Navigate The Private Credit Boom: 5 Do's And Don'ts To Get Hired

Table of Contents

The private credit market is booming, experiencing unprecedented growth and creating a surge in demand for skilled professionals. This expansion, fueled by factors like increased regulatory scrutiny of traditional banks and the search for higher yields, presents a significant opportunity for ambitious individuals seeking a private credit career. But navigating this competitive job market requires a strategic approach. This article will outline five crucial do's and don'ts to help you successfully navigate this competitive landscape and land your ideal role in private credit. We'll cover everything from crafting the perfect private credit resume to mastering the art of the private credit interview.

H2: 5 Do's to Secure a Private Credit Job

H3: Do 1: Tailor Your Resume and Cover Letter for Private Credit Roles

Your resume and cover letter are your first impression. To stand out in the competitive world of private credit jobs, you need to make them count.

- Highlight relevant skills: Focus on skills directly applicable to private credit, such as financial modeling, underwriting, due diligence, portfolio management, leveraged finance, distressed debt analysis, and real estate lending expertise. Quantify your achievements whenever possible.

- Quantify achievements: Instead of simply stating your responsibilities, quantify your accomplishments. For example, instead of "Managed a portfolio of assets," write "Managed a $50 million portfolio of assets, increasing portfolio yield by 15% through strategic restructuring."

- Use keywords from job descriptions: Carefully review job descriptions and incorporate relevant keywords into your resume and cover letter. This helps Applicant Tracking Systems (ATS) identify your application as a strong match.

- Customize for each application: Generic applications won't cut it. Each resume and cover letter should be tailored to the specific firm and role, demonstrating your understanding of their investment strategies and the specific requirements of the position. Research the firm thoroughly before submitting your application.

- Showcase relevant experience: Highlight any experience in areas such as leveraged finance, distressed debt, real estate lending, or other relevant specializations within private credit.

H3: Do 2: Network Strategically Within the Private Credit Industry

Networking is crucial in the private credit industry. It's not just about who you know, but about building genuine relationships.

- Attend industry conferences and events: Conferences offer invaluable networking opportunities. Actively engage with attendees, participate in discussions, and exchange contact information.

- Leverage LinkedIn: Optimize your LinkedIn profile, connect with professionals in private credit, and join relevant groups. Engage in discussions and share insightful content related to the industry.

- Informational interviews are crucial: Reach out to professionals in private credit for informational interviews. These meetings provide invaluable insights into the industry and can lead to unexpected job opportunities.

- Join relevant professional organizations: Membership in organizations like the Association for Corporate Growth (ACG) or industry-specific groups can expand your network and provide access to exclusive events and resources.

- Participate in online forums and discussions: Engage in online discussions and forums related to private credit to share your knowledge and learn from others.

H3: Do 3: Master the Technical Skills Required for Private Credit

Private credit demands a high level of technical proficiency.

- Financial modeling proficiency: Master Excel and consider learning specialized financial modeling software. Demonstrate your ability to build complex models, analyze financial statements, and perform valuation exercises.

- Strong understanding of credit analysis and underwriting: Develop a deep understanding of credit risk assessment, collateral analysis, and the entire underwriting process.

- Knowledge of legal and regulatory frameworks: Familiarity with relevant regulations and legal aspects of private credit transactions is essential.

- Proficiency in data analysis and visualization: Develop skills in analyzing large datasets, identifying trends, and effectively visualizing your findings.

- Familiarity with different private credit strategies: Understand the nuances of various private credit strategies, such as direct lending, mezzanine financing, and distressed debt investing.

H3: Do 4: Prepare for Behavioral and Technical Interviews

The interview process is your chance to shine. Preparation is key.

- Practice answering common interview questions (STAR method): Use the STAR method (Situation, Task, Action, Result) to structure your answers, showcasing your skills and experience effectively.

- Prepare examples demonstrating your skills and experience: Develop compelling examples to illustrate your abilities in areas like financial modeling, credit analysis, and problem-solving.

- Research the firm and the interviewers: Thoroughly research the firm's investment strategy, recent transactions, and the interviewers' backgrounds. This shows genuine interest and allows you to ask informed questions.

- Understand the different types of private credit transactions: Be prepared to discuss your understanding of various transaction types and their associated risks and rewards.

- Be prepared for case studies or technical questions: Practice solving case studies and answering technical questions related to financial modeling, valuation, and credit analysis.

H3: Do 5: Follow Up After Interviews and Maintain Professionalism

The hiring process doesn't end with the interview.

- Send a thank-you note after each interview: Express your gratitude and reiterate your interest in the position.

- Follow up on the status of your application: Politely follow up after a reasonable timeframe to inquire about the status of your application.

- Maintain professional communication throughout the process: Respond promptly to emails and maintain a professional tone in all communications.

- Show genuine interest and enthusiasm for the opportunity: Demonstrate your passion for private credit and your desire to contribute to the firm's success.

H2: 5 Don'ts for Landing a Private Credit Job

H3: Don't 1: Submit a Generic Resume and Cover Letter

Using a generic resume and cover letter shows a lack of effort and interest. Tailoring your application to each specific opportunity demonstrates your dedication and understanding of the firm's requirements.

H3: Don't 2: Neglect Networking Opportunities

The private credit industry is relationship-driven. Neglecting networking opportunities significantly reduces your chances of landing a job. Actively engage in networking events and build relationships with professionals in the field.

H3: Don't 3: Underestimate the Importance of Technical Skills

Technical skills are paramount in private credit. Failing to develop and demonstrate strong technical abilities will hinder your progress.

H3: Don't 4: Underprepare for Interviews

Insufficient preparation leads to poor performance in interviews. Thorough preparation, including practicing answers to common questions and researching the firm, significantly increases your chances of success.

H3: Don't 5: Be Unprofessional During the Hiring Process

Maintaining professionalism throughout the application and interview process is crucial. Poor communication, tardiness, or unprofessional behavior can severely damage your chances of securing a private credit job.

Conclusion: Capitalize on the Private Credit Boom: Secure Your Future

Landing a job in the thriving private credit market requires a strategic approach. By following the five "do's" – tailoring your application, networking effectively, mastering technical skills, preparing thoroughly for interviews, and maintaining professionalism – and avoiding the five "don'ts," you significantly increase your chances of success. Start applying these do's and don'ts today to successfully navigate the private credit boom and secure your dream job in private credit! Begin your search for private credit jobs now and unlock your career potential.

Featured Posts

-

3 1

May 21, 2025

3 1

May 21, 2025 -

New Looney Tunes Animated Short Featuring Cartoon Network Stars 2025

May 21, 2025

New Looney Tunes Animated Short Featuring Cartoon Network Stars 2025

May 21, 2025 -

Alles Over Het Kamerbrief Verkoopprogramma Voor Abn Amro Certificaten

May 21, 2025

Alles Over Het Kamerbrief Verkoopprogramma Voor Abn Amro Certificaten

May 21, 2025 -

Experience Peppa Pig And Babys Adventures 10 Episodes In Cinemas This May

May 21, 2025

Experience Peppa Pig And Babys Adventures 10 Episodes In Cinemas This May

May 21, 2025 -

D Wave Quantum Inc Qbts Stock Investment Analysis

May 21, 2025

D Wave Quantum Inc Qbts Stock Investment Analysis

May 21, 2025

Latest Posts

-

Reddits Ai Stock Picks 12 Companies To Consider

May 21, 2025

Reddits Ai Stock Picks 12 Companies To Consider

May 21, 2025 -

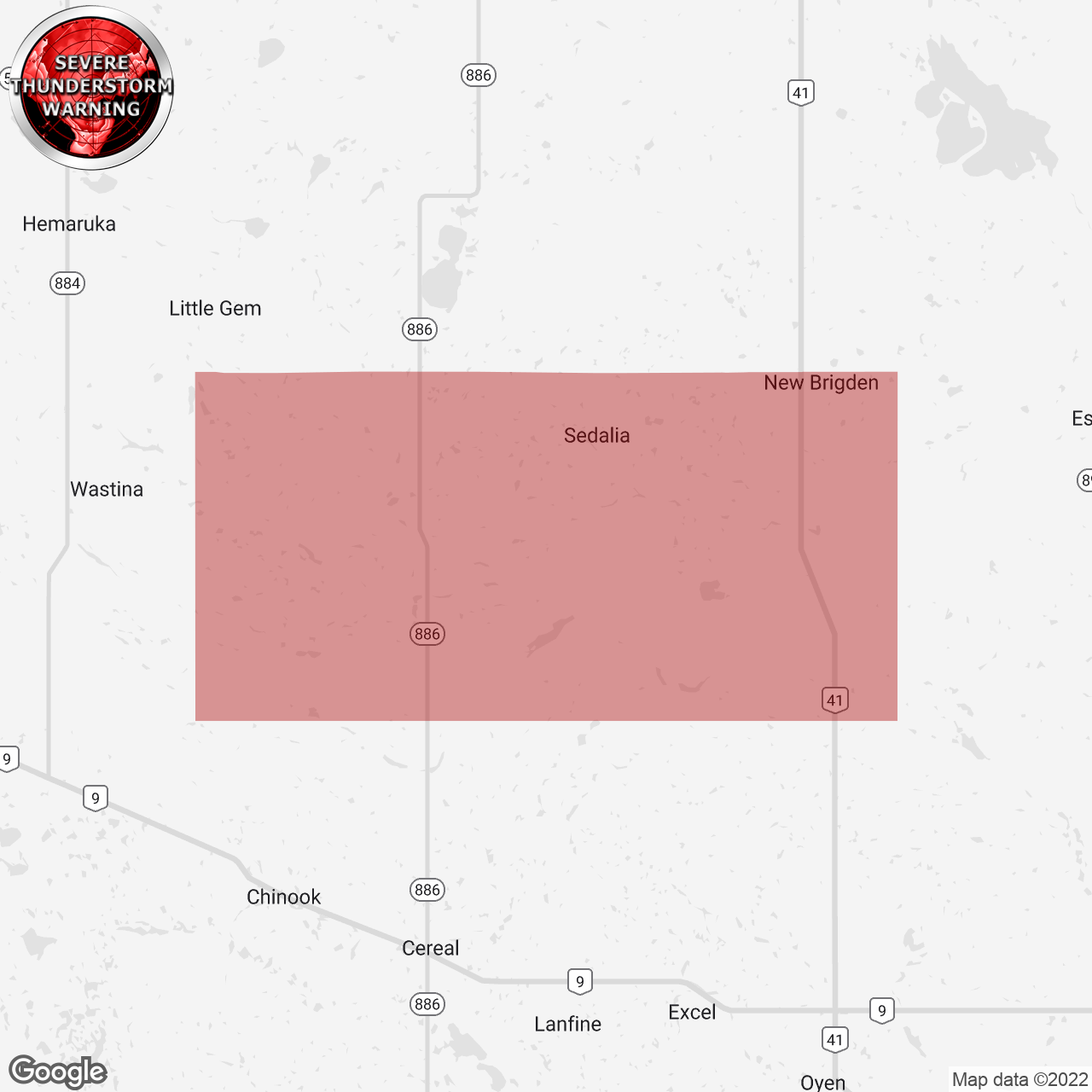

Weather Alert High Winds And Severe Storms Approaching Your Area

May 21, 2025

Weather Alert High Winds And Severe Storms Approaching Your Area

May 21, 2025 -

12 Popular Ai Stocks From Reddit A Detailed Overview

May 21, 2025

12 Popular Ai Stocks From Reddit A Detailed Overview

May 21, 2025 -

Strong Wind And Severe Storm Warning Take Action Now

May 21, 2025

Strong Wind And Severe Storm Warning Take Action Now

May 21, 2025 -

Confirmed Collins Aerospace Implements Layoffs In Cedar Rapids

May 21, 2025

Confirmed Collins Aerospace Implements Layoffs In Cedar Rapids

May 21, 2025