Mississippi Income Tax Elimination: Hernando Prepares For Change

Table of Contents

Understanding the Proposed Mississippi Income Tax Elimination

Timeline and Implementation Details

The proposed Mississippi income tax elimination is a complex process with several moving parts. While the exact timeline remains subject to legislative approval and potential hurdles, projections suggest a phased rollout rather than an immediate elimination. This phased approach aims to minimize economic disruption and allow for necessary adjustments.

- Projected implementation date: While a specific date is yet to be confirmed, legislative discussions point towards a potential start date within the next few years.

- Potential delays: Legislative hurdles, budget considerations, and unforeseen economic factors could lead to delays in the implementation of the tax elimination. Continuous monitoring of legislative updates is crucial.

- Impact on different income brackets: The impact of the Mississippi income tax elimination will vary across income brackets. Lower-income households might see less immediate impact, while higher-income households will experience a more substantial reduction in their tax burden.

Potential Economic Impacts on Hernando

The elimination of the Mississippi income tax holds both promise and potential challenges for Hernando's economy.

- Increased consumer spending: With more disposable income, Hernando residents may increase their spending at local businesses, potentially boosting retail sales and overall economic activity.

- Potential influx of new businesses: The absence of a state income tax could attract new businesses and residents to Hernando, leading to job growth and increased competition.

- Challenges for local government budgeting: Hernando's local government will face the challenge of replacing the lost income tax revenue. This necessitates careful budgetary planning and exploring alternative revenue streams.

- Potential property tax adjustments: To compensate for the loss of income tax revenue, the town may consider adjustments to property taxes or other local levies. Transparency in these processes will be critical to maintain public trust.

Comparison to Other States Without Income Tax

Several states have successfully eliminated their income taxes, offering valuable lessons for Hernando. Examining their experiences can help anticipate potential outcomes.

- Examples of successful income tax elimination states: States like Alaska, Florida, Nevada, and Texas offer valuable case studies on the long-term effects of income tax elimination.

- Challenges faced by states without income tax: These states often rely heavily on sales taxes and property taxes, which can create their own set of challenges, such as potential regressivity and reliance on volatile revenue sources.

- Relevant economic indicators to watch: Key indicators like employment rates, population growth, business investment, and sales tax revenue will be crucial in monitoring the impact of the Mississippi income tax elimination on Hernando.

Financial Planning for Hernando Residents

Adjusting to a Tax-Free Environment

The Mississippi income tax elimination necessitates a review and adjustment of personal financial plans.

- Reviewing current financial plans: Residents should carefully analyze their existing budgets, savings goals, and investment strategies to account for the absence of state income tax.

- Adjusting savings goals: The elimination of state income tax may allow for increased savings, potentially accelerating retirement planning or facilitating other financial goals.

- Exploring new investment opportunities: With increased disposable income, residents can explore new investment avenues to maximize returns and secure their financial future.

- Potential increased charitable giving: Many individuals may choose to allocate a portion of their tax savings towards charitable causes, contributing to the community's welfare.

Potential Impact on Retirement and Estate Planning

Retirement and estate planning strategies may also require adjustments.

- Changes to retirement income: The elimination of state income tax could affect the calculation of retirement income, impacting Social Security benefits and pension payouts.

- Potential changes in estate planning strategies: Estate tax implications might shift, requiring revisions to existing estate plans.

- Consultation with financial advisors: Seeking professional advice is crucial to ensure estate plans align with the changed tax landscape.

Seeking Professional Financial Advice

Proactive financial planning is paramount during this transition.

- Identifying qualified financial advisors: Choosing a reputable financial advisor with expertise in tax planning is vital to develop a personalized strategy.

- Understanding the fee structure: Transparency in fees and service offerings is essential when selecting a financial advisor.

- Importance of proactive financial planning: Don't wait until the last minute. Starting early allows for a well-informed and effective transition.

Hernando's Local Government Preparations

Budgetary Adjustments and Revenue Replacement

Hernando's local government is actively planning to address the loss of income tax revenue.

- Potential increases in sales tax, property tax, or other local taxes: The town may need to adjust its revenue streams by increasing existing taxes or introducing new ones.

- Budgetary adjustments: Careful reallocation of resources and prioritization of essential services will be necessary.

- Public discussions about revenue generation: Transparency and public engagement are vital to ensure community buy-in for any proposed changes.

Infrastructure and Public Services

The impact on infrastructure and public services needs careful consideration.

- Potential effects on schools, roads, public safety: Maintaining the quality of essential services will require meticulous resource allocation.

- Potential funding challenges: The town may need to explore creative funding solutions, such as public-private partnerships or grants.

- Community involvement: Actively involving the community in the planning process ensures decisions reflect local priorities.

Conclusion

The elimination of Mississippi's income tax presents both exciting opportunities and significant challenges for Hernando. Understanding the implications for the local economy, personal finances, and local government is crucial. Proactive financial planning, engagement with local authorities, and a collaborative approach are key to successfully navigating this transformative change. Don't wait – start preparing for the Mississippi income tax elimination today by consulting with financial advisors and staying informed about Hernando's local government plans. Embrace this change and position yourself for success in this new chapter of Mississippi's economic landscape.

Featured Posts

-

Eurowizja 2025 Sztuczna Inteligencja Przewiduje Wyniki Dla Polski

May 19, 2025

Eurowizja 2025 Sztuczna Inteligencja Przewiduje Wyniki Dla Polski

May 19, 2025 -

Dalfsen Amber Alert Parents Arrested After Children Rescued

May 19, 2025

Dalfsen Amber Alert Parents Arrested After Children Rescued

May 19, 2025 -

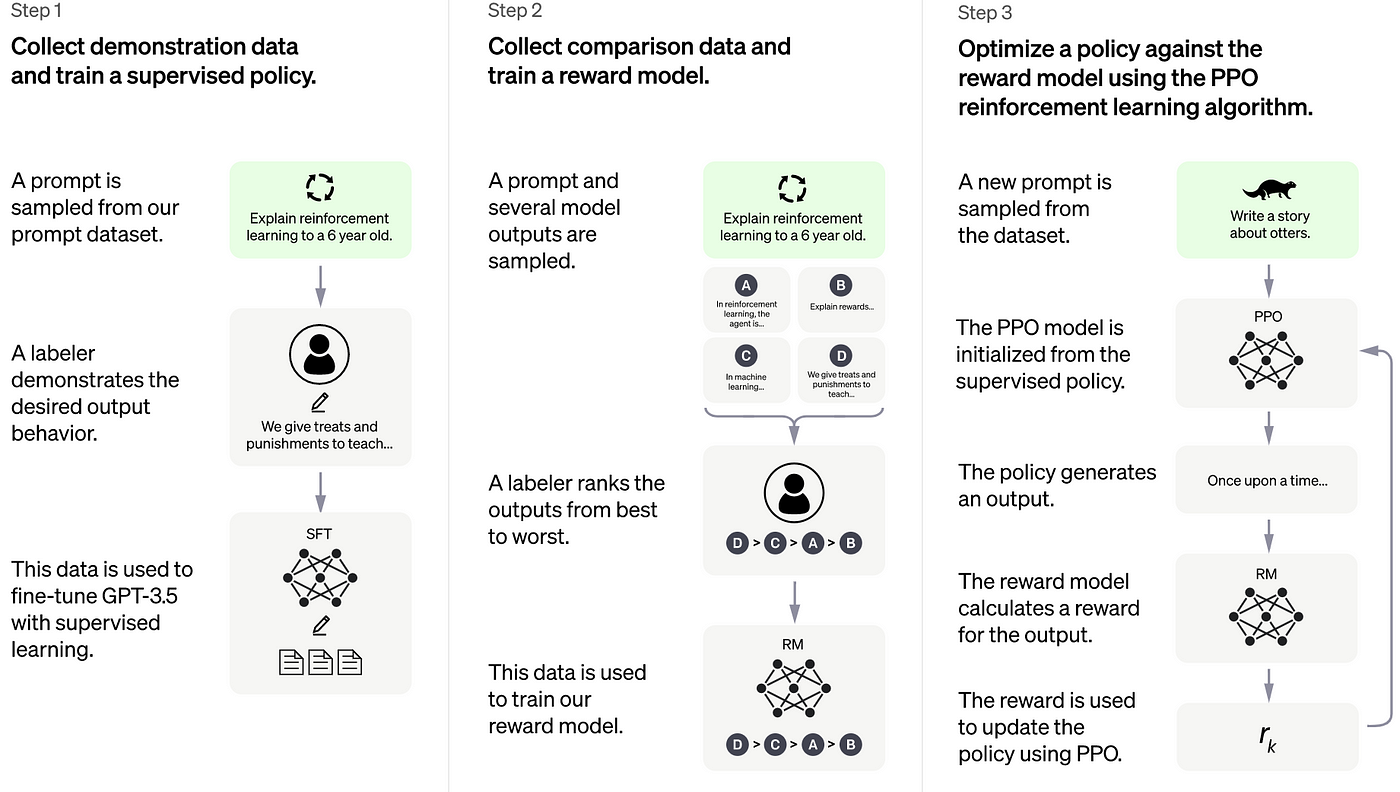

Improving Code Efficiency How Chat Gpts Ai Coding Agent Works

May 19, 2025

Improving Code Efficiency How Chat Gpts Ai Coding Agent Works

May 19, 2025 -

Billy Ray Cyrus Og Elizabeth Hurley Et Nytt Kapittel

May 19, 2025

Billy Ray Cyrus Og Elizabeth Hurley Et Nytt Kapittel

May 19, 2025 -

Portugal Adjusts Spain Power Import Limits Post Blackout

May 19, 2025

Portugal Adjusts Spain Power Import Limits Post Blackout

May 19, 2025