Market Update: Sensex And Nifty Record Significant Gains - Understanding The Factors

Table of Contents

Global Economic Indicators and their Impact on Sensex and Nifty

Positive global economic indicators have played a crucial role in boosting investor confidence and fueling the recent Sensex and Nifty rally. The interplay between global and domestic markets is undeniable; a healthy global economy translates to increased investment opportunities in emerging markets like India.

- Positive global growth forecasts: Leading economies are projecting sustained growth, reducing fears of a global recession. This positive outlook encourages foreign investment flows into India.

- Decreased inflation rates in key economies: Easing inflation in major economies like the US and Europe reduces pressure on central banks to aggressively raise interest rates. This stability benefits global markets, including the Indian stock market.

- Stable interest rates: The relative stability in interest rates in developed economies provides a more predictable environment for investors, making emerging markets like India more attractive.

- Increased Foreign Institutional Investor (FII) inflow: FIIs have been net buyers in the Indian stock market, injecting significant capital and contributing to the market's upward trajectory. This signifies growing confidence in the Indian economy.

- Positive sentiment from global markets: The overall positive sentiment in global markets, driven by positive economic data and corporate earnings, creates a spillover effect, positively impacting investor sentiment in India.

These factors collectively contribute to a more optimistic outlook, encouraging both foreign and domestic investors to increase their exposure to the Indian stock market, thereby driving up the Sensex and Nifty.

Domestic Economic Factors Driving the Sensex and Nifty Rally

Strong domestic economic indicators are equally instrumental in driving the current Sensex and Nifty rally. The resilience of the Indian economy, despite global headwinds, has strengthened investor confidence.

- Strong GDP growth projections: India's robust GDP growth projections signal a healthy economic outlook, attracting both domestic and foreign investment. This growth is expected to continue driving corporate profitability.

- Healthy corporate earnings: Strong corporate earnings reports from numerous Indian companies showcase the strength of the Indian economy and underpin the market's upward trend. Profitable companies attract investors.

- Positive RBI policy decisions: The Reserve Bank of India's (RBI) monetary policy decisions, aimed at balancing growth and inflation, have helped maintain a stable macroeconomic environment. This predictability is crucial for investor confidence.

- Successful monsoon season: A successful monsoon season is critical for India's agricultural sector and overall economic growth. A good monsoon reduces inflationary pressures and stimulates rural demand.

- Government initiatives boosting infrastructure: Government initiatives focused on infrastructure development create long-term investment opportunities and stimulate economic activity, positively impacting investor sentiment.

These domestic factors, combined with the positive global backdrop, have fostered a bullish market sentiment, leading to significant gains in the Sensex and Nifty.

Sector-Specific Performance and its Contribution to Overall Market Gains

The recent market rally is not uniform across all sectors; some sectors have outperformed others, contributing significantly to the overall gains in Sensex and Nifty.

- Strong performance of IT, Banking and FMCG sectors: These sectors have witnessed particularly strong performance, driven by various factors specific to each industry. The IT sector benefited from strong global demand, banking from robust credit growth, and FMCG from increased consumer spending.

- Identify top-performing stocks within each sector and explain reasons for their growth: Analyzing top-performing stocks within each sector reveals the specific drivers of growth. For example, companies with strong quarterly results, innovative products, or positive industry outlooks tend to outperform their peers.

- Analyze how the growth in specific sectors contributes to the overall rise in Sensex and Nifty: The strong performance of these key sectors significantly impacts the overall market indices, driving up the Sensex and Nifty. The market capitalization of these companies contributes substantially to the overall gains.

Analyzing the Role of Foreign and Domestic Institutional Investors (FIIs and DIIs)

The role of FIIs and DIIs in the recent market rally cannot be overstated. Their investment patterns and market sentiment significantly influence the market's direction.

- FII investment: Positive FII inflows have been a key driver of the market’s upward trend, indicating increased confidence in the Indian economy and its growth prospects. Tracking net FII flows provides valuable insight into market sentiment.

- DII investment: Domestic institutional investors have also played a significant role, further bolstering the market's upward momentum. Their participation reflects confidence in the Indian economy's long-term growth potential.

- Portfolio investments: The increase in portfolio investments by both FIIs and DIIs indicates a positive outlook on the Indian stock market and its future prospects.

Conclusion

The significant gains in Sensex and Nifty are a result of a confluence of factors, including positive global economic indicators, robust domestic economic performance, strong sectoral performance, and substantial investment from FIIs and DIIs. While the outlook remains generally positive, investors should remain aware of potential risks and opportunities. Staying informed about the latest market updates on Sensex and Nifty is crucial for making informed investment decisions. Continue monitoring the market and utilize this analysis to inform your investment strategies and understand the factors impacting Sensex and Nifty fluctuations.

Featured Posts

-

Sto Xamilotero Epipedo 23 Eton I Krisi Xionioy Sta Imalaia

May 09, 2025

Sto Xamilotero Epipedo 23 Eton I Krisi Xionioy Sta Imalaia

May 09, 2025 -

U S China Trade Talks De Escalation Efforts This Week

May 09, 2025

U S China Trade Talks De Escalation Efforts This Week

May 09, 2025 -

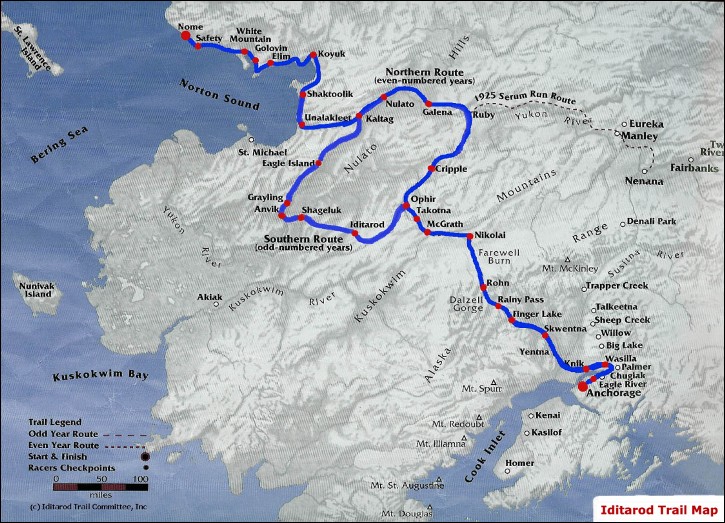

Seven Iditarod Newcomers Race To Nome Their Stories And Challenges

May 09, 2025

Seven Iditarod Newcomers Race To Nome Their Stories And Challenges

May 09, 2025 -

Elizabeth City Police Search For Vehicle Break In Suspect

May 09, 2025

Elizabeth City Police Search For Vehicle Break In Suspect

May 09, 2025 -

Polufinal I Final Ligi Chempionov 2024 2025 Polniy Obzor Prognozy I Statistika Matchey

May 09, 2025

Polufinal I Final Ligi Chempionov 2024 2025 Polniy Obzor Prognozy I Statistika Matchey

May 09, 2025