Millions Could Be Owed HMRC Refunds: Check Your Payslip Now

Table of Contents

Many people unknowingly overpay tax due to various reasons, including incorrect tax codes, underpayment of tax credits, or employer errors. This article will empower you to take control of your finances and reclaim what's rightfully yours. We'll guide you through the process of examining your payslips, understanding potential reasons for refunds, and submitting your claim to HMRC.

Understanding Your Payslip and Tax Codes

Understanding your payslip is crucial for managing your finances and identifying potential HMRC tax refund opportunities. Your tax code, a seemingly simple set of numbers and letters, dictates how much income tax is deducted from your salary each month. A wrong tax code can lead to significant overpayment throughout the tax year.

Let's break down some common tax code abbreviations:

- 1257L: This is a standard tax code for many individuals.

- BR: This code signifies that you are a basic rate taxpayer.

- D0: This indicates that no tax should be deducted. (This is unusual and warrants investigation).

- K1000: This indicates a tax code reduction, possibly due to additional income such as rental income.

How Incorrect Tax Codes Lead to Overpayment: An incorrect tax code instructs your employer to deduct too much tax. For instance, if your tax code is mistakenly lower than it should be, you'll pay more tax than necessary each month, accumulating over the year.

Key Payslip Sections to Focus On:

-

Tax Code: This is the most important element to verify.

-

Tax Deducted: Compare this amount to what you should be paying based on your income and tax code.

-

National Insurance Contributions: Ensure these are calculated correctly.

-

Check your tax code on every payslip.

-

Compare your tax code to the HMRC standard code for your circumstances.

-

Understand the implications of different tax code letters.

-

Note any discrepancies or changes in your tax code over time.

Common Reasons for HMRC Refunds

Several factors can lead to an HMRC tax refund. Understanding these common reasons will help you determine if you might be eligible.

-

Incorrect Tax Code: As discussed above, this is a leading cause of overpayment. Changes in circumstances (marriage, children, etc.) can impact your tax code, and failure to update it promptly results in overpayment.

-

Underpaid Tax Credits: If you're entitled to tax credits (such as Child Tax Credit or Working Tax Credit), any underpayment by HMRC will result in a refund owed.

-

Employer Errors in PAYE Calculations: Employers are responsible for deducting PAYE (Pay As You Earn) tax. Errors in their calculations can lead to you paying too much.

-

Changes in Personal Circumstances: Major life events like marriage, having children, or starting a new job can impact your tax liability. Ensure HMRC has your updated information.

-

Claiming for previous years' underpayments: You can typically claim a refund for the previous four tax years.

How to Check Your Payslips for Potential Refunds

To check for potential HMRC refunds, systematically examine your payslips:

-

Gather all payslips: Collect all your payslips for the relevant tax year (usually April to April).

-

Check the tax code and amount deducted: Carefully compare these figures across all payslips. Look for any inconsistencies or unusual deductions.

-

Identify trends: Analyze your payslips over time to identify any patterns of overpayment.

-

Use a tax calculator: Several online tax calculators can help you determine your expected tax liability based on your income and circumstances. Compare this to the tax actually deducted from your payslips.

-

Keep accurate records: Maintain organised records of your payslips, as this is crucial if you need to make a claim.

Claiming Your HMRC Refund: A Step-by-Step Guide

Once you've identified a potential underpayment, claiming your HMRC refund is straightforward:

-

Gather necessary documentation: This typically includes your payslips, P60s (end-of-year tax summaries), and any other relevant documents.

-

Access the HMRC online portal: The HMRC website provides clear instructions and online forms for submitting your claim.

-

Complete the forms accurately: Ensure all information is accurate and complete to avoid delays.

-

Submit your claim: Follow the instructions on the HMRC website for submitting your claim electronically or by post.

-

Keep records: Retain copies of all documentation submitted and any communication with HMRC.

Secure Your HMRC Refund Today!

Millions of pounds in potential HMRC refunds remain unclaimed. By diligently checking your payslips and understanding the common reasons for overpayment, you can reclaim what's rightfully yours. Don't let hard-earned money go unclaimed! Take action today – check your payslips now and claim what's rightfully yours!

For further assistance and resources, please visit the official HMRC website: [Insert HMRC Website Link Here]

Featured Posts

-

Paulina Gretzkys Husband A Rare Public Outing

May 20, 2025

Paulina Gretzkys Husband A Rare Public Outing

May 20, 2025 -

Porsches Tightrope Walk Ferrari Performance Mercedes Prestige And The Impact Of Global Trade Disputes

May 20, 2025

Porsches Tightrope Walk Ferrari Performance Mercedes Prestige And The Impact Of Global Trade Disputes

May 20, 2025 -

Huuhkajat Kaellmanin Maalivireen Merkitys

May 20, 2025

Huuhkajat Kaellmanin Maalivireen Merkitys

May 20, 2025 -

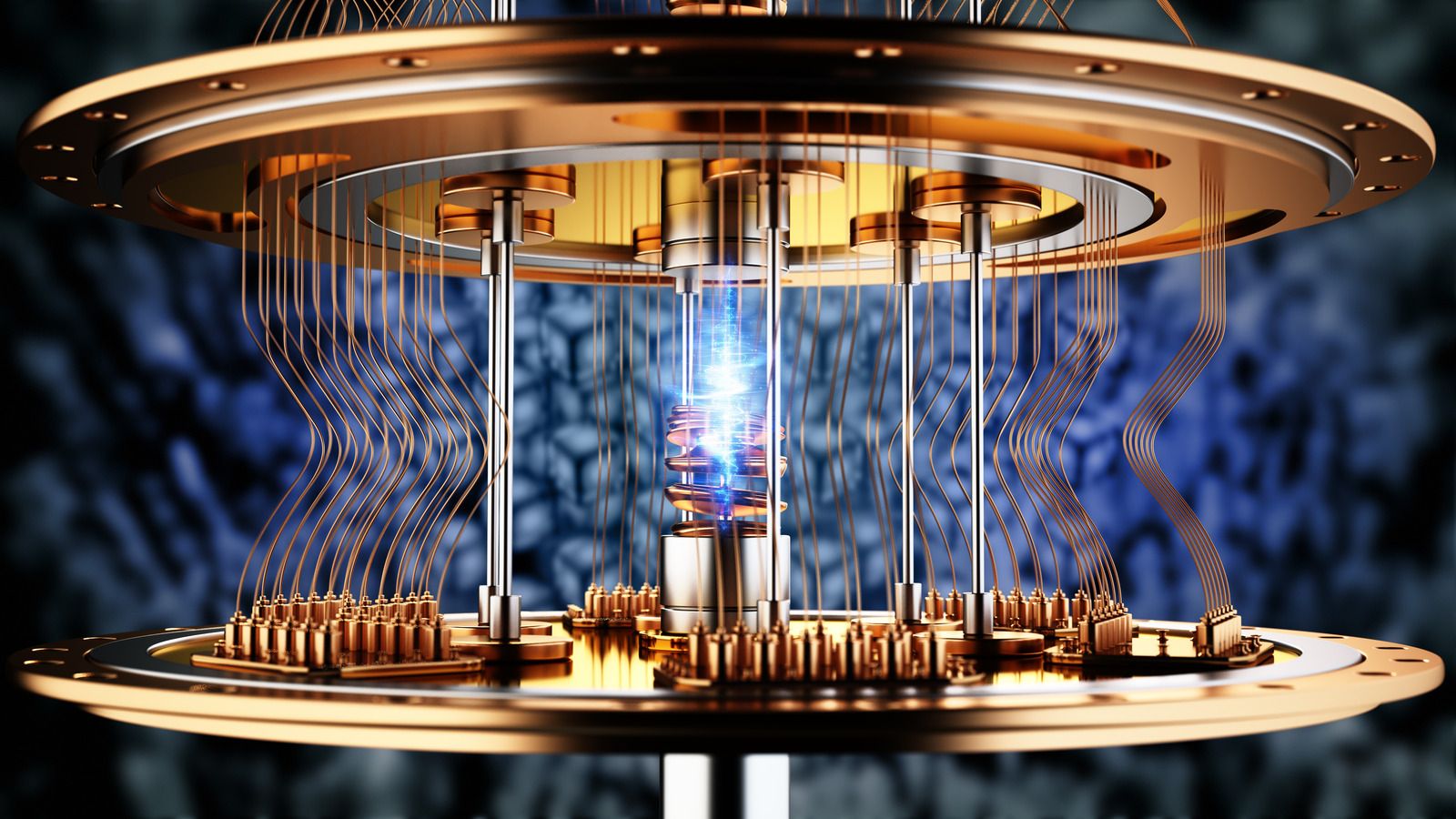

Investing In Quantum Computing Stocks In 2025 Rigetti And Ion Q

May 20, 2025

Investing In Quantum Computing Stocks In 2025 Rigetti And Ion Q

May 20, 2025 -

Nyt Mini Crossword Answers April 13

May 20, 2025

Nyt Mini Crossword Answers April 13

May 20, 2025

Latest Posts

-

Nvidia

May 20, 2025

Nvidia

May 20, 2025 -

Adas

May 20, 2025

Adas

May 20, 2025 -

Ap

May 20, 2025

Ap

May 20, 2025 -

Ap It

May 20, 2025

Ap It

May 20, 2025 -

Esperida Gia Tin Megali Tessarakosti Patriarxiki Ekklisiastiki Akadimia Kritis Irakleio

May 20, 2025

Esperida Gia Tin Megali Tessarakosti Patriarxiki Ekklisiastiki Akadimia Kritis Irakleio

May 20, 2025