Navigating The Proxy Statement (Form DEF 14A): What You Need To Know

Table of Contents

Decoding the Key Sections of a Proxy Statement (Form DEF 14A)

The proxy statement, or Form DEF 14A, is a formal document filed with the Securities and Exchange Commission (SEC) by publicly traded companies. It’s distributed to shareholders before annual meetings or other significant corporate votes. Understanding its structure is the first step to effective analysis. Let’s break down the key sections:

-

Executive Compensation: This section details the compensation packages of top executives, including salaries, bonuses, stock options, and other benefits. Carefully review this section to assess whether executive pay aligns with company performance and overall corporate governance. Look for details on the compensation committee's rationale and any potential conflicts of interest. Analyzing executive pay ratios—comparing CEO pay to the median employee's pay—provides valuable context.

-

Director Elections: This outlines the nominations for the Board of Directors. Analyze each nominee's background, experience, and potential conflicts of interest. Independent directors bring crucial oversight; pay attention to their representation on the board.

-

Shareholder Proposals: This section lists proposals submitted by shareholders. These proposals often cover various issues, such as environmental sustainability, executive compensation, or social responsibility initiatives. Evaluating these proposals gives you insight into shareholder concerns and the company's responsiveness to them.

-

Audit Reports: The independent auditor’s report is a critical component, verifying the accuracy of the company's financial statements. Review any qualifications or concerns raised in the report, as these could indicate potential risks.

-

Mergers and Acquisitions: If a company is involved in a merger or acquisition, this section will detail the proposed transaction, including its terms and rationale. This is crucial information to assess the potential impact on your investment.

Understanding Executive Compensation and its Disclosure in the Proxy Statement

Scrutinizing executive compensation is crucial for assessing corporate governance and potential conflicts of interest. The proxy statement provides detailed information to aid this analysis:

-

Components of Compensation: Beyond base salary, understand the structure of bonuses, stock options, and other benefits. Stock options can incentivize long-term value creation, but their impact should be carefully assessed. Look for details on performance metrics tied to bonuses to ensure alignment with shareholder interests.

-

Pay Ratios: The ratio of CEO pay to the median employee's pay is a significant indicator of pay equity and corporate social responsibility. A disproportionately high ratio may signal concerns about fairness and potential governance issues.

-

Red Flags: Watch out for excessive payouts not tied to performance, golden parachutes for executives, or lack of transparency in compensation decisions. These could be signs of poor corporate governance. Unusually high stock option grants with lax vesting periods might also raise eyebrows.

Analyzing Director Elections and Shareholder Proposals

The proxy statement empowers shareholders to participate in corporate governance through director elections and voting on shareholder proposals:

-

Director Nominations: Evaluate the nominees' qualifications, experience, and independence from management. Seek diverse representation on the board to bring a variety of perspectives and expertise. Look for evidence of experience in relevant fields, leadership skills, and a demonstrated commitment to ethical business practices.

-

Shareholder Proposals: These proposals offer a direct avenue for shareholders to influence company policies. Analyze the proposal's merits, potential impact, and the company’s response to it. Consider the implications of voting for or against each proposal and its alignment with your investment objectives. Understanding the voting process—whether it's a simple majority or supermajority requirement—is key.

Utilizing Proxy Statement Information for Informed Investment Decisions

The information contained within the proxy statement is invaluable for making informed investment decisions and engaging in responsible investing:

-

Investment Decision-Making: Analyzing the proxy statement enhances your due diligence and risk assessment. Information on executive compensation, board composition, and shareholder proposals can help you evaluate the company’s long-term prospects and governance structure, leading to better investment choices.

-

Corporate Governance: The proxy statement reveals a company's corporate governance practices, including its commitment to transparency, accountability, and ethical conduct. This is crucial for responsible investing and choosing companies aligned with your values.

-

Risk Assessment: Identifying potential red flags in executive compensation, audit reports, or shareholder proposals can help you assess potential risks associated with your investment.

-

Shareholder Engagement: Understanding the issues raised in shareholder proposals allows you to engage more effectively with the company's management and advocate for change.

Conclusion

Mastering the proxy statement (Form DEF 14A) is essential for informed investing. By understanding its key sections, analyzing executive compensation, evaluating director nominations and shareholder proposals, and utilizing the information for informed decision-making, you can actively participate in corporate governance and contribute to a more responsible investment landscape. Don't let the complexity deter you—actively reviewing the proxy statement before shareholder meetings empowers you to exercise your voting rights effectively and make a difference. Master your investment strategy by thoroughly reviewing the proxy statement (Form DEF 14A) – your voice matters!

Featured Posts

-

Foodpanda Taiwan Acquisition Uber Cites Regulatory Hurdles For Termination

May 17, 2025

Foodpanda Taiwan Acquisition Uber Cites Regulatory Hurdles For Termination

May 17, 2025 -

Rockwell Automations Strong Earnings Drive Stock Surge Market Movers Overview

May 17, 2025

Rockwell Automations Strong Earnings Drive Stock Surge Market Movers Overview

May 17, 2025 -

The Donald Trump Presidency Navigating Controversy Surrounding Multiple Affairs And Sexual Misconduct Accusations

May 17, 2025

The Donald Trump Presidency Navigating Controversy Surrounding Multiple Affairs And Sexual Misconduct Accusations

May 17, 2025 -

Understanding High Stock Market Valuations Bof As Analysis

May 17, 2025

Understanding High Stock Market Valuations Bof As Analysis

May 17, 2025 -

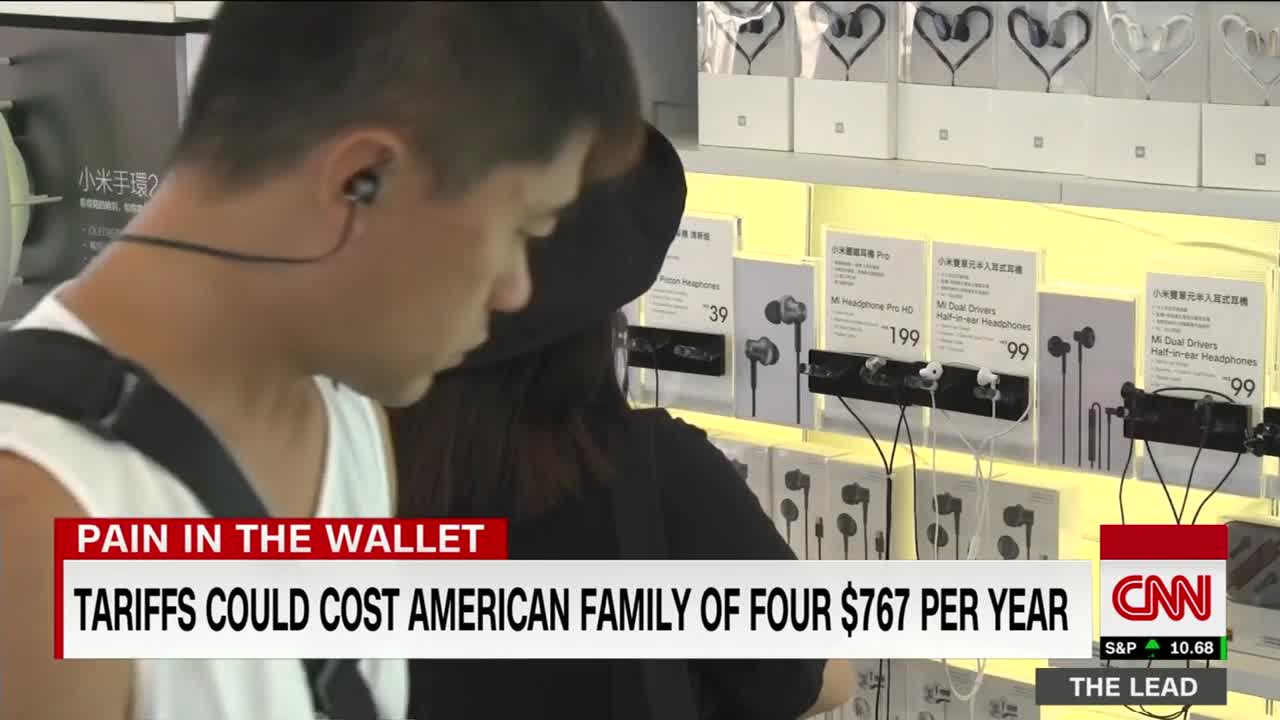

The Impact Of Trump Tariffs On The Price Of Cell Phone Batteries

May 17, 2025

The Impact Of Trump Tariffs On The Price Of Cell Phone Batteries

May 17, 2025