Navigate The Private Credit Boom: 5 Do's & Don'ts

Table of Contents

Do's: Maximizing Success in the Private Credit Market

Successfully participating in the private credit market requires careful planning and execution. Here are five key "do's" to guide your strategy:

Do 1: Thoroughly Understand Your Risk Tolerance and Investment Goals

Before diving into the world of private credit, you must clearly define your risk tolerance and investment goals.

- Define Risk Tolerance: Are you a conservative investor comfortable with lower returns and minimal risk, or are you seeking higher returns with a higher acceptance of risk? Understanding your comfort level with potential losses is paramount.

- Align Investment Goals: Private credit strategies cater to diverse goals. Are you aiming for long-term capital appreciation or short-term income generation? Your investment timeline will influence the types of private debt investments you pursue.

- Diversify Your Portfolio: Don't put all your eggs in one basket. Diversification across various private credit asset classes, sectors, and geographies is crucial for risk mitigation. Thorough due diligence is essential before committing to any investment.

Different private credit strategies, such as senior secured loans (lower risk, lower return) and mezzanine debt (higher risk, higher return), cater to different risk profiles. Understanding these nuances is crucial for aligning your investments with your risk appetite.

Do 2: Partner with Experienced Private Credit Professionals

Navigating the complexities of the private credit market is best done with expert guidance.

- Expert Guidance: Experienced private credit professionals, including fund managers, legal counsel, and financial advisors, offer invaluable support. They possess the expertise to navigate intricate legal and financial aspects.

- Investment Selection: Leverage their knowledge to identify suitable investments that align with your risk tolerance and investment objectives. Their insight can help you avoid potentially problematic deals.

- Transparent Communication: Ensure open and transparent communication with your chosen professionals throughout the investment process.

Engaging a reputable private credit fund manager, for example, can significantly reduce the workload and risk associated with direct private debt investments.

Do 3: Conduct Extensive Due Diligence on Borrowers and Investments

Thorough due diligence is paramount in private credit.

- Financial Analysis: Conduct a comprehensive financial analysis of potential borrowers, scrutinizing credit scores, financial statements, and collateral evaluations.

- Independent Verification: Verify information independently, ensuring its accuracy and reliability. Don't solely rely on information provided by the borrower or intermediary.

- Red Flags: Be aware of potential red flags, such as inconsistent financial reporting, high debt-to-equity ratios, and unexplained discrepancies in financial data.

Neglecting due diligence can lead to significant financial losses.

Do 4: Diversify Your Private Credit Portfolio

Diversification is key to mitigating risk in private credit.

- Asset Class Diversification: Invest across different asset classes, such as direct lending, private debt funds, and potentially other alternative investments.

- Sector Diversification: Spread your investments across various industry sectors to reduce the impact of sector-specific downturns.

- Geographic Diversification: Consider geographic diversification to reduce exposure to region-specific economic risks.

A well-diversified portfolio is more resilient to market fluctuations.

Do 5: Monitor Your Investments Regularly

Proactive monitoring is essential for successful private credit investing.

- Proactive Monitoring: Regularly monitor your investments and maintain open communication with borrowers and fund managers.

- Early Issue Detection: This allows for the early identification and management of potential problems, enabling timely intervention.

- Key Metrics: Track key performance indicators (KPIs) such as default rates, interest payments, and collateral values.

Regular reporting and communication are crucial to staying ahead of potential challenges.

Don'ts: Avoiding Pitfalls in the Private Credit Boom

While the private credit boom offers substantial opportunities, several pitfalls must be avoided.

Don't 1: Invest Based Solely on High Returns

High returns often come with high risk.

- Risk Assessment: Don't prioritize high returns over a thorough risk assessment. Understand the potential downside of each investment before committing.

- Balanced Approach: Strive for a balanced approach, considering both the potential rewards and the potential losses.

- Downside Protection: Evaluate the measures in place to protect your investment against potential losses.

Don't 2: Overlook Legal and Regulatory Compliance

Adherence to all relevant regulations and laws is crucial.

- Regulatory Compliance: Ensure all your activities comply with relevant laws and regulations. Seek professional legal advice when needed.

- Penalties for Non-Compliance: Understand the potential penalties for non-compliance, which can be substantial.

- KYC/AML Compliance: Familiarize yourself with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations.

Don't 3: Neglect Proper Documentation and Agreements

Clear and comprehensive documentation is essential.

- Loan Agreements: Ensure all loan agreements and related legal documents are comprehensive, clearly defining all terms and conditions.

- Legal Counsel: Engage legal counsel to review all documentation before signing.

- Consequences of Poor Documentation: Understand the potential negative consequences of poorly drafted or incomplete agreements.

Don't 4: Underestimate the Liquidity Risk

Private credit investments are typically illiquid.

- Liquidity Challenges: Be aware of the challenges of quickly exiting private credit investments.

- Long-Term Horizons: Private credit generally requires a long-term investment horizon.

- Liquidity Risk Management: Develop strategies to manage liquidity risk effectively, such as diversifying across different investment vehicles.

Don't 5: Ignore Market Cycles and Economic Conditions

Economic downturns can significantly impact private credit investments.

- Market Analysis: Conduct thorough market analysis and economic forecasting to understand potential risks and opportunities.

- Strategic Adjustments: Adjust your investment strategy as economic conditions change.

- Borrower Performance: Understand how economic factors can affect borrower performance and investment returns.

Conclusion: Successfully Navigating the Private Credit Boom

Mastering the private credit boom requires a balanced approach. By following the "do's" and avoiding the "don'ts" outlined above – emphasizing due diligence, diversification, and risk management, and seeking professional guidance – you can navigate the private credit landscape successfully. Remember that successful private credit investment demands a strategic approach, combining the pursuit of high returns with effective risk management and expert advice. Before making any investment decisions in private credit, consult with qualified professionals to make informed decisions in the private credit market.

Featured Posts

-

Is The 2025 Mtv Movie And Tv Awards Show Cancelled

May 12, 2025

Is The 2025 Mtv Movie And Tv Awards Show Cancelled

May 12, 2025 -

Eric Antoine Un Nouvel Amour Apres Son Divorce Officialise Sur M6

May 12, 2025

Eric Antoine Un Nouvel Amour Apres Son Divorce Officialise Sur M6

May 12, 2025 -

Payton Pritchard Celtics Guard Inks Shoe Deal With Converse

May 12, 2025

Payton Pritchard Celtics Guard Inks Shoe Deal With Converse

May 12, 2025 -

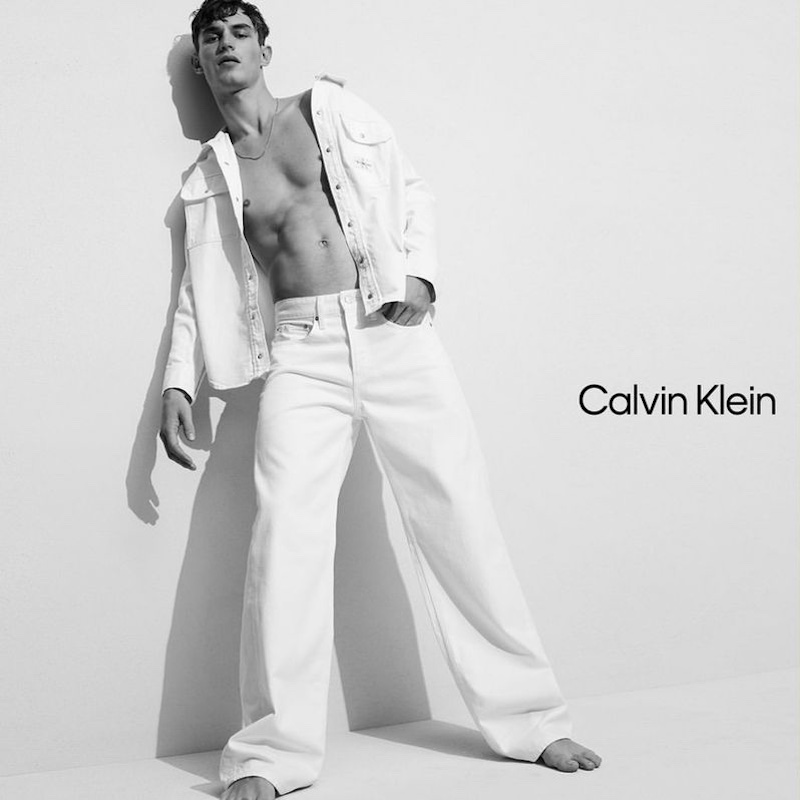

Calvin Kleins New Campaign With Lily Collins Image 5133600

May 12, 2025

Calvin Kleins New Campaign With Lily Collins Image 5133600

May 12, 2025 -

Where To Find Official 2025 New York Yankees Merchandise

May 12, 2025

Where To Find Official 2025 New York Yankees Merchandise

May 12, 2025