Navigate The Private Credit Boom: 5 Do's & Don'ts For Job Seekers

Table of Contents

Do's for Securing a Private Credit Job

1. Tailor Your Resume and Cover Letter

Your resume and cover letter are your first impression. Make them count! In the competitive world of private credit, a generic application won't cut it.

- Focus on relevant skills: Highlight experience in financial modeling, credit analysis, due diligence, portfolio management, leveraged finance, distressed debt, and private equity. Quantify your achievements whenever possible. Instead of saying "managed a portfolio," say "managed a $50 million portfolio, increasing returns by 15% in two years."

- Keyword optimization: Incorporate keywords commonly found in private credit job descriptions. Use tools like LinkedIn to identify frequently used terms.

- Showcase software proficiency: Mention your experience with essential software like Bloomberg Terminal, Argus, and other relevant financial modeling tools.

- Tailor to each application: Customize your resume and cover letter for each specific job and firm. Generic applications demonstrate a lack of interest and effort.

2. Network Strategically

Networking is crucial in the private credit industry. Building relationships can open doors to unadvertised opportunities.

- Attend industry events: Participate in conferences and workshops related to private credit, alternative investments, and leveraged finance.

- Leverage LinkedIn: Actively connect with professionals in the private credit field. Engage with their posts and participate in relevant groups.

- Informational interviews: Reach out to people working in private credit for informational interviews. These conversations can provide invaluable insights and potential leads.

- Join professional organizations: Membership in organizations like the CFA Institute or ACA can provide networking opportunities and enhance your credibility.

3. Develop Specialized Skills

The private credit industry demands specialized expertise. Continuous learning is key to staying competitive.

- Pursue relevant certifications: Consider obtaining certifications such as the Chartered Financial Analyst (CFA) charter or Chartered Alternative Investment Analyst (CAIA) designation.

- Master financial modeling: Develop proficiency in advanced financial modeling techniques and valuation methodologies.

- Gain credit analysis expertise: Become highly skilled in credit risk assessment, including analyzing financial statements and forecasting cash flows.

- Stay updated: Keep abreast of industry trends, regulatory changes, and economic factors impacting the private credit market.

4. Showcase Your Understanding of the Private Credit Landscape

Demonstrate a deep understanding of the private credit market and its intricacies.

- Knowledge of strategies: Show familiarity with various private credit strategies, such as direct lending, mezzanine financing, and distressed debt investing.

- Market awareness: Stay informed about current market conditions, interest rate trends, and economic factors affecting the private credit industry.

- Regulatory compliance: Understand the regulatory environment and compliance requirements within the private credit sector.

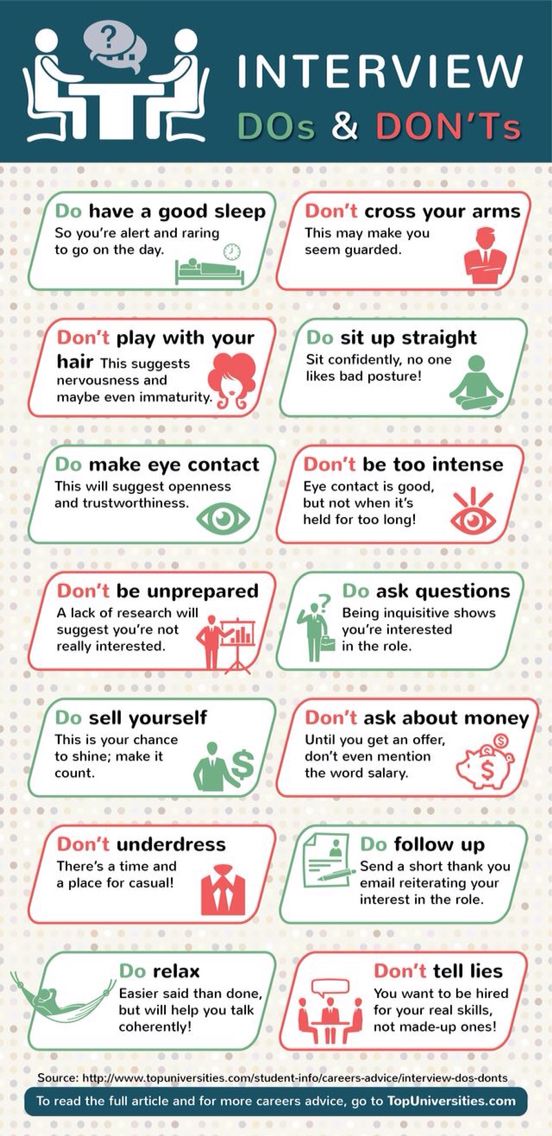

5. Practice Your Interview Skills

Thorough preparation is vital for acing your interviews.

- Behavioral questions: Prepare compelling examples showcasing your skills and experience in handling challenging situations. Use the STAR method (Situation, Task, Action, Result) to structure your answers.

- Technical questions: Practice technical questions related to financial modeling, credit analysis, and valuation.

- Company research: Thoroughly research the firms you are interviewing with. Demonstrate your knowledge of their investment strategies, portfolio companies, and culture.

Don'ts for Private Credit Job Seekers

1. Don't Neglect Networking

Networking is not optional; it's essential. Don't rely solely on online applications.

- Active networking: Attend industry events, leverage LinkedIn, and reach out to professionals for informational interviews.

- Personal connections: Don't underestimate the power of personal referrals and recommendations.

2. Don't Submit Generic Applications

Generic applications show a lack of effort and genuine interest.

- Tailored approach: Customize your resume and cover letter to each specific job and firm.

- Avoid generic templates: Don't use the same application materials for multiple job applications.

3. Don't Underestimate the Importance of Due Diligence

Thoroughly research the firms you apply to.

- Investment strategies: Understand their investment focus, target industries, and typical deal sizes.

- Company culture: Learn about their company culture, values, and team dynamics.

4. Don't Overlook Continuing Education

The private credit market is constantly evolving.

- Stay updated: Continuously learn and update your skills to remain competitive.

- Professional development: Attend workshops, seminars, and online courses to enhance your knowledge.

5. Don't Be Afraid to Ask Questions

Asking thoughtful questions shows genuine interest and engagement.

- Prepared questions: Prepare insightful questions about the role, the firm, and the industry.

- Demonstrate engagement: Your questions should reflect your understanding of private credit and your enthusiasm for the opportunity.

Mastering the Private Credit Job Hunt

This article outlined five key do's and don'ts for job seekers targeting private credit roles. Remember, the private credit job market is highly competitive. By following these guidelines – tailoring your applications, networking strategically, developing specialized skills, showcasing your market understanding, and practicing your interview skills – you'll significantly increase your chances of securing your dream job in this exciting and dynamic field. Start your journey today and master the private credit job hunt!

Featured Posts

-

Broadcoms V Mware Deal An Extreme Price Increase For At And T

Apr 24, 2025

Broadcoms V Mware Deal An Extreme Price Increase For At And T

Apr 24, 2025 -

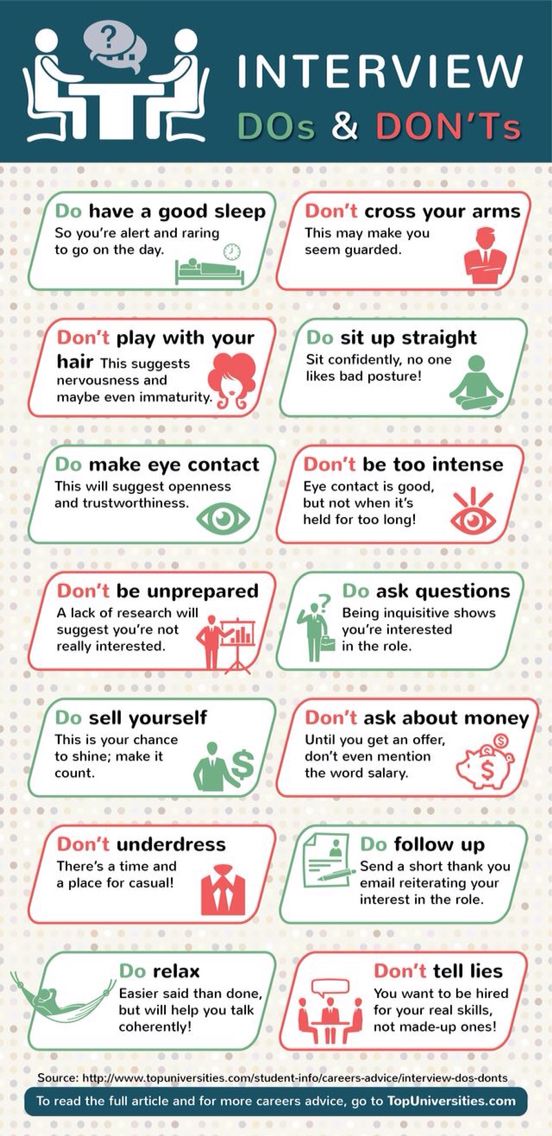

T Mobiles 16 Million Data Breach Fine Three Years Of Security Failures

Apr 24, 2025

T Mobiles 16 Million Data Breach Fine Three Years Of Security Failures

Apr 24, 2025 -

Chalet Girls Unveiling The Reality Of Luxury Ski Season Work

Apr 24, 2025

Chalet Girls Unveiling The Reality Of Luxury Ski Season Work

Apr 24, 2025 -

Nba All Star Game Draymond Green Moses Moody And Buddy Hield Participate In Festivities

Apr 24, 2025

Nba All Star Game Draymond Green Moses Moody And Buddy Hield Participate In Festivities

Apr 24, 2025 -

Chainalysis Acquires Ai Startup Alterya Expanding Blockchain Capabilities

Apr 24, 2025

Chainalysis Acquires Ai Startup Alterya Expanding Blockchain Capabilities

Apr 24, 2025