Long-Term Outlook Positive: Berkshire Hathaway's Impact On Japanese Trading Houses

Table of Contents

Berkshire Hathaway's Investment Strategy in Japan: Understanding Berkshire's Approach to Japanese Trading Houses

Berkshire Hathaway's investment philosophy centers on identifying undervalued, fundamentally strong companies with long-term growth potential. This approach aligns perfectly with the characteristics of prominent Japanese trading houses like Mitsui & Co., Mitsubishi Corporation, Itochu Corporation, Marubeni Corporation, and Sumitomo Corporation – companies known for their stability, diversified portfolios, and established global presence. The rationale behind Berkshire's choice is clear: these are not speculative ventures; rather, they are investments in robust entities with proven track records. Warren Buffett's faith in the management teams and their long-term strategies is a key factor in this decision.

- Emphasis on long-term value creation rather than short-term gains: Berkshire avoids quick flips, prioritizing sustainable growth and consistent returns over rapid, potentially risky profits.

- Focus on established businesses with strong track records: These trading houses possess decades of experience navigating global markets, demonstrating resilience and adaptability.

- Stable dividends and reliable cash flow: This provides a consistent income stream for Berkshire and reinforces the stability of the investment.

Impact on Japanese Trading House Stock Prices and Market Sentiment: Market Reactions and Share Price Performance Following Berkshire's Investments

Berkshire Hathaway's investments have had a demonstrably positive impact on the stock prices of the targeted Japanese trading houses. The announcement of these investments immediately boosted share prices, reflecting a surge in investor confidence. This confidence isn't merely speculative; it's grounded in the perception of reduced risk associated with Berkshire's involvement.

- Increased trading volume and investor interest: The news attracted a significant influx of investors, boosting trading activity and liquidity.

- Improved credit ratings and reduced risk perception: Berkshire's backing reinforces the creditworthiness of these already stable companies, further bolstering investor confidence.

- Attraction of new investors seeking long-term stability: The investment attracted investors seeking reliable, long-term growth opportunities in a potentially volatile global market. While precise share price data requires a dedicated financial analysis, the overall trend has shown a clear upward trajectory following Berkshire's entry.

Strategic Implications for Japanese Trading Houses: Synergies, Growth Opportunities, and Enhanced Global Reach

The strategic implications for the Japanese trading houses extend far beyond simple share price appreciation. Berkshire's investment opens doors to numerous collaborative opportunities. The synergies between Berkshire's diverse portfolio companies and the Japanese trading houses are vast and potentially transformative.

- Access to Berkshire's extensive network and expertise: This provides invaluable connections and insights into various global markets and industries.

- Potential for joint ventures and collaborations: The partnership fosters opportunities for mutually beneficial projects, accelerating growth in both existing and new markets.

- Enhanced global competitiveness and brand recognition: The association with Berkshire Hathaway elevates the profile of the Japanese trading houses, enhancing their credibility and attracting further international partnerships.

Long-Term Outlook and Future Projections: Sustained Growth and Positive Long-Term Prospects

The long-term outlook for Japanese trading houses, considering Berkshire Hathaway's investment, remains overwhelmingly positive. While global economic conditions and geopolitical uncertainties present inherent risks, the fundamental strengths of these companies, coupled with Berkshire's strategic backing, suggest a path of sustained growth.

- Increased profitability and shareholder value: The expected synergies and market expansion are likely to lead to increased profitability and enhanced shareholder returns.

- Resilience to market fluctuations: The diversified nature of these trading houses and their long-standing experience make them relatively resilient to short-term market volatility.

- Sustainable growth in key sectors: These companies are well-positioned to capitalize on growth opportunities in key sectors, including energy, infrastructure, and technology.

Conclusion: The Enduring Positive Impact of Berkshire Hathaway on Japanese Trading Houses

Berkshire Hathaway's investment in Japanese trading houses marks a significant development with far-reaching implications. The positive impact on share prices, market sentiment, and strategic partnerships is undeniable. The long-term outlook for these companies remains robust, promising sustained growth and enhanced shareholder value. The strategic advantages gained by both Berkshire and the Japanese trading houses are substantial, creating a mutually beneficial partnership poised for continued success. Stay informed about the ongoing developments in Berkshire Hathaway's impact on Japanese trading houses, and consider exploring investment opportunities in these stable and promising companies.

Featured Posts

-

Chkn Mtn Awr Byf Lahwr Myn Gwsht Ky Qymtwn Pr Qabw Pane Ke Chylnjz

May 08, 2025

Chkn Mtn Awr Byf Lahwr Myn Gwsht Ky Qymtwn Pr Qabw Pane Ke Chylnjz

May 08, 2025 -

Andors Final Season Cast Offers Bts Glimpse Into Rogue One Prequel

May 08, 2025

Andors Final Season Cast Offers Bts Glimpse Into Rogue One Prequel

May 08, 2025 -

Xrp Trading Volume Tops Solana Amidst Etf Speculation

May 08, 2025

Xrp Trading Volume Tops Solana Amidst Etf Speculation

May 08, 2025 -

Stephen Kings The Long Walk Gets A Chilling New Trailer

May 08, 2025

Stephen Kings The Long Walk Gets A Chilling New Trailer

May 08, 2025 -

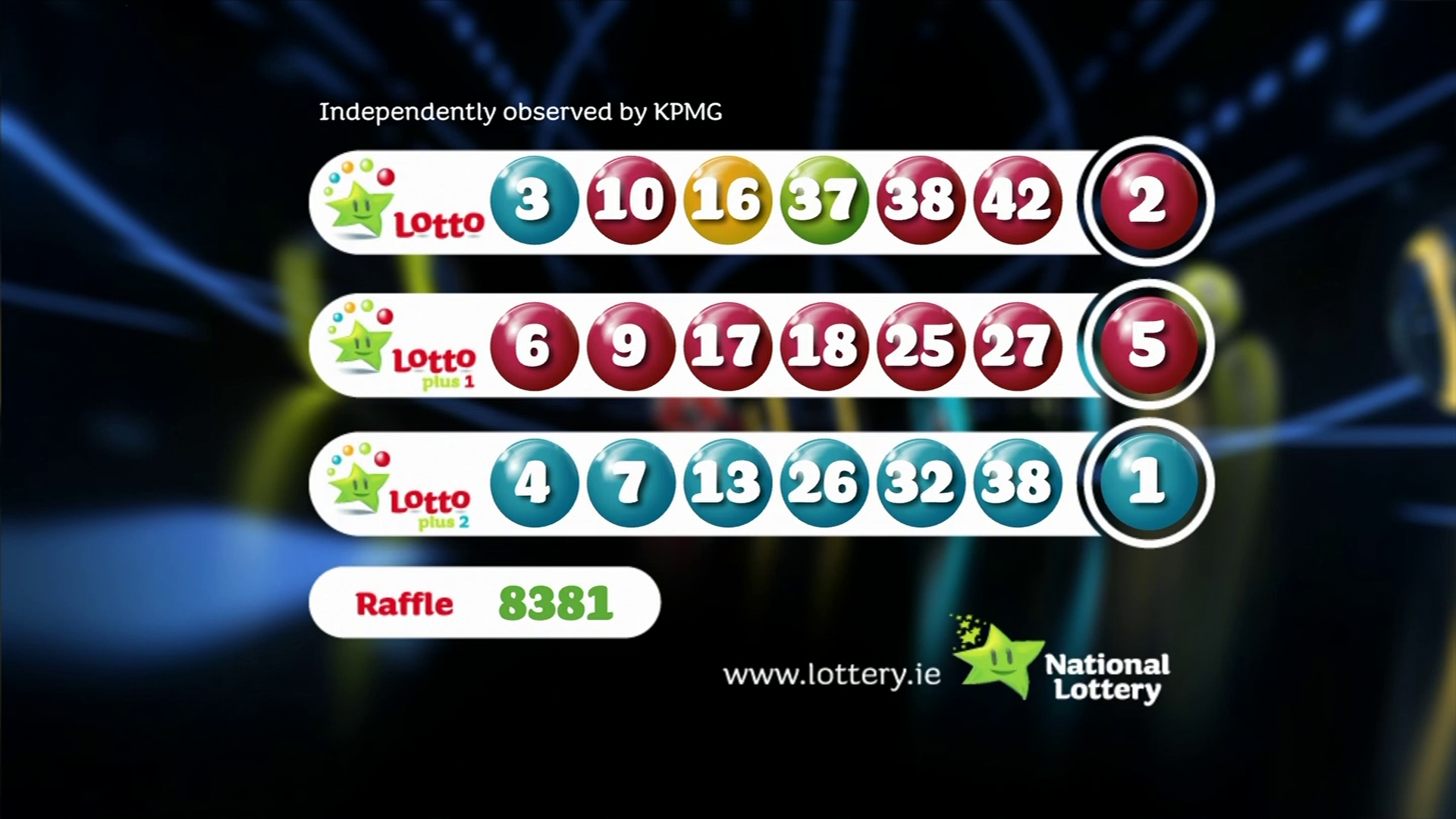

Lotto Draw Results Check The Latest Numbers For Lotto Plus 1 And 2

May 08, 2025

Lotto Draw Results Check The Latest Numbers For Lotto Plus 1 And 2

May 08, 2025