Navan Taps Banks For Upcoming US IPO: Exclusive News

Table of Contents

Key Banks Selected for Navan's IPO Underwriting

The success of any IPO hinges heavily on the selection of underwriters. Navan has chosen some of the most reputable names in investment banking to guide them through this crucial process. The lead underwriters for the Navan IPO are expected to be industry giants such as Goldman Sachs and Morgan Stanley. Keywords: Navan IPO underwriters, lead underwriters, investment banking, IPO process.

- Goldman Sachs: Known for its extensive experience in tech IPOs and its global reach, Goldman Sachs will likely play a pivotal role in attracting major investors. Their deep understanding of the technology sector and proven track record of successful IPOs make them a valuable asset to Navan.

- Morgan Stanley: Another powerhouse in the investment banking world, Morgan Stanley brings its considerable expertise in financial markets and its vast network of potential investors to the table. Their experience in guiding high-growth technology companies through the IPO process is invaluable.

The involvement of these prestigious banks signals a strong vote of confidence in Navan's potential and the robustness of its business model. Their combined experience and market reach will be crucial in ensuring a successful and highly valued Navan Initial Public Offering.

Expected Valuation and IPO Timing for Navan

While the exact date for the Navan IPO remains unannounced, industry insiders are buzzing with anticipation. The anticipated valuation for Navan's IPO is expected to fall within a significant range, reflecting the company's impressive growth trajectory and market position. Keywords: Navan valuation, IPO valuation, IPO timing, IPO date.

- Valuation Range: Although precise figures remain confidential, sources suggest a valuation range potentially reaching into the billions of dollars. This range is driven by Navan's strong revenue growth, expanding customer base, and disruptive technology in the travel management space.

- IPO Timing: While a specific date hasn't been confirmed, many analysts expect the offering to occur within the next [Insert timeframe - e.g., six to twelve months], pending market conditions and regulatory approvals.

Strategic Implications of Navan's US IPO

The Navan US IPO represents a pivotal moment in the company's growth strategy. Securing significant capital through the public markets will unlock exciting opportunities for Navan. Keywords: Navan growth strategy, market share, IPO funding, acquisitions.

- Accelerated Growth: The infusion of capital will fuel Navan's expansion plans, enabling them to enhance their existing travel management software and develop new features to further solidify their market leadership.

- Strategic Acquisitions: The IPO funding will also provide Navan with the resources to pursue strategic acquisitions, potentially expanding its product portfolio and market reach. This could lead to the integration of complementary technologies and services.

- Increased Market Share: By leveraging the increased brand visibility and financial resources obtained through the IPO, Navan aims to aggressively expand its market share in the competitive travel management software sector.

Market Reaction and Investor Sentiment Towards Navan's IPO

Early indications suggest strong investor interest in Navan's upcoming IPO. Analysts are generally positive about the company's prospects, citing its strong revenue growth, innovative technology, and large addressable market. Keywords: investor sentiment, market reaction, IPO risk, market volatility.

- Positive Analyst Sentiment: Several prominent analysts have issued positive reports on Navan, highlighting the company's strong fundamentals and potential for future growth.

- Market Volatility Considerations: Of course, market conditions can impact any IPO. Global economic uncertainty and potential volatility in the stock market represent potential challenges.

Conclusion: Navan's US IPO – A Milestone for Travel Tech

Navan's upcoming US IPO is a significant event, not just for the company itself, but for the entire travel technology sector. The selection of top-tier investment banks underscores the confidence in Navan's potential, while the expected valuation reflects its strong position in the market. This exclusive news highlights a pivotal moment in Navan's journey, promising accelerated growth and expansion. Stay tuned for further updates on the Navan IPO and other developments in the dynamic travel tech space. Subscribe to our newsletter for the latest insights! Keywords: Navan IPO update, stay tuned, travel tech IPO.

Featured Posts

-

Cote D Or Oqtf Et Relations France Algerie Un Temoignage

May 14, 2025

Cote D Or Oqtf Et Relations France Algerie Un Temoignage

May 14, 2025 -

Nuit Des Musees 2025 Cinema A La Fondation Seydoux Pathe

May 14, 2025

Nuit Des Musees 2025 Cinema A La Fondation Seydoux Pathe

May 14, 2025 -

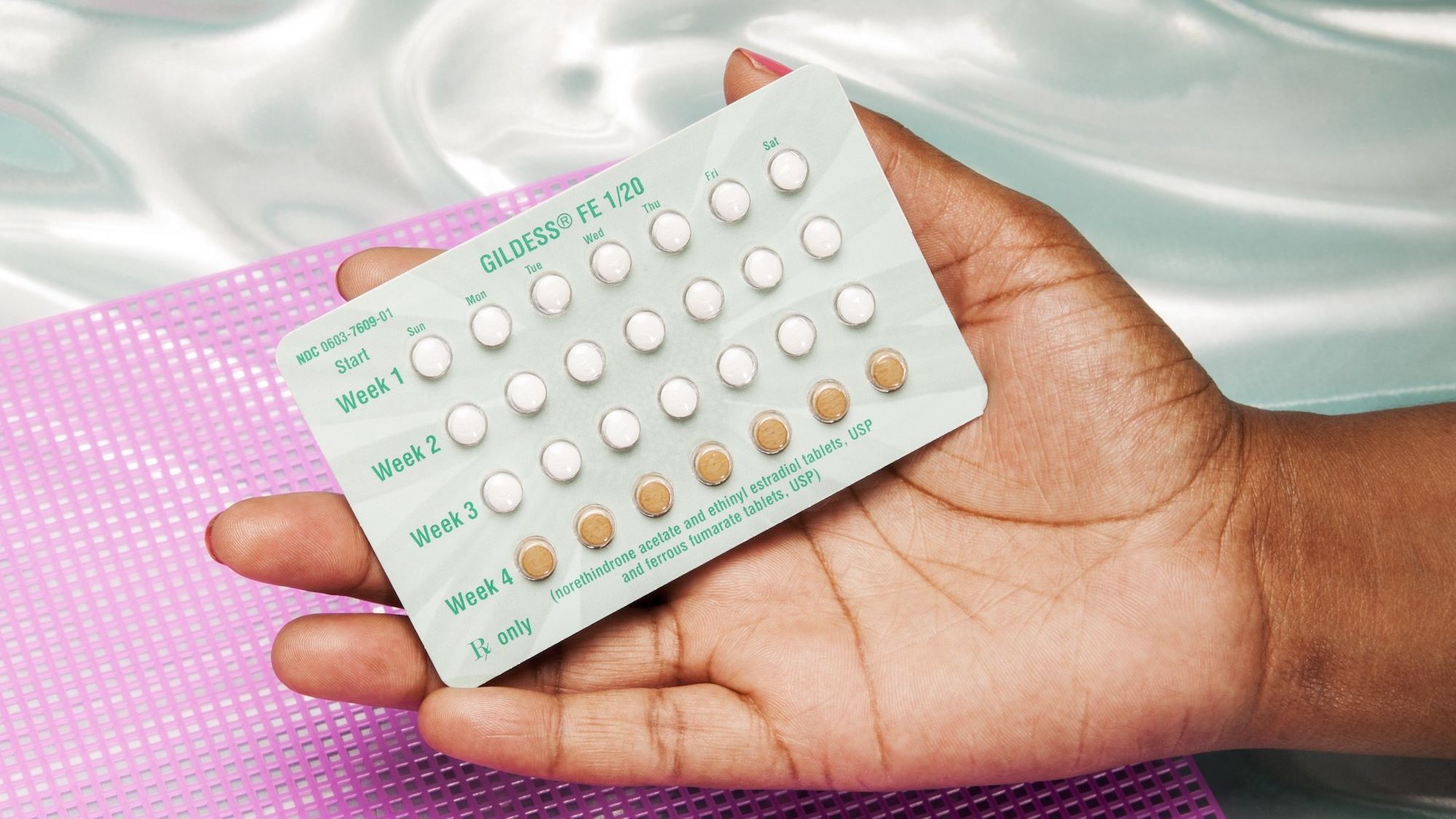

Urgent Recall In Ontario And Canada Check Your Dressings And Birth Control Pills

May 14, 2025

Urgent Recall In Ontario And Canada Check Your Dressings And Birth Control Pills

May 14, 2025 -

Captain America Brave New World Box Office Underwhelms Lowest Mcu Earnings

May 14, 2025

Captain America Brave New World Box Office Underwhelms Lowest Mcu Earnings

May 14, 2025 -

Bayern Stopt Informatieverzameling Nederlander Vanwege Kosten

May 14, 2025

Bayern Stopt Informatieverzameling Nederlander Vanwege Kosten

May 14, 2025