NCLH's Q[Quarter] Earnings Exceed Expectations, Driving Stock Higher

![NCLH's Q[Quarter] Earnings Exceed Expectations, Driving Stock Higher NCLH's Q[Quarter] Earnings Exceed Expectations, Driving Stock Higher](https://peoplelikeyourecords.de/image/nclhs-q-quarter-earnings-exceed-expectations-driving-stock-higher.jpeg)

Table of Contents

Norwegian Cruise Line Holdings (NCLH) announced its Q3 earnings today, exceeding analysts' expectations and sending its stock price soaring. This unexpected surge in profitability signals a robust recovery for the cruise industry and offers positive indicators for future growth. This article will delve into the key factors driving NCLH's success and analyze the implications for investors.

Key Highlights from NCLH's Q3 Earnings Report

Revenue Surges Beyond Projections

NCLH's Q3 revenue significantly surpassed analysts' predictions, demonstrating a strong rebound from the pandemic's impact.

- Revenue: [Insert actual revenue figure]. This represents a [percentage]% increase compared to Q3 2022 and a [percentage]% increase compared to analyst expectations.

- Strong Performance Across Brands: All brands under the NCLH umbrella – Norwegian Cruise Line, Oceania Cruises, and Regent Seven Seas Cruises – contributed to this impressive revenue growth, showcasing the strength and diversity of the company's portfolio.

- High Occupancy Rates: Occupancy rates averaged [percentage]%, exceeding pre-pandemic levels and indicating strong consumer demand.

- Increased ADR: Average daily revenue per passenger (ADR) also increased to [figure], reflecting higher onboard spending and the popularity of premium offerings. This demonstrates the success of NCLH's strategies to enhance the onboard guest experience.

Profitability Exceeds Expectations

NCLH's Q3 profitability dramatically exceeded expectations, reflecting effective cost management and robust revenue generation.

- Net Income: NCLH reported a net income of [insert actual figure], significantly higher than the same period last year and exceeding analyst consensus.

- EPS: Earnings per share (EPS) reached [insert actual figure], surpassing predictions.

- Factors Contributing to Improved Profitability: This remarkable increase in profitability can be attributed to a combination of factors, including strategic cost-cutting measures, increased operational efficiency, and a strong surge in demand for cruises.

Positive Outlook for Future Bookings

NCLH's forward-looking statements regarding future bookings are equally encouraging, suggesting continued growth momentum.

- Future Bookings: The company reported a strong increase in future cruise bookings, indicating continued confidence in the cruise industry's recovery. [Insert specific metrics if available from the earnings report].

- Pent-up Demand: The post-pandemic travel boom, coupled with significant pent-up demand, continues to fuel booking growth.

- Consumer Confidence: Growing consumer confidence and a desire for leisure travel experiences are key drivers of this positive outlook.

Factors Contributing to NCLH's Strong Performance

Increased Consumer Demand for Cruises

The resurgence of cruise travel is a significant factor in NCLH's success.

- Post-Pandemic Travel Boom: The pent-up demand for travel following the pandemic has fueled a remarkable increase in cruise bookings.

- Demographic Trends: NCLH is strategically targeting various demographics, broadening its appeal and maximizing revenue opportunities.

Effective Cost Management Strategies

NCLH's commitment to cost management has played a crucial role in its profitability.

- Operational Efficiency: Improvements in operational efficiency have resulted in significant cost savings without compromising the quality of the guest experience. This includes optimizing crew scheduling and streamlining onboard operations.

- Strategic Cost Reduction: Targeted initiatives to reduce costs across various aspects of the business have further contributed to improved profitability.

Strategic Investments and Innovations

Strategic investments and innovations have also positively impacted NCLH's financial performance.

- Fleet Modernization: Investments in fleet modernization and upgrades have enhanced the guest experience and increased operational efficiency.

- Marketing Innovations: The company has adopted innovative marketing strategies to reach wider audiences and boost bookings.

Implications for Investors and the Cruise Industry

NCLH's exceptional Q3 results have significant implications for both investors and the broader cruise industry.

- Cruise Industry Outlook: NCLH's strong performance reinforces the positive outlook for the cruise industry's recovery and future growth.

- Impact on Competitor Stocks: The results could influence the performance of competitor stocks within the cruise sector, potentially triggering further positive sentiment.

- Investment Opportunities: NCLH's success presents attractive investment opportunities for those interested in the cruise industry and its growth potential.

Conclusion

NCLH's Q3 earnings significantly exceeded expectations, driven by strong revenue growth, effective cost management, and increased consumer demand. This performance signifies a robust recovery for the cruise industry and holds positive implications for NCLH and its investors. The positive outlook for future bookings further strengthens the company's position.

Call to Action: Stay informed on the latest developments in the cruise industry and NCLH's performance by following our blog for regular updates on NCLH earnings and other relevant cruise stock news. Learn more about investing in NCLH and other cruise line stocks by exploring our resources. Stay tuned for our next analysis of NCLH's financial performance.

![NCLH's Q[Quarter] Earnings Exceed Expectations, Driving Stock Higher NCLH's Q[Quarter] Earnings Exceed Expectations, Driving Stock Higher](https://peoplelikeyourecords.de/image/nclhs-q-quarter-earnings-exceed-expectations-driving-stock-higher.jpeg)

Featured Posts

-

Celtics Vs Cavaliers Predictions Expert Picks And Betting Odds For Friday

May 01, 2025

Celtics Vs Cavaliers Predictions Expert Picks And Betting Odds For Friday

May 01, 2025 -

A Decade After Examining The Long Term Effects Of The Louisville Tornado

May 01, 2025

A Decade After Examining The Long Term Effects Of The Louisville Tornado

May 01, 2025 -

Recordati Tariff Volatility Drives M And A Opportunities In Italy

May 01, 2025

Recordati Tariff Volatility Drives M And A Opportunities In Italy

May 01, 2025 -

Hoe Definieren Media Een Zware Auto Geen Stijl Perspectief

May 01, 2025

Hoe Definieren Media Een Zware Auto Geen Stijl Perspectief

May 01, 2025 -

Ted Kotcheff Rambo First Bloods Director Dies Aged 94

May 01, 2025

Ted Kotcheff Rambo First Bloods Director Dies Aged 94

May 01, 2025

Latest Posts

-

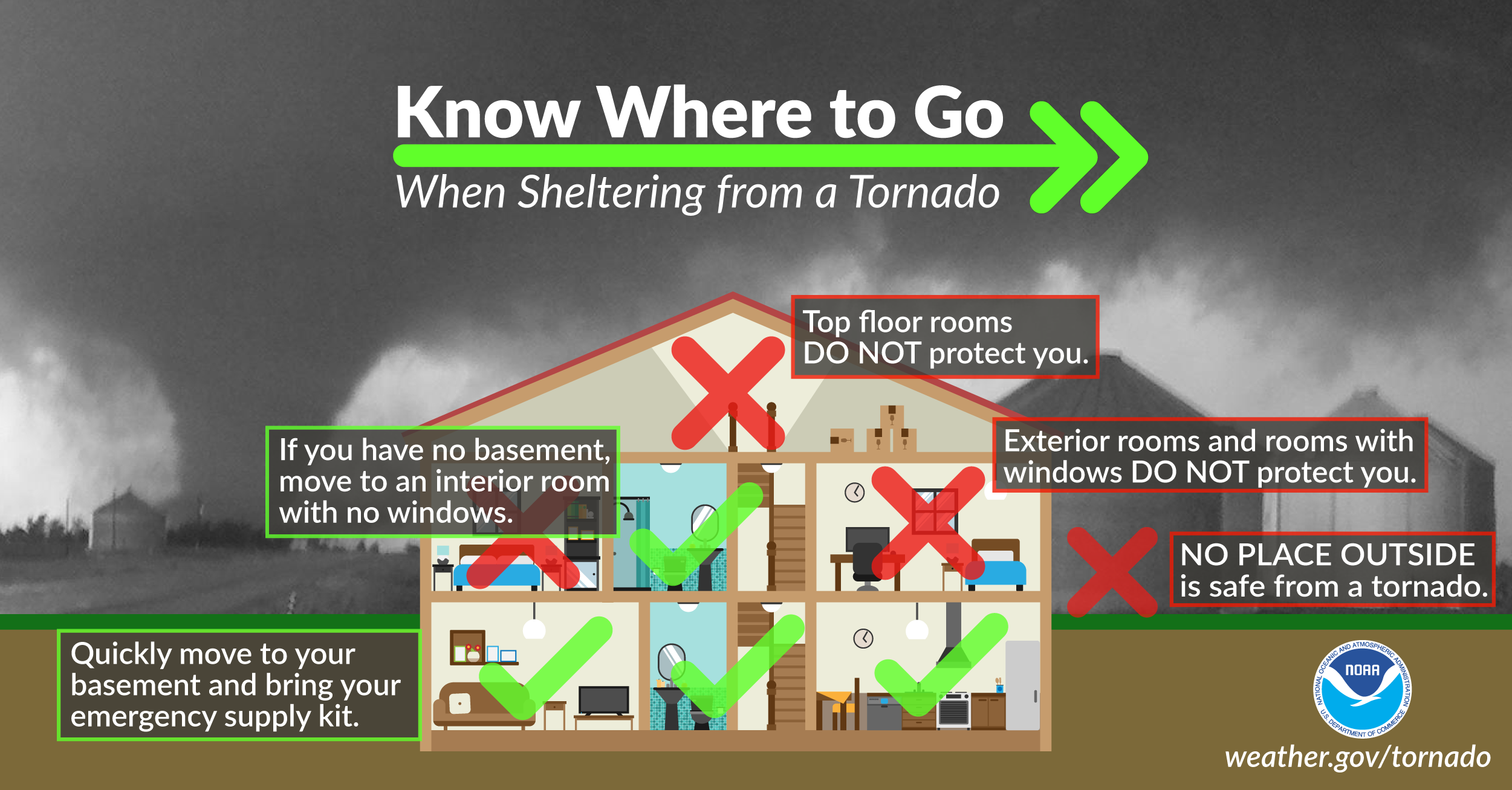

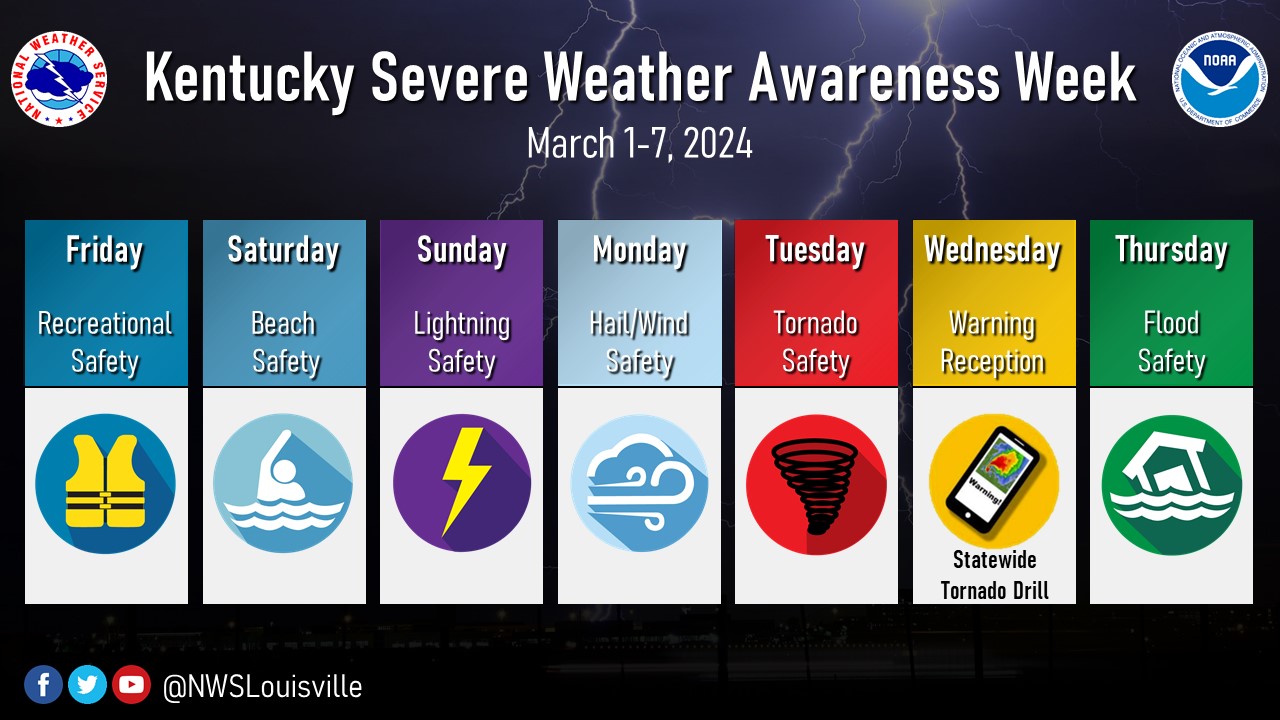

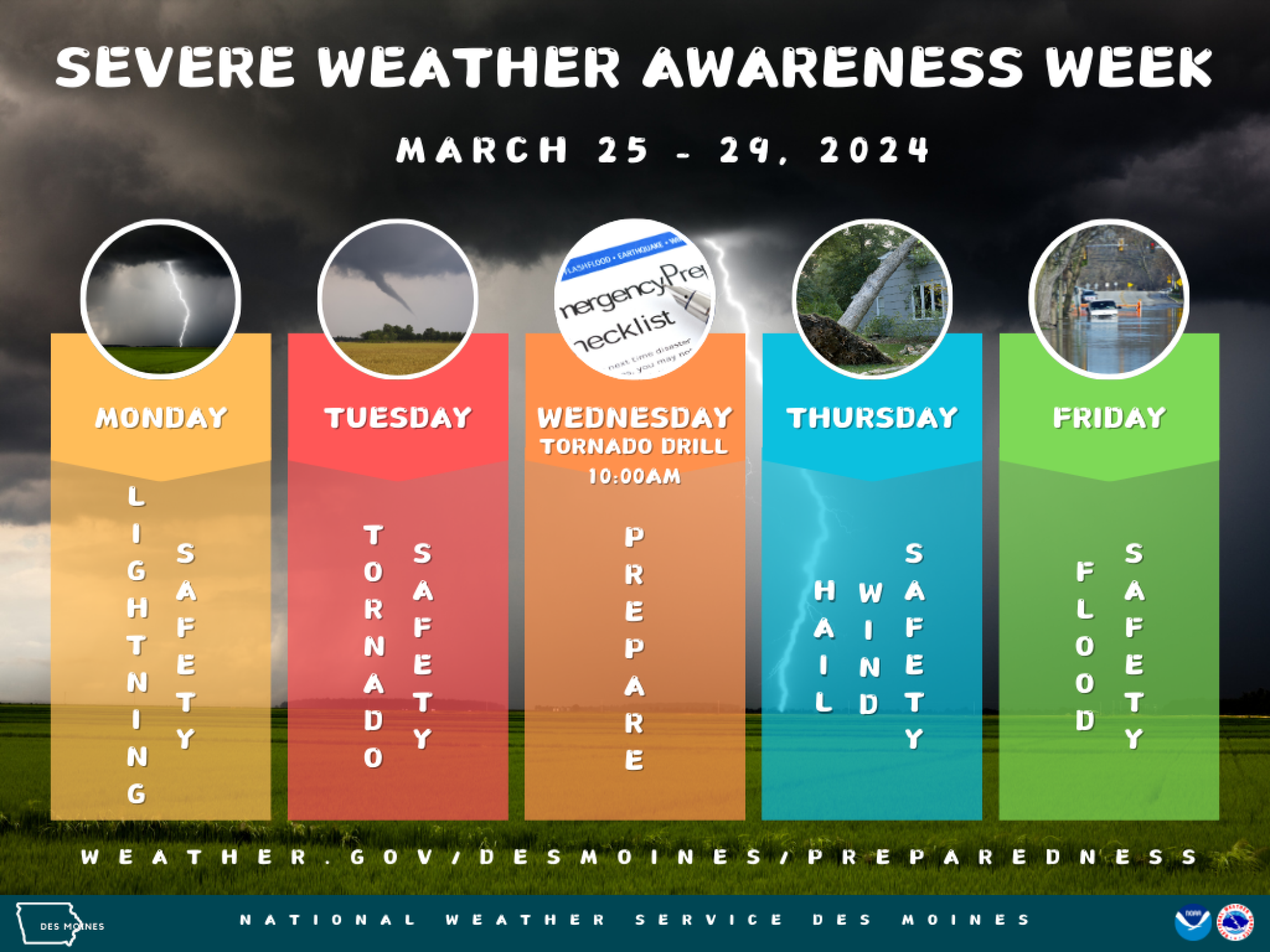

Nws Kentucky Get Ready For Severe Weather Awareness Week

May 01, 2025

Nws Kentucky Get Ready For Severe Weather Awareness Week

May 01, 2025 -

Kentucky Severe Weather Nws Readiness For Awareness Week

May 01, 2025

Kentucky Severe Weather Nws Readiness For Awareness Week

May 01, 2025 -

Louisville Mail Delivery Issues Union Offers Positive Outlook

May 01, 2025

Louisville Mail Delivery Issues Union Offers Positive Outlook

May 01, 2025 -

National Weather Service Prepares For Kentuckys Severe Weather Awareness Week

May 01, 2025

National Weather Service Prepares For Kentuckys Severe Weather Awareness Week

May 01, 2025 -

Kentucky Severe Weather Awareness Week Nws Preparedness Plans

May 01, 2025

Kentucky Severe Weather Awareness Week Nws Preparedness Plans

May 01, 2025