Moody's US Downgrade: White House Responds With Criticism

Table of Contents

Moody's Rationale for the Downgrade

Moody's cited several key factors in its decision to lower the US credit rating. These reasons point to escalating fiscal challenges and a deteriorating outlook for the nation's long-term fiscal strength. The agency highlighted the following:

- Fiscal Challenges: The US faces a substantial and growing national debt, fueled by years of budget deficits and increased government spending. This persistent debt burden puts significant pressure on the nation's creditworthiness.

- Debt Ceiling Showdowns: The recurring political battles surrounding the debt ceiling create uncertainty and risk, undermining investor confidence in the US government's ability to manage its finances responsibly. This political gridlock is a major factor contributing to the downgrade.

- Political Polarization: The intense political polarization in Washington hinders the ability to enact effective long-term fiscal reforms, further exacerbating the nation's fiscal challenges. This lack of bipartisan cooperation makes it difficult to address the underlying issues driving the debt increase.

The downgrade's immediate impact is likely to increase borrowing costs for the US government, making it more expensive to finance its debt. This added financial burden could have knock-on effects on various government programs and initiatives.

The White House's Counterarguments

The White House responded swiftly and forcefully to Moody's downgrade, issuing a statement that strongly criticized the agency's assessment. The Biden administration challenged Moody's rationale, arguing that the agency's analysis failed to adequately account for the positive aspects of the US economy. Key points in the White House's rebuttal included:

- Economic Recovery: The administration highlighted recent job growth and declining inflation as evidence of a strong economic recovery, suggesting a more optimistic outlook than Moody's assessment presented.

- Reduced Deficit: The White House pointed to efforts to reduce the deficit as proof of responsible fiscal management, although the scale of the reduction has been debated extensively.

- Rejection of Methodology: The White House statement implicitly questioned the methodology used by Moody's, suggesting the agency had not fully considered the broader context of the US economy.

The Treasury Department echoed the White House's criticisms, further emphasizing the strength of the US economy and the administration's commitment to fiscal responsibility.

Impact on the US Economy and Global Markets

Moody's downgrade has already created market volatility, influencing interest rates and investor confidence. The short-term implications include increased borrowing costs for the US government and potentially higher interest rates for consumers and businesses. In the long term, a lower credit rating could negatively impact the dollar's value and potentially lead to higher inflation.

Global markets reacted with a mix of concern and uncertainty. The downgrade raised questions about the stability of the US economy and its role in the global financial system, impacting international trade and investment flows. The ripple effects are likely to be felt across various sectors and geographies.

Political Implications and Future Outlook

The Moody's downgrade has become a focal point in the ongoing political debate, with implications for the upcoming elections. Republicans are likely to use the downgrade to criticize the Biden administration's economic policies, while Democrats will likely emphasize the need for bipartisan cooperation on fiscal issues. The political fallout could significantly impact the future direction of US economic policy.

To improve the US credit rating, experts suggest a combination of strategies, including:

- Enacting comprehensive fiscal reforms to address the national debt.

- Promoting bipartisan cooperation to achieve long-term budget solutions.

- Implementing policies to stimulate sustainable economic growth.

The future of the US economy hinges on the ability of policymakers to address these fiscal challenges effectively.

Conclusion: Understanding the Fallout from Moody's US Downgrade

Moody's downgrade of the US credit rating has triggered a significant debate, with the White House strongly criticizing the assessment. While Moody's highlighted concerns about fiscal challenges, political gridlock, and rising debt, the White House emphasized economic recovery and efforts to reduce the deficit. The downgrade's impact on the US economy and global markets is still unfolding, but it has already created market volatility and increased uncertainty. The political implications are significant, shaping the narrative of the upcoming elections and future policy debates. To fully grasp the developing consequences of this significant event, stay informed by following reputable news sources, analyzing economic data, and engaging in further research into US fiscal policy and government debt. Understanding the intricacies of the Moody's downgrade and its evolving effects is crucial for navigating the complex economic landscape.

Featured Posts

-

Een Op De Zes Nederlanders Blijft Vuurwerk Kopen Ondanks Dreigend Landelijk Verbod

May 18, 2025

Een Op De Zes Nederlanders Blijft Vuurwerk Kopen Ondanks Dreigend Landelijk Verbod

May 18, 2025 -

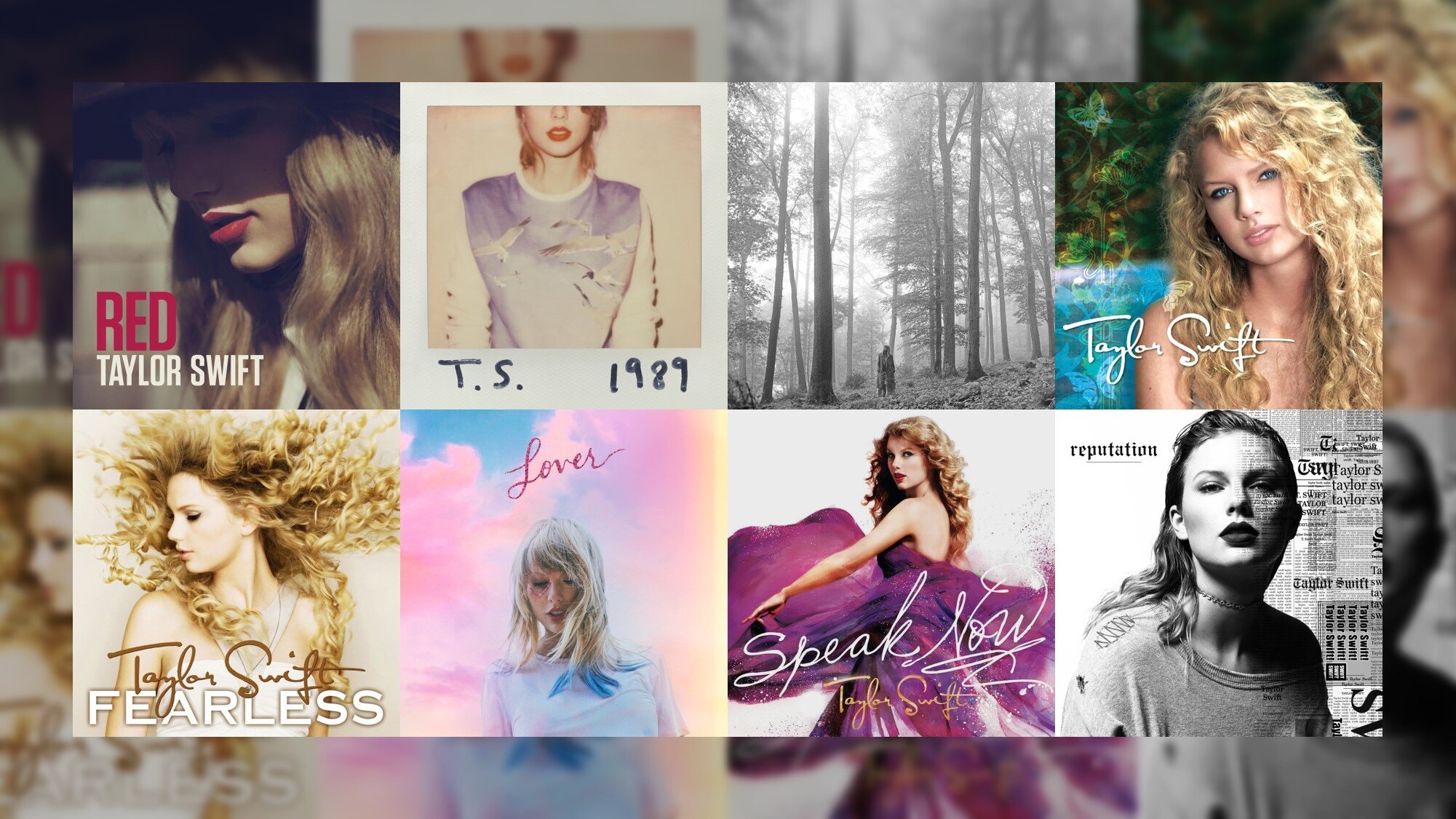

Ranking Taylor Swifts Albums A Critical Analysis Of Her Discography

May 18, 2025

Ranking Taylor Swifts Albums A Critical Analysis Of Her Discography

May 18, 2025 -

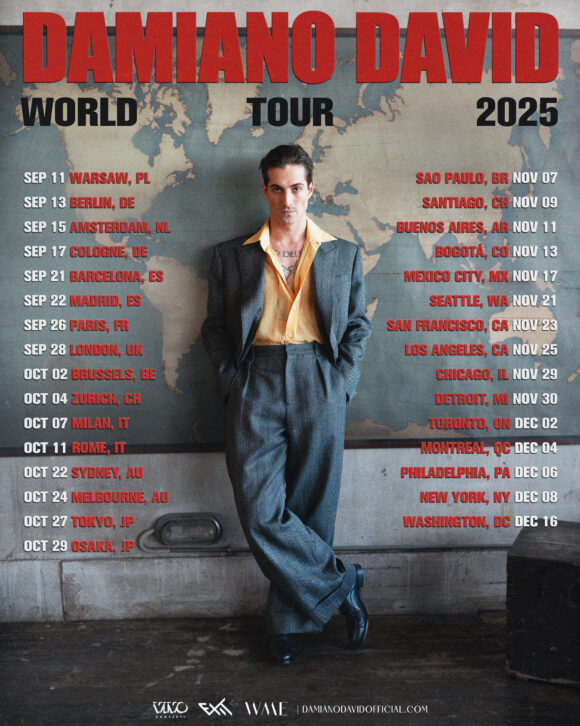

Is Damiano David Joining Eurovision 2025 The Latest Rumours

May 18, 2025

Is Damiano David Joining Eurovision 2025 The Latest Rumours

May 18, 2025 -

Republican Divisions Deepen Over Medicaid Cuts

May 18, 2025

Republican Divisions Deepen Over Medicaid Cuts

May 18, 2025 -

Kane Uest I Pokhorony Instruktsiya Ot Pashi Tekhnikom

May 18, 2025

Kane Uest I Pokhorony Instruktsiya Ot Pashi Tekhnikom

May 18, 2025

Latest Posts

-

The Kardashian Censori West Feud A New Chapter

May 18, 2025

The Kardashian Censori West Feud A New Chapter

May 18, 2025 -

Is There A Kardashian Censori Alliance Against Kanye West

May 18, 2025

Is There A Kardashian Censori Alliance Against Kanye West

May 18, 2025 -

Kim Kardashian And Bianca Censori United Front Against Kanye

May 18, 2025

Kim Kardashian And Bianca Censori United Front Against Kanye

May 18, 2025 -

Is It Back On Bianca Censori And Kanye West Spotted Together In Spain

May 18, 2025

Is It Back On Bianca Censori And Kanye West Spotted Together In Spain

May 18, 2025 -

Kane Uest Publikatsiya Instruktsii K Pokhoronam Vdokhnovlennaya Pashey Tekhnikom

May 18, 2025

Kane Uest Publikatsiya Instruktsii K Pokhoronam Vdokhnovlennaya Pashey Tekhnikom

May 18, 2025