Musk's X: A Financial Review Following The Recent Debt Offering

Table of Contents

The Recent Debt Offering: Details and Implications

X's recent debt offering was a crucial step in financing Musk's ambitious vision for the platform. While the exact details may not be publicly available in their entirety, reports suggest a substantial amount was raised to cover the massive acquisition costs and ongoing operational expenses. This debt likely comprises a mix of high-yield bonds and bank loans, carrying significant interest payments and maturity dates spread over several years.

The reasons behind this debt offering are multifaceted. The initial acquisition of Twitter itself was incredibly expensive, requiring a substantial upfront investment. Furthermore, Musk's plans for significant platform upgrades, including technological advancements and enhanced content moderation systems, require considerable capital expenditure. The ongoing operational costs of running a global social media platform are also substantial.

- Total debt amount raised: (Insert estimated figure from reliable sources, citing the source).

- Key terms of the debt agreement: (Include details on interest rates, maturity dates, and any covenants if available, citing sources).

- Credit rating agencies' assessment of the debt: (Mention ratings from agencies like Moody's, S&P, and Fitch, if available, and their implications).

- Comparison with debt levels of competing social media platforms: (Compare X's debt burden with that of Meta, Alphabet (Google), and others, using publicly available financial data).

Impact on X's Valuation and Financial Health

The debt offering has undoubtedly impacted X's valuation. While the precise pre- and post-offering valuations are difficult to pinpoint definitively due to the private nature of the company, analysts suggest a significant decrease. The substantial debt burden increases X's financial risk and can negatively influence investor confidence.

The company's debt-to-equity ratio – a key indicator of financial leverage – has likely increased considerably post-debt offering. A high debt-to-equity ratio raises concerns about X's ability to meet its financial obligations and can negatively affect its credit rating. A downgrade from credit rating agencies could further increase borrowing costs and limit access to future funding.

- Pre- and post-debt offering valuation figures: (Insert estimates from reputable financial sources, if available, and clearly state the limitations of these estimates).

- Changes in the debt-to-equity ratio: (Provide estimated changes and their implications for financial risk).

- Analysis of X's profitability and cash flow: (Discuss X's current profitability and cash flow, and the impact of the debt service payments on these metrics).

- Potential risks associated with high debt levels: (Discuss potential risks such as bankruptcy, inability to invest in future growth, and vulnerability to economic downturns).

Revenue Generation Strategies and Their Effectiveness

X's current revenue streams primarily rely on advertising and, increasingly, subscription services. The effectiveness of these strategies in the face of the substantial debt burden remains a key concern. While advertising revenue can be volatile, the subscription model offers a more predictable and recurring revenue stream. The success of these strategies will directly impact X's ability to service its debt and achieve financial stability.

Musk's plans for integrating payments and other features could introduce new revenue streams, but their success remains uncertain. The rapid pace of changes within X and the associated controversies might negatively impact user engagement and consequently, revenue generation.

- Breakdown of revenue sources and their percentage contribution: (Provide a breakdown based on available data, specifying the relative contributions of advertising, subscriptions, and other sources).

- Comparison of revenue with pre-acquisition figures: (Compare current revenue with pre-acquisition figures to assess the impact of the changes under Musk's leadership).

- Analysis of user growth and its correlation with revenue: (Assess whether user growth is keeping pace with revenue expectations).

- Potential future revenue streams (e.g., payments integration): (Discuss the potential of new revenue streams and the associated challenges).

Future Funding Needs and Financial Projections

X's future financial performance hinges on its ability to manage its debt and secure additional funding for planned investments. Significant capital expenditure is anticipated in the coming years, primarily for technological upgrades, improvements to the platform's infrastructure, and bolstering content moderation capabilities. Failure to secure sufficient funding could severely hamper X's growth and ability to compete effectively in the social media market.

Future funding could be sourced through further debt offerings, equity financing (potentially diluting existing shareholders' stakes), or a combination of both. Each option presents its own set of risks and challenges. A further debt offering could exacerbate the existing high debt burden, while equity financing might be difficult to secure given the current market conditions and the uncertainty surrounding X's financial prospects.

- Estimated capital expenditure for the next 1-3 years: (Provide estimates based on available information and publicly stated plans).

- Potential funding sources and their associated risks: (Discuss various funding options and their potential downsides).

- Projected revenue and profitability for the next fiscal year: (Present a cautiously optimistic financial forecast, highlighting the inherent uncertainty).

- Sensitivity analysis based on various revenue growth scenarios: (Perform a sensitivity analysis, exploring various revenue growth scenarios and their impact on X's financial health).

Conclusion: The Financial Future of Musk's X

This Musk's X financial review reveals a complex and challenging financial picture. The significant debt burden resulting from the acquisition and subsequent debt offering poses considerable risks to X's long-term financial health. While the platform's revenue generation strategies show some potential, their effectiveness remains uncertain. The success of X's future hinges on its ability to manage its debt, secure additional funding, and execute its strategic vision effectively. Continued monitoring of X's financial performance is crucial to assess the sustainability of its current business model and its prospects for future financial stability. To stay informed on the ongoing developments and deeper insights into the financial landscape of X, continue to follow updates on our regular "Musk's X financial review" and explore other relevant financial news sources.

Featured Posts

-

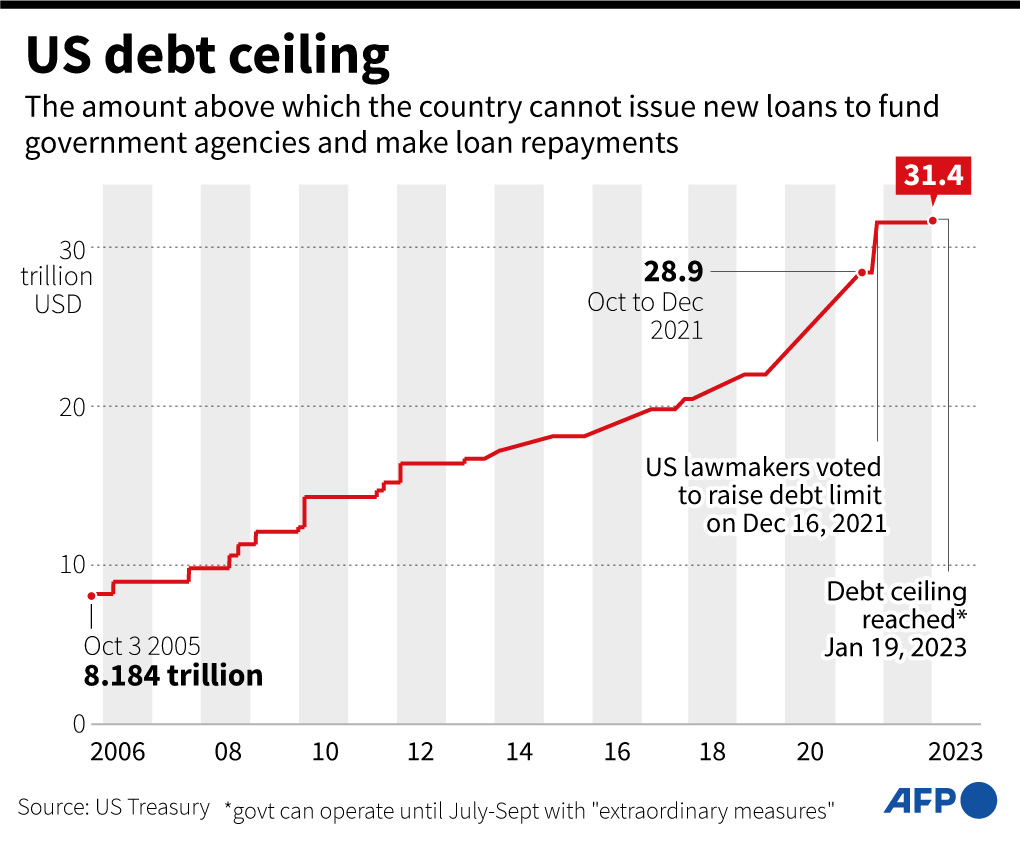

Strong Q Quarter Number Earnings Send Reliance Shares To 10 Month Peak

Apr 29, 2025

Strong Q Quarter Number Earnings Send Reliance Shares To 10 Month Peak

Apr 29, 2025 -

Najchetniej Kupowane Porsche 911 W Polsce Model Za 1 33 Mln Zl

Apr 29, 2025

Najchetniej Kupowane Porsche 911 W Polsce Model Za 1 33 Mln Zl

Apr 29, 2025 -

911 Cayenne

Apr 29, 2025

911 Cayenne

Apr 29, 2025 -

Wnba Bound Diamond Johnsons Journey From Norfolk State To Minnesota Lynx

Apr 29, 2025

Wnba Bound Diamond Johnsons Journey From Norfolk State To Minnesota Lynx

Apr 29, 2025 -

Pw Cs Strategic Retreat The Impact Of Exiting Nine African Markets

Apr 29, 2025

Pw Cs Strategic Retreat The Impact Of Exiting Nine African Markets

Apr 29, 2025