Market Reaction To D-Wave Quantum (QBTS) On Thursday: A Comprehensive Review

Table of Contents

QBTS Stock Performance on Thursday

Opening Price and Intraday Fluctuations

D-Wave Quantum (QBTS) opened Thursday at $XX.XX. Throughout the day, the stock experienced significant intraday fluctuations, reaching a high of $XX.XX and a low of $XX.XX before closing at $XX.XX. This represents a percentage change of X% compared to Wednesday's closing price. Trading volume was [high/low] compared to recent averages, indicating [high/low] investor activity.

- Opening Price: $XX.XX

- Intraday High: $XX.XX

- Intraday Low: $XX.XX

- Closing Price: $XX.XX

- Percentage Change: X%

- Trading Volume: [Volume]

The reasons behind these fluctuations are multifaceted. While [insert specific reason, e.g., a positive earnings report] contributed to upward pressure, [insert specific reason, e.g., broader market sell-off] likely exerted downward pressure. Technically, the stock appeared to test support levels around $XX.XX before recovering some losses. Further analysis is needed to fully understand the precise interplay of these factors.

News and Events Influencing QBTS

Company-Specific News

On Thursday, D-Wave Quantum [mention any relevant news, e.g., announced a new partnership with a major technology company or released an important product update]. This announcement likely played a role in shaping investor sentiment and consequently the stock's performance.

- Specific News Item: [Insert news headline and brief summary with a link to the source.]

- Impact on Investor Sentiment: The news was generally perceived as [positive/negative/neutral], leading to [increased/decreased] buying pressure.

Broader Market Trends

The overall market environment also influenced QBTS's performance. The Nasdaq Composite, a key benchmark for technology stocks, experienced a [positive/negative] day, [mention percentage change]. This broader market trend likely contributed to the [positive/negative] movement in QBTS's price.

- Nasdaq Performance: [Percentage change]

- Impact on QBTS: The downward pressure on the Nasdaq likely amplified the negative sentiment surrounding QBTS.

Investor Sentiment and Trading Volume

Social Media Sentiment

Social media sentiment regarding QBTS on Thursday was largely [positive/negative/mixed]. Twitter and Reddit discussions revealed a [positive/negative/mixed] outlook on the company's prospects, with many users citing [mention specific reasons cited by users].

- Overall Sentiment: [Positive/Negative/Mixed]

- Example Tweets/Posts: [Include relevant examples with proper attribution, e.g., "User @username stated, 'Excited about the new partnership! #QBTS #QuantumComputing'"]

Trading Volume Analysis

Trading volume for QBTS on Thursday was [higher/lower] than the average daily volume over the past month. This could indicate [increased/decreased] investor interest in the stock, possibly driven by the [mention specific news or event].

- Trading Volume: [Volume] compared to average daily volume of [average volume].

- Potential Reasons: The increased/decreased volume likely reflects the [positive/negative] sentiment surrounding the company's recent announcements.

Comparison to Competitors in the Quantum Computing Market

Peer Performance

Compared to other publicly traded quantum computing companies like IonQ and Rigetti, QBTS's performance on Thursday was [better/worse/similar]. [Mention specific details of competitors' performances and provide reasons for any divergence in performance]. These differences might reflect varying investor expectations, company-specific news, or differing market sensitivities.

- IonQ Performance: [Brief description of performance and percentage change]

- Rigetti Performance: [Brief description of performance and percentage change]

- Reasons for Divergence: [Explain the factors that might have led to the difference in performance.]

Conclusion

Thursday's market reaction to D-Wave Quantum (QBTS) showcased the volatility inherent in the quantum computing sector. While [mention positive factors, e.g., positive company-specific news] boosted the stock price, broader market trends and investor sentiment played a significant role in shaping the overall performance. Analyzing social media sentiment, trading volume, and comparisons with competitors provided a more nuanced understanding of the day's events.

Stay informed on future D-Wave Quantum (QBTS) market activity by following financial news sources and conducting your own research into this fascinating sector. For further analysis of QBTS and the quantum computing market, consider consulting professional financial advisors.

Featured Posts

-

Trumps Tariffs Gretzkys Loyalty Canadas Hockey Icon Caught In A Political Crossfire

May 20, 2025

Trumps Tariffs Gretzkys Loyalty Canadas Hockey Icon Caught In A Political Crossfire

May 20, 2025 -

Schumacher Conversacion Reveladora Antes De Su Regreso A La F1 En 2010

May 20, 2025

Schumacher Conversacion Reveladora Antes De Su Regreso A La F1 En 2010

May 20, 2025 -

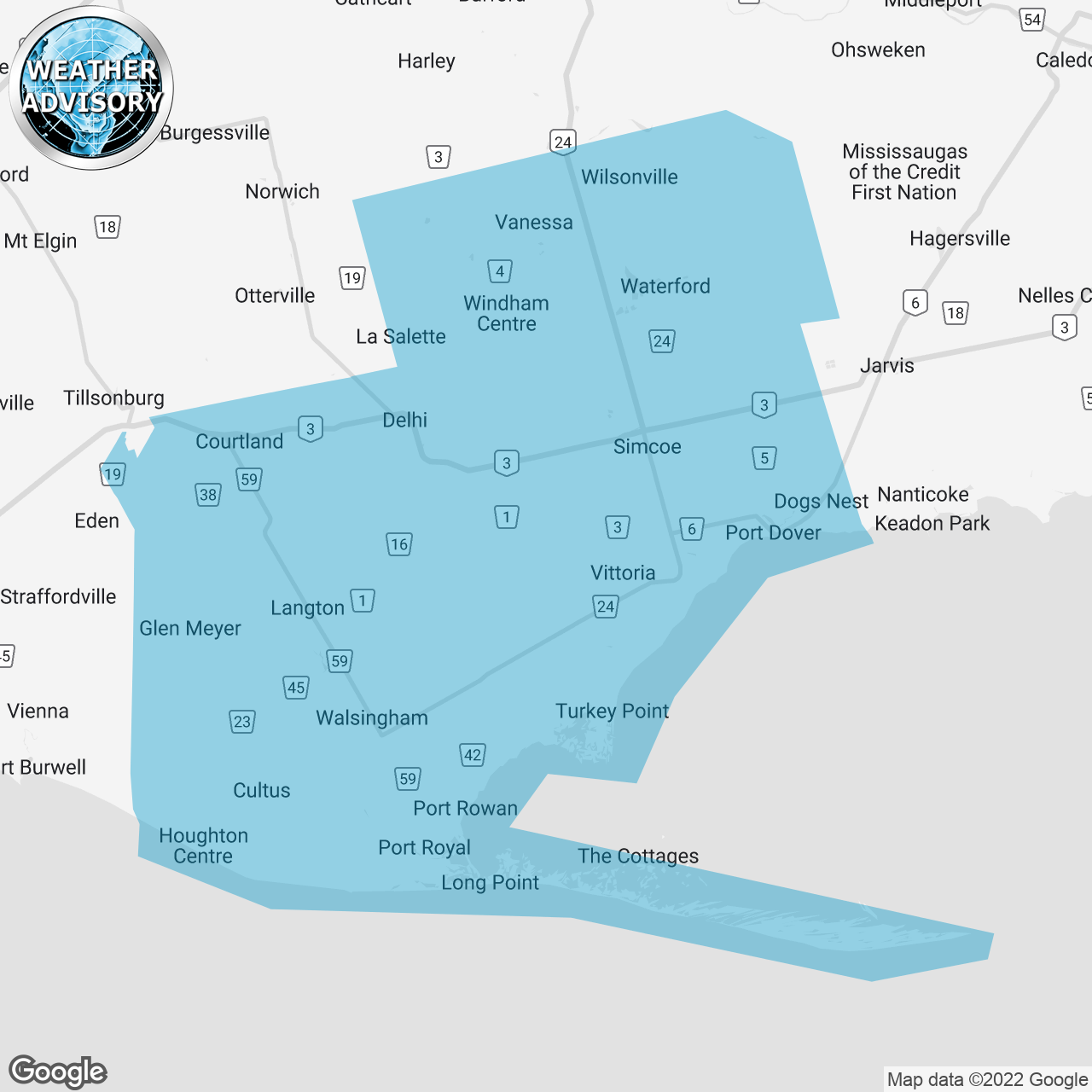

Winter Weather Advisory Understanding School Closure Decisions

May 20, 2025

Winter Weather Advisory Understanding School Closure Decisions

May 20, 2025 -

Aghatha Krysty Tewd Llhyat Bfdl Aldhkae Alastnaey Rwayat Jdydt

May 20, 2025

Aghatha Krysty Tewd Llhyat Bfdl Aldhkae Alastnaey Rwayat Jdydt

May 20, 2025 -

Gross Law Firm Representing Big Bear Ai Bbai Investors Contact Us Before June 10 2025

May 20, 2025

Gross Law Firm Representing Big Bear Ai Bbai Investors Contact Us Before June 10 2025

May 20, 2025

Latest Posts

-

Huuhkajien Valmennus Uudet Suunnitelmat Mm Karsintoja Varten

May 20, 2025

Huuhkajien Valmennus Uudet Suunnitelmat Mm Karsintoja Varten

May 20, 2025 -

Muutoksia Huuhkajien Avauskokoonpanossa Kaellman Ulos

May 20, 2025

Muutoksia Huuhkajien Avauskokoonpanossa Kaellman Ulos

May 20, 2025 -

Malta Besegrat Tuff Start Foer Jacob Friis Nya Era

May 20, 2025

Malta Besegrat Tuff Start Foer Jacob Friis Nya Era

May 20, 2025 -

Huuhkajien Tuleva Ottelu Avauskokoonpanossa Kolme Muutosta

May 20, 2025

Huuhkajien Tuleva Ottelu Avauskokoonpanossa Kolme Muutosta

May 20, 2025 -

Huuhkajien Tie Mm Karsintoihin Valmennus Ratkaisee

May 20, 2025

Huuhkajien Tie Mm Karsintoihin Valmennus Ratkaisee

May 20, 2025