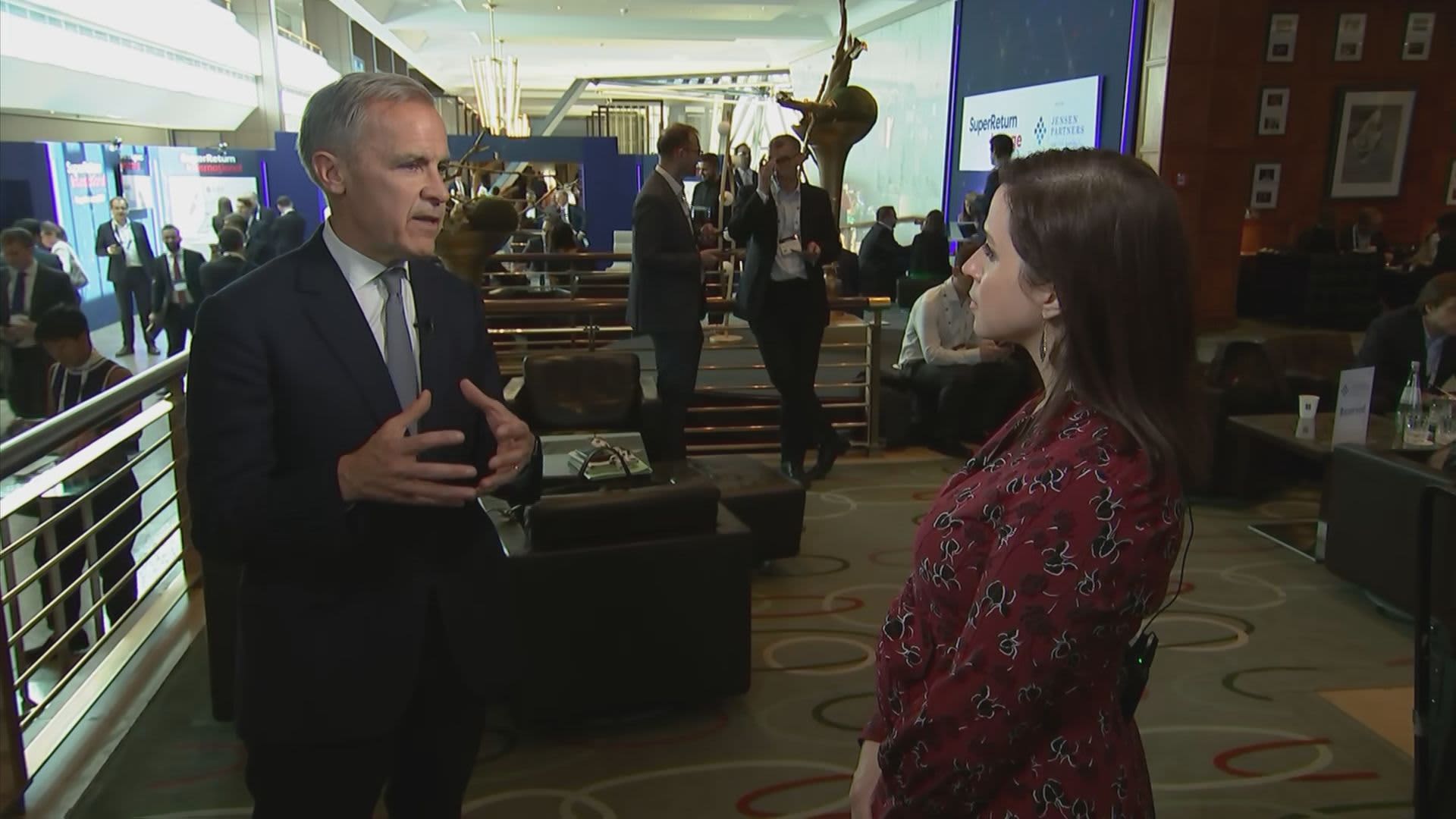

Mark Carney's Upcoming Meeting With President Trump At The White House

Table of Contents

Potential Topics of Discussion

The agenda for this significant meeting is likely to be broad, encompassing several key areas of mutual concern and potential conflict.

US-UK Trade Relations: Navigating the Post-Brexit Landscape

Brexit's impact on US-UK trade relations remains a significant point of contention. While both nations desire a strong trading partnership, disagreements persist. The potential for a comprehensive US-UK trade deal, or the lack thereof, will undoubtedly dominate a portion of their discussion.

- Specific Trade Sectors: The conversation will likely touch upon key sectors like financial services (where regulatory differences present challenges), and agricultural products (subject to potential tariffs and trade barriers).

- Trade Agreements and Negotiations: Existing trade agreements and the ongoing negotiations will influence the tone and outcome of this discussion on US-UK trade. The possibility of a new bilateral agreement, or reliance on existing frameworks, will be a critical point of contention.

- Keywords: US-UK trade, Brexit trade deal, post-Brexit trade, transatlantic trade, trade negotiations.

Global Economic Stability and Monetary Policy: Addressing Shared Challenges

Global economic stability is a shared concern. The meeting is expected to address current challenges, including:

- Inflation and Interest Rate Hikes: The current inflationary pressures in many countries and the subsequent interest rate hikes by central banks will likely be central to their conversation. The potential for a global recession will be a significant concern.

- Central Banking Coordination: The roles of central banks in managing these challenges and the need for international coordination will be discussed. Differing approaches to monetary policy between the US Federal Reserve and other central banks may create tension.

- Keywords: global economic outlook, monetary policy, inflation, interest rates, central banking, global recession.

Climate Change and Environmental Policy: Finding Common Ground?

The differing approaches of the US and UK to climate change and environmental regulations present a complex dynamic. While the UK has ambitious climate targets, the US approach has been less consistent. This meeting may offer an opportunity to find common ground or, conversely, to highlight these contrasting viewpoints.

- Specific Climate Policies: Specific policies such as carbon emissions reduction targets, investments in renewable energy, and environmental regulations will be relevant discussion points.

- Potential for Collaboration: The possibility of collaboration on climate-related initiatives, or the lack thereof, will significantly impact the overall tone and outcome of the meeting.

- Keywords: climate change, environmental policy, sustainability, green initiatives, carbon emissions, climate action.

Implications of the Meeting

The outcome of this meeting will have significant ramifications across various sectors.

Impact on Global Markets: Ripple Effects Across the Globe

The discussion's outcome will undoubtedly influence global financial markets. Positive developments could boost investor confidence, leading to increased market stability. Conversely, disagreements could trigger market volatility and affect currency exchange rates.

- Positive Scenarios: A productive meeting focusing on cooperation could lead to strengthened investor confidence and more stable markets.

- Negative Scenarios: Disagreements on key economic issues could lead to market uncertainty and increased volatility.

- Keywords: global financial markets, stock market, currency exchange, investor sentiment, market volatility.

US-UK Relations: Strengthening or Straining the Bond?

The meeting's success or failure will also significantly shape the trajectory of US-UK relations. Beyond purely economic considerations, the discussion may touch upon broader political alignment and shared security interests.

- Strengthening Relations: A productive meeting could signal a renewed commitment to cooperation and strengthen the bilateral relationship.

- Straining Relations: Disagreements could further strain an already complex relationship, impacting both economic and political cooperation.

- Keywords: US-UK relations, transatlantic relations, diplomatic relations, bilateral relations, international cooperation.

Analysis of Carney's Influence and Expertise

Mark Carney’s extensive experience and expertise will undoubtedly shape the discussion.

Carney’s Background and Experience: A Wealth of Knowledge

Carney's career includes significant roles such as Governor of the Bank of England and Governor of the Bank of Canada. His deep understanding of economics, finance, and global governance provides him with unique insights.

- Key Achievements and Positions: His career trajectory demonstrates his expertise in managing central banks, navigating complex economic challenges, and promoting global financial stability.

- Keywords: Mark Carney, Bank of England, Governor of the Bank of England, economic expert, financial policy, global governance.

Potential Impact of His Perspective: Shaping the Narrative

Carney's perspective, shaped by his experience, is likely to offer balanced economic analysis and policy recommendations. His influence could range from moderating disagreements to highlighting potential risks and opportunities.

- Arguments for Influence: His expertise and neutral standing might facilitate constructive dialogue and compromise.

- Arguments Against Influence: President Trump's independent approach might limit Carney's influence.

- Keywords: expert opinion, economic analysis, policy recommendations, global governance, economic influence.

Conclusion

The Mark Carney's meeting with President Trump at the White House promises to be a critical juncture in global economic and political affairs. The potential discussions on US-UK trade, global economic stability, and climate change will have wide-ranging implications. The meeting’s success hinges on the ability of both parties to find common ground while acknowledging their differences. The long-term consequences of this meeting will unfold over time, affecting global markets, US-UK relations, and the global economic landscape. Stay informed about the developments following Mark Carney's meeting with President Trump at the White House by following reputable news sources and subscribing to relevant newsletters to stay updated on this critical discussion and its ongoing impact.

Featured Posts

-

Transportation Department Workforce Reduction A May Update

May 05, 2025

Transportation Department Workforce Reduction A May Update

May 05, 2025 -

Ufc Bogeymans Controversial Knockout Mc Gregor Sparring Partner Falls In Epic Seven Fight Run

May 05, 2025

Ufc Bogeymans Controversial Knockout Mc Gregor Sparring Partner Falls In Epic Seven Fight Run

May 05, 2025 -

Bianca Censoris Racy Roller Skating Outfit Bra And Thong Look

May 05, 2025

Bianca Censoris Racy Roller Skating Outfit Bra And Thong Look

May 05, 2025 -

Cord Cutting Guide Access Fox Sports News And Shows Online

May 05, 2025

Cord Cutting Guide Access Fox Sports News And Shows Online

May 05, 2025 -

Police Investigating Fatal Collision Near Yellowstone Seven Dead

May 05, 2025

Police Investigating Fatal Collision Near Yellowstone Seven Dead

May 05, 2025

Latest Posts

-

Sydney Sweeney And Jonathan Davino A Look At Their Current Relationship Status

May 05, 2025

Sydney Sweeney And Jonathan Davino A Look At Their Current Relationship Status

May 05, 2025 -

Post Split Sydney Sweeney Karaoke And A Breakup Anthem

May 05, 2025

Post Split Sydney Sweeney Karaoke And A Breakup Anthem

May 05, 2025 -

Jonathan Davino And Sydney Sweeney Breakup Speculation Following L A Sighting

May 05, 2025

Jonathan Davino And Sydney Sweeney Breakup Speculation Following L A Sighting

May 05, 2025 -

Sydney Sweeneys Relationship With Jonathan Davino New Developments In L A

May 05, 2025

Sydney Sweeneys Relationship With Jonathan Davino New Developments In L A

May 05, 2025 -

Karaoke Breakup Song Sydney Sweeneys Reaction To Davino Split

May 05, 2025

Karaoke Breakup Song Sydney Sweeneys Reaction To Davino Split

May 05, 2025