Nail Your Next Private Credit Job: 5 Dos And Don'ts

Table of Contents

Do: Showcase Your Specialized Financial Modeling Skills

Private credit roles demand a high level of financial modeling proficiency. Your ability to analyze complex financial statements, build robust models, and draw insightful conclusions is paramount.

Master Excel and Financial Modeling Software

Proficiency in Microsoft Excel is a given, but you'll need to go beyond the basics. Master advanced functions, and become familiar with industry-standard software like Argus and the Bloomberg Terminal. You should be comfortable performing LBO modeling, discounted cash flow (DCF) analysis, sensitivity analysis, and other valuation techniques crucial for assessing the creditworthiness of potential investments.

Highlight Relevant Projects & Experiences

Don't just list your skills; demonstrate them. Your resume and interview answers should showcase projects where you applied financial modeling techniques. This could include case competitions, independent research, or projects from previous roles. Quantify your results whenever possible. For example, instead of saying "Performed DCF analysis," say "Performed DCF analysis on five potential portfolio companies, resulting in a 15% improvement in investment recommendation accuracy."

- Example 1: Developed a three-statement LBO model for a leveraged buyout transaction, accurately predicting post-acquisition cash flows.

- Example 2: Conducted DCF analysis for a portfolio company, identifying a key risk factor overlooked by the management team, leading to a revised investment strategy.

- Example 3: Utilized Argus to analyze the financial performance of 10 real estate properties, resulting in a more informed investment decision.

Do: Network Strategically Within the Private Credit Industry

Networking is crucial in the private credit world. It's not just about getting your resume seen; it's about building relationships and gaining valuable insights.

Attend Industry Events and Conferences

Attend industry conferences and events relevant to private credit. These are excellent opportunities to meet potential employers, learn about industry trends, and make valuable connections. Look for conferences focusing on private debt, leveraged finance, or alternative credit strategies.

Leverage LinkedIn Effectively

Create a strong LinkedIn profile that showcases your skills and experience in private credit. Actively connect with professionals in the industry, engage with their content, and participate in relevant groups. Use keywords like "private credit analyst," "private debt," and "leveraged finance" in your profile.

- Example 1: Attend the Private Equity & Venture Capital Conference.

- Example 2: Join relevant LinkedIn groups like "Private Credit Professionals" or "Alternative Investments."

- Example 3: Follow key influencers and firms in the private credit space on LinkedIn.

Do: Tailor Your Resume and Cover Letter to Each Application

Generic applications rarely succeed in a competitive field like private credit. Each application should be meticulously tailored to the specific job description and the firm's investment strategy.

Highlight Relevant Keywords

Carefully review each job description and identify keywords relevant to the specific role. Incorporate these keywords naturally into your resume and cover letter. This helps Applicant Tracking Systems (ATS) identify your application as a strong match.

Quantify Your Achievements

Use numbers and metrics to demonstrate the impact of your past experiences. Instead of simply listing your responsibilities, quantify your achievements. Use strong action verbs to describe your accomplishments.

- Example 1: Instead of "Managed portfolio of clients," use "Managed a portfolio of 20 clients, resulting in a 10% increase in client retention."

- Example 2: Keywords to incorporate: "credit analysis," "due diligence," "portfolio management," "financial modeling," depending on the specific job description.

Don't: Neglect the Importance of Due Diligence

Before you even think about the interview, research the firm thoroughly. This demonstrates your initiative and genuine interest.

Research the Firm Thoroughly

Understand the firm's investment strategy, portfolio companies, and team. Review their website, press releases, and news articles. This will allow you to ask informed questions during the interview.

Prepare Intelligent Questions

Asking insightful questions demonstrates your knowledge and interest in the firm. Avoid questions easily answered through basic research on their website.

- Example 1: "What are the firm's key differentiators in the current private credit market?"

- Example 2: "Can you describe the firm's approach to environmental, social, and governance (ESG) factors in investment decisions?"

- Example 3: "What are the firm's plans for growth and expansion in the next few years?"

Don't: Underestimate the Importance of Soft Skills

Technical skills are essential, but strong soft skills are equally important in a team-oriented environment like private credit.

Communication & Teamwork

Excellent communication skills are vital for working effectively with colleagues, clients, and senior management. Highlight your ability to clearly and concisely communicate complex information, both verbally and in writing.

Problem-solving & Analytical Thinking

Demonstrate your ability to analyze complex problems, identify potential solutions, and make sound judgments under pressure.

- Example 1: Practice your storytelling skills, using examples to illustrate your problem-solving abilities.

- Example 2: Prepare examples demonstrating your teamwork experience and contributions to successful projects.

Conclusion: Securing Your Private Credit Career

Securing your private credit job requires a multifaceted approach. By showcasing your financial modeling skills, networking strategically, tailoring your application materials, conducting thorough due diligence, and highlighting your soft skills, you significantly increase your chances of success. Remember to quantify your achievements, research prospective firms, and prepare insightful questions. Apply this advice, and you'll be well on your way to nailing your next private credit job interview and launching a rewarding private credit career. Don't delay – start applying these strategies today to secure your dream private credit job!

Featured Posts

-

Criminal Minds Evolution Season 18 Episode 4 Image Gallery Released

May 27, 2025

Criminal Minds Evolution Season 18 Episode 4 Image Gallery Released

May 27, 2025 -

Exclusive Update Taylor Swift And Blake Lively Amidst The It Ends With Us Lawsuit

May 27, 2025

Exclusive Update Taylor Swift And Blake Lively Amidst The It Ends With Us Lawsuit

May 27, 2025 -

Criminal Minds Evolution Season 18 Premiere Streaming Guide And Where To Watch

May 27, 2025

Criminal Minds Evolution Season 18 Premiere Streaming Guide And Where To Watch

May 27, 2025 -

Analysis Of J And Ks Loss To Goa Despite Chitras Outstanding Performance

May 27, 2025

Analysis Of J And Ks Loss To Goa Despite Chitras Outstanding Performance

May 27, 2025 -

The Fight To Preserve Affinity Graduations In The Face Of Dei Policy Changes

May 27, 2025

The Fight To Preserve Affinity Graduations In The Face Of Dei Policy Changes

May 27, 2025

Latest Posts

-

Replay Loeil De Philippe Caveriviere Du 24 Avril 2025 Face A Philippe Tabarot Video

May 30, 2025

Replay Loeil De Philippe Caveriviere Du 24 Avril 2025 Face A Philippe Tabarot Video

May 30, 2025 -

Tunnel De Tende Le Ministre Tabarot Annonce Une Ouverture En Juin

May 30, 2025

Tunnel De Tende Le Ministre Tabarot Annonce Une Ouverture En Juin

May 30, 2025 -

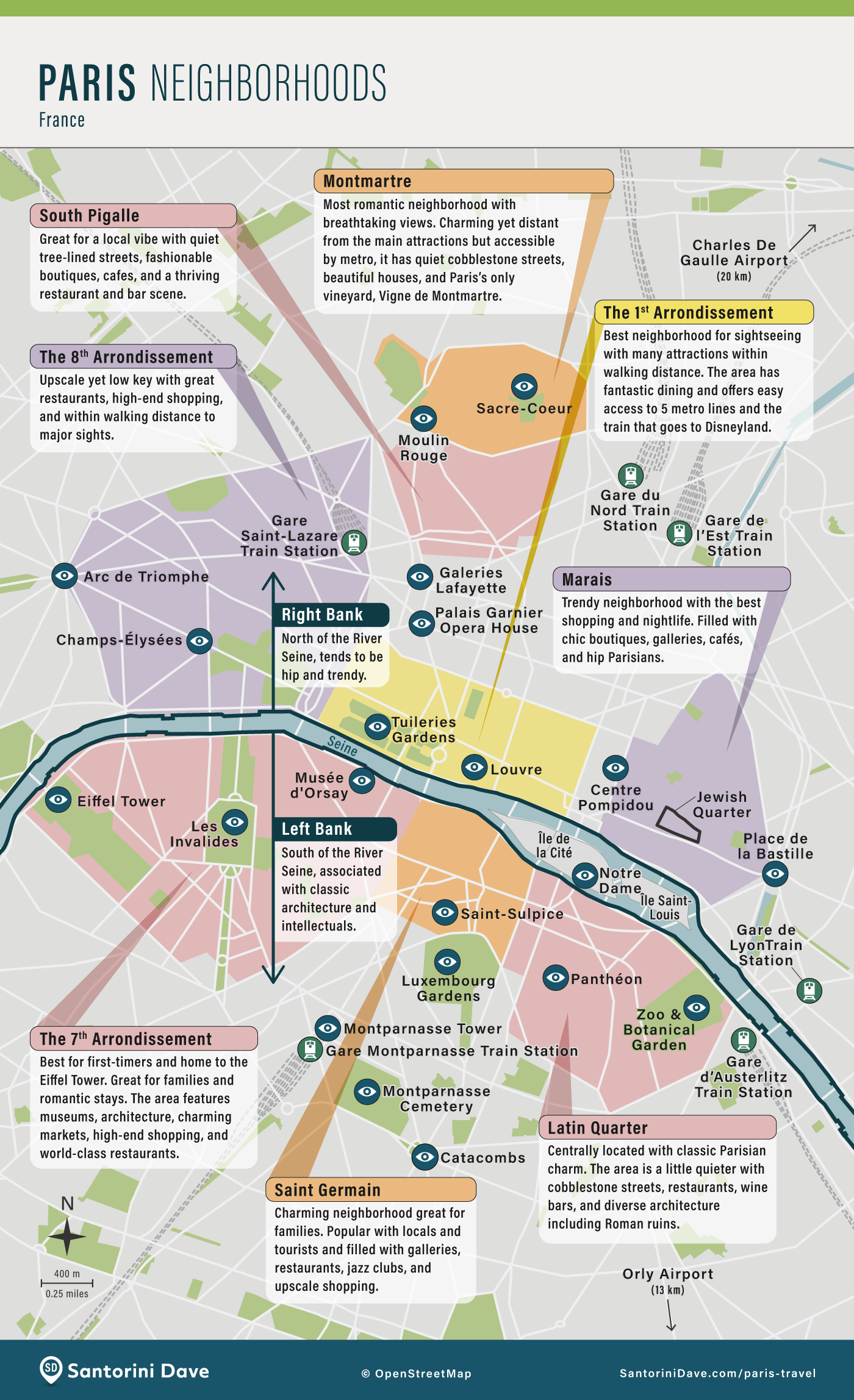

Exploring Paris A Guide To Its Most Popular Neighborhoods

May 30, 2025

Exploring Paris A Guide To Its Most Popular Neighborhoods

May 30, 2025 -

Paris Neighborhoods Choosing The Right Area For Your Trip

May 30, 2025

Paris Neighborhoods Choosing The Right Area For Your Trip

May 30, 2025 -

Finding The Perfect Parisian Neighborhood An Insiders Guide

May 30, 2025

Finding The Perfect Parisian Neighborhood An Insiders Guide

May 30, 2025