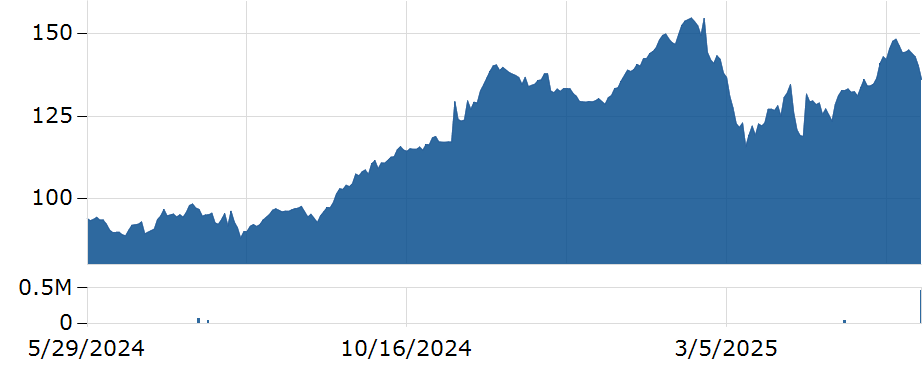

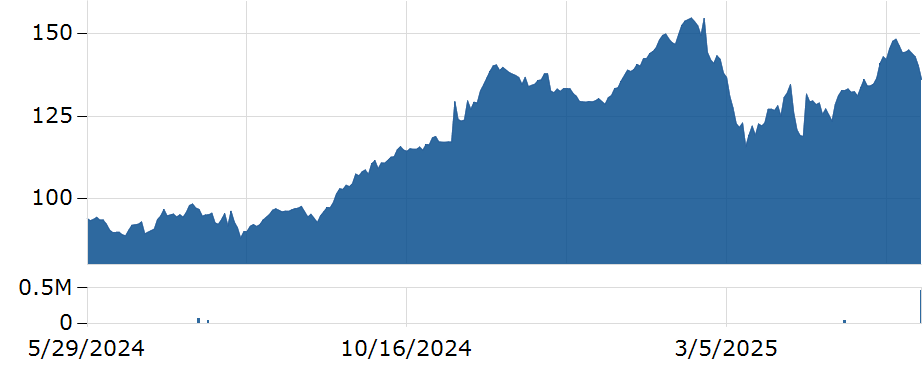

Live Nation Entertainment Stock (LYV): What's Driving Investor Decisions?

Table of Contents

Live Nation's Business Model and Revenue Streams

Live Nation Entertainment is a global leader in live entertainment, with a diversified business model spanning multiple revenue streams. This diversification significantly impacts Live Nation Entertainment stock (LYV) performance. The company's core activities include:

- Ticketing: Through Ticketmaster, Live Nation controls a significant portion of the primary ticketing market, generating substantial revenue through fees and commissions. This segment is crucial for understanding Live Nation Entertainment stock (LYV) valuation.

- Venue Ownership/Operation: Live Nation owns and operates numerous venues worldwide, generating revenue through ticket sales, concessions, and venue rentals. This provides a steady stream of income, less susceptible to the fluctuations affecting touring artists.

- Artist Management: Live Nation represents and manages many prominent artists, earning fees from their tours and other ventures. This segment offers significant potential for growth but also carries risk depending on artist popularity and tour success.

- Sponsorship and Advertising: Live Nation leverages its extensive reach to secure lucrative sponsorship deals and advertising revenue. This diversified revenue stream adds stability to its overall financial picture.

Key Revenue Drivers:

- Ticketing fees and commissions: This remains Live Nation's largest revenue source, directly tied to concert attendance.

- Venue rental and ancillary revenue: Consistent income from venue operations buffers against fluctuations in other segments.

- Artist management fees: High-profile artists contribute significantly, but this revenue is dependent on successful tours.

- Sponsorship and advertising revenue: Brand partnerships provide a supplementary and increasingly important revenue stream.

Live Nation's business exhibits seasonality, with higher revenue during warmer months and concert seasons. This seasonality must be considered when evaluating Live Nation Entertainment stock (LYV).

Macroeconomic Factors Influencing LYV Stock

Macroeconomic conditions significantly impact consumer spending, directly influencing concert attendance and, consequently, Live Nation's profitability. These factors are critical to understanding investor decisions regarding Live Nation Entertainment stock (LYV).

- Consumer discretionary spending: Concert tickets are considered discretionary spending; economic downturns lead to reduced attendance.

- Fuel prices: Higher fuel prices increase touring costs, potentially reducing profitability and impacting Live Nation Entertainment stock (LYV).

- Inflationary pressures on ticket prices: While inflation can increase revenue, excessive price hikes may deter fans, impacting attendance.

- Interest rate hikes: Higher interest rates increase borrowing costs for Live Nation and potentially reduce investor appetite for riskier investments.

Competitive Landscape and Market Share

Live Nation faces competition from various players in the live entertainment industry. Understanding this competitive landscape is vital for analyzing Live Nation Entertainment stock (LYV).

- Ticketmaster's dominance in ticketing: While providing a significant advantage, Ticketmaster faces regulatory scrutiny and competition from smaller ticketing platforms.

- Competition from smaller promoters and venues: Independent promoters and venues offer alternative entertainment options, challenging Live Nation's market share.

- The rise of streaming services: The growth of streaming services might affect live music attendance, although the two entertainment models coexist and even complement each other.

Live Nation employs several strategies to maintain and expand its market share, including strategic acquisitions, technological advancements in ticketing and venue management, and strong artist relationships.

Financial Performance and Key Metrics

Analyzing Live Nation's key financial performance indicators (KPIs) provides crucial insights for investors.

Important Financial Metrics and Their Implications:

- Revenue growth year-over-year: Consistent revenue growth signifies market strength and healthy expansion.

- Net income and profitability: Profitability reflects the efficiency of Live Nation's operations and its ability to generate returns.

- Debt-to-equity ratio: This metric indicates the company's financial leverage and risk profile. High levels of debt can be concerning for investors.

- Free cash flow generation: Strong free cash flow suggests the company's ability to fund operations, pay down debt, and return value to shareholders.

Analyst Ratings and Future Outlook for LYV Stock

Financial analysts provide valuable insights into the future prospects of Live Nation Entertainment stock (LYV). While analyst ratings offer guidance, they are not guarantees of future performance. A balanced perspective is needed, considering both potential upside and downside risks.

Conclusion: Making Informed Decisions on Live Nation Entertainment Stock (LYV)

Investor decisions regarding Live Nation Entertainment stock (LYV) should consider a range of factors: its diversified business model, sensitivity to macroeconomic conditions, competitive pressures, financial performance, and analyst sentiment. Understanding these elements is crucial for assessing the risks and potential rewards associated with investing in Live Nation Entertainment stock (LYV). Make informed decisions on Live Nation Entertainment Stock (LYV) by carefully analyzing these key factors and consulting with a financial advisor. Remember to conduct thorough due diligence before investing in any stock.

Featured Posts

-

Aragon 58 Colegios Con Listas De Espera Soluciones Y Consejos

May 29, 2025

Aragon 58 Colegios Con Listas De Espera Soluciones Y Consejos

May 29, 2025 -

Bayern Munich Rejects Liverpool And Manchester United

May 29, 2025

Bayern Munich Rejects Liverpool And Manchester United

May 29, 2025 -

Fhm Mena Alastqlal Hqwq Wwajbat

May 29, 2025

Fhm Mena Alastqlal Hqwq Wwajbat

May 29, 2025 -

First Look Nike Air Max Dn8 Sneaker Details And Release Info

May 29, 2025

First Look Nike Air Max Dn8 Sneaker Details And Release Info

May 29, 2025 -

Bayrn Mywnkh Yshn Hjwma Ela Brshlwnt Mn Ajl Sfqt Jdydt

May 29, 2025

Bayrn Mywnkh Yshn Hjwma Ela Brshlwnt Mn Ajl Sfqt Jdydt

May 29, 2025

Latest Posts

-

Essential Guide To Top Music Lawyers For 2025

May 30, 2025

Essential Guide To Top Music Lawyers For 2025

May 30, 2025 -

Your Guide To The Leading Music Lawyers Of 2025

May 30, 2025

Your Guide To The Leading Music Lawyers Of 2025

May 30, 2025 -

Additional Paris And London Dates Announced For Role Models No Place Like Tour

May 30, 2025

Additional Paris And London Dates Announced For Role Models No Place Like Tour

May 30, 2025 -

The Ultimate Guide To Top Music Lawyers In 2025

May 30, 2025

The Ultimate Guide To Top Music Lawyers In 2025

May 30, 2025 -

Role Models The Longest Goodbye Tour Adds Paris And London Shows

May 30, 2025

Role Models The Longest Goodbye Tour Adds Paris And London Shows

May 30, 2025