Maluf: Ford's Brazilian Legacy Fades As BYD's Global EV Dominance Grows

Table of Contents

Ford's Declining Market Share in Brazil

Ford's struggles in Brazil are multifaceted, stemming from reduced production, intensified competition, and a failure to adapt to evolving market demands. The legacy of the Maluf family, once synonymous with Ford's success in Brazil, is now overshadowed by these challenges.

Reduced Production and Investments

Ford has significantly reduced its manufacturing output in Brazil, leading to plant closures and job losses. This strategic retreat reflects a broader scaling back of investments in the region.

- Plant closures: The closure of Ford's São Bernardo do Campo plant, a major manufacturing hub, symbolizes the company's shrinking footprint.

- Job losses: Thousands of jobs have been lost directly and indirectly due to reduced production and plant closures, impacting the Brazilian economy.

- Reduced model offerings: The range of Ford vehicles available in Brazil has diminished, limiting consumer choices and potentially impacting sales.

These actions demonstrate a clear shift in Ford's priorities, leaving a significant void in the Brazilian automotive industry. Sales figures show a dramatic decline, reflecting the impact of these decisions on Ford's market share.

Competition from other automakers

The Brazilian automotive market has become increasingly competitive, with both international and domestic brands vying for market share. Ford faces stiff competition from established players and newcomers alike.

- Growth of other manufacturers: Companies like General Motors, Volkswagen, Fiat, and Toyota have strengthened their positions in the Brazilian market, often capitalizing on Ford's reduced presence.

- Changes in consumer preferences: Shifting consumer preferences toward SUVs and smaller, more fuel-efficient vehicles have also contributed to Ford's challenges. Ford's response has been slower than its competitors.

Analyzing market share data reveals a clear picture of Ford's declining dominance and the growth of its competitors in the Brazilian market.

Failure to adapt to changing market demands

Ford's perceived slowness in adapting to changing market demands, especially regarding the rise of electric vehicles, has further exacerbated its decline.

- Lack of EV investment: Compared to competitors, Ford's investment in electric vehicle technology and infrastructure in Brazil has been significantly less aggressive.

- Slow adoption of new technologies: The company's adoption of new technologies and features has lagged behind its competitors, making its vehicles less appealing to tech-savvy Brazilian consumers.

Consumer surveys and expert opinions indicate a strong preference for brands that are at the forefront of technological innovation in the automotive sector.

BYD's Ascendance in the Global and Brazilian EV Market

In stark contrast to Ford's struggles, BYD's rapid ascent is fueled by technological innovation and a bold global expansion strategy. BYD's success challenges the established order, including the long-standing legacy associated with the Maluf name and Ford in Brazil.

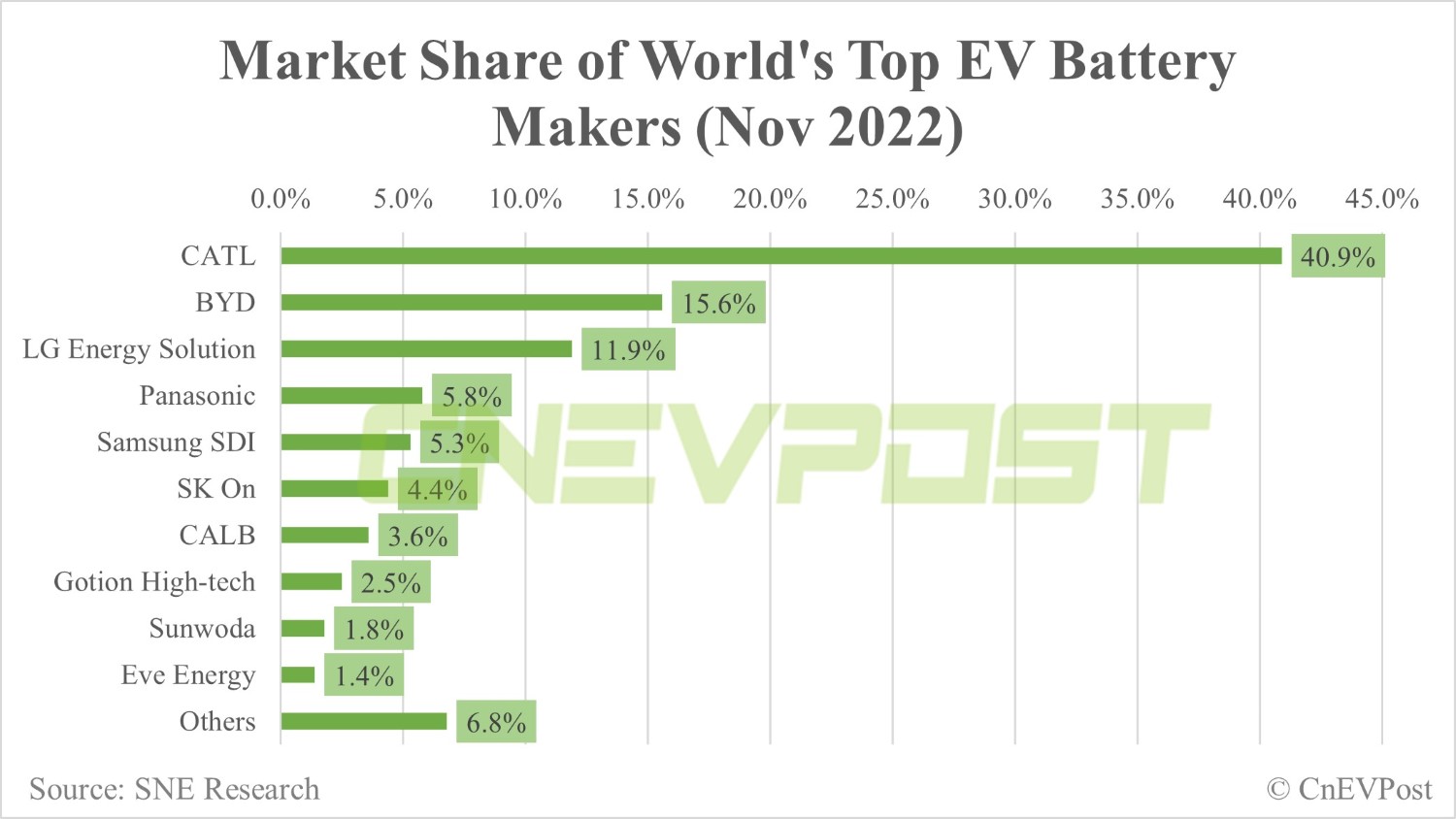

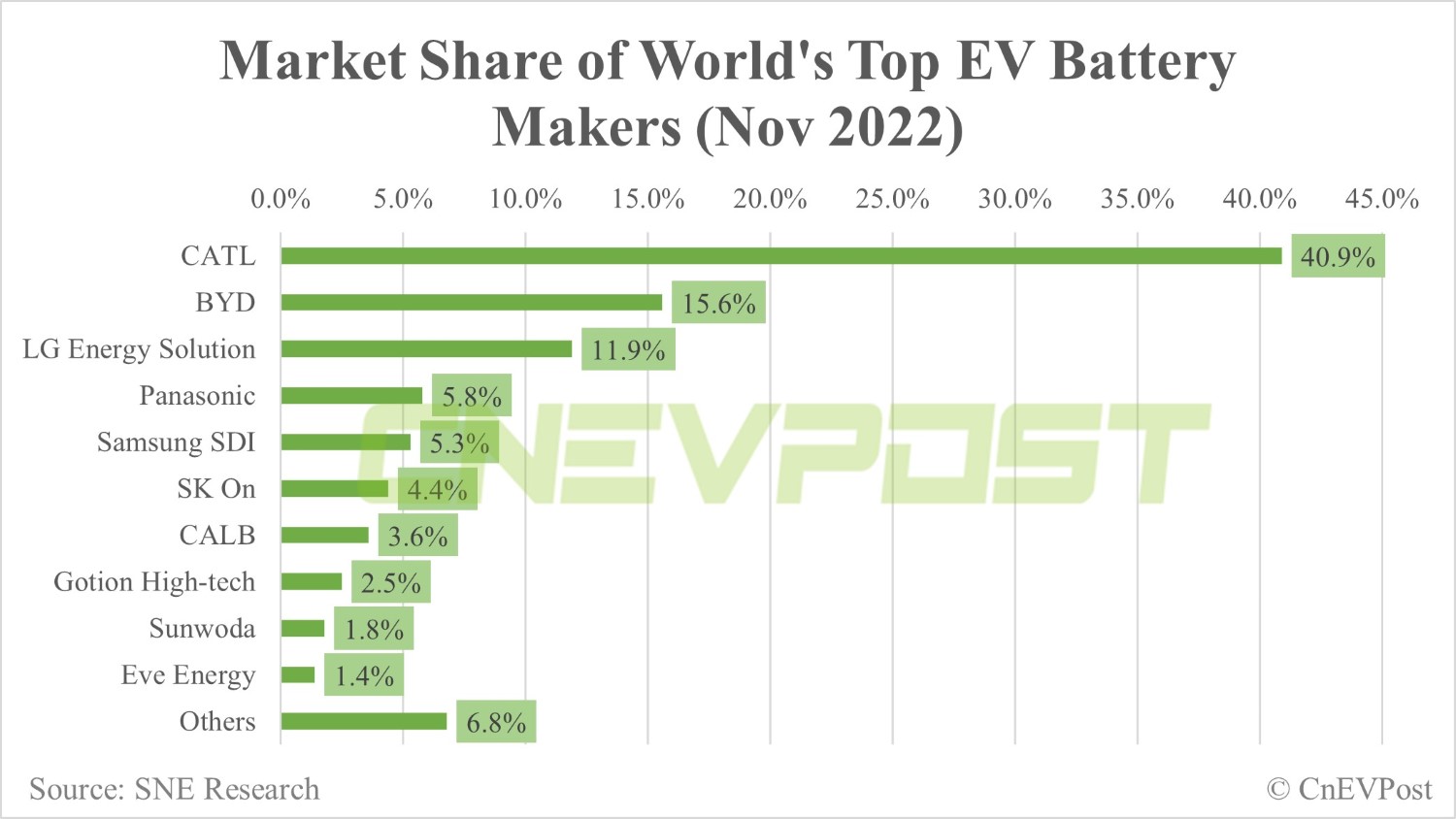

BYD's Technological Advancements

BYD's technological breakthroughs, particularly in battery technology and electric vehicle manufacturing, are key to its success.

- Blade battery technology: BYD's innovative Blade battery technology offers superior energy density and safety, setting it apart from competitors.

- Innovative EV designs: BYD's vehicles boast appealing designs and features, attracting a broad range of consumers.

- Vertical integration: BYD's vertical integration, controlling the entire supply chain from battery production to vehicle assembly, provides a significant competitive advantage.

This technological prowess allows BYD to offer high-quality, competitive EVs, outpacing many established automakers, including Ford.

Aggressive Global Expansion Strategy

BYD's success stems from a well-executed global expansion strategy targeting both developed and emerging markets.

- Market entry strategies: BYD has employed a variety of effective market entry strategies, including strategic partnerships and localized production.

- Partnerships: Collaborations with local distributors and suppliers have facilitated smoother market penetration.

- Localization efforts: Adapting its vehicles and marketing to meet the specific needs and preferences of local markets has been crucial to BYD's success.

BYD's strategic approach offers a masterclass in global expansion for the automotive industry.

BYD's growing presence in Brazil

BYD is making significant inroads into the Brazilian market, rapidly expanding its presence through various initiatives.

- Model introductions: BYD has introduced several EV models tailored to the Brazilian market.

- Dealership network expansion: The company is establishing a robust dealership network to support sales and after-sales service.

- Marketing campaigns: Effective marketing campaigns are raising consumer awareness and building brand recognition.

Sales data and market projections indicate a strong potential for BYD to capture a significant share of the Brazilian EV market.

The Shifting Landscape of the Brazilian Automotive Industry

The contrasting fortunes of Ford and BYD reflect a broader transformation within the Brazilian automotive industry, characterized by the rise of EVs and their economic implications.

The rise of EVs in Brazil

The adoption of electric vehicles in Brazil is accelerating, driven by a confluence of factors.

- Government incentives: Government policies promoting EV adoption are creating a favorable market environment.

- Infrastructure development: The expansion of charging infrastructure is addressing a key barrier to EV adoption.

- Consumer awareness: Growing consumer awareness about the environmental and economic benefits of EVs is fueling demand.

These factors create a fertile ground for the expansion of EV manufacturers like BYD.

Implications for the Brazilian economy

The shifts in the automotive industry have significant economic implications for Brazil, impacting job creation and foreign investment.

- Job losses in Ford: Ford's decline has resulted in significant job losses, negatively impacting the economy.

- Job creation in BYD: BYD's expansion is creating new jobs, both directly and through its supply chain.

- Impact on GDP: The overall impact on Brazil's GDP will depend on the balance between job losses and gains as well as the overall impact on foreign investment.

Economic analyses and expert opinions highlight the importance of navigating this transition effectively to maximize the economic benefits of the shift towards electric vehicles.

Conclusion

Ford's declining market share in Brazil, linked to reduced investment, a lack of focus on EVs, and increased competition, stands in sharp contrast to BYD's rapid growth driven by technological innovation and aggressive market entry. This shift highlights the dramatic transformation of the global and Brazilian automotive landscape, primarily fueled by the electric vehicle revolution. The legacy of Maluf and Ford in Brazil is now facing a significant challenge from a new era of EV dominance.

Call to Action: Stay informed about the evolving automotive landscape and the continued impact of the Maluf legacy as the global shift towards electric vehicles accelerates. Follow our updates on the future of the Brazilian automotive market and the ongoing competition between established players and new EV giants like BYD. Learn more about the future of Maluf: Ford's Brazilian Legacy and the rise of BYD by subscribing to our newsletter.

Featured Posts

-

Atalanta Vs Venezia Prediksi Akurat Susunan Pemain And Statistik Pertandingan Serie A

May 13, 2025

Atalanta Vs Venezia Prediksi Akurat Susunan Pemain And Statistik Pertandingan Serie A

May 13, 2025 -

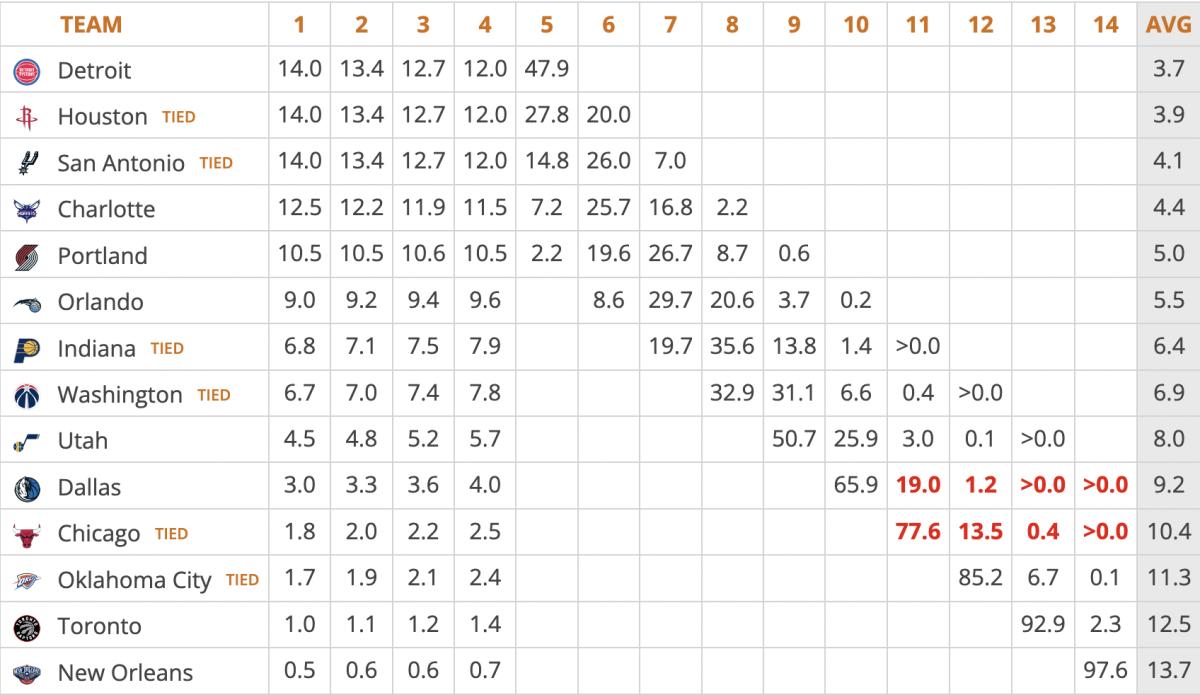

Rebuilding Raptors 7th Best Odds In Nba Draft Lottery

May 13, 2025

Rebuilding Raptors 7th Best Odds In Nba Draft Lottery

May 13, 2025 -

Tempah Byd Ev Di Mas 2025 And Dapatkan Kredit Cas Rm 800 9 15 Mei Nikmati Konsert Rentak Elektrik

May 13, 2025

Tempah Byd Ev Di Mas 2025 And Dapatkan Kredit Cas Rm 800 9 15 Mei Nikmati Konsert Rentak Elektrik

May 13, 2025 -

Oregon Ducks Womens Basketball Overcoming A Large Deficit To Defeat Vanderbilt In Ncaa Tournament Overtime Thriller

May 13, 2025

Oregon Ducks Womens Basketball Overcoming A Large Deficit To Defeat Vanderbilt In Ncaa Tournament Overtime Thriller

May 13, 2025 -

Angel Has Fallen Review Plot Summary And Cast Analysis

May 13, 2025

Angel Has Fallen Review Plot Summary And Cast Analysis

May 13, 2025

Latest Posts

-

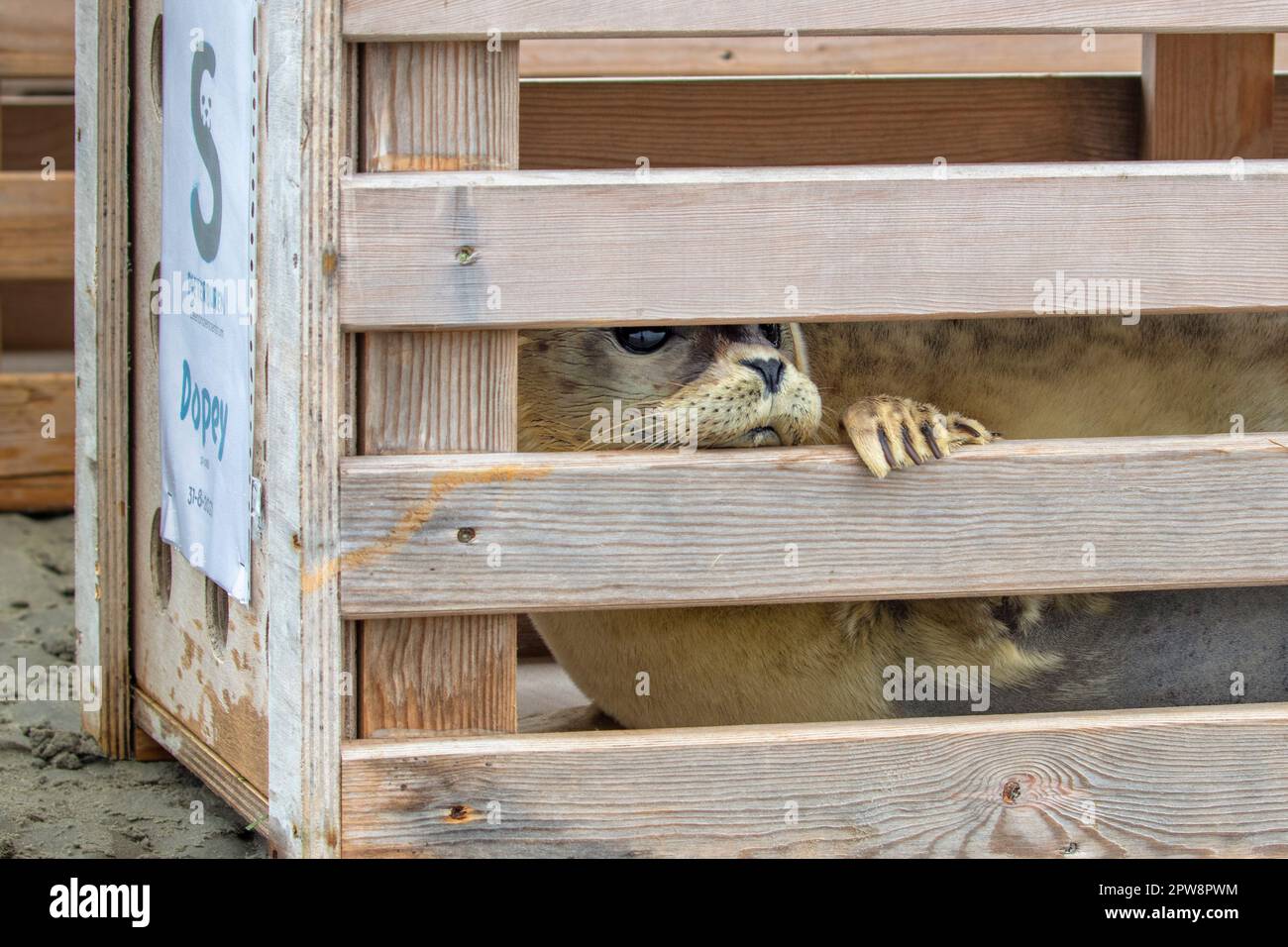

Pieterburen Rescue Centre 50 Years Thousands Of Seals Rescued Now Closed

May 13, 2025

Pieterburen Rescue Centre 50 Years Thousands Of Seals Rescued Now Closed

May 13, 2025 -

Closure Of Pieterburen Seal Rescue Centre 50 Years Of Protecting Seals

May 13, 2025

Closure Of Pieterburen Seal Rescue Centre 50 Years Of Protecting Seals

May 13, 2025 -

The Pieterburen Seal Rescue Centre 50 Years Of Service Final Seals Released

May 13, 2025

The Pieterburen Seal Rescue Centre 50 Years Of Service Final Seals Released

May 13, 2025 -

Schiphol Airport Road And Ferry Traffic Easter And Spring Break Peak Days Predicted

May 13, 2025

Schiphol Airport Road And Ferry Traffic Easter And Spring Break Peak Days Predicted

May 13, 2025 -

Easter And Spring Holiday Travel Schiphol Road And Ferry Peak Days

May 13, 2025

Easter And Spring Holiday Travel Schiphol Road And Ferry Peak Days

May 13, 2025