Navigate The Private Credit Boom: 5 Do's & 5 Don'ts For Job Seekers

Table of Contents

5 Do's to Maximize Your Private Credit Job Search

Do 1: Network Strategically within the Private Credit Industry

Networking is paramount in securing a private credit job. The industry thrives on relationships. To effectively network:

- Leverage LinkedIn: Connect with professionals at private credit firms, join relevant groups, and participate in discussions. Focus on building genuine connections, not just collecting contacts.

- Attend Industry Events: Conferences and workshops offer invaluable networking opportunities. Prepare talking points highlighting your skills and career goals related to private credit financing.

- Informational Interviews: Reach out to professionals for informational interviews. These conversations provide insights into the industry and can lead to job opportunities.

- Target Specific Firms: Research firms known for their strong private credit presence and tailor your approach to their specific investment strategies and company culture.

- Utilize Alumni Networks: If you're an alumnus of a reputable university, leverage your alumni network to connect with professionals working in private credit investment.

Do 2: Tailor Your Resume and Cover Letter to Private Credit Roles

A generic application won't cut it in the competitive private credit market. Your resume and cover letter must showcase your understanding of the industry and highlight relevant skills.

- Highlight Relevant Skills: Emphasize experience in due diligence, financial modeling, portfolio management, credit analysis, and other skills specific to private credit lending.

- Quantify Your Accomplishments: Use numbers to demonstrate your impact in previous roles. Instead of saying "Improved efficiency," say "Improved efficiency by 15% through process optimization."

- Research the Firm: Tailor your application to each firm's specific investment strategy and focus areas. Show you understand their business model.

- Use Keywords: Incorporate keywords from job descriptions to improve your application's visibility through Applicant Tracking Systems (ATS).

- Ensure Visual Appeal: Your resume should be clean, easy to read, and visually appealing, showcasing your attention to detail.

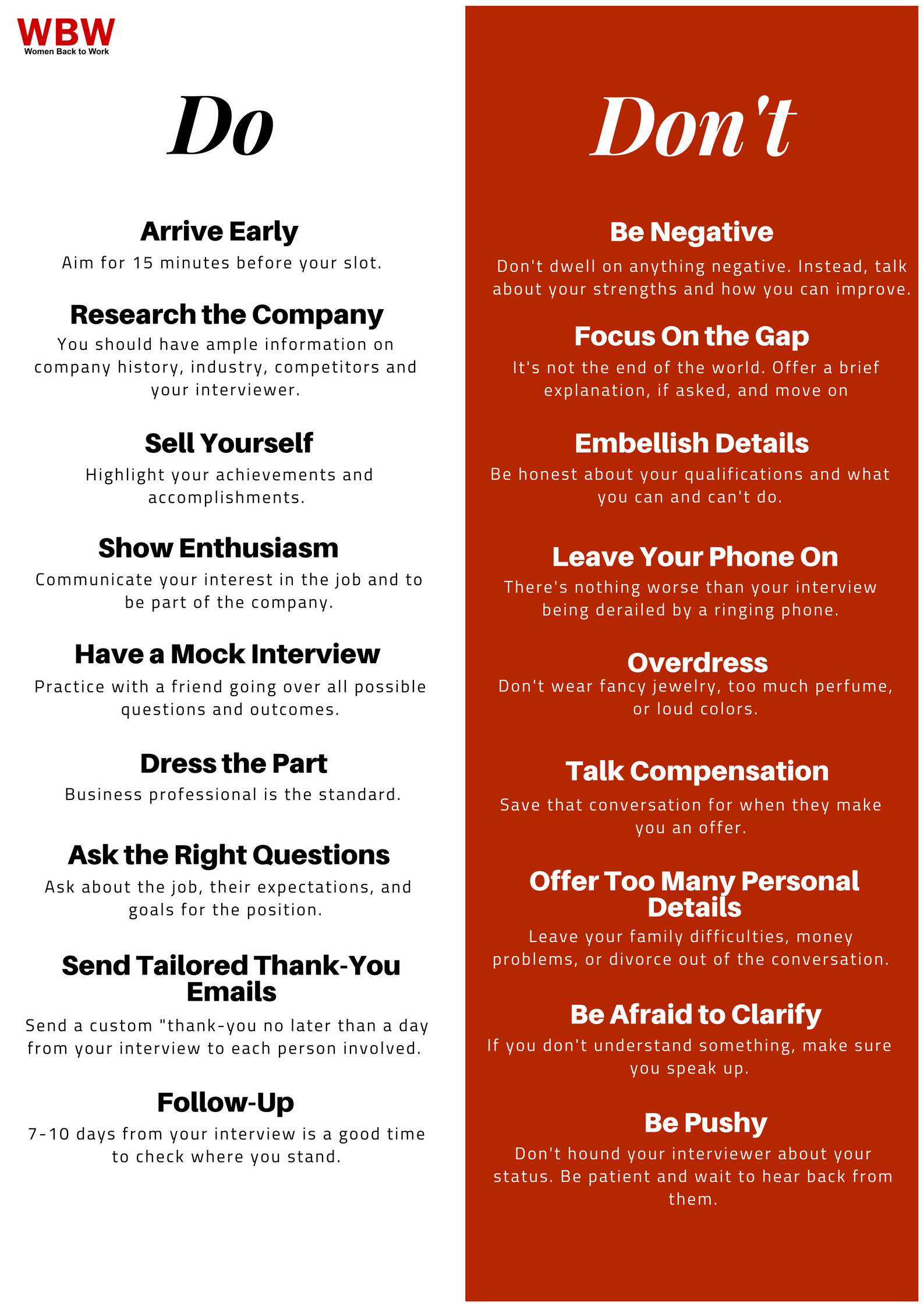

Do 3: Master the Art of the Private Credit Interview

The interview process for private credit jobs is rigorous. Preparation is key.

- Prepare for Technical Questions: Expect questions on finance, accounting, valuation, credit analysis, and financial modeling. Practice your technical skills and be ready to demonstrate your understanding.

- Practice Behavioral Questions: Prepare examples demonstrating your teamwork, problem-solving, and communication skills. Use the STAR method (Situation, Task, Action, Result) to structure your answers.

- Research the Interviewers: Learn about the interviewers' backgrounds and experience to demonstrate your genuine interest.

- Ask Insightful Questions: Prepare thoughtful questions that show you've researched the firm and are genuinely interested in the role and the company culture.

- Follow Up: Send a thank-you note after each interview, reiterating your interest and highlighting key takeaways from the conversation.

Do 4: Showcase Your Understanding of Private Credit Market Trends

Demonstrating knowledge of current market trends and regulatory changes is crucial for securing a private credit analyst or other private credit roles.

- Stay Updated: Regularly read industry publications, follow influential figures on social media, and attend webinars to stay informed about market dynamics.

- Understand Different Strategies: Familiarize yourself with various private credit strategies, including direct lending, mezzanine financing, and distressed debt investing.

- Show Understanding of Risk: Demonstrate your knowledge of credit risk assessment, portfolio management, and due diligence processes.

- Engage in Discussions: Participate in online forums and discussions related to private credit to expand your network and showcase your expertise.

- Read Industry Publications: Stay current on industry news and trends through journals, blogs, and research reports.

Do 5: Develop Specialized Skills in High Demand

Continuous skill development is essential in the dynamic private credit industry.

- Pursue Certifications: Consider obtaining relevant certifications like the CFA (Chartered Financial Analyst) or CAIA (Chartered Alternative Investment Analyst).

- Enhance Modeling Skills: Master financial modeling software like Excel and specialized financial modeling tools.

- Develop Analytical Skills: Hone your analytical and problem-solving abilities to evaluate investment opportunities effectively.

- Improve Communication Skills: Practice clear and concise communication, both written and verbal, to effectively convey complex information.

- Expand Knowledge of Alternative Investments: Develop a broad understanding of alternative investments to provide context for private credit strategies.

5 Don'ts to Avoid During Your Private Credit Job Search

Don't 1: Apply Generically to Every Private Credit Job Posting

Each application needs to be tailored to the specific requirements of the role and the firm.

- Avoid Generic Applications: Don't use the same resume and cover letter for every job application.

- Show Genuine Interest: Highlight why you are specifically interested in this role and this firm.

- Customize Your Approach: Tailor your resume and cover letter to the specific needs and priorities mentioned in the job description.

Don't 2: Neglect Networking and Relationship Building

Networking is crucial for landing a private credit associate position or any role in this close-knit industry.

- Actively Network: Don't underestimate the power of building relationships within the private credit community.

- Attend Networking Events: Take advantage of conferences, industry events, and alumni gatherings.

- Seek Informational Interviews: Use informational interviews to learn more about the industry and make valuable connections.

Don't 3: Underestimate the Importance of Technical Skills

Technical proficiency is fundamental in private credit.

- Master Technical Skills: Proficiency in financial modeling, valuation, and credit analysis is non-negotiable.

- Continuously Upgrade: Keep your skills current by pursuing advanced training and staying informed about industry best practices.

Don't 4: Fail to Prepare for Behavioral and Technical Interview Questions

Thorough preparation is essential for a successful interview.

- Practice Answering Questions: Prepare answers to common behavioral and technical questions.

- Research the Firm and Interviewers: Show your knowledge and genuine interest in the position.

Don't 5: Neglect Following Up After Interviews

A follow-up demonstrates your professionalism and continued interest.

- Send Thank-You Notes: Send personalized thank-you notes to reiterate your interest and highlight key discussion points.

- Maintain Contact: Stay in touch with recruiters and interviewers after the interview process.

Conclusion

Securing a job in the booming private credit sector requires a strategic approach. By following these five "Do's" and avoiding these five "Don'ts," you significantly improve your chances of success. Remember to network diligently, tailor your applications, master the interview process, and continuously develop your expertise in private credit. Don't delay – start your journey into the exciting world of private credit jobs today!

Featured Posts

-

Strategy Acquires 6 556 Bitcoin For 555 8 Million A Detailed Analysis

Apr 30, 2025

Strategy Acquires 6 556 Bitcoin For 555 8 Million A Detailed Analysis

Apr 30, 2025 -

Investasi Rp 3 6 Triliun Target Bkpm Di Pekanbaru Tahun 2024

Apr 30, 2025

Investasi Rp 3 6 Triliun Target Bkpm Di Pekanbaru Tahun 2024

Apr 30, 2025 -

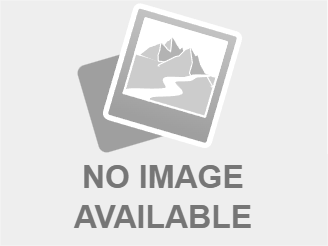

Packing Light For A Cruise Items To Leave Behind

Apr 30, 2025

Packing Light For A Cruise Items To Leave Behind

Apr 30, 2025 -

Domaine Carneros And Schneider Electric Partnership For Energy Resilience

Apr 30, 2025

Domaine Carneros And Schneider Electric Partnership For Energy Resilience

Apr 30, 2025 -

Controversy Erupts Trump Administrations Order To Erase Transgender Swimmers Records At University Of Pennsylvania

Apr 30, 2025

Controversy Erupts Trump Administrations Order To Erase Transgender Swimmers Records At University Of Pennsylvania

Apr 30, 2025