Market Reaction To UK Inflation: Reduced BOE Rate Cut Bets And Sterling's Rise

Table of Contents

Lower-Than-Expected Inflation Fuels Sterling's Appreciation

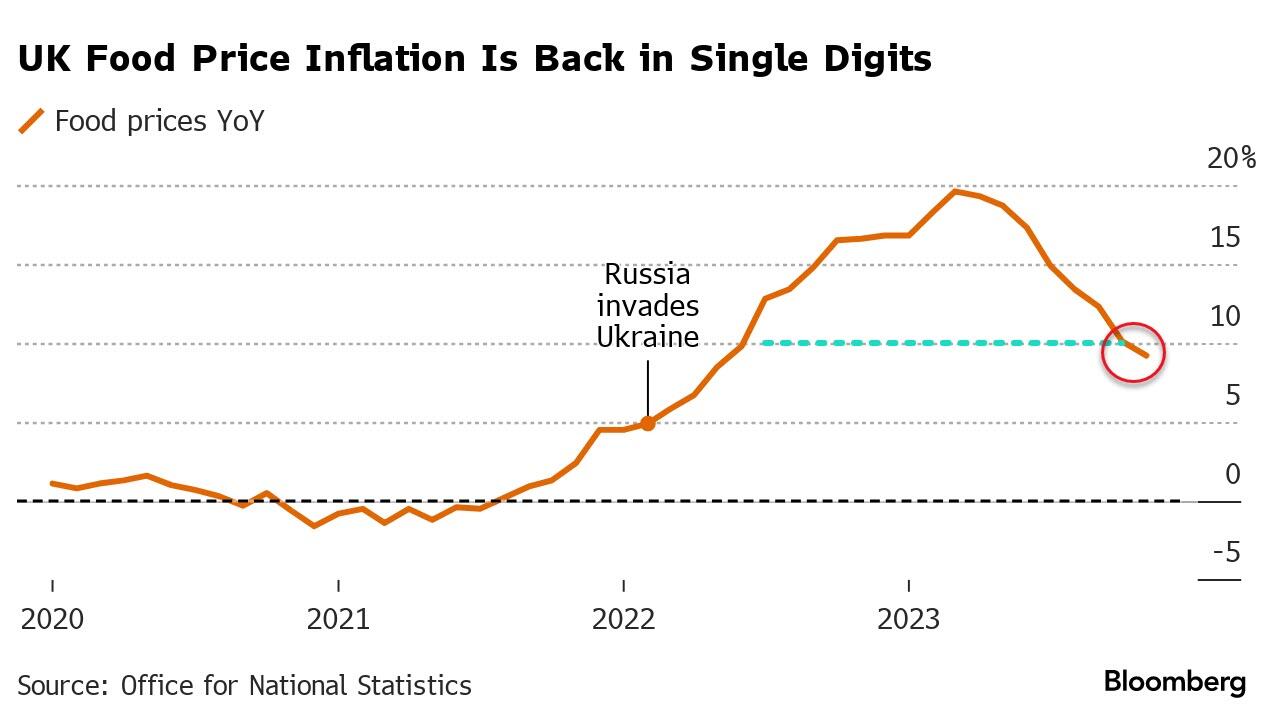

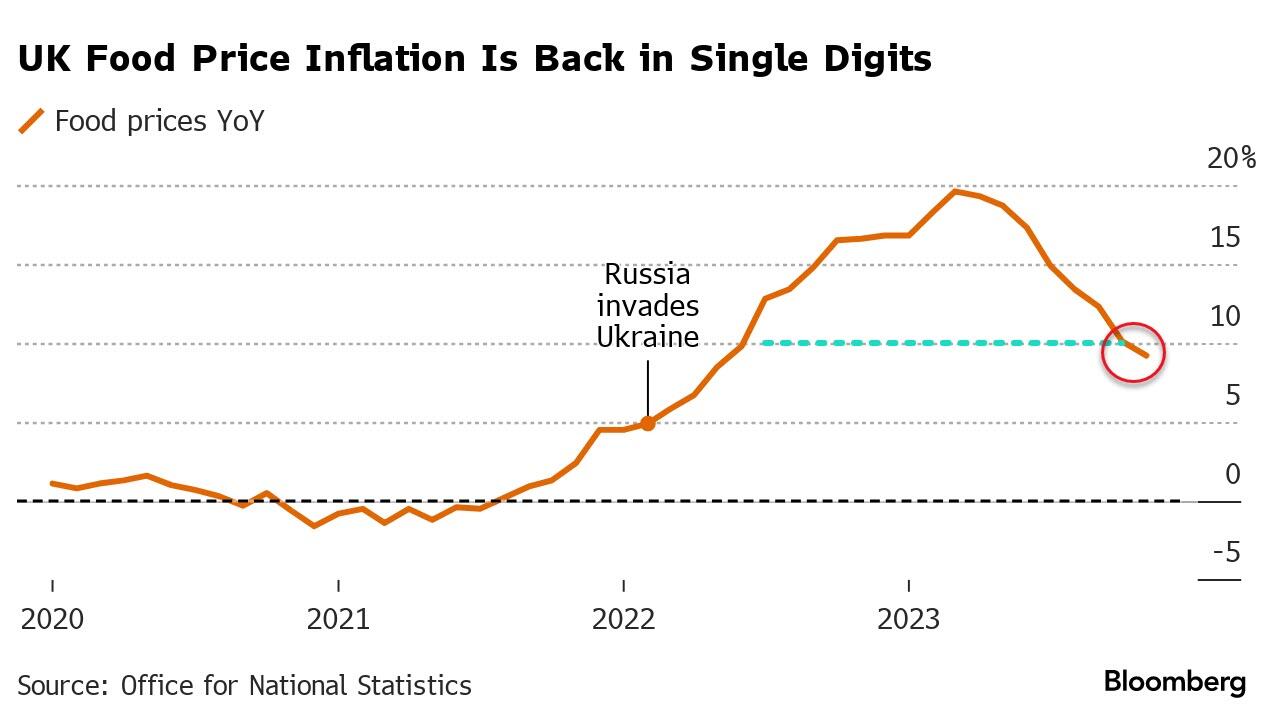

The latest UK inflation data surprised many analysts. Instead of the anticipated increase, inflation showed a slower-than-predicted rise, or even a decline depending on the specific measure. This unexpected development significantly altered market sentiment. The reduced inflationary pressure lessened the perceived need for the Bank of England to implement further interest rate cuts. Consequently, the Pound Sterling experienced a notable strengthening against other major currencies.

- UK inflation data: The Office for National Statistics (ONS) reported [insert specific data here, e.g., a CPI figure of X%, lower than the predicted Y%]. This deviation from analysts' forecasts was the catalyst for the market's positive reaction.

- GBP exchange rate: The Pound appreciated significantly against both the Euro (EUR) and the US Dollar (USD). [Insert specific data points here, e.g., GBP/USD rose from 1.20 to 1.22, GBP/EUR increased from 1.15 to 1.17]. Charts illustrating these movements would be highly beneficial here.

- Currency strength: This surge in Sterling's value reflects increased investor confidence in the UK economy. A stronger Pound makes imports cheaper, potentially easing inflationary pressures further. However, it also makes UK exports more expensive, potentially impacting the UK's trade balance.

- Impact on UK exports and imports: The stronger Pound could negatively affect UK export-oriented businesses, reducing their competitiveness in international markets. Conversely, it offers benefits to importers, allowing them to source goods and materials at lower prices.

Reduced BOE Rate Cut Bets: A Shift in Monetary Policy Expectations

Before the release of the latest inflation figures, the market widely anticipated further interest rate cuts by the BOE to stimulate economic growth and combat inflation. Many analysts believed that persistent inflationary pressures would necessitate continued monetary easing. However, the lower-than-expected inflation data dramatically altered this outlook.

- Bank of England interest rates: The market's expectation of further rate cuts diminished significantly following the inflation announcement. This shift is reflected in the pricing of interest rate futures contracts.

- Monetary policy: The BOE's monetary policy stance now appears less dovish, suggesting a potential pause or even a reversal of the easing cycle. This change impacts investor strategies and asset allocation decisions.

- Impact on bond yields: The reduced likelihood of further rate cuts resulted in a rise in government bond yields (gilts). Investors are now demanding higher returns on UK government debt, reflecting their altered expectations.

- Quantitative easing: The possibility of further quantitative easing (QE) measures by the BOE has also diminished, as the need for such extraordinary measures seems less pressing in light of the lower inflation data.

- Implications for UK economic growth: While a stronger Pound can potentially negatively impact economic growth via reduced exports, the reduced need for further rate cuts also mitigates some risks to economic growth compared to continued easing.

Impact on Financial Markets: Stock Market and Bond Yields

The release of the UK inflation data had a ripple effect across various financial markets. The UK stock market (FTSE 100), initially anticipating further rate cuts, reacted positively to the lower-than-expected inflation.

- UK stock market: The FTSE 100 index [insert specific data on market movements here, e.g., showed a X% increase following the announcement]. Sectors sensitive to interest rates, such as financials and real estate, likely saw a more pronounced response.

- Gilt yields: As discussed, government bond yields (gilts) rose, reflecting the reduced likelihood of further BOE rate cuts and increased investor demand for higher returns.

- Investment strategy: Investors need to adjust their investment strategies based on this shift in market expectations. The reduced likelihood of further rate cuts potentially makes certain asset classes, such as bonds, less attractive, while others, such as equities, may become more appealing.

Potential Risks and Uncertainties

While the market reacted positively to the lower-than-expected inflation, several uncertainties remain. This positive trend could easily reverse depending on future economic data and external factors.

- Inflation uncertainty: The recent decline in inflation might prove temporary, with a potential resurgence driven by factors like rising energy prices or supply chain disruptions. Monitoring future inflation data remains crucial.

- Economic outlook UK: The overall economic outlook for the UK continues to be uncertain, influenced by global geopolitical factors and domestic economic challenges. A significant shift in the global economic landscape could easily influence the Pound's value and market sentiment.

- Geopolitical risks: Geopolitical events, such as the ongoing conflict in Ukraine or other international tensions, can have a significant impact on the UK economy and the Pound Sterling. These risks introduce significant uncertainty.

- Energy prices: The price of energy remains a key driver of inflation, and any substantial increase could quickly reverse the current positive trend. Fluctuations in energy markets are a continuous concern.

- Supply chain disruptions: Ongoing supply chain disruptions can also contribute to higher inflation, potentially negating the benefits of the recent positive data. Resilience of supply chains remains a key factor to observe.

Conclusion

The market's reaction to the latest UK inflation data highlights the significant impact of economic indicators on monetary policy expectations and currency values. Lower-than-expected inflation led to a reduction in BOE rate cut bets and a notable rise in Sterling. However, several uncertainties remain, and the market's response could shift depending on future economic data and global events.

Call to Action: Stay informed about the evolving situation surrounding UK inflation and its impact on the market. Monitor the Bank of England's announcements and closely watch the GBP exchange rate and other key economic indicators for further insights into the market reaction to UK inflation. Understanding these dynamics is crucial for navigating the complexities of the UK financial market. Keep abreast of UK inflation updates to make informed financial decisions.

Featured Posts

-

Cordistes A Nantes Metiers Et Perspectives Face Au Developpement Urbain

May 22, 2025

Cordistes A Nantes Metiers Et Perspectives Face Au Developpement Urbain

May 22, 2025 -

Analyzing The Tigers 8 6 Win Over The Rockies

May 22, 2025

Analyzing The Tigers 8 6 Win Over The Rockies

May 22, 2025 -

Uncover The Perfect Hot Weather Drink

May 22, 2025

Uncover The Perfect Hot Weather Drink

May 22, 2025 -

1 3

May 22, 2025

1 3

May 22, 2025 -

Blake Lively Addressing The Recent Allegations And Rumors

May 22, 2025

Blake Lively Addressing The Recent Allegations And Rumors

May 22, 2025

Latest Posts

-

Cau Ma Da Khoi Cong Xay Dung Cau Noi Dong Nai Va Binh Phuoc Thang 6

May 22, 2025

Cau Ma Da Khoi Cong Xay Dung Cau Noi Dong Nai Va Binh Phuoc Thang 6

May 22, 2025 -

7 Tuyen Ket Noi Quan Trong Tp Hcm Long An Dau Tu Uu Tien

May 22, 2025

7 Tuyen Ket Noi Quan Trong Tp Hcm Long An Dau Tu Uu Tien

May 22, 2025 -

7 Vi Tri Ket Noi Tp Hcm Long An Can Uu Tien Dau Tu

May 22, 2025

7 Vi Tri Ket Noi Tp Hcm Long An Can Uu Tien Dau Tu

May 22, 2025 -

Hon 200km Chay Bo The Thao Va Du Lich Ket Hop Dak Lak Phu Yen

May 22, 2025

Hon 200km Chay Bo The Thao Va Du Lich Ket Hop Dak Lak Phu Yen

May 22, 2025 -

Su Kien Chay Bo Hon 200 Nguoi Ket Noi Dak Lak Va Phu Yen

May 22, 2025

Su Kien Chay Bo Hon 200 Nguoi Ket Noi Dak Lak Va Phu Yen

May 22, 2025