Navigating The Chinese Market: The Struggle For BMW, Porsche, And Others

Table of Contents

Intense Competition and Local Players

The Chinese automotive market is a fiercely competitive arena. The battle isn't just amongst established international players like BMW, Mercedes-Benz, and Audi; it's also a fight against rapidly growing domestic brands. This intense competition significantly impacts the strategies of luxury brands seeking a foothold in this expansive market.

-

Rising Domestic EV Brands: The popularity of homegrown electric vehicle (EV) brands like Nio, Xpeng, and BYD is surging. These companies offer compelling alternatives with competitive pricing and advanced technology, directly challenging the established luxury brands. Their success highlights the shift towards electric mobility within the Chinese automotive market.

-

Expansion of Local Luxury Brands: Established local players like Geely and Great Wall Motors are aggressively expanding into the luxury segment, posing a direct threat to international competitors. Their deep understanding of the local market and strong distribution networks give them a significant advantage.

-

The Price War: The ongoing price war amongst EV manufacturers further intensifies the competitive landscape. This price pressure forces luxury brands to reconsider their pricing strategies and offer more competitive packages to maintain their market share within the Chinese automotive market.

This intense competition forces luxury brands to offer increasingly competitive pricing and innovative features to remain relevant and maintain market share. They must constantly innovate and adapt to survive in this dynamic environment.

Understanding Unique Consumer Preferences

Chinese consumers exhibit unique preferences and buying behaviors that differ significantly from those in Western markets. Luxury brands must adapt their offerings and marketing strategies to resonate with these nuanced preferences to achieve success in the Chinese automotive market.

-

Technology and Connectivity: Chinese consumers place a strong emphasis on advanced technology and seamless connectivity features in their vehicles. Features like advanced driver-assistance systems (ADAS), large infotainment screens, and over-the-air software updates are highly valued.

-

Preference for Larger Vehicles: There’s a clear preference for larger vehicles, especially SUVs. This preference reflects changing lifestyles and a desire for spaciousness and comfort.

-

Influence of Social Media and Online Reviews: Social media and online reviews significantly influence purchasing decisions. Positive online sentiment and strong social media presence are crucial for success.

-

Growing Demand for Electric and Hybrid Vehicles: Government incentives and growing environmental concerns drive a substantial and rapidly growing demand for electric and hybrid vehicles within the Chinese automotive market. This trend presents both opportunities and challenges for luxury brands.

Navigating Regulatory Hurdles and Infrastructure

The Chinese automotive market is characterized by stringent regulations and evolving infrastructure. Successfully navigating these complexities is critical for long-term sustainability and growth.

-

Import Tariffs and Taxes: Complex import tariffs and taxes significantly impact profitability, requiring careful financial planning and strategic pricing.

-

Stringent Emission Standards: Stringent emission standards and regulations for EVs necessitate substantial investment in R&D and compliance efforts.

-

EV Charging Infrastructure: The uneven distribution of EV charging infrastructure across different regions presents logistical challenges. Addressing range anxiety and ensuring convenient charging access is crucial.

-

Bureaucratic Processes: Navigating the bureaucratic processes and approvals required for market entry and expansion can be time-consuming and complex.

Supply Chain Disruptions and Geopolitical Factors

Global supply chain disruptions and geopolitical tensions pose additional challenges to luxury brands operating in the Chinese automotive market.

-

Chip Shortages: The impact of chip shortages on production and delivery timelines necessitates proactive supply chain management and diversification strategies.

-

Trade Disputes and Political Uncertainties: Trade disputes and political uncertainties can significantly impact market stability and require careful risk assessment and mitigation.

-

Supply Chain Diversification: Diversifying supply chains to mitigate risks associated with geopolitical instability and unexpected disruptions is crucial for business continuity.

Conclusion:

The Chinese automotive market represents both a vast opportunity and a significant challenge for international luxury brands like BMW and Porsche. Success requires a deep understanding of consumer preferences, skillful navigation of stringent regulations, and proactive management of external risks. By focusing on innovation, localization, and forging strong relationships with local partners, these brands can enhance their prospects for thriving in this dynamic and increasingly competitive Chinese automotive market. To further refine your understanding of strategies for success in this crucial market, continue researching and exploring the diverse resources available on the Chinese automotive market.

Featured Posts

-

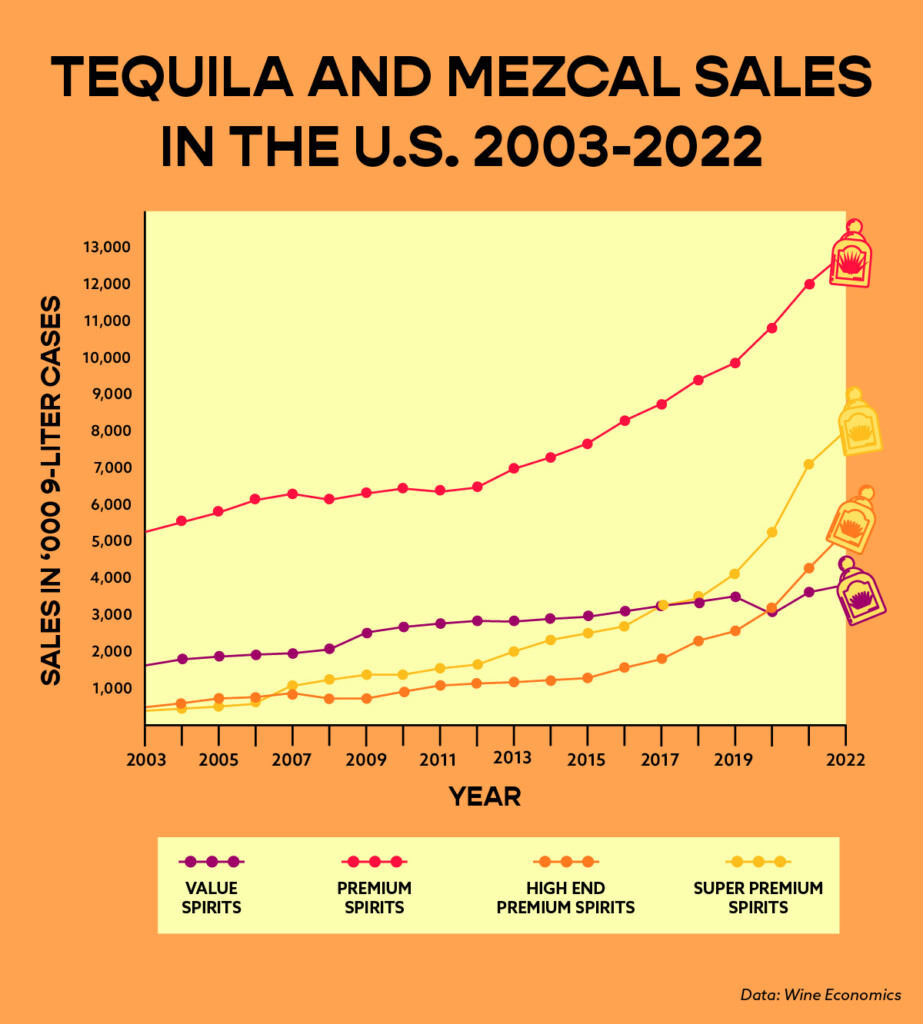

The Rise And Fall Analyzing The Celebrity Tequila Market

May 19, 2025

The Rise And Fall Analyzing The Celebrity Tequila Market

May 19, 2025 -

Prohibicion De Celulares En Elecciones El Recurso De Correismo

May 19, 2025

Prohibicion De Celulares En Elecciones El Recurso De Correismo

May 19, 2025 -

Addressing The Budget Crisis In Perry County Schools The Enrollment Factor

May 19, 2025

Addressing The Budget Crisis In Perry County Schools The Enrollment Factor

May 19, 2025 -

Eurovisions Voting System A Step By Step Explanation

May 19, 2025

Eurovisions Voting System A Step By Step Explanation

May 19, 2025 -

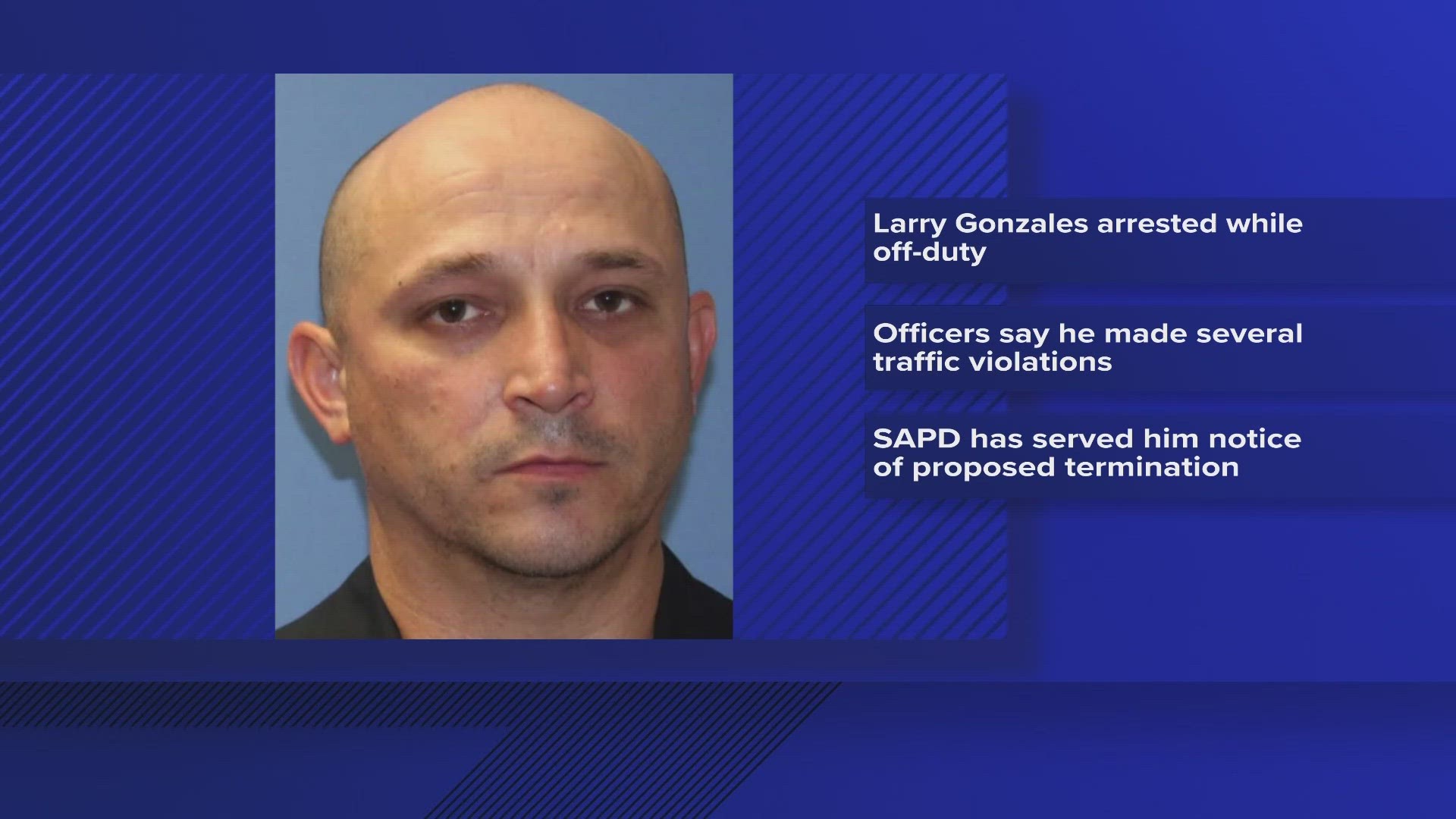

East Hampton Police Officer Arrested For Dwi Southampton Police Department Announcement

May 19, 2025

East Hampton Police Officer Arrested For Dwi Southampton Police Department Announcement

May 19, 2025