Meet Greg Abel: Warren Buffett's Chosen Successor And His Plans For Berkshire Hathaway

Table of Contents

Greg Abel's Rise Through Berkshire Hathaway

Greg Abel's journey within Berkshire Hathaway is a testament to his dedication and skill. His career progression showcases a steady climb marked by significant contributions to various subsidiaries. He didn't arrive at the CEO position overnight; rather, he earned it through years of dedicated service and proven leadership.

- Early career at Berkshire Hathaway subsidiaries: Abel's Berkshire Hathaway journey began with roles at various subsidiaries, allowing him to gain a deep understanding of the conglomerate's diverse operations. This hands-on experience provided invaluable insight into the intricacies of different business models.

- Key achievements and contributions in each role: His contributions consistently demonstrated operational expertise and a knack for driving efficiency. He played a pivotal role in optimizing operations and increasing profitability in several key sectors.

- Progression to Vice Chairman and eventual CEO: His consistent performance and demonstrated leadership capabilities led to his promotion to Vice Chairman, positioning him as the clear successor to Warren Buffett. This reflects the confidence the board has in his capabilities.

- Emphasis on his operational expertise and management skills: Abel's strength lies not just in financial acumen, but also in operational excellence. He's known for his ability to streamline processes, improve efficiency, and maximize the value of Berkshire's various holdings. This operational expertise is a critical asset as the company navigates the complexities of modern business.

Understanding Greg Abel's Leadership Style

While sharing some similarities with Warren Buffett's approach, Greg Abel's leadership style also presents key differences. Understanding these nuances is crucial to predicting Berkshire Hathaway's future trajectory under his guidance.

- Collaborative approach versus Buffett's more autonomous style: Unlike Buffett's arguably more independent style, Abel is known for fostering collaboration and teamwork. He empowers his teams and encourages open communication, creating a more inclusive and participatory environment.

- Focus on operational efficiency and long-term value creation: Similar to Buffett, Abel emphasizes long-term value creation but with a stronger focus on operational efficiency. He seeks to optimize the performance of Berkshire's existing businesses before seeking significant new investments.

- Ability to manage diverse business units within Berkshire Hathaway: Berkshire Hathaway encompasses a vast array of businesses, and Abel has demonstrated a keen ability to manage this diverse portfolio effectively. This requires a strong understanding of various industries and market dynamics.

- Emphasis on data-driven decision making: Abel's approach relies heavily on data analysis and rigorous evaluation. This contrasts with some of Buffett's more intuitive decision-making, but aligns with the demands of today's data-rich business environment.

Greg Abel's Investment Strategy for Berkshire Hathaway

A key question on many investors' minds is: will Greg Abel maintain Warren Buffett's value investing principles? The answer seems to be a qualified "yes," but with potential adaptations.

- Continuation of long-term value investing: Abel is committed to the core tenets of value investing – identifying undervalued assets with strong long-term growth potential. This approach will likely remain central to Berkshire's investment strategy.

- Potential diversification into new sectors or technologies: While adhering to value investing principles, Abel might explore diversification into sectors that were less prominent during Buffett's tenure, possibly including renewable energy or technology companies with robust long-term prospects.

- Focus on sustainable and responsible investing: Given the growing importance of Environmental, Social, and Governance (ESG) factors, Abel may incorporate a stronger emphasis on sustainable and responsible investing, aligning with evolving investor preferences and societal expectations.

- Adaptation to changing economic landscapes: The global economy is constantly evolving. Abel will need to adapt Berkshire Hathaway's investment strategy to navigate these changes, including geopolitical shifts, technological disruptions, and macroeconomic fluctuations.

The Future of Berkshire Hathaway Under Greg Abel

The future of Berkshire Hathaway under Greg Abel's leadership presents both exciting opportunities and significant challenges.

- Maintaining Berkshire's strong financial performance: Sustaining Berkshire Hathaway's impressive track record of financial performance is a paramount challenge for Abel. This requires skillful management of existing assets, strategic investments, and navigating economic uncertainties.

- Navigating evolving market conditions: The business landscape is continuously changing. Abel must navigate technological advancements, evolving consumer preferences, and global economic instability.

- Succession planning within Berkshire Hathaway: Abel will need to address succession planning within Berkshire Hathaway itself. Building a strong leadership team is crucial for the long-term success of the company.

- Expanding into new markets and industries: Further expansion into new and emerging markets will be essential to maintain growth. This will require careful due diligence and strategic decision-making.

Comparing Greg Abel and Warren Buffett's Approaches

While both are undeniably skilled investors and leaders, Greg Abel and Warren Buffett have distinct approaches to management and investment.

- Differences in communication styles: Buffett is known for his engaging and straightforward communication, while Abel's style might be slightly more reserved.

- Varying levels of public engagement: Buffett has cultivated a strong public persona, while Abel’s public profile is comparatively lower.

- Different strengths in management and leadership: Buffett’s strength was in identifying undervalued companies, while Abel excels in operational management and efficiency.

- Impact on investor confidence and relations: These differences in style will influence how investors perceive and interact with Berkshire Hathaway in the future.

Conclusion

Greg Abel's ascension to CEO of Berkshire Hathaway marks a significant turning point for this iconic investment firm. While he will undoubtedly build upon Warren Buffett's legacy of value investing, his leadership style and strategic approach will likely shape a new era for the company. His operational expertise, collaborative management style, and emphasis on data-driven decision-making suggest a future marked by sustained growth and adaptability. Understanding Abel's vision is crucial for investors and business professionals alike.

Call to Action: Learn more about Greg Abel and the evolving landscape of Berkshire Hathaway. Stay informed about the future of this iconic investment firm and its new CEO. Follow [link to relevant resource/website] to stay updated on all things Greg Abel and Berkshire Hathaway.

Featured Posts

-

Celtics Vs Suns April 4th Where To Watch And Stream The Game

May 06, 2025

Celtics Vs Suns April 4th Where To Watch And Stream The Game

May 06, 2025 -

Gigi Hadid Confirms Bradley Cooper Relationship On Instagram For 30th Birthday Celebration

May 06, 2025

Gigi Hadid Confirms Bradley Cooper Relationship On Instagram For 30th Birthday Celebration

May 06, 2025 -

Turning Trash To Treasure An Ai Powered Podcast From Scatological Documents

May 06, 2025

Turning Trash To Treasure An Ai Powered Podcast From Scatological Documents

May 06, 2025 -

Exploring The Unique Soundscape Of Jeff Goldblum And The Mildred Snitzer Orchestras I Dont Know Why I Just Do

May 06, 2025

Exploring The Unique Soundscape Of Jeff Goldblum And The Mildred Snitzer Orchestras I Dont Know Why I Just Do

May 06, 2025 -

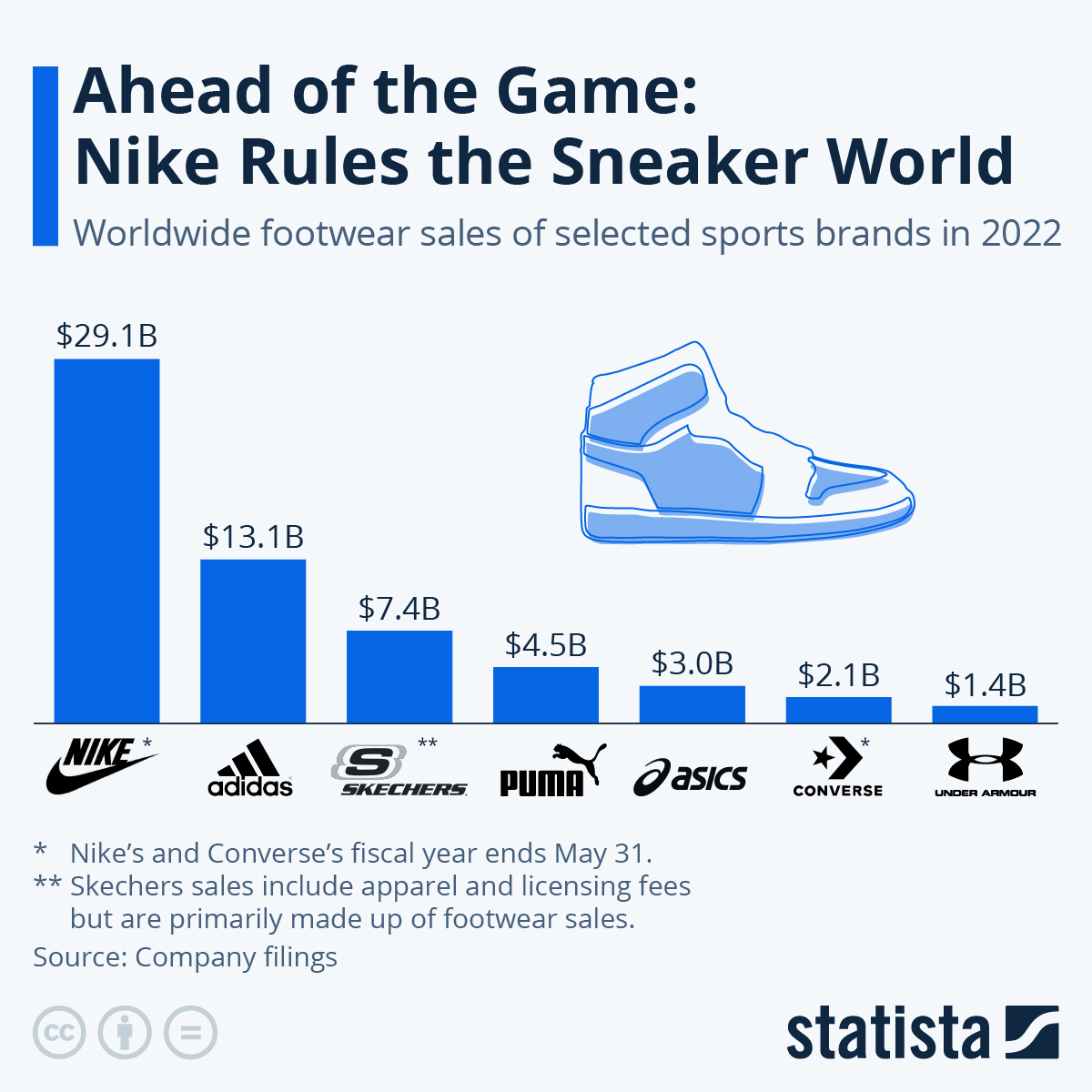

Five Year Revenue Low Predicted For Nike Analysis And Impact

May 06, 2025

Five Year Revenue Low Predicted For Nike Analysis And Impact

May 06, 2025

Latest Posts

-

Dylan Beard Balancing Walmart Deli And Elite Track

May 06, 2025

Dylan Beard Balancing Walmart Deli And Elite Track

May 06, 2025 -

2025 Met Gala Le Bron James Honorary Chair Role Cancelled Following Knee Injury

May 06, 2025

2025 Met Gala Le Bron James Honorary Chair Role Cancelled Following Knee Injury

May 06, 2025 -

Rachel Zeglers Met Gala Appearance Amidst Snow White Backlash Lizzo Doechii And More

May 06, 2025

Rachel Zeglers Met Gala Appearance Amidst Snow White Backlash Lizzo Doechii And More

May 06, 2025 -

Rachel Zegler At The Met Gala Snow White Controversy And Star Studded Guest List

May 06, 2025

Rachel Zegler At The Met Gala Snow White Controversy And Star Studded Guest List

May 06, 2025 -

Met Gala 2025 Le Bron James Withdraws As Honorary Chair Due To Injury

May 06, 2025

Met Gala 2025 Le Bron James Withdraws As Honorary Chair Due To Injury

May 06, 2025