LVMH's Q1 Sales Figures Send Shares Down 8.2%

Table of Contents

Disappointing Q1 Sales Figures: A Closer Look

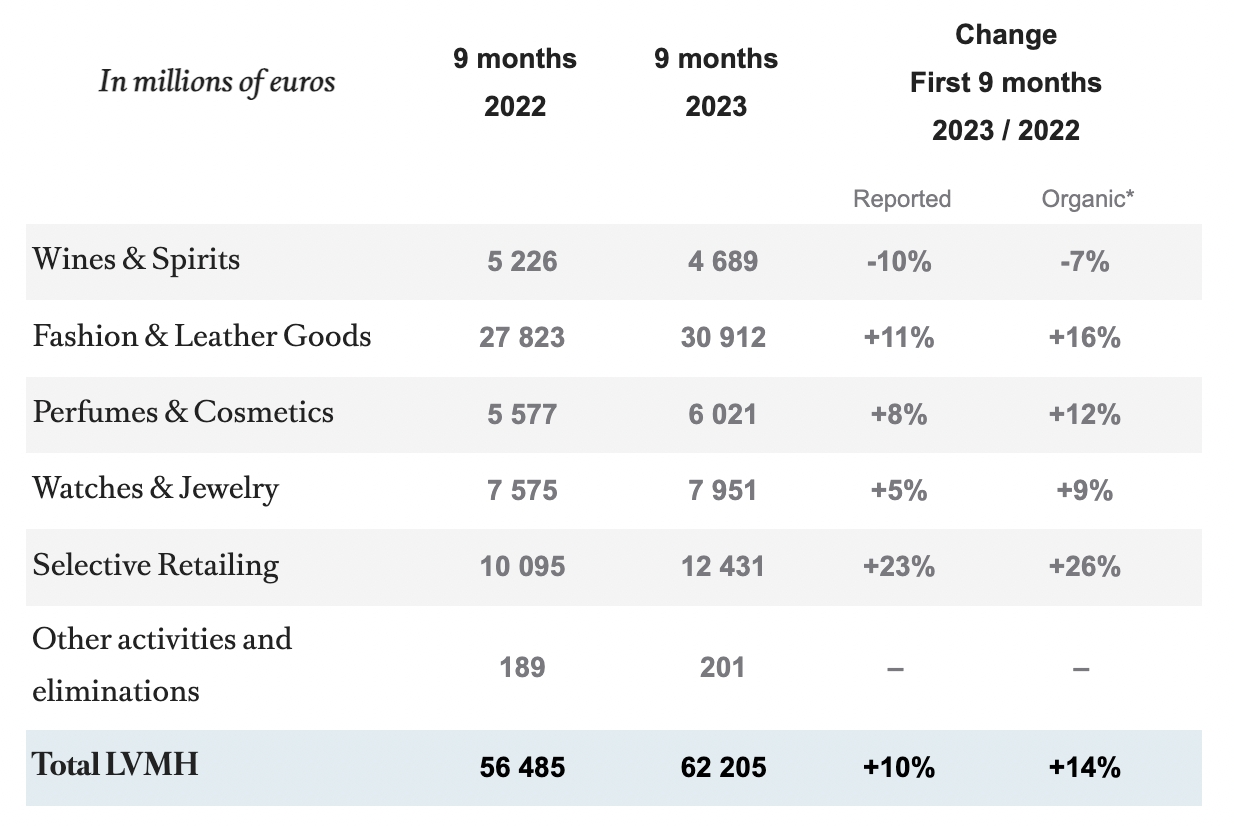

Revenue Breakdown and Key Performance Indicators (KPIs)

LVMH's Q1 2024 revenue fell short of analyst expectations, revealing a concerning trend within the luxury goods market. While the exact figures require reference to the official LVMH financial report, a significant percentage decrease compared to Q1 2023 was observed. Key performance indicators (KPIs) paint a worrying picture:

- Revenue Growth: A substantial decline in revenue growth compared to the same period last year and initial projections.

- Operating Margin: A compression of the operating margin, indicating reduced profitability.

- Earnings Per Share (EPS): A likely decrease in EPS, reflecting the overall financial pressure on the company.

Performance varied across LVMH's divisions:

- Fashion & Leather Goods: This division, typically a major revenue driver, likely experienced a slowdown.

- Wines & Spirits: This sector might have shown some resilience, but likely wasn't enough to offset losses elsewhere.

- Perfumes & Cosmetics: This area may have performed relatively better, though possibly not enough to fully compensate.

- Watches & Jewelry: This division, often sensitive to economic fluctuations, could have also experienced a dip.

Geographic Performance Analysis

The geographic breakdown of LVMH's Q1 sales reveals significant regional disparities. While some markets displayed resilience, others experienced a sharper decline:

- Europe: Potentially saw stable or slightly improved performance.

- North America: Might have shown relatively robust growth compared to other regions.

- Asia (excluding China): Possibly experienced moderate growth.

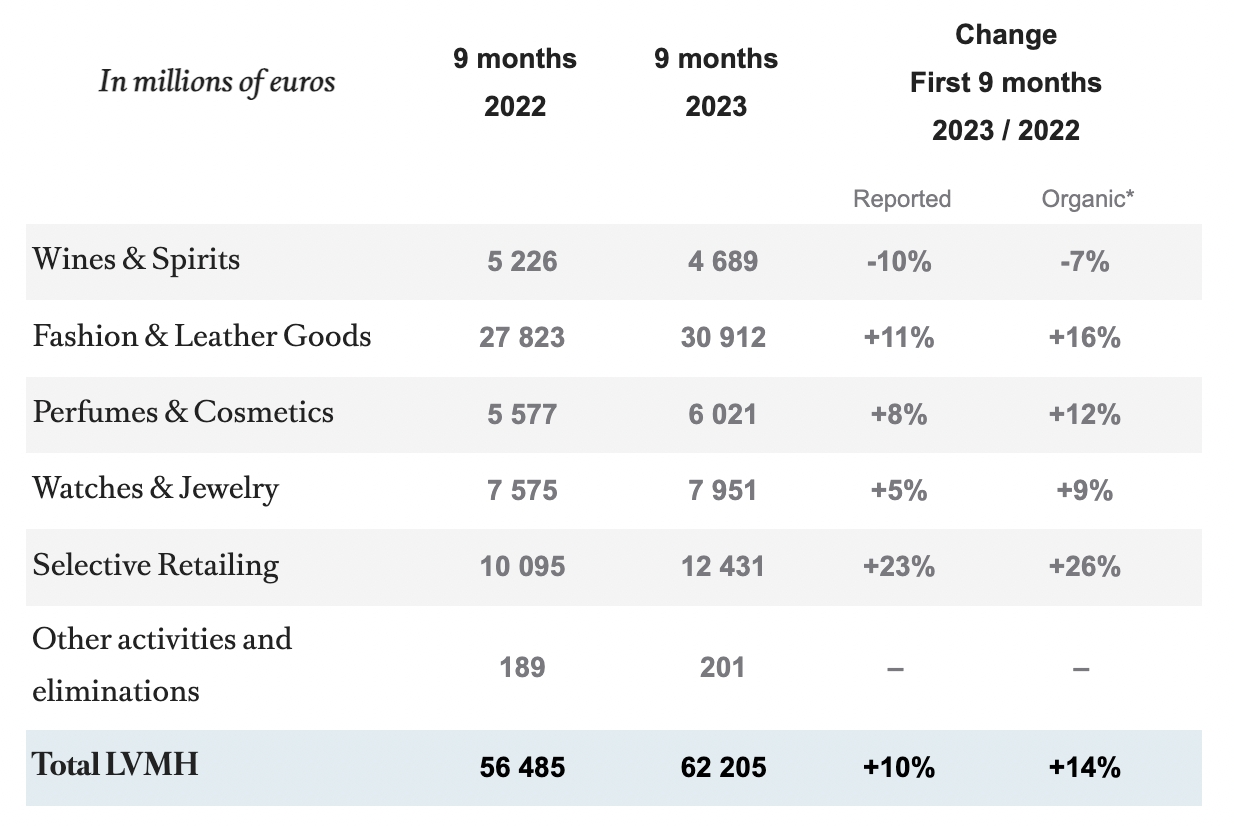

- China: The significant slowdown in the Chinese luxury market heavily impacted LVMH's overall performance, as China represents a huge market for luxury goods. This was driven by factors including reduced consumer confidence and government policies. Visualizing this data with charts and graphs would highlight this disparity dramatically.

Macroeconomic factors such as inflation, currency fluctuations (particularly the Euro/USD exchange rate), and geopolitical uncertainty significantly influenced performance in various regions.

Factors Contributing to the Decline

Slowdown in the Chinese Market

The Chinese luxury market, a crucial driver of growth for LVMH and other luxury brands, experienced a considerable slowdown in Q1 2024. Several factors contributed to this decline:

- Reduced Consumer Spending: Economic uncertainty and shifts in consumer priorities led to a decrease in luxury spending.

- Government Regulations: Changes in government policies and a focus on domestic brands potentially impacted luxury goods sales.

- Shifting Consumer Preferences: A growing preference for experiences over material possessions might have played a role.

Global Economic Uncertainty

Global economic headwinds significantly impacted LVMH's Q1 performance. Key concerns include:

- Inflation: High inflation rates eroded consumer purchasing power, reducing demand for luxury goods.

- Recessionary Fears: Concerns about a potential global recession discouraged spending on non-essential items like luxury products.

- Supply Chain Disruptions: While perhaps less impactful than other factors, lingering supply chain issues might have slightly increased costs or limited availability.

Increased Competition

The luxury goods sector is becoming increasingly competitive, with the emergence of new brands and the strengthening of existing players. This heightened competition has put pressure on LVMH's market share.

Changes in Consumer Spending Habits

Consumer behavior is evolving, with a shift towards experiences and sustainable practices. This change in spending habits could be impacting the demand for traditional luxury goods.

Market Reaction and Investor Sentiment

Share Price Volatility

The announcement of LVMH's disappointing Q1 sales figures triggered an immediate and sharp reaction in the stock market. The 8.2% drop in the share price reflects investor concerns about the company's future prospects.

Analyst Reactions and Future Outlook

Analysts have expressed varying degrees of concern regarding LVMH's performance, with some downgrading their forecasts for the company's future growth. However, many still see long-term potential in the brand and remain positive about its ability to navigate the current challenges.

Investor Confidence

The Q1 results have undoubtedly shaken investor confidence in LVMH, at least in the short term. However, the long-term impact will depend on the company's ability to address the challenges it faces and deliver stronger results in subsequent quarters.

Conclusion

LVMH's Q1 2024 sales figures revealed a disappointing performance, marked by a significant revenue shortfall and an 8.2% drop in its share price. The decline can be attributed to a confluence of factors, including a slowdown in the crucial Chinese market, global economic uncertainty, increased competition, and evolving consumer spending habits. This negative market reaction highlights the vulnerability of the luxury sector to macroeconomic fluctuations and changing consumer preferences.

To stay informed about LVMH's future financial performance and the evolving dynamics of the luxury goods market, continuous monitoring is essential. Further research into LVMH’s Q1 sales figures and their strategic responses is recommended to understand the longer-term implications. Keep an eye on the LVMH share price and its reaction to market changes for a comprehensive understanding of this significant player in the luxury goods sector. Learning more about LVMH's financial reporting and analysis techniques will help you make more informed investment decisions.

Featured Posts

-

Muezelerde Araba Sergileme Yoentemleri Porsche 956 Oernegi

May 24, 2025

Muezelerde Araba Sergileme Yoentemleri Porsche 956 Oernegi

May 24, 2025 -

Sergey Yurskiy Vecher Pamyati V Teatre Mossoveta

May 24, 2025

Sergey Yurskiy Vecher Pamyati V Teatre Mossoveta

May 24, 2025 -

Memorial Day Weekend 2025 Your Guide To The Busiest Travel Days

May 24, 2025

Memorial Day Weekend 2025 Your Guide To The Busiest Travel Days

May 24, 2025 -

Keiki Memorial Day Art Contest Celebrating Hawaiis Artistic Talent Through Lei Making

May 24, 2025

Keiki Memorial Day Art Contest Celebrating Hawaiis Artistic Talent Through Lei Making

May 24, 2025 -

Rost Chisla Brakov Na Kharkovschine Faktory I Posledstviya

May 24, 2025

Rost Chisla Brakov Na Kharkovschine Faktory I Posledstviya

May 24, 2025

Latest Posts

-

Understanding Frank Sinatras Four Marriages

May 24, 2025

Understanding Frank Sinatras Four Marriages

May 24, 2025 -

The Fall From Grace 17 Celebrities Who Ruined Their Public Image

May 24, 2025

The Fall From Grace 17 Celebrities Who Ruined Their Public Image

May 24, 2025 -

17 Celebrity Scandals That Changed Everything

May 24, 2025

17 Celebrity Scandals That Changed Everything

May 24, 2025 -

The Four Women Who Married Frank Sinatra Their Stories And Impact

May 24, 2025

The Four Women Who Married Frank Sinatra Their Stories And Impact

May 24, 2025 -

From Grace To Disaster 17 Celebrities Whose Reputations Imploded

May 24, 2025

From Grace To Disaster 17 Celebrities Whose Reputations Imploded

May 24, 2025