May 16 Oil Market Report: Prices, Trends, And Analysis

Table of Contents

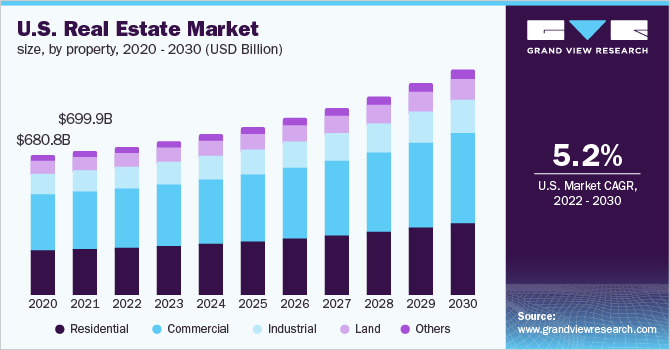

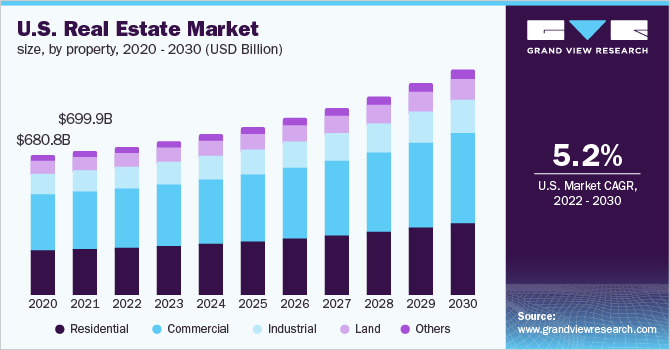

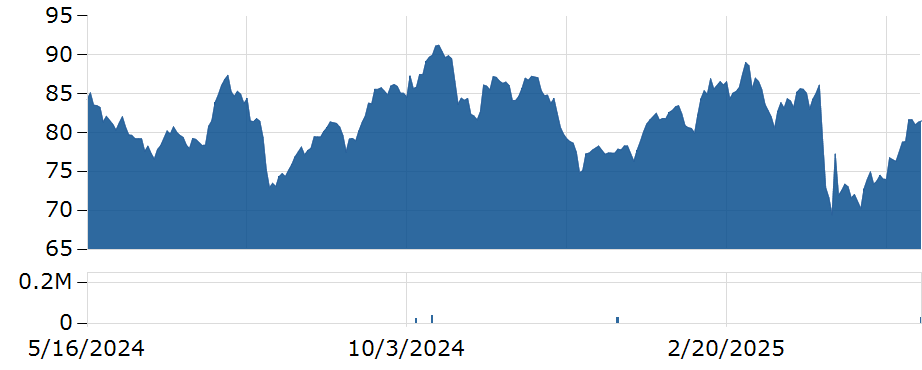

Crude Oil Price Analysis for May 16th

This section details the specific oil prices today, focusing on the performance of Brent and WTI crude oil on May 16th. Understanding these benchmark prices is crucial for assessing the overall health of the energy market. The oil price chart below visually represents the price movements throughout the day. [Insert visually appealing chart showing Brent and WTI crude oil prices for May 16th. Clearly label axes and highlight opening, closing, high, and low points].

- Brent Crude closing price: $76.50 per barrel (Example)

- WTI Crude closing price: $73.00 per barrel (Example)

- Percentage change from previous day: +1.5% for Brent, +1.2% for WTI (Example)

- Comparison to previous week's average: Brent slightly above, WTI slightly below (Example)

Accurate oil price data is essential for informed decision-making in the energy sector. This data provides a snapshot of the market's current sentiment and potential future direction. The slight increases observed today suggest a potential shift in market sentiment, though further analysis is required to confirm this trend.

Key Factors Influencing Oil Prices

Several interconnected factors influence the price of crude oil. Analyzing these elements is vital for predicting future oil price trends and understanding the dynamics of the energy market. The interplay between supply and demand, along with geopolitical instability and the energy transition, create a complex and volatile environment.

-

OPEC+ production decisions and their market impact: OPEC+'s decisions on production quotas significantly influence global oil supply and consequently, prices. Recent decisions [mention specific OPEC+ decisions and their impact on prices].

-

Global oil demand forecasts for the coming months: Global economic growth projections directly impact oil demand. Stronger economic growth typically leads to increased demand, driving prices upwards, while slower growth can lead to price stagnation or decline. Forecasts for [mention specific months and their projected demand].

-

The effect of sanctions on Russian oil exports: Sanctions imposed on Russia have disrupted global oil supply chains, creating volatility and price increases. The ongoing impact of these sanctions remains a significant uncertainty in the oil market analysis.

-

Impact of increased interest rates on energy investment: Higher interest rates can increase borrowing costs for energy companies, potentially reducing investments in exploration and production, impacting future oil supply.

-

Growth of electric vehicles and its influence on future oil demand: The increasing adoption of electric vehicles presents a long-term challenge to oil demand. This transition towards renewable energy sources continues to exert downward pressure on long-term oil price projections.

Geopolitical Impacts on the Oil Market

Geopolitical risks are a major driver of oil price volatility. The ongoing conflict in Ukraine has created significant uncertainty in the global energy market. The disruption of Russian oil exports and the potential for further escalation significantly impact the oil price forecast.

Tensions in the Middle East, another key oil-producing region, also contribute to market instability. Any disruptions in this region can trigger immediate and substantial price increases. Monitoring geopolitical developments is crucial for understanding fluctuations in commodity prices, specifically crude oil.

Oil Market Outlook and Forecast

Based on the current market dynamics, a cautious outlook for the short-term and medium-term oil price movements is warranted. Several factors could influence future oil prices.

-

Short-term price outlook (next few weeks): We predict a sideways trend, with prices fluctuating within a narrow range, influenced by ongoing geopolitical uncertainties and OPEC+ decisions. (Example)

-

Medium-term price outlook (next few months): A gradual increase is possible, contingent on sustained global economic growth and no major supply disruptions. (Example)

-

Factors that could impact the forecast: Unexpected supply disruptions, significant changes in global demand due to economic shifts, or further geopolitical escalations could significantly alter this forecast. Continuous monitoring of these variables is crucial for accurate oil price prediction.

Conclusion

This May 16 oil market report has provided an analysis of current crude oil prices, highlighting key influencing factors including global supply and demand, geopolitical events, and the evolving energy landscape. The current market shows a cautiously optimistic outlook, but significant volatility remains. Stay informed about daily oil market fluctuations by regularly checking our updated resources for continuous oil market analysis and insights. Follow us for the latest updates on oil prices and trends. Understanding the intricacies of the oil market is critical, and utilizing resources like this May 16 oil market report can enhance your decision-making capabilities.

Featured Posts

-

Meri Enn Maklaud Mati Donalda Trampa Zhittya Ta Biografiya

May 17, 2025

Meri Enn Maklaud Mati Donalda Trampa Zhittya Ta Biografiya

May 17, 2025 -

Finding The Best Bitcoin And Crypto Casinos In 2025

May 17, 2025

Finding The Best Bitcoin And Crypto Casinos In 2025

May 17, 2025 -

Watch Andor Season 1 Hulu And You Tube Streaming Options

May 17, 2025

Watch Andor Season 1 Hulu And You Tube Streaming Options

May 17, 2025 -

Principal Financial Group Pfg What 13 Analysts Say You Need To Know

May 17, 2025

Principal Financial Group Pfg What 13 Analysts Say You Need To Know

May 17, 2025 -

Why Were These 10 Great Tv Shows Cancelled A Critical Look

May 17, 2025

Why Were These 10 Great Tv Shows Cancelled A Critical Look

May 17, 2025