Market Reaction: Deciphering CoreWeave Inc. (CRWV)'s Tuesday Stock Dip

Table of Contents

CoreWeave Inc. (CRWV), a leading provider of cloud computing and AI infrastructure, experienced a significant stock dip on Tuesday. This unexpected market reaction has left investors questioning the underlying causes. This article dissects the potential factors contributing to the CRWV stock price decline, analyzing recent financial performance, macroeconomic influences, and speculative considerations to offer a comprehensive understanding of this volatility for investors interested in CRWV stock and the broader tech market. We'll examine the interplay between CRWV's operational performance, broader market trends, and investor sentiment to provide insights into this Tuesday stock market event.

H2: Analyzing CoreWeave's Recent Financial Performance and Analyst Ratings

H3: Impact of Quarterly Earnings Reports:

CRWV's recent quarterly earnings report (assuming one was released prior to the Tuesday dip) is a crucial element in understanding the stock's movement. Let's analyze key performance indicators (KPIs):

- Revenue Growth: Did CRWV meet or exceed analyst expectations regarding revenue growth? A shortfall in revenue could trigger a negative market reaction, impacting the CRWV stock price.

- Profitability: Was the company profitable, and if so, did profitability meet predictions? Decreased profitability or unexpected losses would significantly influence investor confidence and the CRWV stock price.

- Guidance: What is the company's outlook for future quarters? Lower-than-expected guidance often leads to investor concern and sell-offs.

- Analyst Downgrades: Did any financial analysts downgrade their ratings for CRWV following the earnings report? Analyst opinions heavily influence investor sentiment and can amplify downward pressure on the stock price.

For example, if CRWV's revenue growth slowed compared to previous quarters or if it missed profit targets, this could be a direct contributor to the Tuesday stock dip. A comparison of these figures against previous quarters and competitor performance provides crucial context.

H3: Competitor Analysis in the Cloud Computing Market:

The cloud computing market is highly competitive. Analyzing CRWV's position against giants like AWS, Azure, and Google Cloud is essential:

- Market Share: Is CRWV losing market share to competitors? Aggressive pricing strategies or innovative product offerings from competitors could pressure CRWV's growth and negatively impact its stock.

- Competitive Pressures: Are there any new technologies or services introduced by competitors that pose a threat to CRWV's business model?

- New Entrants: Is the market experiencing an influx of new players, increasing competitive intensity?

Understanding CRWV’s competitive landscape is crucial. News of significant competitor advancements or strategic partnerships could negatively impact investor confidence in CRWV's future prospects, contributing to the Tuesday stock dip.

H2: Macroeconomic Factors and Their Influence on CRWV's Stock Price

H3: Broader Market Trends:

The overall market environment significantly impacts individual stock performance.

- General Market Sell-off: Was there a broader sell-off in the technology sector or the overall market on Tuesday? A general market downturn could have negatively affected CRWV regardless of its specific performance.

- Tech Stock Performance: How did other tech stocks, especially those in the cloud computing sector, perform on Tuesday? Comparing CRWV's performance against its peers provides valuable insight.

- Macroeconomic Indicators: Were there any significant macroeconomic events, like interest rate hikes or negative economic news, that could have contributed to widespread market pessimism? Increased interest rates, for instance, can disproportionately impact high-growth tech stocks like CRWV.

Understanding the broader market context is crucial to determine if the CRWV stock dip was specific to the company or a reflection of larger market forces.

H3: Investor Sentiment and Market Volatility:

Investor sentiment plays a significant role in short-term stock price fluctuations.

- News Articles and Social Media: What was the overall sentiment expressed in news articles and social media regarding CRWV around the time of the dip? Negative sentiment can trigger sell-offs.

- Market Volatility: Was the market generally volatile on Tuesday? Increased volatility can amplify the impact of even minor negative news on individual stocks.

Analyzing news coverage and social media sentiment provides insight into the narrative surrounding the CRWV stock price drop.

H2: Speculative Factors and Potential Future Implications

H3: Impact of AI Development and Adoption:

CRWV's business model is heavily reliant on the growth of AI and its adoption.

- AI-related Risks: Are there any uncertainties or risks associated with CRWV's AI-focused strategy?

- AI Market Shifts: Could shifts in AI technology or market demand impact CRWV's future performance?

The rapid evolution of AI technology introduces both opportunities and risks for CRWV, which investors must carefully consider.

H3: Long-Term Growth Prospects for CRWV:

Despite the Tuesday dip, CRWV's long-term prospects are crucial for investors.

- Competitive Advantages: What are CRWV's key competitive advantages in the cloud computing and AI markets?

- Strategic Initiatives: Are there any strategic initiatives underway that could improve CRWV's position in the future?

A balanced assessment of CRWV's long-term prospects, considering both risks and opportunities, is crucial for making informed investment decisions.

Conclusion:

CoreWeave Inc. (CRWV)'s Tuesday stock dip resulted from a confluence of factors, including potentially disappointing quarterly earnings, competitive pressures within the dynamic cloud computing market, broader macroeconomic headwinds, and investor sentiment. While short-term market fluctuations are inevitable, investors should focus on CRWV's long-term growth prospects within the expanding AI and cloud computing sectors. For a deeper understanding of the intricacies of the CoreWeave Inc. (CRWV) stock price and to make informed investment decisions, continue monitoring market analysis and company performance updates. Stay informed about future CRWV market reactions and developments in the cloud computing and AI sectors.

Featured Posts

-

Adam Ramey Of Dropout Kings Dead At Age

May 22, 2025

Adam Ramey Of Dropout Kings Dead At Age

May 22, 2025 -

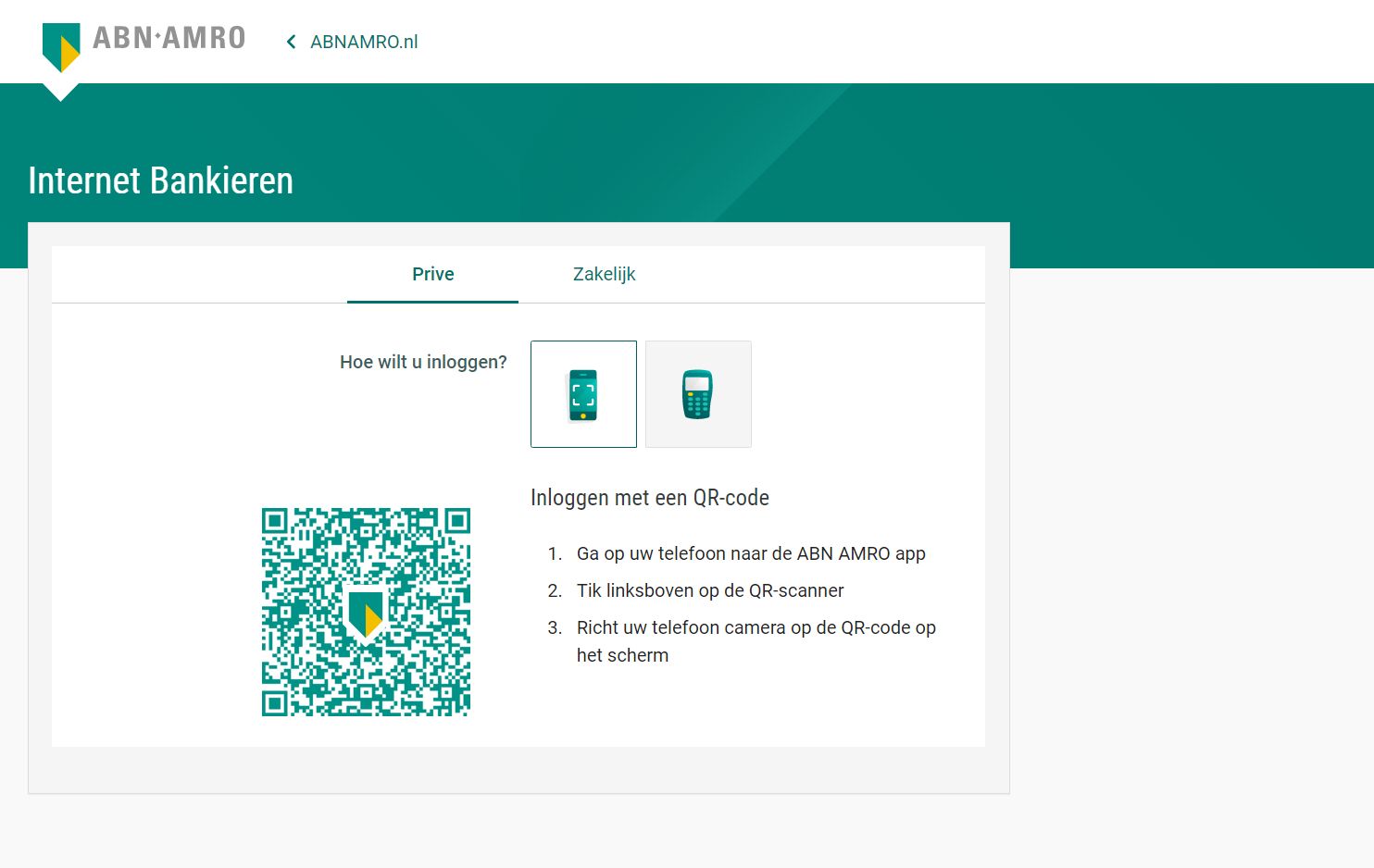

Abn Amro Toenemend Autobezit Drijft Groei In Occasionverkoop

May 22, 2025

Abn Amro Toenemend Autobezit Drijft Groei In Occasionverkoop

May 22, 2025 -

Ea Fc 24 Fut Birthday Player Tier List Best Cards To Use

May 22, 2025

Ea Fc 24 Fut Birthday Player Tier List Best Cards To Use

May 22, 2025 -

Tuerkiye Nin Nato Zirvesi Ndeki Basarisi Ve Oenemi

May 22, 2025

Tuerkiye Nin Nato Zirvesi Ndeki Basarisi Ve Oenemi

May 22, 2025 -

Air Traffic Control Outages Beyond Newarks Black Screens And Silent Radios

May 22, 2025

Air Traffic Control Outages Beyond Newarks Black Screens And Silent Radios

May 22, 2025

Latest Posts

-

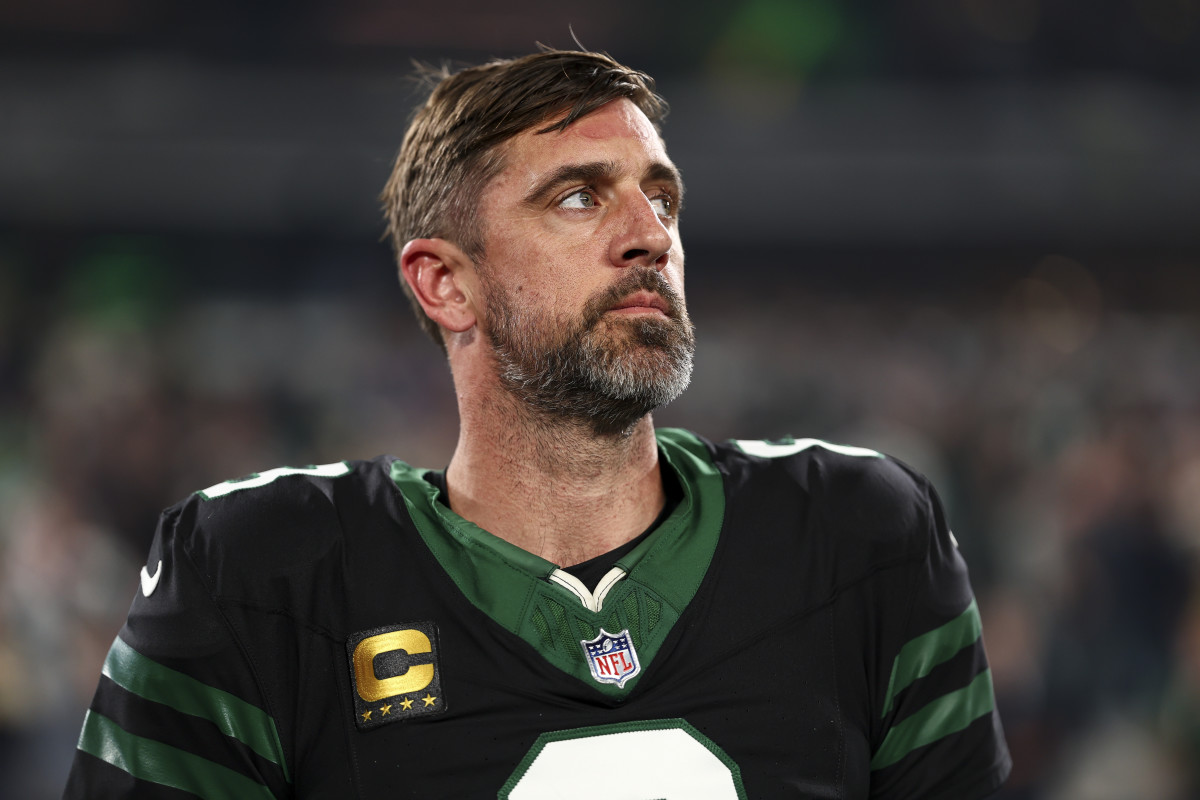

Rodgers Steelers Visit A Deeper Look At The Implications

May 22, 2025

Rodgers Steelers Visit A Deeper Look At The Implications

May 22, 2025 -

Pittsburgh Steelers Insider Perspective On The Pickens Trade Rumors

May 22, 2025

Pittsburgh Steelers Insider Perspective On The Pickens Trade Rumors

May 22, 2025 -

Aaron Rodgers At Steelers Facility Speculation And Analysis

May 22, 2025

Aaron Rodgers At Steelers Facility Speculation And Analysis

May 22, 2025 -

George Pickens Trade Explaining Pittsburghs Decision

May 22, 2025

George Pickens Trade Explaining Pittsburghs Decision

May 22, 2025 -

Why The Steelers Didnt Trade George Pickens Insider Analysis

May 22, 2025

Why The Steelers Didnt Trade George Pickens Insider Analysis

May 22, 2025