Live Nation Entertainment (LYV): Analyzing The Investment Landscape

Table of Contents

Live Nation's Dominant Market Position and Revenue Streams

Live Nation Entertainment's success stems from its powerful market position and diverse revenue streams. This diversification mitigates risk and contributes to consistent growth, making LYV stock attractive to many investors.

Ticketing Dominance:

Live Nation's Ticketmaster subsidiary holds a near-monopoly in the live event ticketing market. This dominance translates to:

- Massive market share and pricing power: Ticketmaster's vast network allows for significant control over pricing and distribution, generating substantial revenue.

- Potential antitrust concerns and regulatory scrutiny: This powerful market position has drawn regulatory scrutiny in the past and continues to be a potential risk factor for LYV. Ongoing antitrust investigations and potential legal challenges represent a significant threat.

- Technological advancements and digital ticketing strategies: Ticketmaster’s continuous investment in technology, including mobile ticketing and dynamic pricing algorithms, enhances efficiency and revenue generation. They are constantly working to stay ahead of competitors and technological shifts within the industry.

Diverse Revenue Streams:

Live Nation’s revenue isn't solely reliant on ticketing. This diversification strengthens its financial resilience and long-term growth potential. Key revenue streams include:

- Concert promotion and venue ownership: Live Nation promotes concerts across its vast network of venues globally, capturing revenue from ticket sales, sponsorships, and concessions.

- Sponsorship and advertising deals: Major brands leverage Live Nation's platforms for advertising and sponsorships, creating another consistent revenue source.

- Artist management and other ancillary businesses: Live Nation manages many high-profile artists, generating revenue from their performances and merchandise sales. This vertical integration provides a powerful competitive advantage.

- Data analytics and fan engagement opportunities: Live Nation leverages its massive data collection to better understand fan preferences, improve marketing strategies, and create more personalized experiences. This data-driven approach is a key driver of innovation and future growth.

Financial Performance and Growth Prospects of LYV

Analyzing Live Nation Entertainment's financial performance and growth prospects provides a clearer picture of its investment potential. Understanding key financial metrics is crucial to assess the health and potential future of LYV stock.

Recent Financial Results:

(Note: This section would ideally include up-to-date charts and graphs illustrating revenue growth, profitability, and debt levels from recent quarterly and annual reports. Data should be sourced directly from Live Nation's financial filings.) Analyzing these financial statements reveals key trends:

- Revenue growth trends and drivers: Identify the factors contributing to revenue growth, such as increased concert attendance, higher ticket prices, and successful expansion into new markets.

- Profitability margins and operating efficiency: Examine profit margins and operating efficiency to gauge the company's ability to manage costs and maximize profits.

- Debt levels and financial health: Assess the company's debt levels and overall financial health to understand its financial stability and risk profile. A high debt-to-equity ratio might indicate higher risk.

Future Growth Opportunities:

Live Nation’s future growth hinges on several key strategic initiatives:

- International expansion into new markets: Expanding into underpenetrated global markets presents substantial growth opportunities.

- Technological innovations and digital platforms: Continuous investment in technology allows for enhanced fan experiences, improved operational efficiency, and new revenue streams. This is crucial in a rapidly evolving digital landscape.

- Strategic acquisitions and partnerships: Acquisitions of smaller promoters, ticketing platforms, or artist management companies can expand market share and diversify revenue streams.

- Exploring new music genres and artist collaborations: Adapting to evolving musical tastes and securing partnerships with emerging artists is crucial for staying ahead of trends.

Risks and Challenges Facing Live Nation Entertainment (LYV)

While Live Nation enjoys a strong market position, several risks and challenges could impact its future performance and the value of LYV stock. Understanding these potential downsides is critical for informed investment decisions.

Economic Downturns:

Live Nation's business is sensitive to economic fluctuations.

- Sensitivity to macroeconomic factors like inflation and unemployment: During economic recessions, discretionary spending on entertainment decreases, impacting ticket sales and concert attendance.

- Impact on ticket sales and concert attendance: Economic downturns directly affect the demand for live entertainment events, impacting revenue generation.

- Strategies to mitigate economic risks: Live Nation can mitigate these risks through diversified revenue streams, cost-cutting measures, and strategic pricing strategies.

Competition and Market Saturation:

The live entertainment industry is competitive, with the potential for new entrants and disruptive technologies.

- Competition from smaller promoters and independent venues: Smaller promoters and independent venues offer competition, especially in niche markets.

- Threat from streaming services and online concert platforms: The rise of streaming services and virtual concerts presents a challenge to traditional live events.

- Innovative strategies to maintain a competitive edge: Live Nation must continuously innovate to maintain its competitive advantage through technological advancements and strategic acquisitions.

Regulatory and Legal Risks:

Regulatory and legal risks pose potential challenges to Live Nation's operations.

- Antitrust investigations and potential fines: Ongoing regulatory scrutiny related to Ticketmaster's market dominance represents a significant risk.

- Data privacy regulations and compliance costs: Compliance with data privacy regulations necessitates significant investments and carries the risk of non-compliance penalties.

- Risk management strategies and legal compliance: Proactive risk management and strict adherence to legal requirements are crucial to mitigate these risks.

Conclusion:

Live Nation Entertainment (LYV) presents a compelling investment case, with a dominant market position, diversified revenue streams, and significant growth potential. However, investors must carefully consider the risks associated with economic downturns, competition, and regulatory scrutiny. Thorough due diligence and a long-term investment horizon are essential. Before making any investment decisions concerning Live Nation Entertainment (LYV), conduct further research and consult with a financial advisor. Consider diversifying your portfolio to minimize risk. Is Live Nation Entertainment (LYV) the right investment for your portfolio? Begin your in-depth analysis today!

Featured Posts

-

De Regels Achter De Zes Wissels Van Liverpool In De Wedstrijd Tegen Southampton

May 29, 2025

De Regels Achter De Zes Wissels Van Liverpool In De Wedstrijd Tegen Southampton

May 29, 2025 -

Will These Characters Return For Stranger Things Season 5

May 29, 2025

Will These Characters Return For Stranger Things Season 5

May 29, 2025 -

Air Jordan May 2025 Release Dates Everything You Need To Know

May 29, 2025

Air Jordan May 2025 Release Dates Everything You Need To Know

May 29, 2025 -

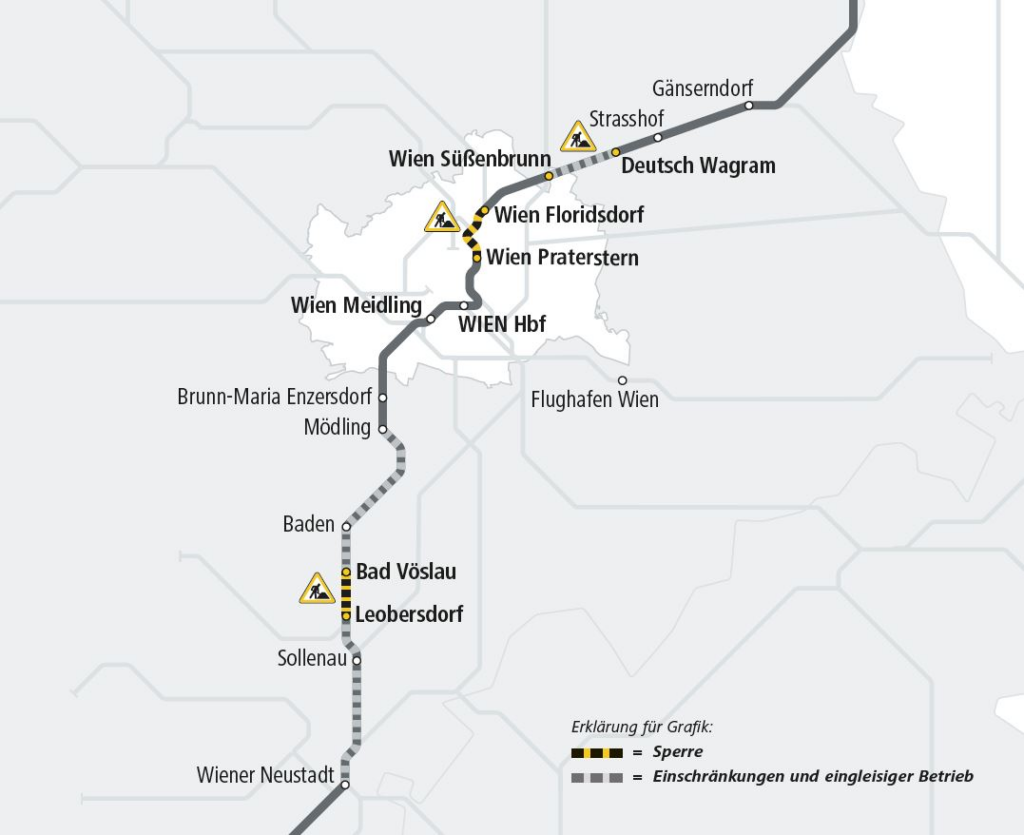

Umfangreiche Bauarbeiten In Pulheim Welche Stadtteile Sind Betroffen

May 29, 2025

Umfangreiche Bauarbeiten In Pulheim Welche Stadtteile Sind Betroffen

May 29, 2025 -

New How To Train Your Dragon Poster Highlights Toothless And Red Death Size Difference

May 29, 2025

New How To Train Your Dragon Poster Highlights Toothless And Red Death Size Difference

May 29, 2025

Latest Posts

-

30 Best Books To Read This Summer Critics Picks

May 31, 2025

30 Best Books To Read This Summer Critics Picks

May 31, 2025 -

Discover Local History In Depth Coverage From Kpc News

May 31, 2025

Discover Local History In Depth Coverage From Kpc News

May 31, 2025 -

Understanding The Past Historical Resources From Kpc News

May 31, 2025

Understanding The Past Historical Resources From Kpc News

May 31, 2025 -

The Francis Scott Key Bridge Disaster A Look Back At March 26 1968

May 31, 2025

The Francis Scott Key Bridge Disaster A Look Back At March 26 1968

May 31, 2025 -

Kpc News Delving Into The Rich History Of Location

May 31, 2025

Kpc News Delving Into The Rich History Of Location

May 31, 2025