Minnesota Film Production: The Impact Of Tax Credits

Table of Contents

Economic Benefits of Minnesota Film Tax Credits

The film tax credits offered by Minnesota aren't just about incentivizing filmmaking; they're a powerful engine for economic growth and job creation.

Job Creation and Economic Growth

Film productions are labor-intensive endeavors, generating a ripple effect of employment opportunities throughout the state. The tax credits stimulate job creation not only for on-screen talent (actors) and behind-the-scenes crews (directors, cinematographers, editors), but also for numerous support services, ranging from catering and transportation to equipment rentals and post-production facilities. While precise figures fluctuate yearly, anecdotal evidence and industry reports suggest a marked increase in film-related jobs since the implementation of the incentives. This translates to:

- Increased employment opportunities for local residents: Minnesotans benefit from a wider range of skilled and unskilled positions, boosting local employment rates.

- Attraction of skilled professionals from across the country: The tax credits make Minnesota a more competitive location, drawing experienced professionals to the state, enhancing the overall skill base of the industry.

- Stimulation of related industries like hospitality and catering: Film productions require extensive support services, creating opportunities for hotels, restaurants, and other businesses that benefit from the influx of production crews and cast members.

Increased Revenue for Local Businesses

The economic impact extends far beyond direct employment. Film productions inject significant revenue into local businesses. Money spent on goods and services directly benefits local economies.

- Support for small businesses and local economies: From renting local equipment to sourcing catering from nearby establishments, productions contribute directly to the prosperity of local businesses of all sizes.

- Increased tax revenue for the state and local governments: The increased economic activity translates into higher tax revenues for state and local governments, creating a positive feedback loop.

- Positive spillover effects on other industries: The boost in economic activity from film production can have a cascading effect, benefiting related sectors and contributing to overall economic health. This includes increased spending at local shops, restaurants, and hotels, benefitting the wider community.

Attracting Major Film and Television Productions to Minnesota

Minnesota's film tax credit program plays a crucial role in attracting large-scale film and television projects.

Competitiveness with Other States

Minnesota's tax credit program stands alongside those of other states known for film production. While specifics vary, Minnesota's incentives are often competitive, offering a significant advantage in attracting major studios and productions.

- Competitive tax rates attract major studios and production companies: The tax breaks make Minnesota a more financially attractive location to shoot compared to states without similar programs or those with less generous incentives.

- Minnesota’s diverse landscapes and locations provide a unique filming backdrop: From the majestic North Shore to the vibrant cities of Minneapolis and St. Paul, Minnesota offers diverse locations that can cater to various filming needs.

- Showcase examples of large-scale productions that chose Minnesota due to the incentives: Highlighting specific successful productions that selected Minnesota due to the incentives provides compelling evidence of their effectiveness. (Include specific examples here if available.)

Promoting Minnesota as a Film Destination

The film tax credits aren't just about financial incentives; they significantly enhance Minnesota's image as a desirable filming location.

- Positive media coverage showcasing Minnesota's film industry growth: The increased activity resulting from the incentives generates positive media attention, attracting further interest from the film industry.

- Increased tourism due to the popularity of films and TV shows shot in the state: Productions shot in Minnesota can attract tourists interested in visiting filming locations, boosting tourism revenue.

- Enhanced image of Minnesota as a vibrant and innovative state: A thriving film industry adds to Minnesota's overall appeal, showcasing its creativity and dynamism.

Challenges and Future of Minnesota Film Tax Credits

While the benefits are substantial, there are also challenges and considerations for the future of Minnesota's film tax credit program.

Budgetary Considerations and Sustainability

- Ensuring long-term sustainability of the program: Regular evaluation and potential adjustments are crucial to ensure the program remains fiscally sound and effective in the long term.

- Evaluating the program's effectiveness and return on investment: Careful analysis of the program's impact on the economy and the film industry is necessary to justify continued funding.

- Potential for adjustments to maximize impact and minimize cost: Refining the program's structure to target specific areas or types of productions could maximize its effectiveness while controlling costs.

Future Growth and Development of the Minnesota Film Industry

Sustaining momentum requires proactive strategies.

- Investing in film education and training programs: Nurturing local talent through educational initiatives ensures a skilled workforce for future productions.

- Creating incentives for post-production work in Minnesota: Encouraging post-production activities within the state can further boost job creation and economic activity.

- Continued promotion of Minnesota as a premier filming location: Ongoing marketing efforts are key to attracting future productions and solidifying Minnesota's position in the film industry.

Conclusion

Minnesota's film tax credit program has demonstrably revitalized the state's film industry, fostering substantial economic growth and attracting major productions. The program's success is evident in the creation of numerous jobs, the increased revenue for local businesses, and the enhanced national and international profile of Minnesota as a desirable filming location. To learn more about the opportunities available and how you can participate in the continued growth of this thriving industry, explore the resources available on Minnesota film production tax credits and incentives. Become part of the exciting future of Minnesota film production.

Featured Posts

-

How The Uk Courts Definition Of Woman Impacts Sex Based Rights And Transgender Individuals

Apr 29, 2025

How The Uk Courts Definition Of Woman Impacts Sex Based Rights And Transgender Individuals

Apr 29, 2025 -

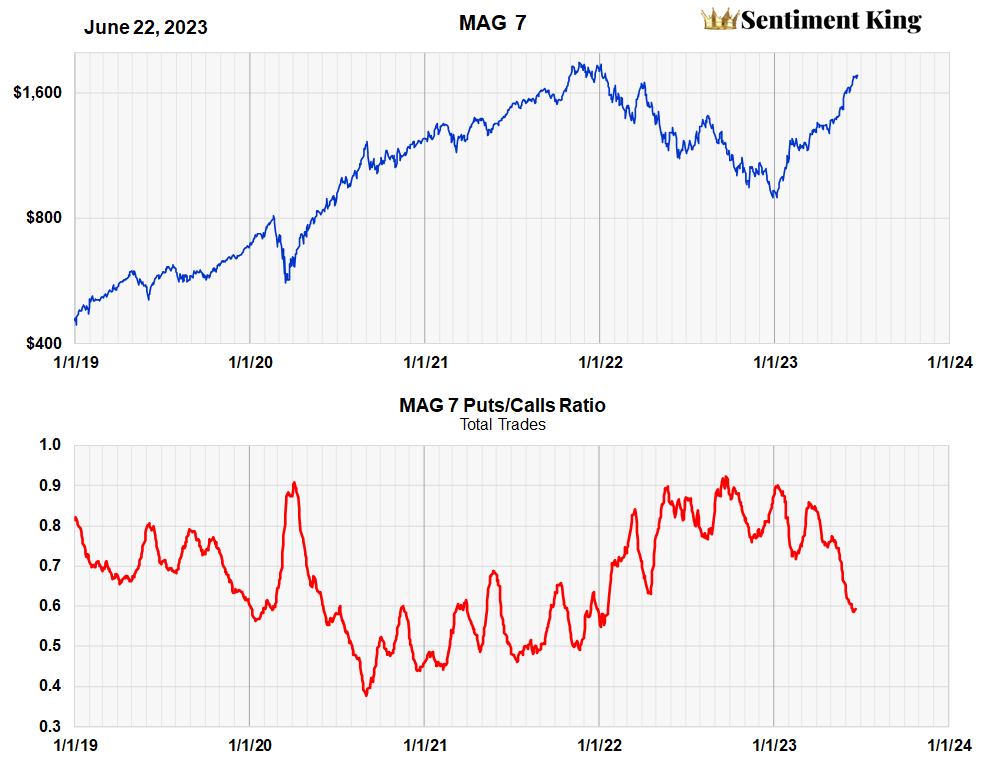

2 5 Trillion Evaporated The 2024 Market Value Plunge Of The Magnificent Seven

Apr 29, 2025

2 5 Trillion Evaporated The 2024 Market Value Plunge Of The Magnificent Seven

Apr 29, 2025 -

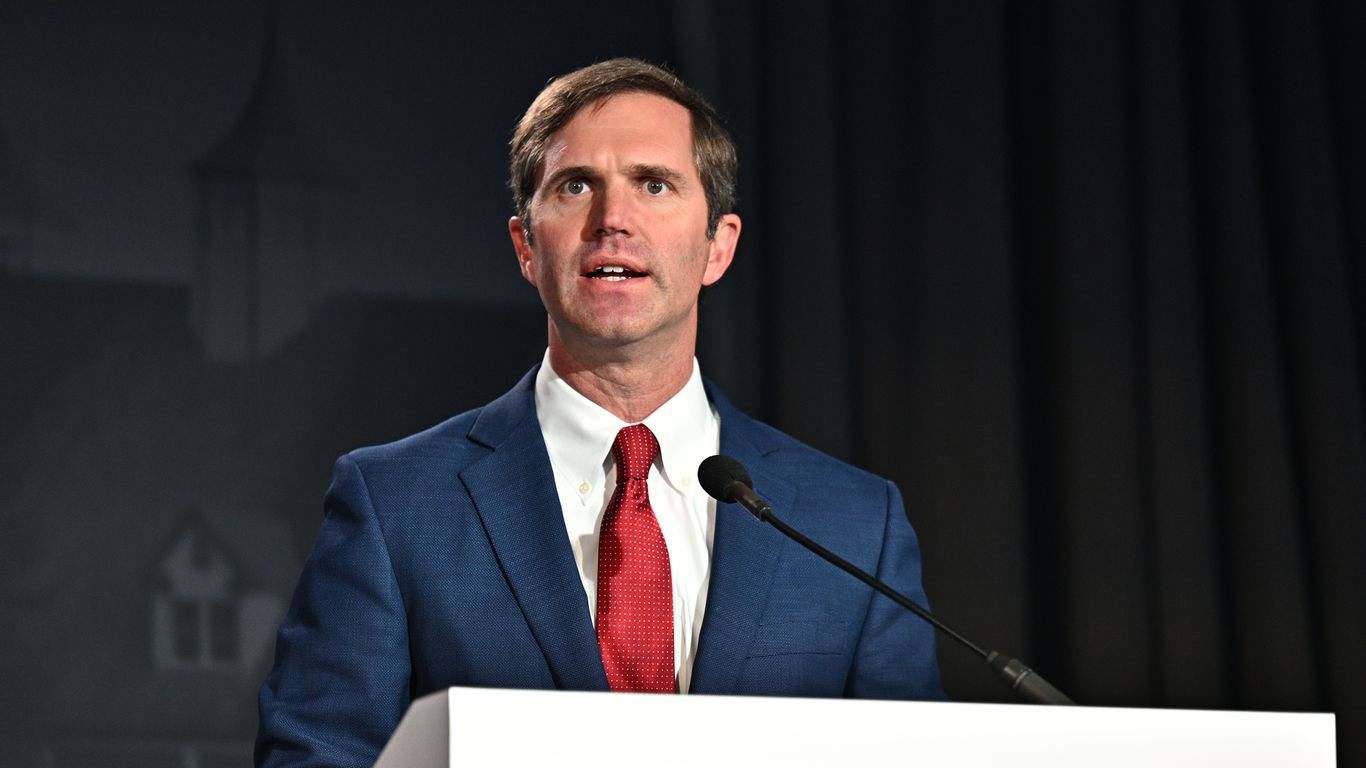

Kentucky Governor Issues State Of Emergency Due To Imminent Heavy Rain And Flooding

Apr 29, 2025

Kentucky Governor Issues State Of Emergency Due To Imminent Heavy Rain And Flooding

Apr 29, 2025 -

Dubais Khazna Targets Saudi Market After Silver Lake Partnership

Apr 29, 2025

Dubais Khazna Targets Saudi Market After Silver Lake Partnership

Apr 29, 2025 -

Dont Miss Out Hudsons Bay Liquidation Sale Now On

Apr 29, 2025

Dont Miss Out Hudsons Bay Liquidation Sale Now On

Apr 29, 2025