LVMH Stock Drops After Missing Q1 Sales Targets

Table of Contents

Q1 Sales Figures and the Market's Reaction

LVMH reported significantly lower-than-expected sales figures for the first quarter of 2024. While precise numbers will vary depending on the final reporting, initial announcements indicated a considerable shortfall compared to both projected targets and the previous year's Q1 performance. This substantial deviation from expectations immediately triggered a negative market reaction.

- Percentage drop in LVMH stock price: Reports indicated a double-digit percentage drop in LVMH's share price within the first trading days following the announcement. The exact percentage fluctuated depending on market volatility.

- Comparison to analyst predictions: Prior to the announcement, analysts had predicted robust growth for LVMH, fueled by the continued demand for luxury goods. The actual results fell dramatically short of these predictions, contributing to the sell-off.

- Impact on investor confidence: The unexpected drop in sales significantly eroded investor confidence, leading to a substantial outflow of capital from LVMH investments. The market clearly signaled its concern about the company's future prospects.

Underlying Factors Contributing to Missed Targets

Several interconnected factors contributed to LVMH's failure to meet its Q1 sales targets. These factors represent a complex interplay of macroeconomic headwinds and specific challenges faced by the company.

- Impact of inflation on consumer purchasing power: Persistently high inflation rates across many key markets reduced consumer disposable income, impacting luxury spending. Consumers, faced with higher costs for essentials, likely scaled back on non-essential luxury purchases.

- Specific challenges faced by different LVMH brands: While some brands within the LVMH portfolio might have experienced relative resilience, others, particularly those reliant on specific geographic markets or product categories, suffered more significant setbacks. For example, challenges in specific regions or slower-than-expected sales of certain product lines within brands like Louis Vuitton or Dior may have contributed to the overall shortfall.

- Supply chain bottlenecks and their effects: Ongoing disruptions to global supply chains continued to impact production and delivery timelines, affecting inventory levels and potentially leading to lost sales opportunities. These disruptions likely resulted in delayed product launches and unfulfilled demand.

- Geopolitical risks and their influence on sales: Geopolitical instability in various regions negatively affected consumer sentiment and impacted tourism, a crucial driver of luxury goods sales. The war in Ukraine and other global tensions contributed to this uncertainty.

LVMH's Response and Future Outlook

In response to the disappointing Q1 results, LVMH released an official statement acknowledging the challenges faced and outlining its strategies to address them. The company highlighted its commitment to long-term growth and emphasized its continued focus on innovation, brand building, and operational efficiency.

- Key points from LVMH's official press release: The statement likely included reassurances about the company's financial health, highlighted planned cost-cutting measures, and emphasized ongoing investments in research and development.

- Planned strategies for improving sales and regaining market share: These strategies likely involved adjusting pricing strategies, focusing on key markets with stronger growth potential, and further investing in digital marketing and e-commerce initiatives to reach a wider audience.

- Analyst predictions for future stock price movements: Analysts' forecasts vary widely, with some expressing cautious optimism while others remain more reserved. The future performance of LVMH stock will depend on its ability to execute its recovery plan effectively.

- Potential long-term implications for the company: The Q1 results could affect LVMH's long-term strategic planning and investment decisions. The company may need to re-evaluate its market positioning and prioritize different growth avenues.

Investor Sentiment and Trading Strategies

The news of LVMH's Q1 underperformance significantly impacted investor sentiment. Many investors reacted negatively, while others saw an opportunity to buy the dip.

- Changes in investor sentiment before and after the Q1 results: Before the announcement, sentiment was largely positive, based on analyst predictions. Post-announcement, there was a sharp shift towards caution and uncertainty.

- Potential trading strategies for investors (with caveats): Some investors might consider buying LVMH stock at a discounted price, anticipating a rebound. However, it's crucial to note that this is a high-risk strategy and should only be undertaken after thorough due diligence. A "hold" strategy might be preferable for long-term investors with a higher risk tolerance.

- Risk assessment for LVMH investments: Investing in LVMH stock carries inherent risks, including volatility and potential further price declines. It's crucial to weigh potential rewards against the associated risks before making any investment decisions.

- Long-term investment prospects: Despite the recent setback, LVMH remains a powerful brand with a strong long-term track record. Its long-term prospects remain positive, depending on its ability to adapt to changing market conditions and execute its recovery plan successfully.

Conclusion: Navigating the LVMH Stock Dip

The LVMH stock drop following the release of disappointing Q1 2024 sales figures highlights the vulnerability of even the most successful luxury brands to macroeconomic headwinds and unforeseen challenges. The impact on investors has been significant, leading to uncertainty and prompting a reevaluation of investment strategies. While the future of LVMH stock remains somewhat uncertain, the company's long-term potential remains considerable. To stay informed about LVMH stock performance and make informed decisions, continue monitoring relevant financial news sources and conduct thorough research on LVMH Stock, Luxury Goods Market Analysis, and LVMH Investment Strategies.

Featured Posts

-

Fedor Lavrov Lyudi Lyubyat Schekotat Nervy O Pavle I I Trillerakh

May 24, 2025

Fedor Lavrov Lyudi Lyubyat Schekotat Nervy O Pavle I I Trillerakh

May 24, 2025 -

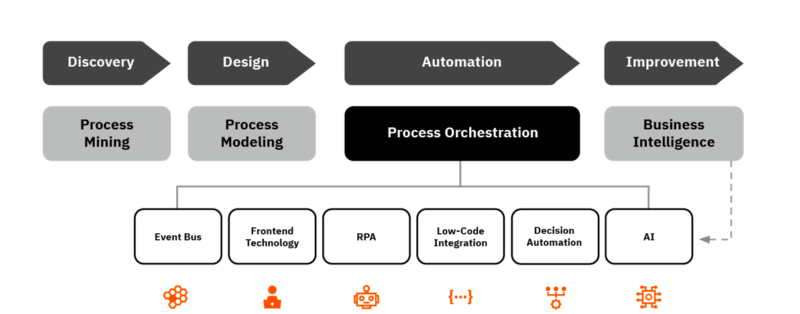

Maximize Your Automation Investment Learn Orchestration At Camunda Con 2025 Amsterdam

May 24, 2025

Maximize Your Automation Investment Learn Orchestration At Camunda Con 2025 Amsterdam

May 24, 2025 -

Camunda Con 2025 Optimizing Ai And Automation With Process Orchestration In Amsterdam

May 24, 2025

Camunda Con 2025 Optimizing Ai And Automation With Process Orchestration In Amsterdam

May 24, 2025 -

A Realistic Look At Escaping To The Country Pros And Cons

May 24, 2025

A Realistic Look At Escaping To The Country Pros And Cons

May 24, 2025 -

The 10 Fastest Ferraris A Lap Around Fiorano

May 24, 2025

The 10 Fastest Ferraris A Lap Around Fiorano

May 24, 2025

Latest Posts

-

Woody Allen Sexual Abuse Claims Re Examined Following Sean Penns Public Backing

May 24, 2025

Woody Allen Sexual Abuse Claims Re Examined Following Sean Penns Public Backing

May 24, 2025 -

The Sean Penn Dylan Farrow Woody Allen Controversy A Deeper Look

May 24, 2025

The Sean Penn Dylan Farrow Woody Allen Controversy A Deeper Look

May 24, 2025 -

Sean Penn Questions Dylan Farrows Accusations Against Woody Allen

May 24, 2025

Sean Penn Questions Dylan Farrows Accusations Against Woody Allen

May 24, 2025 -

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 24, 2025

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 24, 2025 -

The Woody Allen Dylan Farrow Case Sean Penns Perspective

May 24, 2025

The Woody Allen Dylan Farrow Case Sean Penns Perspective

May 24, 2025