Moody's Downgrade Triggers Dow Futures Fall And Dollar Slip

Table of Contents

Moody's Downgrade: The Catalyst for Market Volatility

Moody's decision to downgrade the US government's credit rating from AAA to Aa1 is a landmark event with far-reaching consequences. This signifies a reduction in the perceived creditworthiness of the US government, indicating a heightened risk of default on its debt obligations.

-

Rationale: Moody's cited the US government's fiscal trajectory, marked by increasing debt burdens and political gridlock hindering efforts to address the escalating debt, as the primary reasons for the downgrade. The agency expressed concerns about the erosion of governance strength and the mounting fiscal challenges facing the nation.

-

Impact on Investor Confidence: The downgrade immediately eroded investor confidence. The perception of increased risk associated with US government bonds led many investors to reassess their holdings and seek safer alternatives. This shift in sentiment played a crucial role in the subsequent market reactions.

-

Historical Context: While rare, credit rating downgrades of major economies have occurred before. Recalling past instances, such as the downgrade of the US rating in 2011, provides valuable context for understanding the potential long-term implications of this latest event. These historical events highlight the significant impact such actions can have on market stability and investor behavior.

Dow Futures Plummet: Immediate Market Reaction

The announcement of the Moody's downgrade triggered an immediate and sharp decline in Dow Jones futures. The market reacted swiftly to the news, reflecting the uncertainty and concern it generated among investors.

-

Percentage Drop: Dow futures experienced a significant percentage drop, underscoring the market's sensitivity to the downgrade. The magnitude of this decline serves as a clear indication of the market's immediate response to the perceived increased risk.

-

Implications for Future Stock Market Performance: The fall in Dow futures signaled a potential broader correction in the stock market. The extent of this correction will depend on various factors, including investor sentiment, economic data, and future actions by central banks and policymakers.

-

Trading Volume and Volatility: The news resulted in increased trading volume and heightened volatility in the futures market. This heightened activity reflects the uncertainty and heightened risk perception within the market.

Dollar Weakness: A Flight to Safety?

Concurrently, the US dollar experienced a decline against other major currencies. This movement is partly attributed to a "flight to safety," a phenomenon where investors move their assets into perceived safer havens during times of economic uncertainty.

-

Flight to Safety: Investors, worried about the implications of the downgrade, sought refuge in assets deemed less risky, such as other currencies like the Euro or Japanese Yen. This shift in investment preferences contributed to the weakening of the dollar.

-

Impact on International Trade and Investment: A weaker dollar can affect international trade and investment flows. It can make US exports more competitive but also increase the cost of imports. The implications for US businesses and the global economy are multifaceted.

-

Major Currency Pairs: The EUR/USD and USD/JPY currency pairs, among others, showed noticeable shifts reflecting the change in investor sentiment and the relative strength of different currencies in the wake of the downgrade.

Impact on Bond Yields

The Moody's downgrade had a direct impact on US Treasury bond yields. This impact is largely due to the inverse relationship between bond prices and yields.

-

Inverse Relationship: As investor demand for US Treasury bonds fell due to the downgrade, bond prices decreased, leading to a rise in yields. This reflects the increased perceived risk associated with these bonds.

-

Long-Term and Short-Term Yields: Both long-term and short-term Treasury bond yields reacted to the news. The impact on each was influenced by various factors, including investor expectations regarding future interest rate policies.

-

Implications for Borrowing Costs: Higher bond yields translate to increased borrowing costs for the US government. This will have implications for future government spending and fiscal policy decisions.

Analyzing Investor Sentiment and Future Outlook

The Moody's downgrade significantly impacted investor sentiment, creating a climate of uncertainty and apprehension.

-

Potential for Further Market Corrections: The possibility of further market corrections cannot be ruled out, given the continued uncertainty and the potential for ripple effects across various sectors of the economy.

-

Responses of Central Banks and Governments: The actions and responses of central banks and governments will play a crucial role in shaping the future market trajectory. Their strategies to mitigate the impact of the downgrade will influence investor confidence and market stability.

-

Long-Term Implications for the US Economy: The long-term consequences of the downgrade remain uncertain, but they are likely to be significant and far-reaching. The potential for slower economic growth and increased borrowing costs presents considerable challenges.

Conclusion

Moody's downgrade of the US government's credit rating has unleashed a significant market reaction, characterized by a fall in Dow futures, a weakening of the dollar, and a shift in investor sentiment. The downgrade's impact stems from concerns about the US fiscal trajectory and its implications for the country's creditworthiness. The consequences extend beyond the immediate market fluctuations and raise questions about the longer-term stability of the US economy and its global standing. Understanding the far-reaching consequences of this Moody's downgrade is crucial for navigating the complexities of the current market landscape. Stay informed about the evolving situation and monitor the impact of this Moody's downgrade on the markets. Continue to follow updates on Dow futures, dollar movements, and the overall effect on the global economy by regularly checking reputable financial news sources. Understanding the consequences of a Moody's downgrade is crucial for making informed investment decisions.

Featured Posts

-

Amazon Hercule Poirot Per Ps 5 A Meno Di 10 E Offerta Limitata

May 20, 2025

Amazon Hercule Poirot Per Ps 5 A Meno Di 10 E Offerta Limitata

May 20, 2025 -

Chinas Pressure On Manilas Missile System Fails

May 20, 2025

Chinas Pressure On Manilas Missile System Fails

May 20, 2025 -

Hmrc System Down Widespread Access Issues Affecting Uk Taxpayers

May 20, 2025

Hmrc System Down Widespread Access Issues Affecting Uk Taxpayers

May 20, 2025 -

Restrictions De Circulation Sur Le Boulevard Fhb Ex Vge Deux Roues Et Trois Roues Concernes A Partir Du 15 Avril

May 20, 2025

Restrictions De Circulation Sur Le Boulevard Fhb Ex Vge Deux Roues Et Trois Roues Concernes A Partir Du 15 Avril

May 20, 2025 -

Improved Call Times Hmrc Implements Voice Recognition For Faster Service

May 20, 2025

Improved Call Times Hmrc Implements Voice Recognition For Faster Service

May 20, 2025

Latest Posts

-

Flavio Cobollis Triumph Bucharest Tiriac Open Victory

May 20, 2025

Flavio Cobollis Triumph Bucharest Tiriac Open Victory

May 20, 2025 -

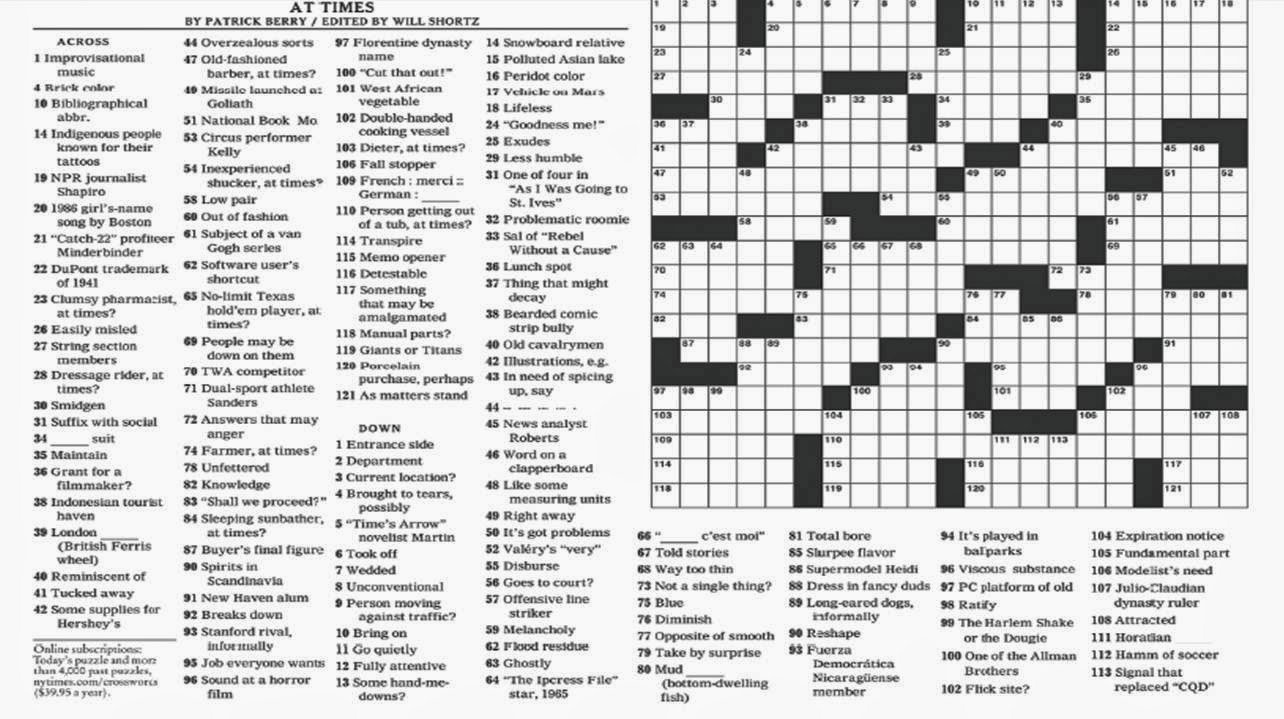

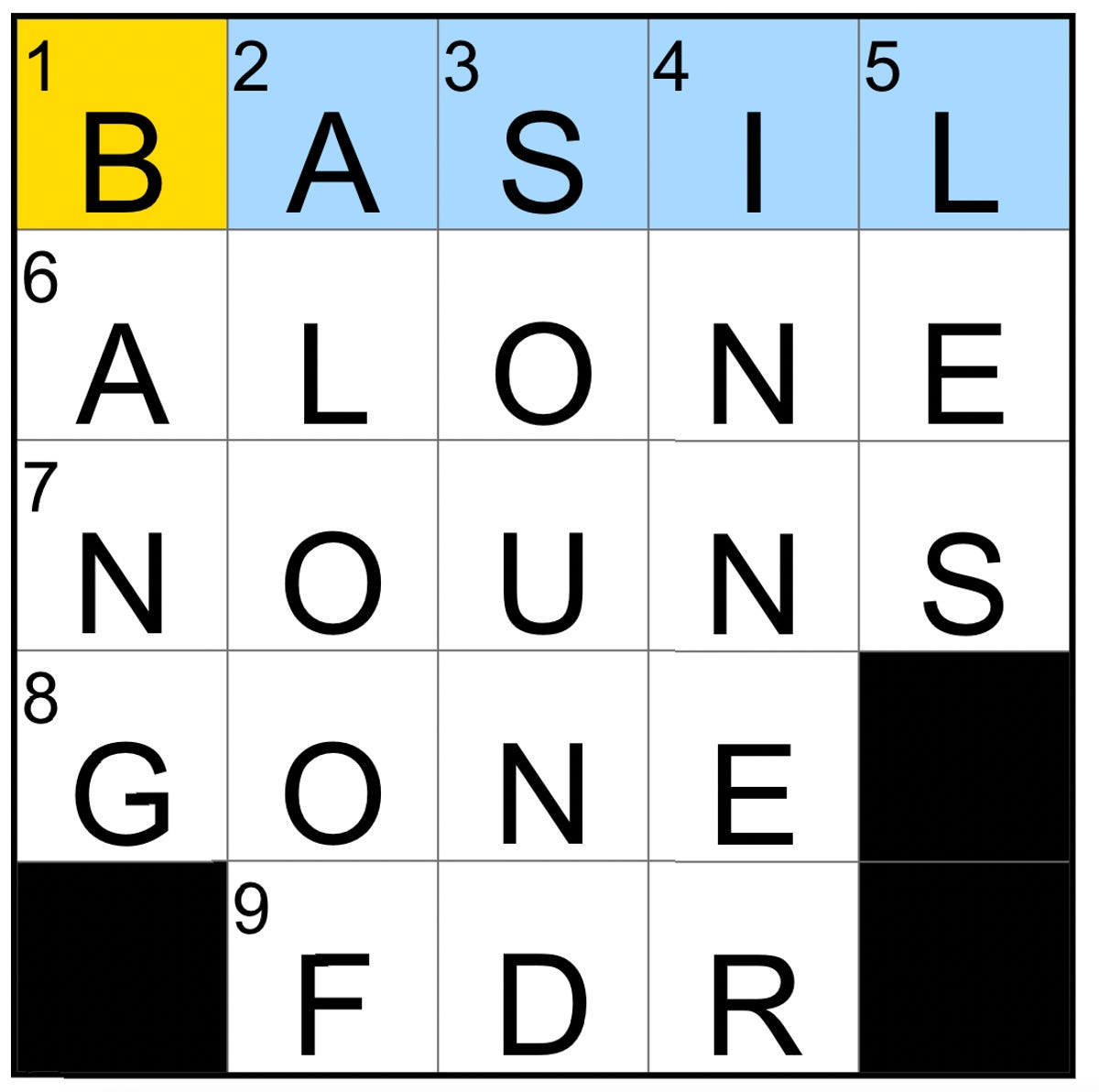

Unlock The Nyt Mini Crossword April 20 2025 Answers And Clues

May 20, 2025

Unlock The Nyt Mini Crossword April 20 2025 Answers And Clues

May 20, 2025 -

Nyt Mini Crossword April 26 2025 Helpful Hints

May 20, 2025

Nyt Mini Crossword April 26 2025 Helpful Hints

May 20, 2025 -

April 26 2025 Nyt Mini Crossword Puzzle Hints

May 20, 2025

April 26 2025 Nyt Mini Crossword Puzzle Hints

May 20, 2025 -

Nyt Mini Crossword April 20 2025 Answers And Hints

May 20, 2025

Nyt Mini Crossword April 20 2025 Answers And Hints

May 20, 2025