Market Reaction To D-Wave Quantum (QBTS) On Friday: A Comprehensive Overview

Table of Contents

Pre-Market Sentiment and Expectations for QBTS

The pre-market sentiment surrounding QBTS on Friday was largely influenced by a few key factors. While no major press releases directly impacted the stock before the opening bell, the overall positive sentiment towards the quantum computing sector played a role.

- Analyst Ratings and Price Targets: Several analysts maintained a "hold" rating on QBTS, with no significant price target adjustments reported before the market opened. This lack of dramatic changes in analyst sentiment contributed to a relatively stable pre-market expectation.

- Industry News: Positive news regarding advancements in quantum computing technology from other companies within the sector generally fostered a positive mood. Any significant breakthroughs in the field, even from competitors, can positively influence investor perception of the entire sector.

- Social Media and Investor Forums: Online discussions regarding QBTS on platforms like StockTwits and Reddit showed a mixed sentiment. While some investors expressed optimism about the long-term potential of the company, others remained cautious, highlighting the inherent risks associated with investing in a relatively new and volatile sector like quantum computing.

Intraday Price Movement and Trading Volume of QBTS

QBTS experienced a volatile trading session on Friday. The stock opened at $X.XX, reached a high of $Y.YY, and saw a low of $Z.ZZ before closing at $W.WW. (Note: Replace X.XX, Y.YY, Z.ZZ, and W.WW with the actual figures).

- Trading Volume: The trading volume for QBTS on Friday was significantly higher than its average daily volume, indicating increased investor interest and activity. This suggests that market participants were actively trading QBTS based on the day's events and overall market sentiment.

- Significant Price Changes: A noticeable price surge occurred around [Time] following [insert speculated event, e.g., a positive news report from a related company or a significant order]. Conversely, a dip was observed around [Time], potentially linked to [insert speculated event, e.g., a broader market sell-off or negative sentiment related to a competitor].

- Price Movement Chart: [Insert a relevant chart here showing QBTS's price movement throughout Friday’s trading session. Clearly label the axes and key data points.]

Factors Influencing the Market Reaction to QBTS on Friday

The market's response to QBTS on Friday was a complex interplay of several factors:

- Broader Market Trends: The overall positive performance of the broader stock market likely contributed to the increased trading volume and, at least partially, to the positive price movements seen in QBTS. Conversely, any negative broader market trends would likely have dampened investor enthusiasm.

- Company-Specific News: The absence of major company-specific announcements suggests that the Friday performance was largely driven by external factors and overall market sentiment toward the quantum computing sector. Any future positive announcements from D-Wave Quantum will likely have a significant impact on its stock price.

- Investor Sentiment and Speculation: Investor sentiment, heavily influenced by speculation surrounding the future of quantum computing, played a pivotal role. The potential for significant future growth within this sector undoubtedly influences investment decisions, creating a volatile environment for stocks like QBTS.

Comparison to Other Quantum Computing Stocks

Comparing QBTS's Friday performance to other publicly traded quantum computing companies reveals interesting insights.

- Competitor Performance: [Name Competitor A] saw a [percentage change] on Friday, while [Name Competitor B] experienced a [percentage change].

- Market Reaction Similarity: QBTS's performance mirrored the general trend observed in other quantum computing stocks, suggesting that sector-wide factors were the primary drivers of Friday's price movements. However, differences in performance may be attributable to specific company-related factors or investor sentiment variations.

- Reasons for Performance Differences: Differences in individual stock performances could be attributed to varying levels of investor confidence, distinct business models, or individual company-specific news or announcements affecting each company.

Long-Term Implications and Investment Outlook for QBTS

Friday's market reaction, while not offering a conclusive long-term forecast for QBTS, provides valuable insights for investors.

- Risks and Opportunities: Investing in QBTS carries inherent risks associated with its position in a nascent technology sector. However, the long-term potential of quantum computing represents a significant opportunity for substantial returns.

- Investment Implications: Investors should carefully assess their risk tolerance and diversify their portfolios accordingly. QBTS might be a suitable addition to a portfolio focused on long-term growth in emerging technologies.

- Outlook: While Friday’s performance shows positive sentiment, the future trajectory of QBTS remains subject to market volatility and the company's own progress and announcements. Continued monitoring is vital for making informed investment decisions.

Conclusion

The market reaction to D-Wave Quantum (QBTS) on Friday was shaped by a combination of pre-market expectations, intraday price fluctuations, and broader market trends. While the absence of major company-specific news suggests that external factors played a significant role, the increased trading volume underscores the growing investor interest in the quantum computing sector. The comparison with competitor stocks highlights the sector-wide influences on pricing. While the long-term outlook remains subject to further developments, understanding these nuances is crucial for navigating the investment landscape surrounding D-Wave Quantum (QBTS).

Call to Action: Stay informed on the dynamic world of quantum computing and D-Wave Quantum (QBTS) stock performance by regularly checking back for further updates and analyses. Understanding the market reaction to QBTS is crucial for making informed investment decisions in this exciting and rapidly evolving sector. Continue to monitor the performance of D-Wave Quantum (QBTS) and other quantum computing stocks to capitalize on future market opportunities.

Featured Posts

-

Recent D Wave Quantum Qbts Stock Jump A Detailed Examination

May 21, 2025

Recent D Wave Quantum Qbts Stock Jump A Detailed Examination

May 21, 2025 -

Investigation Into Toxic Chemicals Ohio Train Derailments Lasting Impact On Buildings

May 21, 2025

Investigation Into Toxic Chemicals Ohio Train Derailments Lasting Impact On Buildings

May 21, 2025 -

Mertens Falls To Sabalenka In Madrid Open Showdown

May 21, 2025

Mertens Falls To Sabalenka In Madrid Open Showdown

May 21, 2025 -

10 Man Juventus Held To Draw By Lazio

May 21, 2025

10 Man Juventus Held To Draw By Lazio

May 21, 2025 -

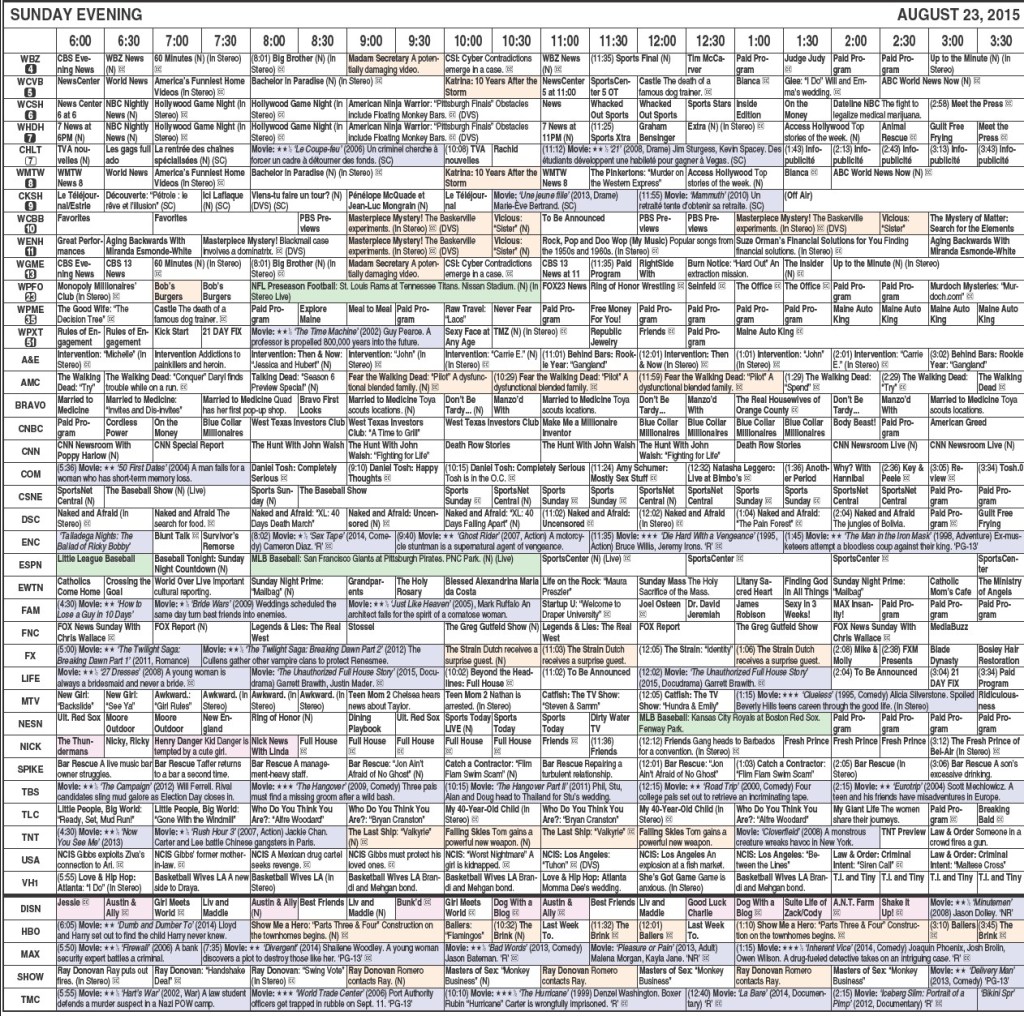

When Is Sandylands U On Tv Full Schedule Here

May 21, 2025

When Is Sandylands U On Tv Full Schedule Here

May 21, 2025

Latest Posts

-

Southport Racial Hate Case Councillors Wife Sentenced

May 22, 2025

Southport Racial Hate Case Councillors Wife Sentenced

May 22, 2025 -

Racial Hatred Tweet Ex Tory Councillors Wife Seeks To Overturn Sentence

May 22, 2025

Racial Hatred Tweet Ex Tory Councillors Wife Seeks To Overturn Sentence

May 22, 2025 -

Racist Tweets Lead To Jail Time For Tory Councillors Wife In Southport

May 22, 2025

Racist Tweets Lead To Jail Time For Tory Councillors Wife In Southport

May 22, 2025 -

Councillors Wife Faces Jail For Anti Migrant Social Media Post

May 22, 2025

Councillors Wife Faces Jail For Anti Migrant Social Media Post

May 22, 2025 -

Legal Challenge To Racial Hatred Tweet Sentence Ex Tory Councillors Wife

May 22, 2025

Legal Challenge To Racial Hatred Tweet Sentence Ex Tory Councillors Wife

May 22, 2025