Lowest Personal Loan Interest Rates Today: A Complete Guide

Table of Contents

Understanding Factors Affecting Your Personal Loan Interest Rate

Several crucial factors determine the interest rate you'll receive on a personal loan. Understanding these elements is the first step towards securing the lowest possible rate.

Your Credit Score: The Cornerstone of Loan Approval and Rates

Your credit score, a three-digit number representing your creditworthiness, is arguably the most significant factor influencing your personal loan interest rate. Lenders use your FICO score (Fair Isaac Corporation score) to assess the risk of lending you money. A higher FICO score signifies lower risk, resulting in lower interest rates.

- Credit Score Impact on Interest Rates:

- 750+: Excellent rates, often the lowest available.

- 650-749: Good rates, competitive offers.

- Below 650: Higher rates or potential loan rejection. You may need to explore options like secured loans or loans with co-signers.

Improving your credit score before applying for a loan can dramatically improve your chances of securing a lower interest rate. Focus on:

- Paying bills on time consistently.

- Keeping your credit utilization ratio low (ideally below 30%).

- Disputing any errors on your credit report.

- Maintaining a mix of credit accounts (credit cards, installment loans).

Loan Amount and Term: How Much You Borrow and for How Long

The amount you borrow and the loan's repayment term directly impact your interest rate. Generally:

- Larger loan amounts often come with higher interest rates because they represent a greater risk for lenders.

- Loan term significantly affects the total interest paid. A shorter loan term means higher monthly payments but lower overall interest. Conversely, a longer term results in lower monthly payments but significantly higher overall interest charges.

Let's illustrate with an example: A $10,000 loan at 8% APR over 3 years will cost you less in total interest than the same loan over 5 years. While the monthly payments will be lower with the 5-year loan, the cumulative interest paid will be considerably higher.

The Lender's Role: Comparing Different Loan Options

Different lenders—banks, credit unions, and online lenders—offer varying interest rates and loan terms. It's crucial to compare offers from multiple lenders to find the most competitive rates.

- Banks: Typically offer a wide range of loan products but may have stricter lending criteria.

- Credit Unions: Often offer lower interest rates to their members but may have membership requirements.

- Online Lenders: Provide convenience and speed but may have higher fees or less personalized service.

Utilizing online loan comparison tools can streamline this process, allowing you to see multiple offers side-by-side without repeatedly applying.

Strategies for Securing the Lowest Personal Loan Interest Rates Today

Securing the lowest interest rate requires proactive steps.

Improve Your Credit Score Before Applying

As previously mentioned, a strong credit score is paramount. Take proactive steps to improve your score well in advance of applying for a personal loan. This includes:

- Paying down high-interest debt.

- Correcting any inaccuracies on your credit report.

- Utilizing credit-building tools.

- Monitoring your credit reports regularly.

Resources like [link to credit score improvement resource] and [link to credit report agency] can help you track your progress.

Shop Around for the Best Rates

Comparing offers from multiple lenders is essential to finding the best rate. Pre-qualification allows you to check potential rates and terms without impacting your credit score. This is a crucial step, enabling you to identify the most competitive options. Always read the fine print, thoroughly understanding all fees and charges.

Negotiate with Lenders

Negotiating a lower interest rate is possible, especially if you have a strong credit score and a stable financial history. Highlight your positive financial attributes and compare offers from competing lenders to leverage better terms.

Avoiding Common Personal Loan Pitfalls

Beware of common pitfalls that can lead to costly mistakes.

High APRs and Hidden Fees

Scrutinize the Annual Percentage Rate (APR) and look out for hidden fees like origination fees, prepayment penalties, or late payment fees. High APRs and excessive fees can significantly increase the overall cost of your loan.

Predatory Lending Practices

Predatory lenders target vulnerable borrowers with high-interest rates and deceptive terms. Be wary of loans with excessively high interest rates, unclear terms, or aggressive sales tactics. Report suspicious lending practices to the appropriate authorities.

Borrowing More Than You Need

Borrow only the amount you absolutely need. Taking on more debt than necessary increases your risk and extends your repayment period, leading to higher overall interest payments.

Conclusion: Finding the Lowest Personal Loan Interest Rates Today and Beyond

Securing the lowest personal loan interest rates today involves understanding your credit score, comparing lenders, and negotiating effectively. By improving your creditworthiness, shopping around for the best offers, and avoiding predatory lending practices, you can significantly reduce the total cost of borrowing. Don't settle for high interest – start your search for the lowest personal loan interest rates today by comparing offers from multiple lenders and improving your credit score. Find the best loan that suits your financial needs! Remember to utilize reputable loan comparison websites like [link to reputable loan comparison website 1] and [link to reputable loan comparison website 2] to simplify your search.

Featured Posts

-

Barcelonas Road To The Quarter Finals Raphinhas Impact

May 28, 2025

Barcelonas Road To The Quarter Finals Raphinhas Impact

May 28, 2025 -

Hailee Steinfeld Postpones Wedding Recalls Josh Allens Proposal

May 28, 2025

Hailee Steinfeld Postpones Wedding Recalls Josh Allens Proposal

May 28, 2025 -

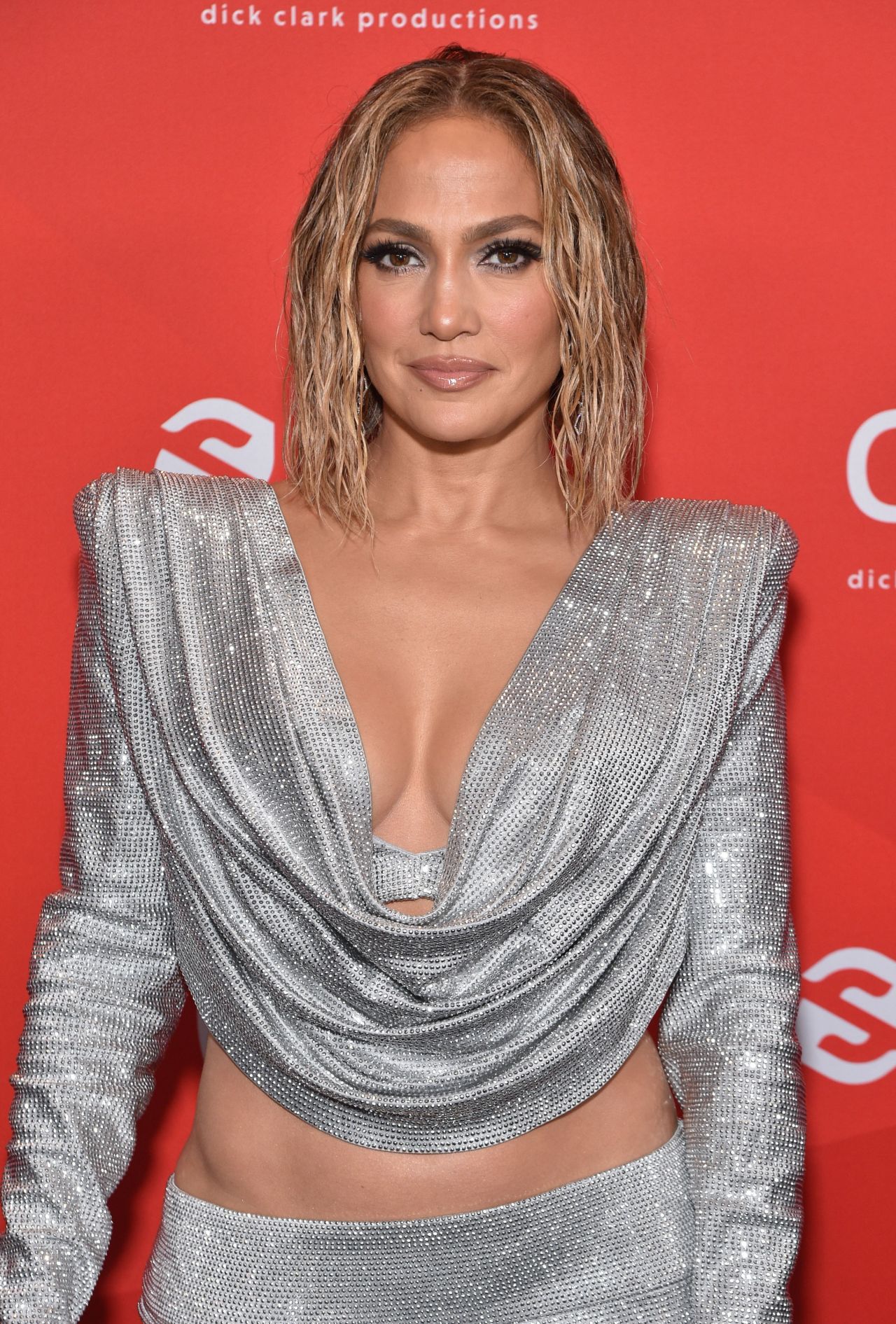

Jennifer Lopez Your 2025 American Music Awards Host

May 28, 2025

Jennifer Lopez Your 2025 American Music Awards Host

May 28, 2025 -

Jennifer Lopez To Host American Music Awards 2024 In Las Vegas

May 28, 2025

Jennifer Lopez To Host American Music Awards 2024 In Las Vegas

May 28, 2025 -

Harvard And The Trump Administration A Funding Showdown

May 28, 2025

Harvard And The Trump Administration A Funding Showdown

May 28, 2025

Latest Posts

-

Sncf Greve 8 Mai Tout Savoir Sur La Situation Actuelle

May 30, 2025

Sncf Greve 8 Mai Tout Savoir Sur La Situation Actuelle

May 30, 2025 -

Droits De Douane Calcul Declaration Et Reglementation

May 30, 2025

Droits De Douane Calcul Declaration Et Reglementation

May 30, 2025 -

Declaration De Philippe Tabarot Sur La Greve Et Les Revendications A La Sncf

May 30, 2025

Declaration De Philippe Tabarot Sur La Greve Et Les Revendications A La Sncf

May 30, 2025 -

Droits De Douane Mode D Emploi Et Procedures

May 30, 2025

Droits De Douane Mode D Emploi Et Procedures

May 30, 2025 -

Greve A La Sncf Le Depute Philippe Tabarot S Exprime Sur Les Revendications

May 30, 2025

Greve A La Sncf Le Depute Philippe Tabarot S Exprime Sur Les Revendications

May 30, 2025