Market Volatility And Investor Reactions: A Case Study Of Recent Market Swings

Table of Contents

The recent market swings have highlighted the inherent market volatility of financial markets, leaving investors questioning their strategies and risk tolerance. Understanding investor reactions to market volatility is crucial for navigating these turbulent times and making informed investment decisions. This article will delve into a case study of recent market fluctuations, examining the underlying causes and the diverse responses from various investor groups. We'll explore how different levels of market volatility impact investment choices and offer insights for mitigating risk.

H2: Understanding Market Volatility

H3: Defining Market Volatility:

Market volatility refers to the rate and extent of changes in market prices. It's essentially a measure of price fluctuation. Think of it as the "bumpiness" of the ride in the financial markets. We can measure market volatility using several statistical tools, such as standard deviation and beta.

- Defining volatility in simple terms: Volatility reflects how much a security's price is likely to change over time. High volatility means prices swing wildly; low volatility means prices remain relatively stable.

- Measuring volatility: Standard deviation measures the dispersion of a dataset around its mean. A higher standard deviation indicates greater market volatility. Beta measures a security's price volatility relative to the overall market.

- Factors influencing volatility: Numerous factors influence market volatility, including:

- Economic news (e.g., inflation reports, employment data)

- Geopolitical events (e.g., wars, political instability)

- Interest rate changes (monetary policy decisions by central banks)

- Unexpected corporate announcements (e.g., earnings surprises, mergers and acquisitions)

H3: Causes of Recent Market Swings:

Recent market swings have been significantly influenced by several interconnected factors.

- Inflationary pressures: Persistently high inflation has forced central banks to aggressively raise interest rates, impacting borrowing costs and slowing economic growth. This uncertainty has fueled market volatility.

- Geopolitical tensions: The ongoing war in Ukraine and rising tensions between major global powers have introduced significant uncertainty into the markets, contributing to increased market volatility.

- Interest rate hikes: Central bank actions to curb inflation through interest rate hikes have directly impacted market valuations, leading to increased price swings and market volatility. Higher rates make borrowing more expensive, impacting business investment and consumer spending.

- Supply chain disruptions: Lingering supply chain issues have contributed to inflation and uncertainty, impacting corporate profits and overall market sentiment, contributing to market volatility.

H3: Types of Market Volatility:

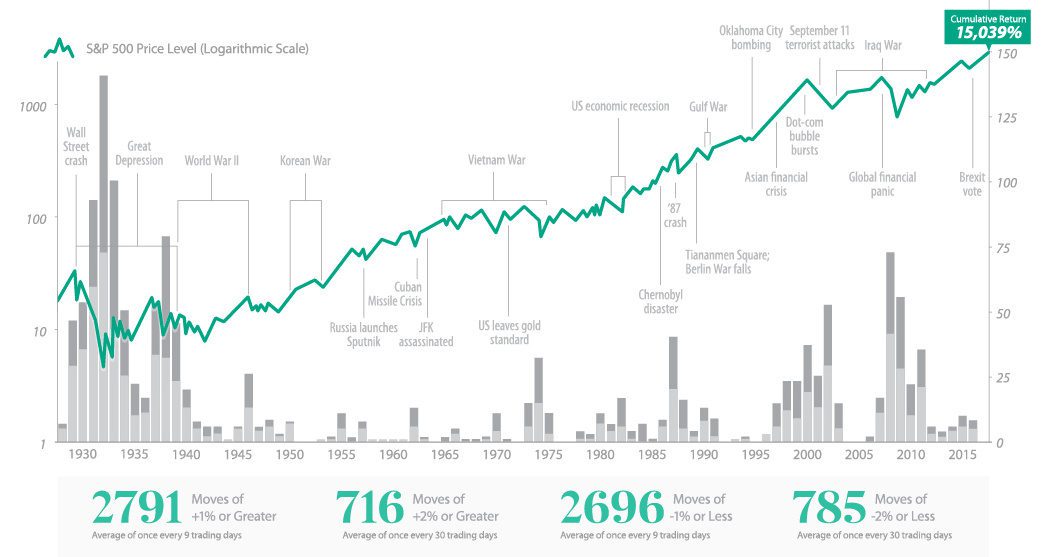

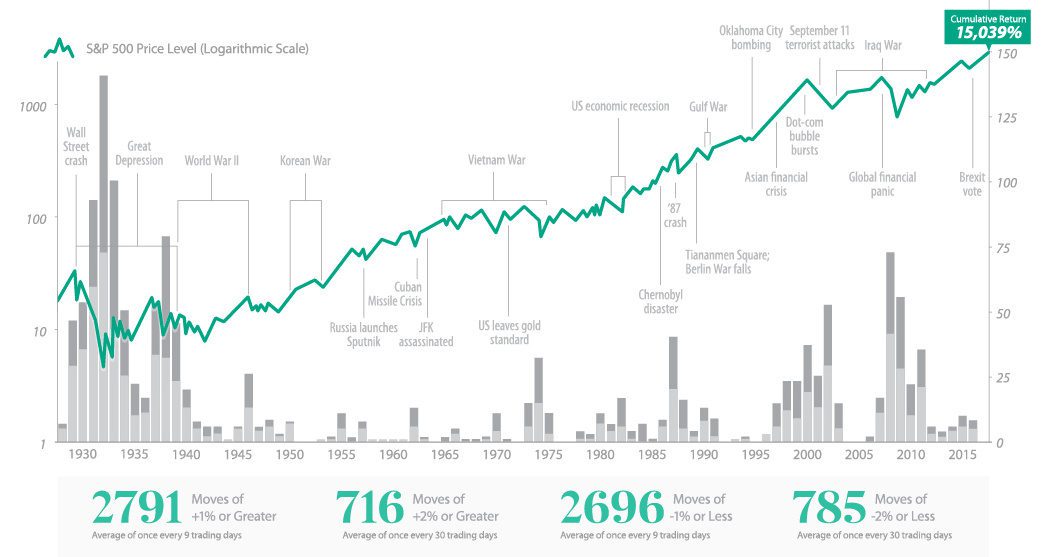

Market volatility can be broadly categorized into short-term and long-term volatility.

- Short-term volatility: This refers to price fluctuations over a shorter period, such as days or weeks. It's often caused by short-term news events or market sentiment shifts. Short-term traders often capitalize on these swings.

- Long-term volatility: This refers to price fluctuations over a longer period, such as months or years. It's typically driven by broader economic trends, technological changes, or shifts in investor preferences. Long-term investors are more likely to weather these fluctuations.

- Impact on investment strategies: Short-term volatility is more relevant to short-term trading strategies, while long-term volatility is a crucial factor for long-term investment planning and portfolio construction.

H2: Investor Reactions to Market Volatility

H3: Behavioral Finance and Market Volatility:

Market volatility significantly impacts investor psychology.

- Fear and greed: These powerful emotions often drive irrational investment decisions. Fear can lead to panic selling during market downturns, while greed can fuel speculative bubbles during periods of rapid growth.

- Herd behavior: Investors often mimic the actions of others, leading to amplified market swings. This can exacerbate both upward and downward trends.

- Cognitive biases: Anchoring bias (over-relying on initial information) and confirmation bias (seeking information that confirms pre-existing beliefs) can lead to poor investment decisions during volatile periods.

H3: Diversification Strategies During Volatility:

Diversification is a cornerstone of effective risk management during periods of market volatility.

- Asset classes: Diversifying across different asset classes—stocks, bonds, real estate, commodities—can help reduce overall portfolio volatility.

- Reducing portfolio volatility: By spreading investments across various asset classes, the impact of negative movements in one area is lessened by potential positive movements in others.

- Asset allocation: A well-defined asset allocation strategy is crucial for managing risk and achieving investment goals during periods of market volatility.

H3: Investor Risk Tolerance and Market Volatility:

Risk tolerance is a key factor in determining how investors react to market volatility.

- Risk tolerance definition: Risk tolerance reflects an investor's ability and willingness to accept potential losses in pursuit of higher returns.

- Investor reactions: Conservative investors tend to reduce risk during volatility, while aggressive investors may view it as an opportunity to buy at lower prices. Moderate investors usually adopt a balanced approach.

- Understanding risk profile: Understanding your own risk tolerance is critical for making informed investment decisions and managing your emotional response to market volatility.

H2: Case Study: Analyzing a Recent Market Event

H3: Choosing a Specific Event:

For this case study, let's analyze the market reaction to the rapid interest rate increases by the Federal Reserve in 2022.

- Background: These aggressive rate hikes aimed to combat high inflation, but also caused significant uncertainty in the markets.

- Contributing factors: High inflation, supply chain issues, and geopolitical uncertainty all contributed to the need for these rate hikes and the subsequent market reaction.

- Impact on asset classes: The rate hikes led to declines in bond prices, increased volatility in the stock market, and shifts in investor sentiment across various sectors.

H3: Investor Behavior During the Event:

During the period of rapid interest rate increases, investor behavior demonstrated several key trends.

- Buying and selling patterns: We saw a shift from growth stocks to value stocks as investors sought safety and higher dividend yields.

- Market sentiment: Market sentiment turned cautious as investors grappled with uncertainty about the economic outlook and the impact of higher interest rates.

- Impact on specific sectors: Sectors sensitive to interest rates, such as real estate and technology, experienced significant declines, while more defensive sectors performed relatively better.

H3: Lessons Learned from the Case Study:

This case study highlights several important lessons:

- Successful strategies: Diversification, a well-defined risk tolerance assessment, and a long-term investment horizon were crucial for mitigating losses and navigating the period of high volatility.

- Common mistakes: Panic selling and making emotional investment decisions proved detrimental. Ignoring risk tolerance levels also often led to negative outcomes.

- Importance of long-term planning: Maintaining a long-term investment approach, rather than reacting to short-term market fluctuations, was crucial for success.

Conclusion:

Understanding market volatility and its impact on investor behavior is crucial for successful investing. This article highlighted the significance of diversification, risk tolerance assessment, and long-term investment planning in mitigating the effects of market volatility. The case study demonstrated the importance of disciplined investment strategies and the dangers of emotional decision-making. Learn more about navigating market volatility and protecting your investments by exploring our resources on risk management and portfolio diversification. Contact us today to discuss your investment strategy and how to mitigate the effects of market volatility on your portfolio.

Featured Posts

-

Official New York Mets Announce Final Two Starting Pitchers

Apr 28, 2025

Official New York Mets Announce Final Two Starting Pitchers

Apr 28, 2025 -

Investigation Into The Persistence Of Toxic Chemicals From Ohio Train Derailment

Apr 28, 2025

Investigation Into The Persistence Of Toxic Chemicals From Ohio Train Derailment

Apr 28, 2025 -

Mets Biggest Rival Dominant Pitcher Performance

Apr 28, 2025

Mets Biggest Rival Dominant Pitcher Performance

Apr 28, 2025 -

Federal Workers Facing Layoffs Transitioning To State And Local Government Jobs

Apr 28, 2025

Federal Workers Facing Layoffs Transitioning To State And Local Government Jobs

Apr 28, 2025 -

160 Game Hit Streak Snapped The End Of An Orioles Broadcaster Jinx

Apr 28, 2025

160 Game Hit Streak Snapped The End Of An Orioles Broadcaster Jinx

Apr 28, 2025