Moody's 5% 30-Year Yield: What It Means For Selling In America

Table of Contents

Understanding the Moody's 5% 30-Year Yield and its Implications

The 30-year Treasury yield reflects the interest rate the US government pays on its long-term debt. Moody's, a leading credit rating agency, provides assessments of this debt's creditworthiness, influencing investor confidence and, consequently, the yield. A 5% 30-year yield signifies a relatively high return for investors, reflecting various economic factors we'll explore later. This yield has a direct correlation with mortgage rates; when Treasury yields rise, mortgage rates generally follow suit. This relationship is fundamental to understanding the impact of the Moody's 5% 30-Year Yield on the US Housing Market.

- Impact on affordability: Higher mortgage rates make homeownership less affordable for potential buyers, reducing purchasing power and shrinking the pool of qualified borrowers.

- Influence on demand: Decreased affordability directly impacts the demand for housing, potentially leading to a slowdown in sales and price adjustments.

- Refinancing implications: Existing homeowners with mortgages may find refinancing options less attractive due to higher interest rates, potentially locking them into their current rates.

Impact on Home Sellers in the US

The Moody's 5% 30-Year Yield and its resulting higher mortgage rates significantly impact home sellers in the US. Increased borrowing costs translate to lower buyer demand. This reduced demand creates a more competitive selling environment for homeowners.

- Increased competition: More homes on the market with fewer buyers create intense competition among sellers.

- Longer listing times: Properties may stay on the market for extended periods, increasing carrying costs and potentially leading to price reductions.

- Price reductions: To attract buyers in a slower market, sellers often need to adjust their pricing strategies, sometimes accepting offers below their initial asking price.

- Effective selling strategies: Sellers need to adopt strategies like professional staging, competitive pricing, and high-quality photography to stand out and attract buyers. Working with a skilled real estate agent who understands the current market dynamics driven by the Moody's 5% 30-Year Yield is crucial.

Economic Factors Contributing to the Moody's 5% 30-Year Yield

Several macroeconomic factors contribute to the current Moody's 5% 30-Year Yield and its impact on the US Housing Market. These factors intricately intertwine to influence interest rates and investor sentiment.

- Inflation: Persistent inflation pushes the Federal Reserve to raise interest rates to curb rising prices. Higher interest rates increase bond yields, including the 30-year Treasury yield.

- Federal Reserve policy: The Federal Reserve's monetary policy decisions, particularly interest rate adjustments, directly influence bond yields and mortgage rates. Quantitative tightening (QT) also impacts yields.

- Global economic uncertainty: Global economic instability can lead to increased demand for US Treasuries as a safe haven asset, potentially impacting yields.

Alternatives and Strategies for Home Sellers

Navigating the current market requires proactive strategies for home sellers. Understanding the implications of the Moody's 5% 30-Year Yield is paramount.

- Flexible pricing: Being open to negotiations and considering offers below the initial asking price can be crucial for a successful sale.

- Enhanced marketing: High-quality photography, virtual tours, and targeted marketing campaigns can attract more potential buyers.

- Real estate expertise: Partnering with a skilled real estate agent with deep market knowledge is vital for effective pricing, negotiation, and marketing strategies.

Conclusion

The Moody's 5% 30-Year Yield has profound implications for the US housing market. Higher mortgage rates resulting from this yield are decreasing buyer demand, increasing competition among sellers, and potentially leading to longer listing times and price reductions. Understanding the interplay between this yield, economic factors, and the resulting market dynamics is crucial for both buyers and sellers. Successfully selling your home in this environment requires knowledge of the Moody's 5% 30-Year Yield and its implications. Thorough research and consultation with experienced real estate professionals are essential for navigating the complexities of the current market. Understanding the Moody's 5% 30-Year Yield is crucial for making informed decisions in today's housing market.

Featured Posts

-

Financial Challenges How To Overcome Lack Of Funds And Build Wealth

May 21, 2025

Financial Challenges How To Overcome Lack Of Funds And Build Wealth

May 21, 2025 -

Teletoon Spring Streaming Jellystone And Pinata Smashling Highlight New Shows

May 21, 2025

Teletoon Spring Streaming Jellystone And Pinata Smashling Highlight New Shows

May 21, 2025 -

The Goldbergs Everything You Need To Know About The Cast And Characters

May 21, 2025

The Goldbergs Everything You Need To Know About The Cast And Characters

May 21, 2025 -

Stijgende Huizenprijzen Abn Amros Verwachting Ondanks Dalende Rente

May 21, 2025

Stijgende Huizenprijzen Abn Amros Verwachting Ondanks Dalende Rente

May 21, 2025 -

Finansoviy Reyting Ukrayini 2024 Credit Kasa Finako Ukrfinzhitlo Atlana I Credit Plus Na Vershini

May 21, 2025

Finansoviy Reyting Ukrayini 2024 Credit Kasa Finako Ukrfinzhitlo Atlana I Credit Plus Na Vershini

May 21, 2025

Latest Posts

-

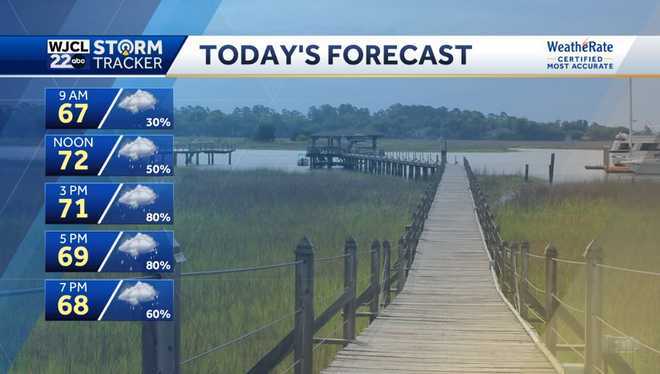

When Will It Rain Precise Timing And Predictions

May 21, 2025

When Will It Rain Precise Timing And Predictions

May 21, 2025 -

Check The Latest Rain Forecasts And Timing

May 21, 2025

Check The Latest Rain Forecasts And Timing

May 21, 2025 -

Updated Rain Predictions Know When To Expect Wet Weather

May 21, 2025

Updated Rain Predictions Know When To Expect Wet Weather

May 21, 2025 -

Reddits Ai Stock Picks 12 Companies To Consider

May 21, 2025

Reddits Ai Stock Picks 12 Companies To Consider

May 21, 2025 -

Weather Alert High Winds And Severe Storms Approaching Your Area

May 21, 2025

Weather Alert High Winds And Severe Storms Approaching Your Area

May 21, 2025