Microsoft's Activision Deal Faces FTC Appeal: Future Uncertain

Table of Contents

The FTC's Arguments Against the Merger

The FTC's core argument centers on the potential for anti-competitive practices stemming from the Microsoft Activision Blizzard merger. Their FTC complaint highlights several key concerns:

-

Reduced Competition in the Console Market: The FTC argues that Microsoft, already a significant player in the gaming console market with its Xbox, could leverage its ownership of Activision Blizzard to stifle competition from Sony's PlayStation and other platforms. By making key franchises exclusive to Xbox, or offering them on other consoles under unfavorable terms, Microsoft could gain an unfair advantage.

-

Exclusivity Concerns around Key Franchises: The FTC is particularly concerned about the potential for Call of Duty, a hugely popular and profitable franchise, to become exclusive to Xbox. This could significantly harm PlayStation's market share and limit consumer choice. The lack of access to this major title could force gamers to switch consoles or abandon the franchise altogether. This action would undoubtedly represent a significant anti-competitive practice.

-

Harm to Consumers: The FTC argues that the merger could lead to higher prices, fewer choices, and reduced innovation for consumers. By eliminating a major competitor, Microsoft could potentially increase prices for games and subscriptions or reduce the quality of services.

-

Market Dominance: The FTC’s case rests heavily on the assertion that Microsoft acquiring Activision Blizzard will lead to substantial market dominance, significantly reducing competition and harming consumers through higher prices and fewer choices in the gaming market.

Microsoft's Defense of the Activision Acquisition

Microsoft vehemently denies the FTC's accusations, arguing that the merger will actually increase competition and benefit gamers. Their defense strategy rests on these pillars:

-

Increased Competition and Innovation: Microsoft contends that the acquisition will foster innovation and create a more competitive gaming ecosystem. They argue that access to Activision Blizzard's portfolio will allow them to enhance their Game Pass subscription service, offering greater value to consumers.

-

Continued Call of Duty Availability: Microsoft has repeatedly pledged to continue offering Call of Duty on PlayStation and other platforms, even going so far as to sign legally binding agreements to ensure its cross-platform availability. This promise aims to directly counter the FTC's concern about exclusivity.

-

Benefits to Gamers: Microsoft highlights the potential benefits for gamers, including access to a wider range of games through Game Pass and the potential for improved game development and technological advancements.

-

Proposed Remedies: To address the FTC's concerns, Microsoft has offered potential remedies, though the specifics remain subject to ongoing negotiations and legal proceedings. These may include commitments to licensing Call of Duty to competitors.

The Potential Outcomes and Their Implications

The FTC's appeal creates several potential scenarios, each with significant ramifications:

-

FTC Wins the Appeal: If the FTC prevails, the Microsoft Activision Blizzard merger would likely be blocked or significantly altered. This could involve divestitures—Microsoft selling off parts of Activision Blizzard—or other substantial concessions to address the FTC's concerns. It would set a significant precedent for future tech mergers and antitrust enforcement.

-

Microsoft Wins the Appeal: A victory for Microsoft would allow the merger to proceed as planned, potentially reshaping the gaming landscape. However, it could also raise concerns about the effectiveness of antitrust regulations and the power of large tech companies.

-

Settlement: The parties could reach a settlement, with Microsoft agreeing to certain conditions to satisfy the FTC's concerns. This could involve concessions on game exclusivity, pricing, or other aspects of the deal.

Global Regulatory Scrutiny and Similar Cases

The Microsoft Activision Blizzard deal isn't just facing scrutiny in the US. Regulatory bodies worldwide are examining its implications:

-

International Regulations: The European Union (EU) and the UK's Competition and Markets Authority (CMA) have also reviewed the deal, with the UK initially blocking it before later approving it under certain conditions, demonstrating the complexities of navigating global antitrust laws.

-

Comparison to Other Tech Mergers: This case is being compared to other significant tech mergers, providing insights into the evolving landscape of antitrust enforcement in the digital age. These comparisons offer valuable lessons for future deals.

-

Broader Implications for Global Antitrust Law: The outcome of this case will have significant implications for global antitrust law and how regulators approach mergers and acquisitions in the tech sector, influencing future regulatory decisions across the globe.

Conclusion: The Future of the Microsoft Activision Deal Remains Uncertain

The Microsoft Activision Blizzard merger is a pivotal moment for the gaming industry and antitrust regulation. The FTC's appeal highlights the complexities of balancing innovation with competition. The arguments for and against the merger are significant, focusing on the potential impacts on competition, consumer choice, and the future of the gaming landscape. The outcome of the appeal will profoundly shape the gaming industry’s future and set a significant precedent for future mergers in the tech sector. Stay informed about updates on the Microsoft Activision Blizzard merger and its impact on gaming industry news and antitrust legislation. This is a developing story with far-reaching consequences.

Featured Posts

-

Will Kyle Walker Peters Join West Ham Evaluating The Transfer Bid

May 24, 2025

Will Kyle Walker Peters Join West Ham Evaluating The Transfer Bid

May 24, 2025 -

Nemecke Firmy A Hromadne Prepustanie Analyza Situacie Na H Nonline Sk

May 24, 2025

Nemecke Firmy A Hromadne Prepustanie Analyza Situacie Na H Nonline Sk

May 24, 2025 -

Amsterdam Stock Market Crash 7 Plunge Amidst Trade War Fears

May 24, 2025

Amsterdam Stock Market Crash 7 Plunge Amidst Trade War Fears

May 24, 2025 -

Uspekh Kazakhstana Tretiy Vykhod V Final Kubka Billi Dzhin King

May 24, 2025

Uspekh Kazakhstana Tretiy Vykhod V Final Kubka Billi Dzhin King

May 24, 2025 -

First Look Sylvester Stallone In Tulsa King Season 3 Set Photo

May 24, 2025

First Look Sylvester Stallone In Tulsa King Season 3 Set Photo

May 24, 2025

Latest Posts

-

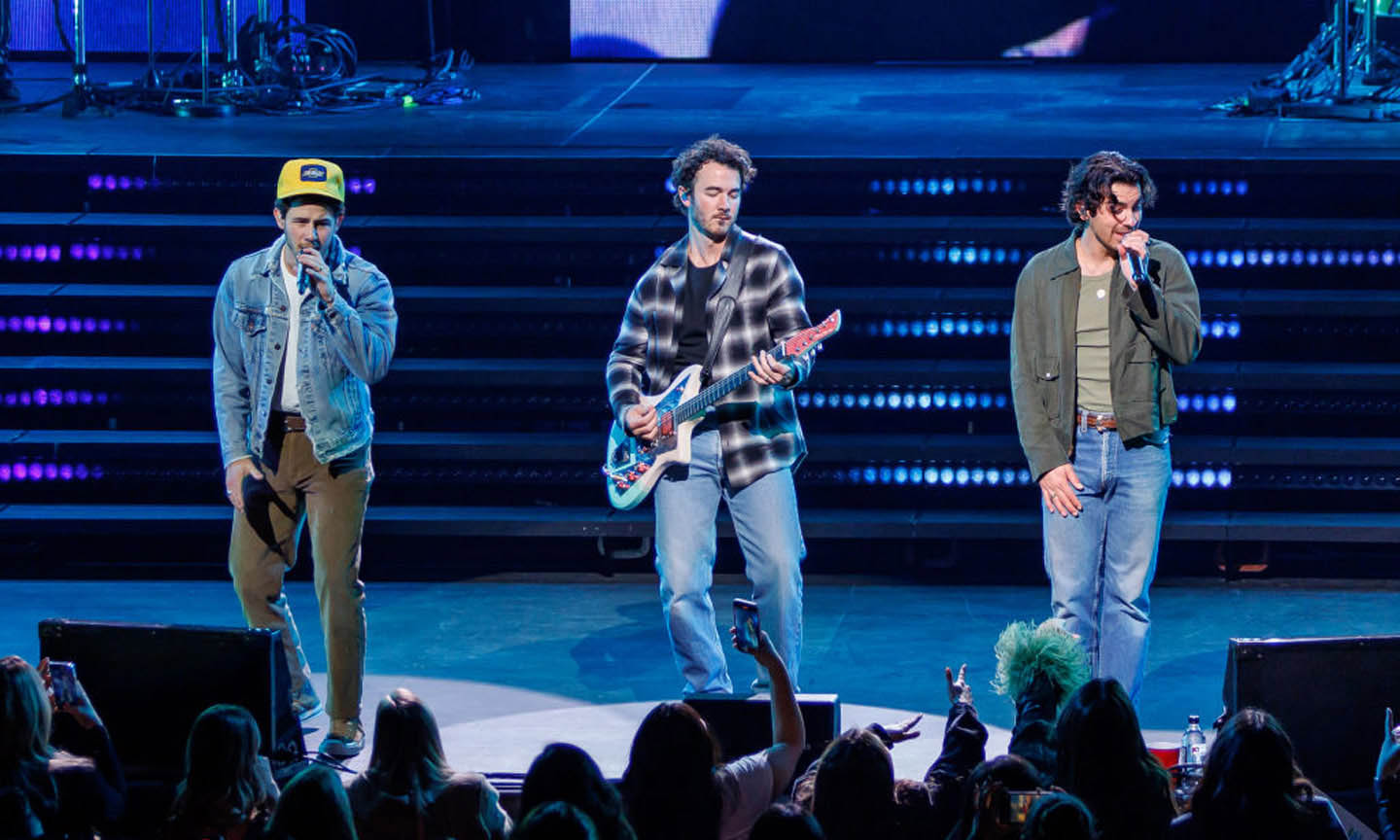

The Jonas Brothers A Couples Hilarious Fight Over Joe

May 24, 2025

The Jonas Brothers A Couples Hilarious Fight Over Joe

May 24, 2025 -

Couple Fights Over Joe Jonas His Response Is Golden

May 24, 2025

Couple Fights Over Joe Jonas His Response Is Golden

May 24, 2025 -

Sylvester Stallones Tulsa King Season 2 Blu Ray Sneak Peek

May 24, 2025

Sylvester Stallones Tulsa King Season 2 Blu Ray Sneak Peek

May 24, 2025 -

The Last Rodeo Highlighting Neal Mc Donoughs Acting

May 24, 2025

The Last Rodeo Highlighting Neal Mc Donoughs Acting

May 24, 2025 -

Experience Free Films And Meet Stars At The Dallas Usa Film Festival

May 24, 2025

Experience Free Films And Meet Stars At The Dallas Usa Film Festival

May 24, 2025