Lutnick-Built FMX Challenges CME: Treasury Futures Trading Begins

Table of Contents

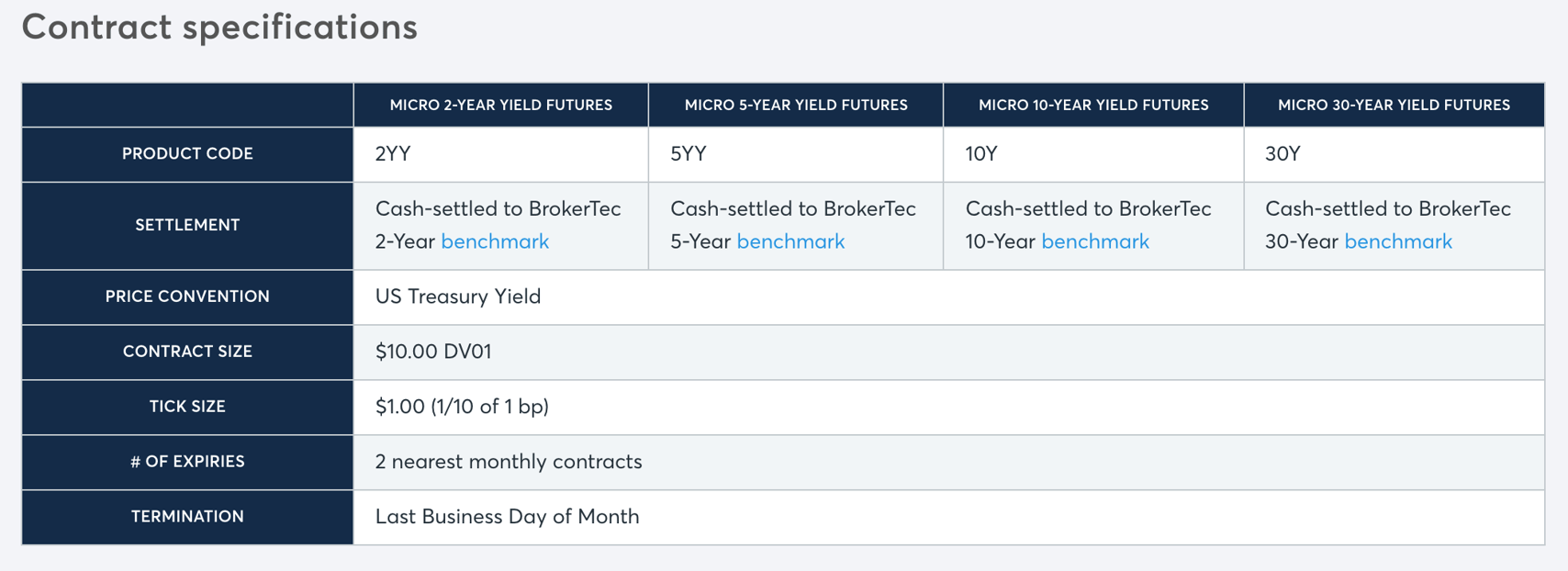

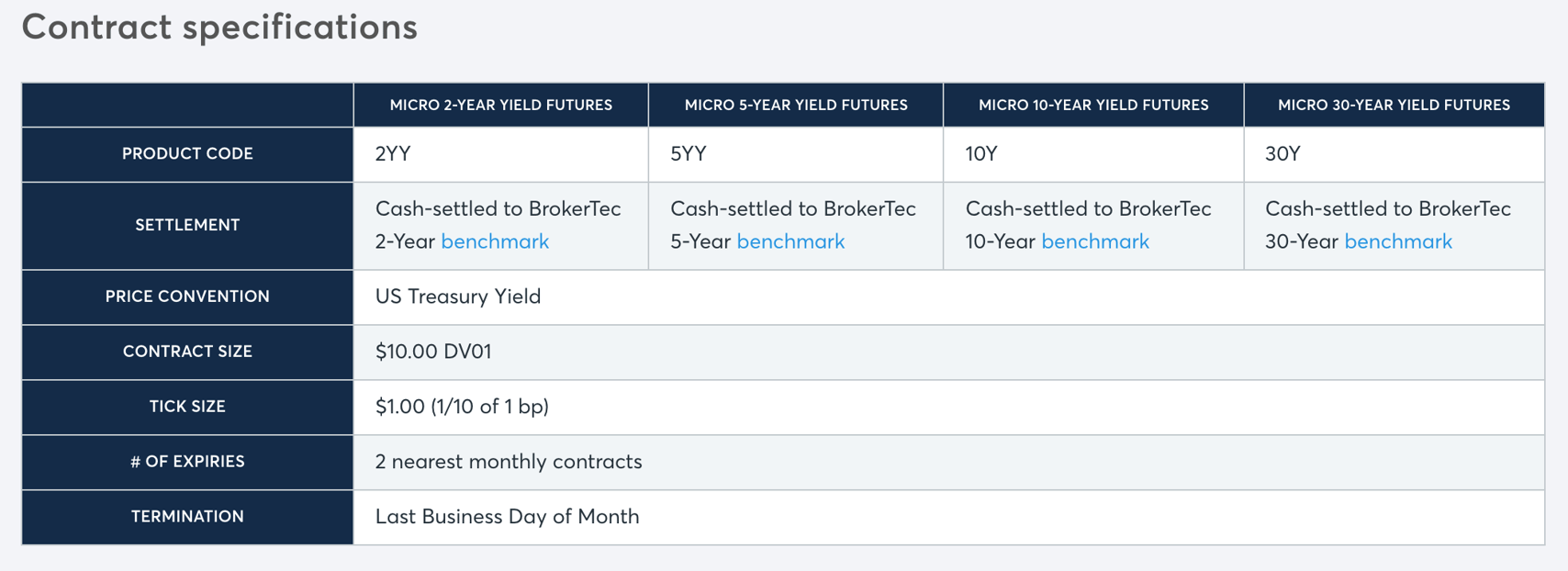

FMX's Entry into the Treasury Futures Market

Lutnick's Strategic Move and Market Disruption

Steven A. Lutnick's investment in FMX represents a significant strategic move, aiming to disrupt the established order of Treasury futures trading, currently dominated by the CME Group. This isn't just about adding another player; it's about introducing a potentially superior platform with the power to reshape the market.

- Technological Advantages: FMX boasts cutting-edge technology, promising faster execution speeds and increased efficiency compared to existing platforms. This translates to potential cost savings and improved trading opportunities for users.

- Competitive Pricing Strategies: FMX's pricing model is expected to be highly competitive, potentially attracting traders seeking lower fees and better value for their services.

- Target Market Focus: FMX is likely targeting a specific segment of the market, possibly focusing on high-frequency traders or those seeking a more technologically advanced platform.

The potential impact on liquidity and market share is substantial. If FMX successfully attracts a significant portion of the trading volume from CME, it could lead to a redistribution of power within the Treasury futures market and potentially affect the pricing of Treasury bonds themselves.

Key Features and Advantages of the FMX Platform

FMX's success hinges on its ability to offer compelling advantages over existing platforms like CME. Key features designed to lure traders include:

- Advanced Trading Tools: Sophisticated algorithms and analytical tools provide traders with enhanced capabilities for making informed trading decisions.

- User-Friendly Interface: An intuitive and easy-to-navigate platform aims to streamline the trading process, improving overall user experience.

- Enhanced Security: Robust security measures ensure the safety and integrity of traders' funds and data, a critical aspect of building trust and attracting users.

- High-Speed Execution: Faster order execution speeds can be crucial in highly competitive markets, giving traders a potentially significant edge.

Comparing FMX's features to CME's offerings highlights key competitive advantages. While CME holds a substantial market share built on years of experience, FMX’s focus on innovation and technology may be enough to attract a notable portion of traders seeking modern and efficient solutions.

CME Group's Response to the New Competition

CME's Market Position and Strategies

The CME Group, as the current market leader in Treasury futures trading, is likely to respond aggressively to the challenge posed by FMX. CME’s response will hinge on leveraging its established reputation, extensive network, and existing infrastructure.

- Technological Upgrades: CME may invest heavily in upgrading its own technology to compete more effectively with FMX's cutting-edge platform.

- Pricing Adjustments: CME may adjust its pricing structure to remain competitive, potentially offering discounted fees or other incentives to retain its market share.

- Enhanced Services: Expanding services beyond basic trading, such as offering enhanced risk management tools or improved data analytics capabilities, could become a key strategic differentiator.

The impact of this competition on CME's market share and profitability remains to be seen, but it's clear that the company will need to adapt and innovate to maintain its dominance.

The Impact on Traders and Market Liquidity

The entry of FMX will significantly alter the trading landscape, influencing the experience of market participants. The implications can be both positive and negative:

- Increased Competition: Increased competition will likely benefit traders through potentially lower fees, better services, and enhanced technological offerings.

- Greater Choice: The availability of multiple trading platforms increases choice for traders, allowing them to select the platform that best suits their specific needs and trading styles.

- Fragmentation of Liquidity: A potential downside is the fragmentation of liquidity, as trading volume might be spread across multiple platforms instead of being concentrated in one market, potentially leading to less efficient pricing.

Analyzing the long-term effects on market depth and overall liquidity requires careful observation of trading activity as the competition unfolds.

The Future of Treasury Futures Trading

Implications for the Broader Financial Landscape

The competition between FMX and CME has far-reaching implications beyond the Treasury futures market itself.

- Innovation in Futures Trading Technology: The competition is spurring innovation in the technology underpinning futures trading, potentially leading to more efficient and transparent markets.

- Impact on Regulatory Frameworks: The evolving landscape may necessitate adjustments to existing regulatory frameworks to accommodate the introduction of new technologies and market structures.

The potential for greater efficiency and transparency in the Treasury futures market is a significant positive outcome of this increased competition.

Potential for Consolidation or Continued Competition

The future relationship between FMX and CME is uncertain. Several scenarios are plausible:

- Acquisition: CME might acquire FMX to eliminate competition and consolidate its market share.

- Sustained Competition: Both platforms could coexist, competing for market share based on their respective strengths and offerings.

- Shift in Market Dominance: FMX could potentially supplant CME as the dominant player in the Treasury futures market over time.

The evolution of regulatory environments and future technological advances will play a crucial role in shaping this dynamic future, impacting market participants and the broader financial industry.

Conclusion

The emergence of FMX, spearheaded by Steven A. Lutnick, marks a pivotal moment in the history of Treasury futures trading. Its direct challenge to CME Group's dominance has injected significant competition into the market, promising innovation, potentially lower costs, and increased choice for traders. While the long-term implications remain to be fully realized, the competition is already reshaping the landscape of Treasury bond trading and will likely lead to significant developments in the broader financial industry. Stay tuned for updates on the evolving landscape of Treasury futures trading, and learn more about the impact of Lutnick's FMX on the future of financial markets.

Featured Posts

-

Teslas Legal Strategy After Musks Compensation Controversy

May 18, 2025

Teslas Legal Strategy After Musks Compensation Controversy

May 18, 2025 -

Right To Repair In The Us Army Benefits Challenges And Future Outlook

May 18, 2025

Right To Repair In The Us Army Benefits Challenges And Future Outlook

May 18, 2025 -

Eurovision 2025 Uk Entry Announced Amidst Most Controversial Acts

May 18, 2025

Eurovision 2025 Uk Entry Announced Amidst Most Controversial Acts

May 18, 2025 -

True Crime Docuseries Outperforms 96 Rt Rated Netflix Romance Drama

May 18, 2025

True Crime Docuseries Outperforms 96 Rt Rated Netflix Romance Drama

May 18, 2025 -

Update Driver Dead Following Dam Square Car Explosion Suicide Under Investigation

May 18, 2025

Update Driver Dead Following Dam Square Car Explosion Suicide Under Investigation

May 18, 2025

Latest Posts

-

Quebec Labour Tribunal Hears Amazon Union Case Over Warehouse Shutdowns

May 18, 2025

Quebec Labour Tribunal Hears Amazon Union Case Over Warehouse Shutdowns

May 18, 2025 -

Scrutinizing Trumps Aerospace Transactions Assessing The Details

May 18, 2025

Scrutinizing Trumps Aerospace Transactions Assessing The Details

May 18, 2025 -

220 Million Lawsuit Filed Against Mohawk Council By Kahnawake Casino Owners

May 18, 2025

220 Million Lawsuit Filed Against Mohawk Council By Kahnawake Casino Owners

May 18, 2025 -

Litige Amazon Syndicat Fermeture D Entrepots Au Quebec

May 18, 2025

Litige Amazon Syndicat Fermeture D Entrepots Au Quebec

May 18, 2025 -

The Trump Presidency And Aerospace A Look At Dealmaking And Disclosure

May 18, 2025

The Trump Presidency And Aerospace A Look At Dealmaking And Disclosure

May 18, 2025