Money Laundering Lapses Cost Paytm Payments Bank ₹5.45 Crore: FIU-IND Penalty Explained

Table of Contents

Paytm Payments Bank recently faced a significant setback with a ₹5.45 crore penalty levied by the Financial Intelligence Unit-India (FIU-IND) for shortcomings in its anti-money laundering (AML) compliance. This substantial financial penalty underscores the critical importance of robust AML measures within the Indian financial sector. This article delves into the details of the penalty, examining the reasons behind it and its implications for Paytm Payments Bank and the broader financial landscape. We will explore the FIU-IND's role, the specific nature of the lapses, and the crucial steps financial institutions must take to ensure stringent compliance.

The FIU-IND Penalty and its Significance

The Financial Intelligence Unit-India (FIU-IND) is a central agency responsible for receiving, processing, analyzing, and disseminating information related to money laundering and terrorist financing. It plays a crucial role in India's fight against financial crime, collaborating with domestic and international agencies. The ₹5.45 crore penalty imposed on Paytm Payments Bank is a significant blow, not only impacting its financial standing but also severely damaging its reputation. This penalty highlights the seriousness with which the Indian government views AML violations.

The legal framework governing AML compliance in India is stringent, with the Prevention of Money Laundering Act (PMLA), 2002, laying down the legal basis. Non-compliance can lead to substantial financial penalties, reputational damage, and even legal action against individuals and the institution.

- FIU-IND's mandate includes investigation and imposition of penalties. Their actions are designed to deter similar behavior by other financial institutions.

- The penalty serves as a significant deterrent for other financial institutions. It sends a clear message about the government's commitment to combating money laundering.

- The amount reflects the seriousness of the lapses identified by the FIU-IND. The size of the penalty is directly proportional to the gravity of the offense.

- The penalty has the potential to negatively impact investor confidence in Paytm Payments Bank. This can affect its future growth and investment opportunities.

Nature of Money Laundering Lapses at Paytm Payments Bank

The FIU-IND's investigation revealed specific shortcomings in Paytm Payments Bank's AML compliance framework. While the exact details of all identified weaknesses may not be publicly available, reports suggest deficiencies in several key areas. These lapses created vulnerabilities that could have facilitated money laundering activities.

- Insufficient KYC (Know Your Customer) measures: Inadequate verification of customer identities left loopholes for fraudulent activities. Weak KYC processes are a major vulnerability in AML compliance.

- Inadequate transaction monitoring systems: The bank's systems failed to effectively identify and flag suspicious transactions, allowing potentially illicit funds to flow through undetected. This highlights the need for robust transaction monitoring systems with advanced analytics capabilities.

- Lack of timely reporting of suspicious activities: Failure to promptly report suspicious transactions to the FIU-IND hampered investigations and allowed potentially illegal activities to continue. Timely reporting is a critical component of effective AML compliance.

- Weaknesses in internal controls and compliance procedures: Overall weaknesses in internal controls and a lack of rigorous adherence to established procedures allowed the lapses to occur. Regular internal audits and staff training are essential to maintain compliance.

Consequences and Impact on the Financial Sector

The Paytm Payments Bank penalty has far-reaching consequences, extending beyond the specific institution. The incident has increased scrutiny on all payments banks in India, prompting regulators to examine AML compliance procedures across the sector. This could lead to stricter regulatory oversight and more frequent audits.

- Increased scrutiny on payments banks: All financial institutions are now facing heightened scrutiny regarding their AML compliance procedures.

- Potential for stricter regulatory oversight: We can expect more stringent regulations and more frequent audits from regulatory bodies.

- Emphasis on enhanced AML compliance measures: Financial institutions will need to invest in more robust AML compliance systems and training.

- Need for better technology and training: Investing in advanced technology for transaction monitoring and providing comprehensive training to employees is crucial.

Lessons Learned and Future Implications

The Paytm Payments Bank case serves as a cautionary tale for the entire financial sector. It highlights the critical need for proactive and robust AML compliance measures. The incident underscores the importance of continuous improvement and adaptation to evolving threats.

- Strengthening KYC procedures: Implementing more stringent KYC processes is essential to ensure accurate customer identification.

- Investing in advanced transaction monitoring technology: Utilizing AI-powered systems can improve the detection of suspicious activities.

- Improving employee training on AML compliance: Regular and comprehensive training is necessary to ensure staff are adequately equipped to identify and report suspicious activity.

- Regular audits and compliance reviews: Frequent audits and reviews ensure adherence to AML regulations and identify any weaknesses.

Conclusion

The ₹5.45 crore penalty imposed on Paytm Payments Bank for money laundering lapses underscores the severe consequences of neglecting anti-money laundering (AML) compliance. The FIU-IND's action highlights the seriousness with which the Indian government views such violations. The shortcomings identified, including insufficient KYC measures, inadequate transaction monitoring, and delayed reporting of suspicious activities, have significant implications for the entire financial sector. All financial institutions must prioritize robust AML compliance to avoid similar penalties, maintain public trust, and contribute to a safer and more secure financial ecosystem. The Paytm Payments Bank case serves as a stark reminder of the importance of proactive and comprehensive AML compliance programs. Learn more about FIU-IND penalties and strengthening your AML compliance program to protect your institution.

Featured Posts

-

Stefanos Stefanu Ve Kibris In Gelecegi Icin Kritik Girisimler

May 15, 2025

Stefanos Stefanu Ve Kibris In Gelecegi Icin Kritik Girisimler

May 15, 2025 -

College Van Omroepen Streeft Naar Vertrouwen Binnen Npo

May 15, 2025

College Van Omroepen Streeft Naar Vertrouwen Binnen Npo

May 15, 2025 -

Review 2026 Bmw I X Best Case Ev Or Overhyped

May 15, 2025

Review 2026 Bmw I X Best Case Ev Or Overhyped

May 15, 2025 -

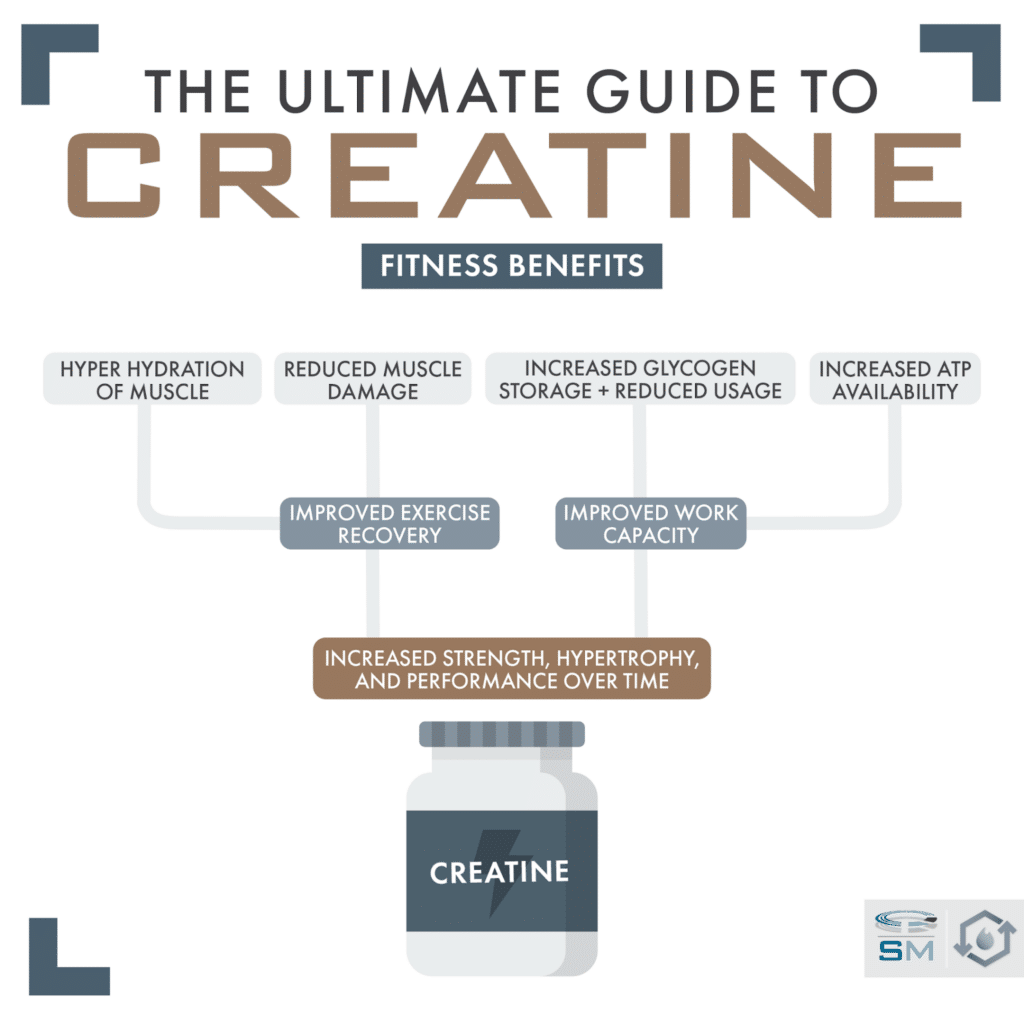

The Ultimate Guide To Creatine Benefits Risks And Dosage

May 15, 2025

The Ultimate Guide To Creatine Benefits Risks And Dosage

May 15, 2025 -

Bangladesh Election Body Bars Sheikh Hasinas Party

May 15, 2025

Bangladesh Election Body Bars Sheikh Hasinas Party

May 15, 2025

Latest Posts

-

Exploring Androids Revamped User Interface Design Language Changes

May 15, 2025

Exploring Androids Revamped User Interface Design Language Changes

May 15, 2025 -

The 2026 Bmw I X A Comprehensive Electric Vehicle Assessment

May 15, 2025

The 2026 Bmw I X A Comprehensive Electric Vehicle Assessment

May 15, 2025 -

2026 Bmw I X Evaluating The Electric Vehicles Potential

May 15, 2025

2026 Bmw I X Evaluating The Electric Vehicles Potential

May 15, 2025 -

Review 2026 Bmw I X Best Case Ev Or Overhyped

May 15, 2025

Review 2026 Bmw I X Best Case Ev Or Overhyped

May 15, 2025 -

Bmw I X 2026 Is This The Future Of Electric Vehicles

May 15, 2025

Bmw I X 2026 Is This The Future Of Electric Vehicles

May 15, 2025