NCLH Stock: Is It A Top Pick For Hedge Fund Managers?

Table of Contents

NCLH's Financial Performance and Future Prospects

Analyzing NCLH's recent financial reports is crucial for understanding its current standing and future potential. Key metrics reveal important trends. Recent quarters have shown a steady increase in revenue, driven by strong booking numbers and higher occupancy rates. While profit margins are recovering, they still lag pre-pandemic levels, partly due to increased fuel costs and operational expenses. Debt levels remain a concern, though NCLH is actively working on deleveraging.

The company's strategic growth plans are also vital to consider. NCLH is investing in new ship orders, expanding its fleet to cater to growing demand. Furthermore, the company is diversifying its itineraries, exploring new destinations and enhancing its onboard experiences to attract a wider range of passengers.

However, potential risks must be acknowledged. Fuel price volatility can significantly impact profitability. Economic downturns and geopolitical instability can also negatively influence consumer spending on discretionary items like cruises. The lingering threat of future pandemics or other unforeseen events adds another layer of complexity to the NCLH stock outlook.

- Key Financial Metrics: Revenue Growth, Occupancy Rates, Net Income, Debt-to-Equity Ratio

- Expansion Plans: New Ship Deployments, Itinerary Diversification, Brand Extensions

- Risk Factors: Fuel Price Volatility, Economic Downturn, Geopolitical Events, Public Health Crises

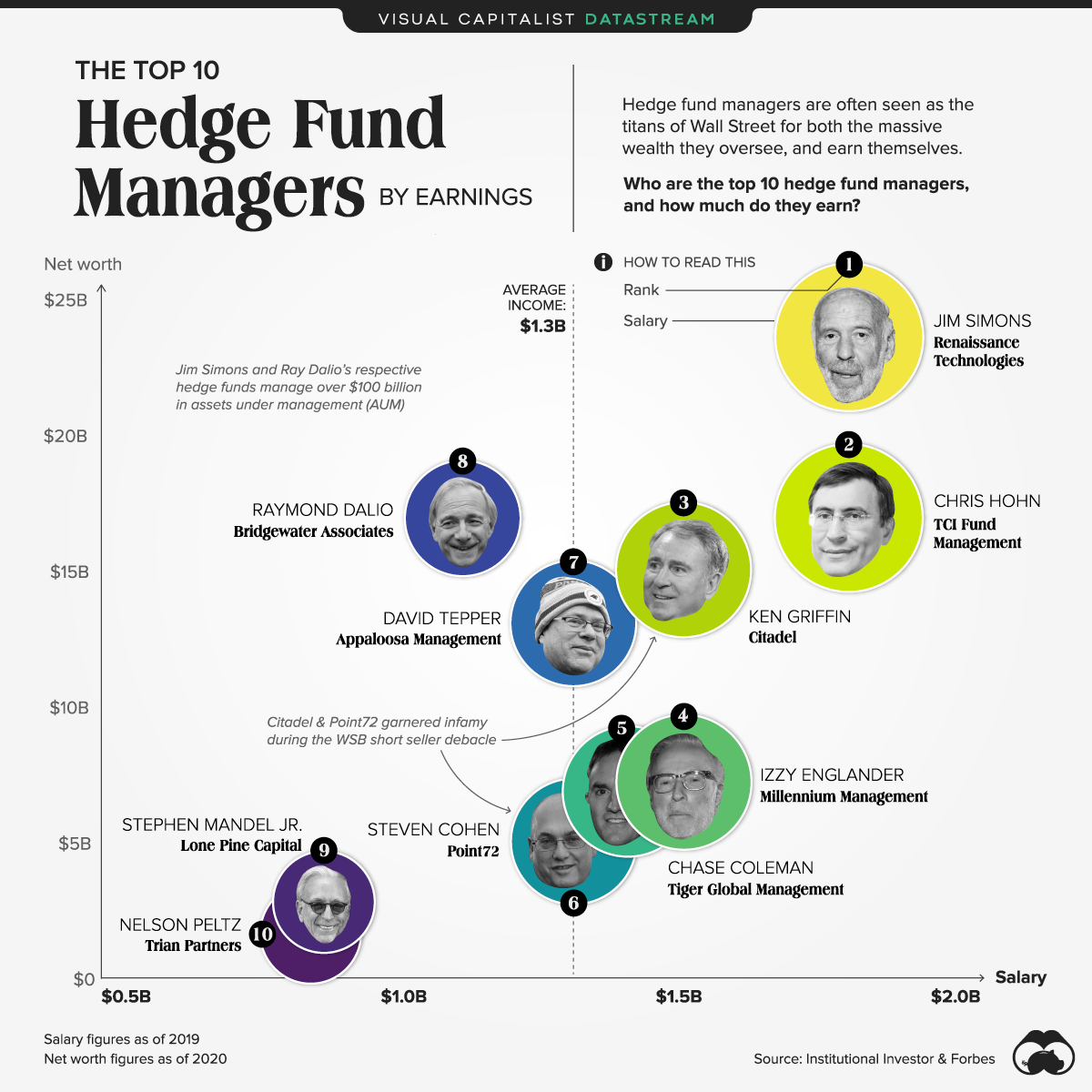

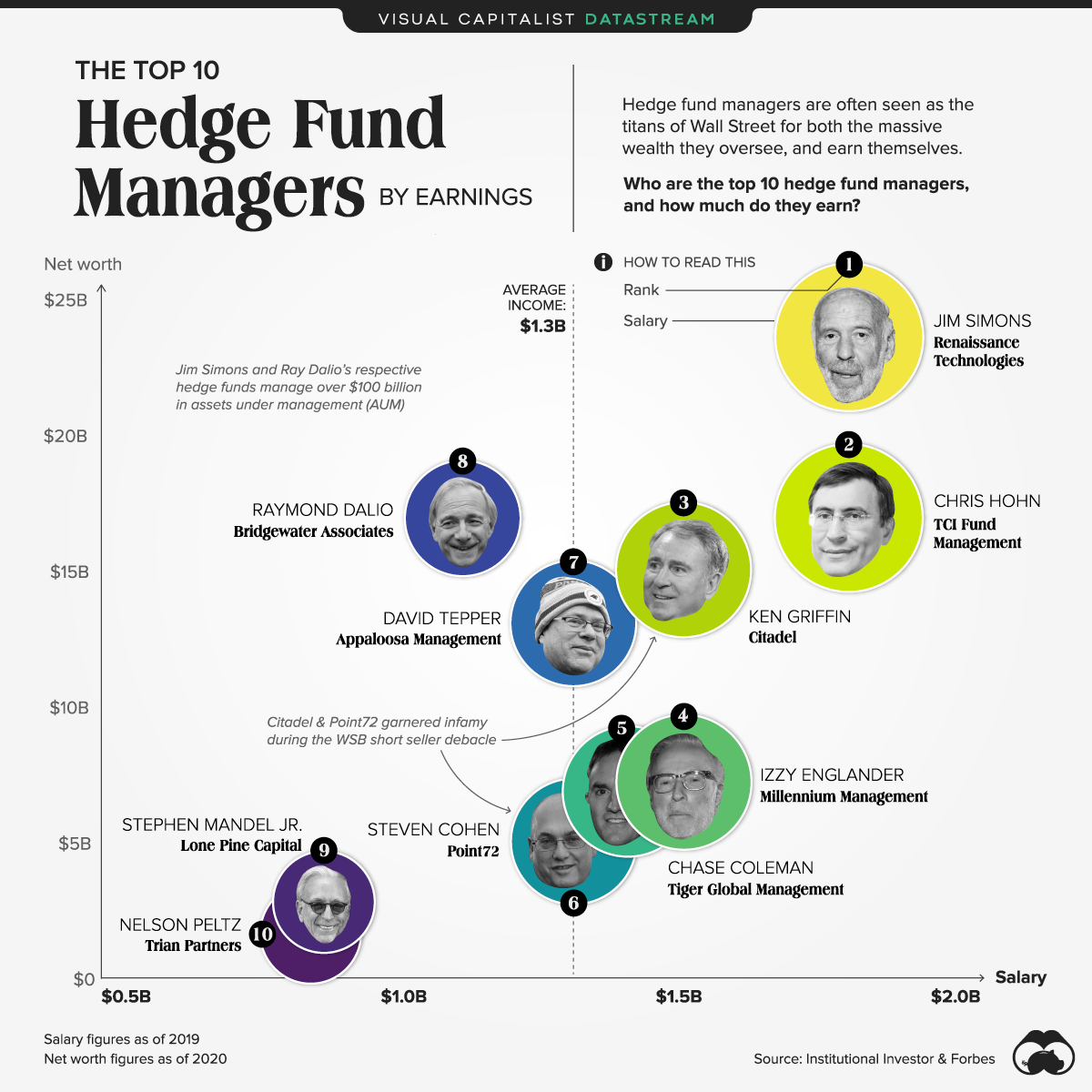

Hedge Fund Interest in NCLH

Several prominent hedge funds have shown significant interest in NCLH, increasing their positions in recent months. This suggests a belief in the company's long-term recovery and growth potential. Their investment thesis likely revolves around the expected rebound in leisure travel and the cruise industry's resilience. The overall sentiment among hedge fund managers towards the cruise industry appears cautiously optimistic, with many viewing it as an undervalued sector ripe for recovery. Understanding their investment strategies provides valuable insight into the potential of NCLH.

- List of prominent hedge funds invested in NCLH: (Note: Due to the dynamic nature of hedge fund holdings, a comprehensive list requires constant updating. Refer to SEC filings for the most current information.)

- Analysis of their investment thesis for NCLH: (Analysis would require accessing specific hedge fund reports and investor statements, which is beyond the scope of this general article.)

- Hedge fund portfolio allocation to the cruise industry: (This requires extensive market research and may vary widely across funds.)

Valuation and Investment Risks

Evaluating NCLH's stock valuation is crucial for determining its investment appeal. While metrics like P/E ratio and price-to-book ratio offer insights, they must be interpreted within the context of the company's stage of recovery and industry-specific factors. A discounted cash flow (DCF) analysis, incorporating projected future cash flows, provides a more comprehensive valuation. However, it's crucial to remember that DCF models are highly sensitive to assumptions and projections.

Investing in NCLH carries inherent risks. Economic downturns can significantly reduce consumer spending on discretionary travel. Geopolitical events and unforeseen crises (like another pandemic) can disrupt operations and impact demand. These factors highlight the potential for both high reward and high risk in NCLH.

- Key Valuation Metrics and Comparisons to Competitors: P/E Ratio, Price-to-Book Ratio, Enterprise Value/EBITDA, Discounted Cash Flow Analysis.

- Risk Assessment: Macroeconomic Factors, Industry-Specific Risks (competition, regulation), Operational Risks, Geopolitical Risks.

- Potential for High Returns vs. High Risk: NCLH's high-growth potential is counterbalanced by its sensitivity to external factors.

Comparing NCLH to Competitors

NCLH competes with other major cruise companies like Carnival Corporation (CCL) and Royal Caribbean Cruises (RCL). A comparative analysis of key performance indicators, including revenue growth, occupancy rates, and profitability, reveals NCLH's relative strengths and weaknesses. NCLH generally focuses on a slightly more premium market segment than Carnival, while maintaining a larger footprint than Royal Caribbean in some key regions. Each company has its own unique brand identity, target audience, and fleet strategy. Market share analysis shows NCLH's position within the competitive landscape. Brand strength and customer loyalty are also key differentiating factors to consider when comparing these industry giants.

- Comparative Analysis of Key Performance Indicators: Revenue, Profit Margins, Debt Levels, Customer Satisfaction Scores

- Market Share and Competitive Landscape: Analysis of market share data for each company.

- Brand Strength and Customer Loyalty: Evaluating brand perception and customer retention rates.

Conclusion: Is NCLH Stock Right for You?

In summary, NCLH's financial health is improving, fueled by the cruise industry's recovery. Hedge fund interest indicates a positive outlook for the company's long-term prospects. However, valuation remains a key consideration, and substantial risks are inherent in investing in the cruise industry. A careful assessment of NCLH's competitive position relative to CCL and RCL is also necessary.

The potential for high returns exists, but so does the potential for significant losses. NCLH stock is not a guaranteed winner. Before making any investment decisions regarding NCLH stock, thorough due diligence is essential. This includes a comprehensive analysis of the company's financials, the cruise industry's outlook, and your own risk tolerance. It's crucial to consult with a qualified financial advisor for personalized investment advice. Remember to develop a robust NCLH investment strategy that aligns with your financial goals and risk profile. Consider the long-term NCLH stock outlook, factoring in the factors discussed in this analysis. This article is for informational purposes only and does not constitute financial advice.

Featured Posts

-

San Diego Jail Death Family Alleges Hours Of Untended Torture

Apr 30, 2025

San Diego Jail Death Family Alleges Hours Of Untended Torture

Apr 30, 2025 -

Vong Chung Ket Thaco Cup 2025 Lich Thi Dau Chinh Thuc Va Noi Xem Truc Tuyen

Apr 30, 2025

Vong Chung Ket Thaco Cup 2025 Lich Thi Dau Chinh Thuc Va Noi Xem Truc Tuyen

Apr 30, 2025 -

Open Ais Chat Gpt Takes On Google Shoppings New Frontier

Apr 30, 2025

Open Ais Chat Gpt Takes On Google Shoppings New Frontier

Apr 30, 2025 -

Savo Vardo Turnyras Vilniuje Mato Buzelio Netiketa Tyla

Apr 30, 2025

Savo Vardo Turnyras Vilniuje Mato Buzelio Netiketa Tyla

Apr 30, 2025 -

Becciu Chat Segrete E Accuse Al Vaticano Il Cardinale Parla Di Complotto

Apr 30, 2025

Becciu Chat Segrete E Accuse Al Vaticano Il Cardinale Parla Di Complotto

Apr 30, 2025