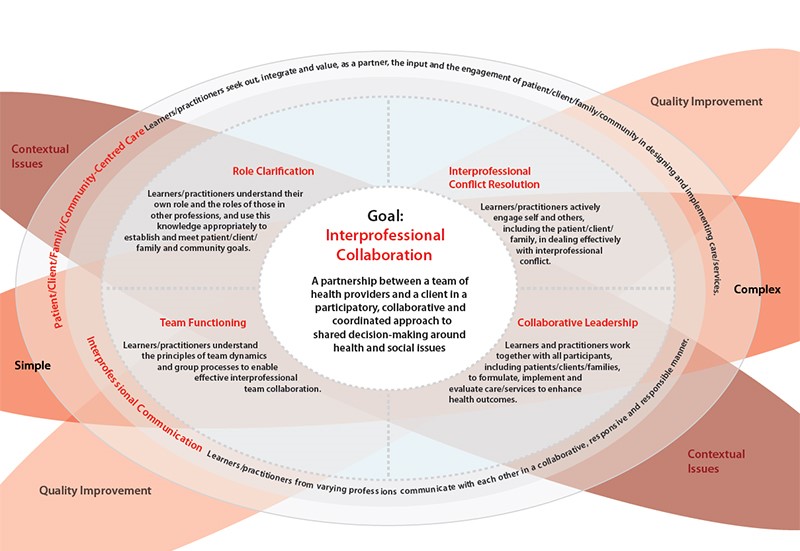

Improving Interprofessional Collaboration Lessons From A Plastic Glove Project Rcn And Vet Nursing

May 31, 2025

Improving Interprofessional Collaboration Lessons From A Plastic Glove Project Rcn And Vet Nursing

May 31, 2025 -

Zverev And Griekspoor Clash In Thrilling Bmw Open 2025 Quarter Finals

May 31, 2025

Zverev And Griekspoor Clash In Thrilling Bmw Open 2025 Quarter Finals

May 31, 2025 -

Vatican City To Host The Final Stage Of The Giro D Italia 2025

May 31, 2025

Vatican City To Host The Final Stage Of The Giro D Italia 2025

May 31, 2025 -

Latest April Outlook Updates And Features

May 31, 2025

Latest April Outlook Updates And Features

May 31, 2025 -

4 Recetas Para Sobrevivir A Un Apagon Ricas Y Sencillas

May 31, 2025

4 Recetas Para Sobrevivir A Un Apagon Ricas Y Sencillas

May 31, 2025