Market Update: Dissecting The D-Wave Quantum (QBTS) Stock Decline On Monday

Table of Contents

Monday saw a significant drop in D-Wave Quantum (QBTS) stock, leaving many investors questioning the reasons behind this unexpected decline. This market update will dissect the various factors contributing to the QBTS stock dip, examining broader market trends, specific company news, investor sentiment, and the competitive landscape of the burgeoning quantum computing sector. We'll explore these elements to provide a clearer understanding of the situation and offer insights for navigating this volatile market.

Analyzing the QBTS Stock Drop: Key Factors

Several interconnected factors likely contributed to Monday's decline in QBTS stock. Let's examine the most prominent influences.

Impact of Broader Market Trends

Monday's market downturn affected many tech stocks, particularly those in speculative, high-growth sectors like quantum computing. This broader market weakness played a significant role in QBTS's performance.

- Negative Market Sentiment: A general sense of pessimism permeated the market on Monday, potentially triggered by concerns about [mention specific economic concerns, e.g., inflation, interest rates]. This negative sentiment often disproportionately impacts growth stocks like QBTS.

- Tech Stock Sell-Off: The Nasdaq Composite, a key indicator of tech stock performance, experienced a [percentage]% decline on Monday. This overall sell-off in the technology sector likely dragged down QBTS along with other emerging technology companies.

- Broader Economic Concerns: [Mention specific economic indicators like unemployment figures, consumer confidence index, etc., and their potential impact on investor risk appetite]. These macroeconomic factors can significantly impact investor confidence in riskier investments.

For example, if the Nasdaq Composite fell by 2%, and QBTS dropped by 3%, this highlights the increased sensitivity of QBTS to broader market fluctuations compared to the overall tech sector.

Company-Specific News and Announcements

While no significant negative news directly from D-Wave Quantum was released on Monday, the absence of positive news or catalysts could have contributed to the sell-off.

- Lack of Positive Press Releases: The absence of any significant announcements regarding new partnerships, product launches, or technological breakthroughs may have led to a lack of investor enthusiasm.

- Upcoming Financial Reports: The anticipation of upcoming financial reports can sometimes create uncertainty in the market. If investors anticipate potentially disappointing results, they might preemptively sell their shares.

- No Major Partnerships Announced: The quantum computing field is characterized by strategic collaborations. The lack of any new significant partnerships announced by D-Wave Quantum might have disappointed some investors expecting such news.

Investor Sentiment and Trading Volume

Analyzing trading volume provides further insight into the QBTS stock decline.

- Increased Trading Volume: A significant increase in trading volume on Monday compared to recent averages could indicate a considerable shift in investor sentiment. High volume often accompanies large price movements, suggesting substantial buying or selling pressure.

- Short-Selling Activity: Increased short-selling activity could also have contributed to the price drop. Short sellers bet against a stock, potentially exacerbating downward pressure. [If data is available, include details on short interest percentage].

- Analyst Commentary: Any negative commentary from financial analysts covering QBTS could have influenced investor sentiment and trading decisions.

Competition and the Quantum Computing Landscape

The competitive landscape of quantum computing is dynamic, and developments within the sector can significantly influence investor perception.

- Competitor Advancements: Announcements from competitors like IBM, Google, or IonQ regarding advancements in their quantum computing technologies might have shifted investor attention and capital away from D-Wave Quantum.

- Industry-Wide Challenges: Challenges facing the entire quantum computing industry, such as scaling limitations or technological hurdles, might have negatively impacted investor confidence across the board.

- Shifting Investor Focus: The quantum computing sector is highly speculative. Any shift in investor focus toward other emerging technologies might lead to a reallocation of capital away from QBTS.

Long-Term Outlook for D-Wave Quantum (QBTS)

Despite the recent decline, a long-term perspective on D-Wave Quantum's potential remains crucial for informed investment decisions.

Fundamental Analysis of D-Wave Quantum

D-Wave Quantum's business model centers on providing access to its quantum annealing systems for various applications.

- Future Product Launches: Any announcements about upcoming product launches or software improvements could significantly influence future stock performance.

- Strategic Partnerships and Collaborations: Establishing strategic partnerships with major corporations in various sectors can expand D-Wave's market reach and drive revenue growth.

- Technological Advancements: Ongoing research and development efforts could lead to breakthroughs that enhance the capabilities and market appeal of D-Wave's quantum systems.

Assessing the Risk/Reward Ratio

Investing in QBTS carries inherent risks.

- Market Volatility: The quantum computing sector is known for its significant volatility, making QBTS stock susceptible to price swings.

- Technological Disruption: Rapid technological advancements could render current technologies obsolete, posing a significant risk to D-Wave's long-term competitiveness.

- Competition: The intensity of competition within the quantum computing space poses a challenge to D-Wave's market share and profitability.

However, the potential rewards are substantial given the transformative potential of quantum computing. The high risk is balanced by the possibility of substantial returns if D-Wave Quantum successfully establishes itself as a leading player in the field.

Conclusion

Monday's drop in D-Wave Quantum (QBTS) stock underscores the inherent volatility of the quantum computing market. While broader market factors and possibly company-specific considerations played a role, a comprehensive analysis is necessary before reaching definitive conclusions. Understanding the interplay of market trends, company performance, and competitive dynamics is essential for navigating the complexities of investing in QBTS. Continue monitoring the D-Wave Quantum (QBTS) stock and the broader quantum computing landscape to make informed investment decisions regarding your D-Wave Quantum (QBTS) holdings. Stay informed about future developments to capitalize on opportunities within the exciting, albeit volatile, world of quantum computing.

Featured Posts

-

Seamless Banking In Nederland Tikkie Explained

May 21, 2025

Seamless Banking In Nederland Tikkie Explained

May 21, 2025 -

World Trading Tournament Wtt With Aimscap A Comprehensive Guide

May 21, 2025

World Trading Tournament Wtt With Aimscap A Comprehensive Guide

May 21, 2025 -

Synaylia Kathigiton Dimotikoy Odeioy Rodoy Stin Dimokratiki

May 21, 2025

Synaylia Kathigiton Dimotikoy Odeioy Rodoy Stin Dimokratiki

May 21, 2025 -

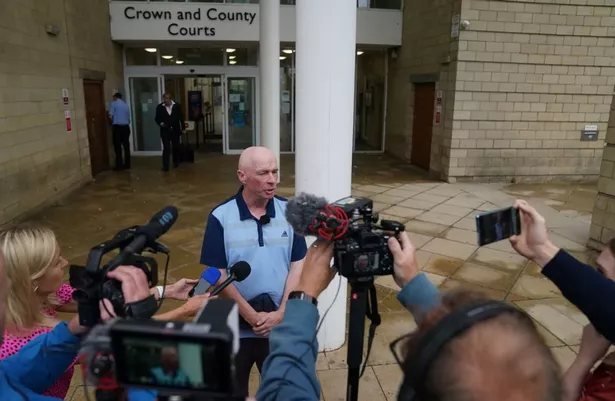

Councillors Wifes Jail Sentence Statement On Migrant Hotel Remarks

May 21, 2025

Councillors Wifes Jail Sentence Statement On Migrant Hotel Remarks

May 21, 2025 -

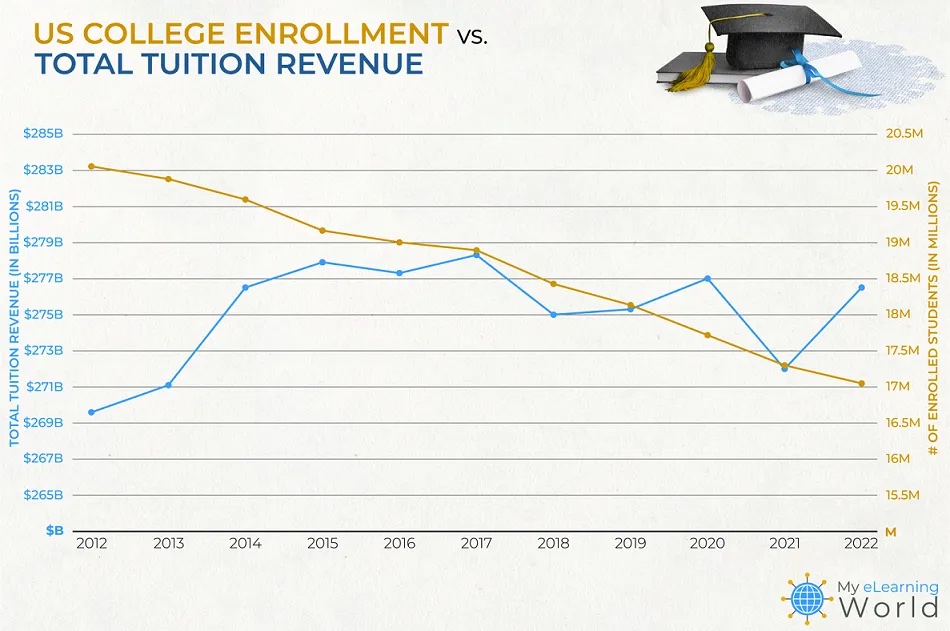

College Enrollment Decline A Crisis For Boom Towns

May 21, 2025

College Enrollment Decline A Crisis For Boom Towns

May 21, 2025

Latest Posts

-

Wife Of Jailed Tory Councillor Says Fire Rant Against Migrant Hotels Wasnt Intended To Incite Violence

May 22, 2025

Wife Of Jailed Tory Councillor Says Fire Rant Against Migrant Hotels Wasnt Intended To Incite Violence

May 22, 2025 -

Sentence Appeal For Ex Tory Councillors Wife Over Racist Tweet

May 22, 2025

Sentence Appeal For Ex Tory Councillors Wife Over Racist Tweet

May 22, 2025 -

Update Ex Tory Councillors Wifes Appeal On Racial Hatred Tweet

May 22, 2025

Update Ex Tory Councillors Wifes Appeal On Racial Hatred Tweet

May 22, 2025 -

Southport Racial Hate Case Councillors Wife Sentenced

May 22, 2025

Southport Racial Hate Case Councillors Wife Sentenced

May 22, 2025 -

Racial Hatred Tweet Ex Tory Councillors Wife Seeks To Overturn Sentence

May 22, 2025

Racial Hatred Tweet Ex Tory Councillors Wife Seeks To Overturn Sentence

May 22, 2025