Microsoft-Activision Merger: FTC's Appeal And Potential Outcomes

Table of Contents

The FTC's Core Arguments Against the Merger

The FTC's opposition to the Microsoft-Activision merger rests on several key pillars, all centered around concerns about reduced competition and potential harm to consumers.

Concerns about Market Domination

The FTC's primary argument hinges on the assertion that the merger would grant Microsoft undue control over the gaming market. This concern stems from Microsoft's potential to leverage its ownership of Activision Blizzard's vast portfolio of popular games, including the immensely popular Call of Duty franchise, to stifle competition.

-

Exclusionary Practices: The FTC worries that Microsoft could make Call of Duty and other Activision Blizzard titles exclusive to its Xbox ecosystem, thus disadvantaging competitors like Sony PlayStation and Nintendo Switch. This could significantly limit consumer choice and potentially drive up prices.

-

Subscription Services: The merger also raises concerns about Microsoft's dominance in the rapidly growing gaming subscription market (Game Pass). The acquisition of Activision Blizzard's titles would further strengthen Game Pass, potentially pushing out competitors and reducing consumer choice in subscription services.

-

Market Share Analysis: The FTC's case relies on a detailed analysis of market share and competitive dynamics, arguing that the combined entity would hold an unacceptably high market share, leading to anti-competitive behavior.

-

Examples of Potential Anti-Competitive Behavior:

- Making Call of Duty exclusive to Xbox and PC.

- Offering more favorable terms to Game Pass subscribers compared to other platforms.

- Limiting access to Activision Blizzard games on competing subscription services.

Impact on Game Pricing and Innovation

The FTC also argues that the merger could lead to higher game prices and reduced innovation. By eliminating a major competitor, Microsoft could potentially increase prices for Activision Blizzard games or reduce investment in research and development of new titles.

-

Reduced Competition: Less competition can lead to a lack of incentive for innovation and the creation of new, compelling games.

-

Price Increases: Consumers could face higher prices for games, particularly popular titles like Call of Duty, due to reduced competition.

-

Stifled Innovation: A lack of competitive pressure could result in slower innovation and fewer new gaming experiences for consumers.

-

Exclusive Content Harms Consumers:

- Limits consumer choice.

- Potentially increases prices.

- Stifles innovation in game development.

The Role of Cloud Gaming

The rapidly growing cloud gaming sector is another area of concern for the FTC. Microsoft is a significant player in cloud gaming, and the merger could further solidify its position, potentially shutting out smaller competitors.

-

Dominance in Cloud Gaming: The FTC argues that the merger would give Microsoft an unfair advantage in the cloud gaming market, hindering the development of competing services.

-

Emerging Cloud Gaming Services: The acquisition could threaten the viability of emerging cloud gaming providers, limiting consumer choice and innovation.

-

Future of Cloud Gaming: The merger's impact on the future competitiveness of the cloud gaming landscape is a central point of contention.

-

Competitive Threats:

- Exclusion of competing cloud gaming platforms from Activision Blizzard titles.

- Preferential treatment of Microsoft's own cloud gaming service.

- Higher prices for cloud gaming subscriptions.

Potential Outcomes of the FTC's Appeal

The FTC's appeal could result in several potential outcomes, each with significant ramifications for the gaming industry.

The Appeal Succeeds

If the FTC successfully overturns the initial court ruling, the merger could be blocked entirely, or Microsoft might be forced to accept significant conditions to allow the deal to proceed.

-

Complete Blockage: The most extreme outcome would be a complete blocking of the merger, forcing Microsoft to abandon its acquisition of Activision Blizzard.

-

Conditional Approval: The FTC might approve the merger, but only if Microsoft agrees to significant remedies, such as licensing Call of Duty to competitors or divesting certain Activision Blizzard assets.

-

Impact on Microsoft: A successful FTC appeal could significantly impact Microsoft's stock price and reshape its gaming strategy.

-

Potential Impacts:

- Significant financial losses for Microsoft.

- A restructuring of Microsoft's gaming business.

- Negative impact on investor confidence.

The Appeal Fails

Should the FTC's appeal fail, the merger would likely proceed as planned. This would have significant implications for future merger approvals and the precedent it sets for antitrust enforcement.

-

Precedent for Future Mergers: An unsuccessful appeal could set a precedent for future large tech mergers, potentially making it easier for similar acquisitions to proceed with less regulatory scrutiny.

-

Implications for Antitrust Enforcement: The outcome will significantly influence the effectiveness of antitrust enforcement in the tech sector, potentially impacting future regulatory actions.

-

Impact on Competition: A failed appeal would likely lead to reduced competition in the gaming market, with potential implications for game prices and innovation.

-

Implications for Other Large Tech Mergers:

- Could embolden other companies to pursue large acquisitions.

- Could weaken antitrust enforcement against future mergers.

- Could lead to further consolidation in the tech industry.

Negotiated Settlement

There's also a possibility that Microsoft and the FTC could reach a negotiated settlement. This could involve Microsoft making concessions to address the FTC's concerns.

-

Concessions from Microsoft: Microsoft might offer concessions, such as licensing agreements for Call of Duty or other key titles, to alleviate the FTC's concerns about market dominance.

-

Remedies in a Settlement Agreement: A negotiated settlement could include a variety of remedies aimed at mitigating potential anti-competitive behavior.

-

Potential Licensing Agreements: Microsoft might be required to license certain Activision Blizzard titles to competitors, ensuring continued competition in the market.

-

Potential Settlement Terms:

- Licensing agreements for key game titles.

- Divestiture of certain Activision Blizzard assets.

- Behavioral commitments to avoid anti-competitive practices.

Impact on the Gaming Industry and Consumers

The outcome of the FTC's appeal will have profound implications for both the gaming industry and its consumers.

Effect on Game Availability and Pricing

The merger's outcome will directly affect the availability and pricing of games, especially Call of Duty. If the merger is blocked or significantly altered, gamers can expect to see the status quo maintained or potentially even increased competition. Conversely, a successful merger without significant conditions could potentially reduce choice and lead to higher prices.

-

Call of Duty's Future: The fate of Call of Duty is central to the debate, with its availability across multiple platforms a major concern.

-

Impact on Other Platforms: The outcome will significantly affect the gaming landscape on other platforms like PlayStation and Nintendo Switch.

-

Short-Term and Long-Term Effects: Gamers should expect short-term uncertainty followed by longer-term consequences depending on the final ruling.

-

Potential Impacts on Gamers:

- Changes in game availability on different platforms.

- Potential changes in game pricing.

- Impact on the development of future games.

Future of Mergers and Acquisitions in the Gaming Industry

The Microsoft-Activision merger sets a critical precedent for future mergers and acquisitions in the gaming industry. The outcome will shape the regulatory landscape and significantly influence industry consolidation.

-

Regulatory Scrutiny: The FTC's actions demonstrate increased regulatory scrutiny of large tech mergers, suggesting stricter enforcement in the future.

-

Industry Consolidation: The outcome could either accelerate or slow down industry consolidation, influencing the future structure of the gaming market.

-

Evolving Regulatory Landscape: The regulatory environment is likely to evolve significantly in response to the outcome of this case.

-

Potential Changes to the Regulatory Process:

- Increased scrutiny of mergers in the gaming and tech sectors.

- New regulations aimed at preventing anti-competitive practices.

- Changes to the process of merger approval.

Conclusion

The Microsoft-Activision merger stands as a pivotal moment for the gaming industry. The FTC's appeal presents a complex legal and economic challenge, with potential outcomes ranging from a complete blockage to a negotiated settlement. The implications for competition, innovation, and consumer access to games are far-reaching and will shape the gaming landscape for years to come. Staying informed about the developments in the Microsoft-Activision merger is crucial for gamers, developers, and industry observers alike. The resolution of this case will serve as a significant benchmark for future mergers and acquisitions within the gaming and technology sectors. Keep following updates on this significant antitrust lawsuit and the implications for the gaming industry.

Featured Posts

-

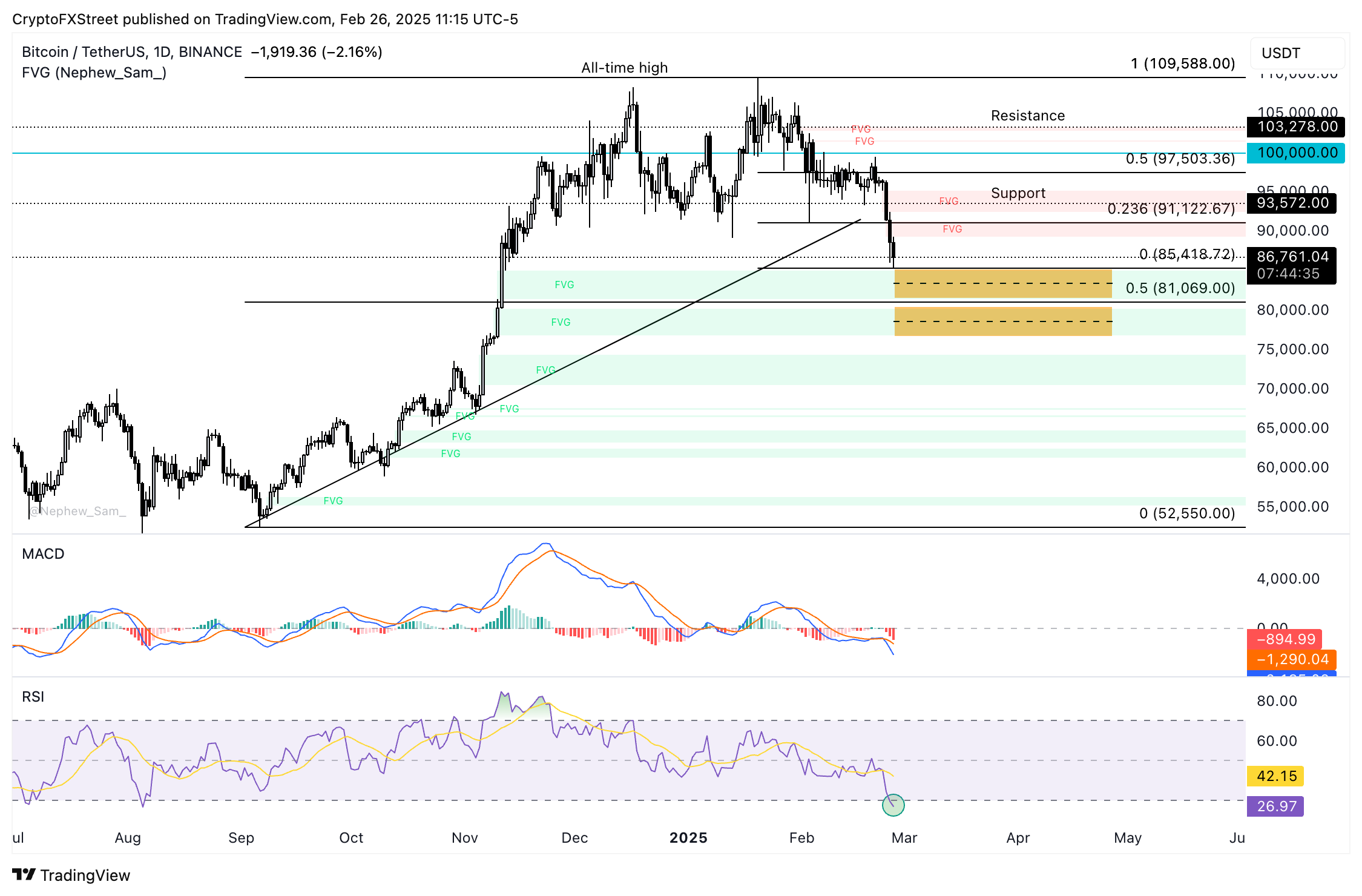

Bitcoin And Trump Will His 100 Day Speech Influence Btc To Reach 100 000

May 08, 2025

Bitcoin And Trump Will His 100 Day Speech Influence Btc To Reach 100 000

May 08, 2025 -

Snegopady V Yaroslavskoy Oblasti Prognoz Pogody I Rekomendatsii

May 08, 2025

Snegopady V Yaroslavskoy Oblasti Prognoz Pogody I Rekomendatsii

May 08, 2025 -

Uber Stock A Comprehensive Investment Analysis

May 08, 2025

Uber Stock A Comprehensive Investment Analysis

May 08, 2025 -

Fitorja E Psg Se Strategji Taktika Dhe Rezultati

May 08, 2025

Fitorja E Psg Se Strategji Taktika Dhe Rezultati

May 08, 2025 -

Ethereum Price Prediction Buy Signal Flashes On Weekly Chart

May 08, 2025

Ethereum Price Prediction Buy Signal Flashes On Weekly Chart

May 08, 2025