Microsoft-Activision Deal: FTC's Appeal And Its Potential Impact

Table of Contents

The FTC's Arguments Against the Merger

The FTC's core concern centers on the potential for anti-competitive practices stemming from the Microsoft-Activision merger. They argue that the acquisition would grant Microsoft undue market dominance, stifling competition and harming consumers. Their arguments primarily revolve around several key areas:

-

Reduced competition in the console gaming market: The FTC fears that Microsoft, controlling both Xbox and Activision Blizzard's titles like Call of Duty, would leverage its power to disadvantage its main competitor, Sony PlayStation. This could lead to higher prices, less innovation, and a diminished gaming experience for PlayStation users.

-

Impact on the cloud gaming market and subscription services: The FTC is concerned about Microsoft's potential to restrict access to Activision Blizzard's games on competing cloud gaming services, giving its own Game Pass subscription service an unfair advantage. This could limit consumer choice and hinder the growth of the cloud gaming market.

-

Concerns regarding access to Activision Blizzard's popular game franchises: Call of Duty, World of Warcraft, Candy Crush, and other Activision Blizzard franchises are immensely popular. The FTC worries that Microsoft could make these games exclusive to Xbox, or significantly limit their availability on competing platforms, effectively locking out a large portion of gamers.

-

Potential for Microsoft to leverage its market power to disadvantage competitors: The FTC argues that the combined entity would have the power to set prices, dictate terms, and control the distribution of games in ways that harm competitors and ultimately, consumers. This could stifle innovation and reduce the overall quality of gaming experiences.

These concerns are backed by detailed economic analyses and legal arguments presented in the FTC's filings, aiming to demonstrate a clear violation of antitrust laws.

Microsoft's Defense and Proposed Remedies

Microsoft counters the FTC's allegations, arguing that the merger will ultimately benefit consumers through increased innovation and competition. They've presented several concessions to address the FTC's concerns:

-

Agreements to keep Call of Duty on PlayStation for a certain period: Microsoft has pledged to keep Call of Duty on PlayStation for a substantial number of years, aiming to alleviate concerns about exclusivity.

-

Commitments regarding access to Activision Blizzard's games on other platforms: Microsoft has committed to making Activision Blizzard games available on various platforms, including cloud gaming services other than its own, further assuring gamers of continued access.

-

Claims that the merger will benefit consumers through increased innovation and competition: Microsoft argues the combined resources will allow for greater investment in game development, leading to more innovative and higher-quality games for everyone.

However, the effectiveness of these proposed remedies remains a point of contention. The FTC argues that these commitments are insufficient to address the fundamental anti-competitive concerns raised. The effectiveness of these remedies will likely play a crucial role in the court's final decision.

The Potential Impact on the Gaming Industry

The outcome of the FTC's appeal will have far-reaching implications for the gaming industry:

-

Consolidation within the gaming market: A successful Microsoft-Activision merger could trigger further consolidation in the gaming sector, potentially leading to a less diverse and competitive market.

-

Impact on game pricing and availability: The merger could influence pricing strategies and game availability, potentially leading to higher prices or limited access to certain titles.

-

Influence on future mergers and acquisitions in the tech sector: The decision will set a precedent for future mergers and acquisitions in the tech industry, influencing how regulators approach similar deals in the future.

-

The evolving landscape of cloud gaming and subscription services: The outcome significantly impacts the growth and competition within the cloud gaming and subscription service markets.

This decision will shape the future of game development, distribution, and pricing strategies, potentially leading to a more centralized or fragmented market depending on the court's ruling.

The Legal Precedents and Antitrust Implications

This case holds significant weight in terms of legal precedent and antitrust implications:

-

Examination of similar cases and their outcomes: The court will examine similar antitrust cases involving large tech mergers, considering past rulings and their relevance to this situation.

-

Discussion of the definition of a relevant market: Defining the relevant market (console gaming, cloud gaming, mobile gaming, etc.) is crucial, as it dictates the level of market power Microsoft would possess.

-

Analysis of the burden of proof on the FTC: The FTC bears the burden of proving that the merger would substantially lessen competition. The court's analysis of this burden of proof will shape future antitrust litigation.

-

Potential impact on regulatory frameworks for tech mergers: The outcome could influence future regulatory frameworks for tech mergers, leading to stricter scrutiny or more lenient approaches.

This case has significant implications for antitrust enforcement and its role in regulating the powerful tech industry, influencing how regulators approach future mergers and acquisitions involving major tech companies.

Conclusion

The FTC's appeal against the Microsoft-Activision deal presents a complex legal battle with significant implications for the gaming industry. Both the FTC and Microsoft have presented strong arguments regarding competition and consumer welfare. The potential impact on the gaming landscape, from pricing and availability to the overall competitive structure, is undeniable. The court's decision will not only determine the fate of this specific merger but also set a precedent for future antitrust cases involving large tech companies. To stay informed about the ongoing developments and the long-term consequences of the court’s decision, follow the progress of the Microsoft-Activision deal and stay updated on the FTC's appeal. Learn more about the impact of the Microsoft-Activision merger and its implications for the future of the gaming industry and antitrust law. This case is crucial for the future of gaming and how antitrust law will be applied in the ever-evolving tech sector.

Featured Posts

-

Exclusive Funding Open Ais Texas Data Center Receives 11 6 Billion Investment

May 22, 2025

Exclusive Funding Open Ais Texas Data Center Receives 11 6 Billion Investment

May 22, 2025 -

Love Monster Types Behaviors And Coping Mechanisms

May 22, 2025

Love Monster Types Behaviors And Coping Mechanisms

May 22, 2025 -

Southern French Alps Weather Impact Of Recent Storm On Snow Conditions

May 22, 2025

Southern French Alps Weather Impact Of Recent Storm On Snow Conditions

May 22, 2025 -

Downtown Manhattan A Prime Real Estate Destination For High Net Worth Individuals

May 22, 2025

Downtown Manhattan A Prime Real Estate Destination For High Net Worth Individuals

May 22, 2025 -

Aex Koersreactie Abn Amro Presteert Boven Verwachting

May 22, 2025

Aex Koersreactie Abn Amro Presteert Boven Verwachting

May 22, 2025

Latest Posts

-

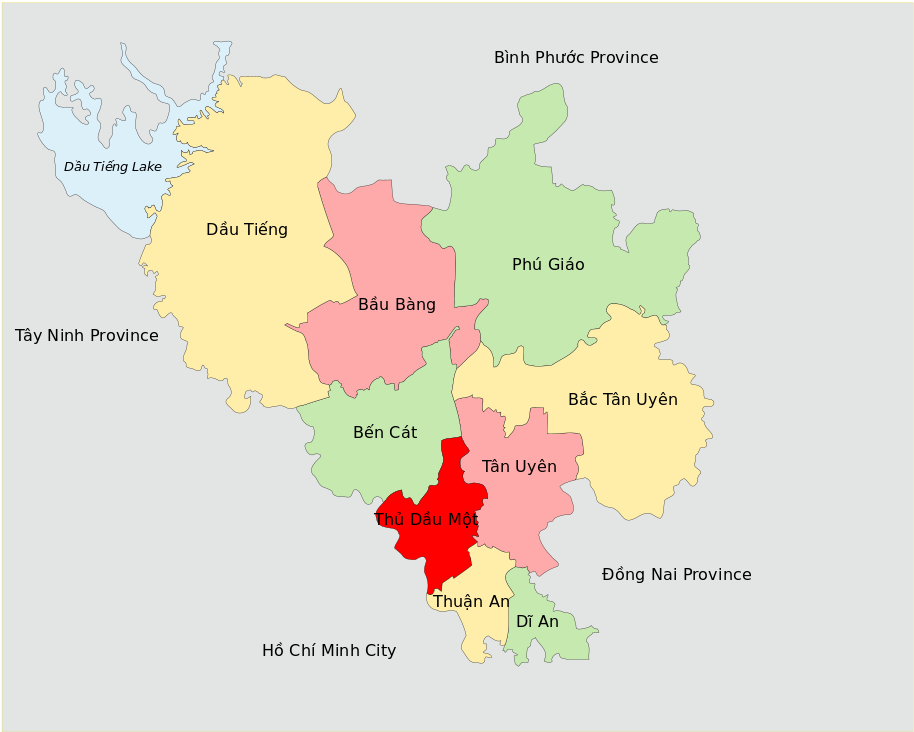

Cau Va Duong Noi Binh Duong Tay Ninh Ten Goi Va Thong Tin Chi Tiet

May 22, 2025

Cau Va Duong Noi Binh Duong Tay Ninh Ten Goi Va Thong Tin Chi Tiet

May 22, 2025 -

Crwv Stock Skyrockets Nvidias Investment Fuels Growth

May 22, 2025

Crwv Stock Skyrockets Nvidias Investment Fuels Growth

May 22, 2025 -

Core Weave Stock Crwv Jumps On Nvidias Strategic Stake

May 22, 2025

Core Weave Stock Crwv Jumps On Nvidias Strategic Stake

May 22, 2025 -

Nvidias Core Weave Crwv Investment Stock Price Soars

May 22, 2025

Nvidias Core Weave Crwv Investment Stock Price Soars

May 22, 2025 -

Core Weave Crwv Stock Surge Following Nvidia Investment

May 22, 2025

Core Weave Crwv Stock Surge Following Nvidia Investment

May 22, 2025