Musk's X Debt Sale: Financial Details Reveal Company Transformation

Table of Contents

The Scale of Musk's X Debt Sale

The sheer magnitude of Musk's X debt sale is striking, indicating a significant financial undertaking. Understanding the terms and the players involved is crucial to grasping its implications.

Total Debt Amount and Terms

While precise figures are often initially kept confidential, reports suggest a substantial amount of debt was raised through a combination of bonds and loans. [Insert citation to a reliable financial news source detailing the amount if available, e.g., "According to Bloomberg, X raised approximately $X billion..."] The interest rates associated with this debt are likely to be significant, reflecting the perceived risk involved in lending to X under its current circumstances.

- Maturity Dates: The maturity dates of the debt are crucial in understanding X's long-term financial obligations. Shorter-term debt provides more immediate flexibility but requires refinancing sooner. Longer-term debt offers stability but carries higher interest payments. [Insert information on maturity dates if available from reliable sources].

- Collateral: The type of collateral used to secure the debt, if any, is also a critical factor. This could range from assets like X's intellectual property to physical assets. The availability of suitable collateral influences the interest rates offered to lenders. [Include information on collateral if available].

- Impact on Profitability: The substantial interest payments associated with this debt sale will significantly impact X's profitability in the coming years. Successfully servicing this debt will require significant revenue generation and cost-cutting measures.

Investors and Lenders Involved

Several major financial institutions and investors were reportedly involved in this debt sale, taking on considerable risk in exchange for potentially high returns. [Insert names of key investors and lenders if available, citing reliable sources].

- Key Investors and Investment Amounts: [Insert details on key investors and their investment amounts, if publicly available, and cite sources].

- Perceived Risk: Investing in X carries inherent risks due to its recent turbulent history, leadership changes, and significant debt burden. Lenders and investors likely factored these risks into their investment decisions.

- Potential Benefits for Lenders/Investors: Despite the risk, the potential for substantial returns, particularly if X's transformation under Musk's leadership is successful, incentivized participation in the debt sale.

Reasons Behind Musk's X Debt Sale

Musk's decision to undertake such a large debt sale is likely driven by a combination of factors, primarily focused on restructuring and fueling ambitious growth plans.

Debt Refinancing and Financial Restructuring

The debt sale might be partly aimed at refinancing existing high-interest debt, streamlining X's financial obligations, and improving its overall balance sheet.

- Previous Debt Burdens: [Discuss X's previous debt situation, including any high-interest loans, if information is publicly available].

- Balance Sheet Improvement: Successfully refinancing debt at lower interest rates would significantly enhance X's balance sheet, improving its financial health and reducing its interest expense.

- Impact on Credit Rating: The debt sale could have a positive or negative impact on X's credit rating, depending on the terms of the new debt and the overall financial health of the company.

Funding X's Ambitious Growth Plans

A significant portion of the proceeds from the debt sale will likely be allocated to fund Musk's ambitious growth plans for X.

- Specific Projects: [Mention any publicly known projects funded by the debt sale, such as new features, technological advancements, or potential acquisitions].

- Strategic Implications: These investments have significant strategic implications, potentially shaping X's future direction and competitive landscape.

- Potential ROI: The success of these projects and their associated return on investment will be crucial to X's ability to service its debt and achieve long-term financial sustainability.

Implications and Future Outlook for X

The implications of this debt sale for X's future and the broader tech industry are far-reaching.

Impact on X's Financial Health and Stability

The substantial increase in debt significantly impacts X's financial health and stability.

- Risks Associated with High Debt Levels: High debt levels increase financial risk, particularly if revenue generation doesn't meet projections.

- Ability to Service Debt: X's ability to consistently make interest payments and eventually repay the principal will be a key determinant of its long-term success.

- Future Debt Reduction Strategies: X will need to develop and execute strategies for reducing its debt burden over time to mitigate financial risks.

The Broader Impact on the Tech Industry

Musk's X debt sale sets a precedent for other tech companies, potentially influencing their financing strategies.

- Precedent Set: The success or failure of this debt sale will have a significant influence on how other tech companies approach funding and debt management.

- Impact on Valuations: The debt sale and its subsequent impact on X's financial performance could affect the valuations of other social media companies.

- Impact on Future Fundraising: The success or failure of this debt sale could significantly impact future fundraising rounds for other tech companies.

Conclusion

Musk's X debt sale represents a significant financial event with far-reaching implications for the company's future. The scale of the debt, the reasons behind it, and its potential consequences all paint a complex picture of X's ongoing transformation. Understanding the details of this debt sale provides crucial insights into the financial strategies employed by Musk and the future trajectory of X. For further analysis and updates on Musk's X debt sale and its impact, continue to follow reputable financial news sources. Stay informed about the evolving financial landscape of X and its debt burden. Understanding the intricacies of Musk's X debt sale is crucial for anyone following the tech industry and its evolving financial strategies.

Featured Posts

-

Legal Definition Of Woman In The Uk Examining The Effects On Sex Based Rights And The Transgender Community

Apr 29, 2025

Legal Definition Of Woman In The Uk Examining The Effects On Sex Based Rights And The Transgender Community

Apr 29, 2025 -

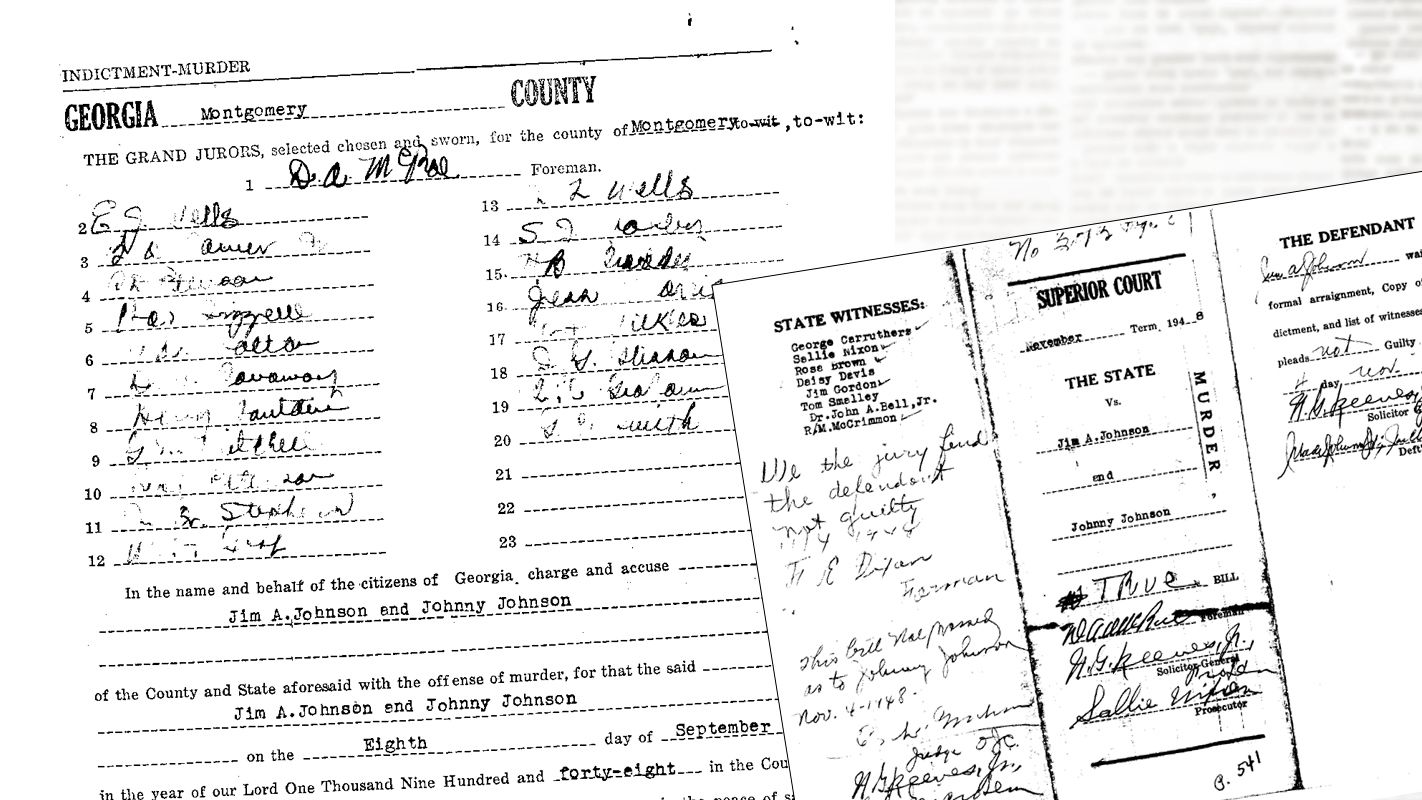

The Ny Times And The January 29th Dc Air Disaster Buried Truths

Apr 29, 2025

The Ny Times And The January 29th Dc Air Disaster Buried Truths

Apr 29, 2025 -

Minnesota Snow Plow Naming Contest Winners Revealed

Apr 29, 2025

Minnesota Snow Plow Naming Contest Winners Revealed

Apr 29, 2025 -

Europe On Edge Analyzing Recent Russian Military Movements

Apr 29, 2025

Europe On Edge Analyzing Recent Russian Military Movements

Apr 29, 2025 -

Social Media Misidentifies Pilot Killed In D C Midair Collision

Apr 29, 2025

Social Media Misidentifies Pilot Killed In D C Midair Collision

Apr 29, 2025