Microsoft-Activision Deal: FTC's Appeal And Future Implications

Table of Contents

The FTC's Arguments Against the Merger

The FTC's core concern centers on the potential for anti-competitive practices resulting from the Microsoft-Activision deal. They argue that the merger would significantly reduce competition, giving Microsoft an unfair advantage and harming consumers. Their arguments hinge on several key points:

-

Reduced competition in the console gaming market (Xbox vs. PlayStation): The FTC claims that Microsoft, by acquiring Activision Blizzard, would gain control over immensely popular franchises like Call of Duty, World of Warcraft, and Candy Crush, potentially hindering competition with Sony's PlayStation. This could lead to higher prices, reduced innovation, and less choice for consumers.

-

Concerns over the exclusive availability of Activision Blizzard titles on Xbox platforms: A major point of contention is the potential for Microsoft to make Activision Blizzard games exclusive to its Xbox ecosystem, including Game Pass, thus limiting their availability on PlayStation and other platforms. This exclusivity could significantly impact the competitiveness of rival consoles.

-

Impact on cloud gaming services and subscription models: The FTC also expressed worries about the merger's impact on the burgeoning cloud gaming market. Microsoft's control over key Activision Blizzard titles could stifle innovation and competition in this rapidly growing sector, potentially limiting consumer access to diverse cloud gaming options.

-

Argumentation regarding market definition and market share: The FTC's arguments are based on a specific definition of the relevant market. They argue that the merger would significantly increase Microsoft's market share within this defined market, creating a situation where Microsoft could exert undue influence on pricing and innovation. The FTC cited specific examples of Microsoft's past acquisitions and their impact on competition to bolster their claims.

Microsoft's Defense and Proposed Remedies

Microsoft strongly refutes the FTC's claims, arguing that the merger will benefit consumers through increased innovation, wider game access, and enhanced competition. Their defense rests on several pillars:

-

Microsoft's commitment to maintaining the availability of Activision Blizzard games on multiple platforms: Microsoft has repeatedly pledged to continue releasing Activision Blizzard titles on PlayStation and other platforms, emphasizing its commitment to fair competition. They’ve offered long-term agreements to ensure the continued availability of Call of Duty on PlayStation, addressing a major concern of the FTC.

-

Proposed concessions and agreements to address the FTC's concerns: To alleviate the FTC's worries, Microsoft has proposed various concessions, including licensing agreements to ensure the continued availability of Activision Blizzard games on rival platforms. This proactive approach aims to demonstrate their commitment to a competitive market.

-

Emphasis on benefits for gamers and the industry through innovation and wider game access: Microsoft highlights the potential benefits for gamers through increased game availability and innovation spurred by the merger. They argue that combining their resources with Activision Blizzard will lead to enhanced game development and better experiences for consumers.

The regulatory bodies in other countries have taken differing stances on the merger. The UK's Competition and Markets Authority initially blocked the deal, but the European Commission approved it, illustrating the complexities and nuances of international regulatory environments.

The Appeal Process and Potential Outcomes

The FTC's appeal process involves presenting its case before an appellate court, which will review the lower court's decision. The timeline for this process can be lengthy, potentially stretching over several months or even years.

-

Discussion of legal precedents and similar cases: The court will likely consider relevant legal precedents and similar cases involving mergers and acquisitions in the tech industry to inform its decision.

-

Possible outcomes: FTC win, Microsoft win, or a negotiated settlement: The potential outcomes include an FTC victory, overturning the lower court's ruling and blocking the merger; a Microsoft victory, upholding the lower court's decision; or a negotiated settlement, where both parties agree to certain conditions to resolve the dispute.

-

The implications of each outcome for the gaming landscape: Each outcome would have significantly different implications for the gaming industry, influencing competition, pricing, and the availability of popular game titles. Experts are closely monitoring the appeal process, analyzing the evidence and predicting the possible outcomes, with much of the focus on the evidence regarding market definition and Microsoft's commitment to maintaining multi-platform availability of key titles.

Long-Term Implications for the Gaming Industry

Regardless of the final outcome, the Microsoft-Activision deal and the FTC's appeal will have lasting implications for the gaming industry:

-

Impact on future mergers and acquisitions in the gaming industry: This case sets a crucial precedent for future mergers and acquisitions in the gaming sector. The ruling will influence how regulatory bodies approach future deals, potentially leading to stricter scrutiny and more stringent requirements.

-

Influence on regulatory oversight of the tech sector: The case highlights the increasing regulatory scrutiny facing large tech companies and their mergers and acquisitions. The outcome will significantly influence future regulatory approaches towards monopolies and anti-competitive behavior in the tech industry.

-

Changes to game distribution models and pricing strategies: The deal's outcome will impact game distribution models, subscription services, and pricing strategies. The emphasis on platform exclusivity and the potential for increased prices are key concerns.

-

Potential effect on game development and innovation: The case could impact game development and innovation, depending on whether the merger creates more competition or stifles it. Concerns over reduced innovation and a potential loss of diverse gaming experiences are central to the debate.

This case sets a precedent for future regulatory actions concerning large tech mergers, impacting not only gaming but also other tech sectors.

Conclusion

The FTC and Microsoft present vastly different perspectives on the Microsoft-Activision deal. The FTC argues the merger would stifle competition, while Microsoft maintains it will benefit gamers through increased innovation and wider access to games. The FTC's appeal introduces significant uncertainty and high stakes for the future of the gaming industry. The outcome will shape future mergers and acquisitions, regulatory oversight, and the very landscape of game development and distribution. The ongoing legal battle surrounding the Microsoft-Activision deal remains a critical development. Stay tuned for updates and analysis as this landmark case unfolds, shaping the future of gaming and corporate mergers.

Featured Posts

-

Cnn Anchors Love For Florida His Top Vacation Destination

Apr 26, 2025

Cnn Anchors Love For Florida His Top Vacation Destination

Apr 26, 2025 -

Human Centered Ai An Interview With Microsofts Design Chief

Apr 26, 2025

Human Centered Ai An Interview With Microsofts Design Chief

Apr 26, 2025 -

Californias Economic Rise Now The Worlds Fourth Largest Economy

Apr 26, 2025

Californias Economic Rise Now The Worlds Fourth Largest Economy

Apr 26, 2025 -

Nintendo Switch 2 Preordering The Old Fashioned Way

Apr 26, 2025

Nintendo Switch 2 Preordering The Old Fashioned Way

Apr 26, 2025 -

The Karen Read Case A Year By Year Account Of The Legal Proceedings

Apr 26, 2025

The Karen Read Case A Year By Year Account Of The Legal Proceedings

Apr 26, 2025

Latest Posts

-

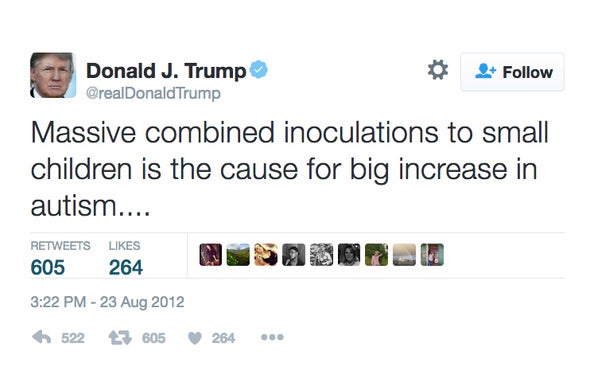

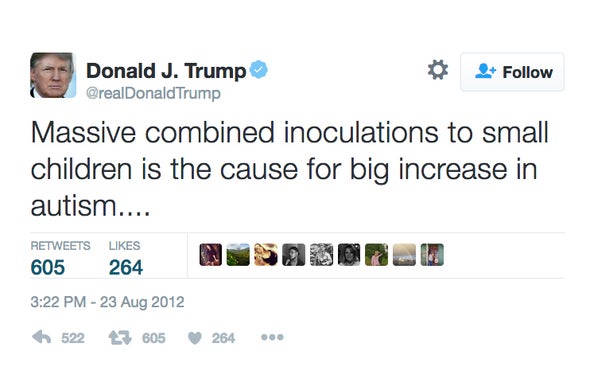

Anti Vaccine Advocate Review Of Autism Vaccine Connection Sparks Outrage Nbc 10 Philadelphia Reports

Apr 27, 2025

Anti Vaccine Advocate Review Of Autism Vaccine Connection Sparks Outrage Nbc 10 Philadelphia Reports

Apr 27, 2025 -

Hhss Controversial Choice Anti Vaccine Activist To Examine Debunked Autism Vaccine Claims

Apr 27, 2025

Hhss Controversial Choice Anti Vaccine Activist To Examine Debunked Autism Vaccine Claims

Apr 27, 2025 -

Anti Vaccine Activists Role In Hhs Autism Vaccine Review Raises Concerns

Apr 27, 2025

Anti Vaccine Activists Role In Hhs Autism Vaccine Review Raises Concerns

Apr 27, 2025 -

Anti Vaccine Activist Review Of Autism Vaccine Link Sparks Outrage Nbc Chicago Sources

Apr 27, 2025

Anti Vaccine Activist Review Of Autism Vaccine Link Sparks Outrage Nbc Chicago Sources

Apr 27, 2025 -

Hhss Controversial Choice Anti Vaccine Activist To Examine Debunked Autism Vaccine Connection

Apr 27, 2025

Hhss Controversial Choice Anti Vaccine Activist To Examine Debunked Autism Vaccine Connection

Apr 27, 2025