Negative Inflation In Thailand: A Boon For Monetary Policy?

Table of Contents

Thailand has recently experienced a period of negative inflation, also known as deflation. This unusual economic phenomenon raises critical questions about its implications for the country's monetary policy and overall economic health. While some might view falling prices as beneficial for consumers, deflation can also pose significant challenges, impacting consumer spending, investment, and overall economic growth. This article will delve into the complexities of negative inflation in Thailand and explore whether it presents a boon or a bane for the country's monetary policymakers.

Understanding Negative Inflation in Thailand

Defining Deflation and its Causes in the Thai Context:

Deflation is a sustained decrease in the general price level of goods and services in an economy over a period of time. Unlike inflation, where prices rise, deflation represents a decline in the purchasing power of money. In the Thai context, several factors contribute to this current deflationary trend. These include decreased consumer demand due to economic uncertainty, a global economic slowdown impacting Thai exports, the strength of the baht making imports cheaper, and improvements in supply chains leading to lower production costs. The Consumer Price Index (CPI) in Thailand has consistently shown negative growth for [Insert recent period and specific data, e.g., the past three months, with a -0.5% average], clearly indicating a deflationary environment.

- Reduced consumer spending: Uncertainty about the future and decreased disposable income have led to cautious spending habits among Thai consumers.

- Global economic uncertainties impacting exports: The global slowdown has reduced demand for Thai goods, particularly in export-oriented sectors.

- Appreciation of the Thai baht: A strong baht makes imports cheaper, putting downward pressure on domestic prices.

- Supply chain improvements leading to lower prices: Increased efficiency and technological advancements have contributed to lower production costs.

Impacts of Deflation on the Thai Economy:

While falling prices might seem advantageous, offering increased purchasing power to consumers, the potential negative impacts of deflation on the Thai economy are significant. Delayed purchases in anticipation of further price drops can stifle demand, leading to a vicious cycle. Businesses face shrinking profit margins, potentially leading to reduced investment and job losses. Furthermore, a deflationary spiral, where falling prices lead to decreased investment and lower wages, can significantly hinder economic growth. The strong baht, while seemingly beneficial, can damage the competitiveness of Thai exports in the global market.

- Increased purchasing power for consumers: Consumers can buy more goods and services with the same amount of money.

- Potential for a debt deflation spiral: Falling prices increase the real value of debt, making it harder for borrowers to repay loans.

- Reduced business investment due to low profit margins: Businesses may postpone investment due to weak demand and falling prices.

- Impact on export competitiveness due to a strong baht: Thai exports become less competitive in the international market.

Monetary Policy Responses to Negative Inflation in Thailand

The Role of the Bank of Thailand (BOT):

The Bank of Thailand (BOT) plays a crucial role in managing the country's monetary policy. Its primary mandate is to maintain price stability and support sustainable economic growth. To combat deflation, the BOT utilizes various tools, including interest rate cuts to stimulate borrowing and spending, and potentially quantitative easing to inject liquidity into the financial system. However, the BOT faces challenges, such as limited effectiveness of interest rate cuts when near-zero rates are already in place and the potential for unintended consequences of quantitative easing. Coordinating with fiscal policy measures implemented by the government is also vital for a comprehensive approach.

- Interest rate adjustments: Lowering interest rates can incentivize borrowing and investment.

- Quantitative easing measures: Injecting liquidity into the market through purchasing government bonds or other assets.

- Potential challenges in stimulating economic growth: Low consumer confidence and global uncertainty can hinder the effectiveness of monetary policy.

- Coordination with fiscal policy: Government spending programs can complement monetary policy efforts.

Effectiveness of Current Monetary Policies:

The effectiveness of the BOT's current monetary policy measures remains to be fully assessed. Past interest rate cuts have had [Insert data on effectiveness and impact], while the impact of any potential quantitative easing measures is yet to be fully realized. Alternative monetary policy options, such as targeted lending programs to specific sectors or unconventional measures, could be considered. Furthermore, stronger collaboration with the government on fiscal stimulus packages might be necessary to boost aggregate demand.

- Evaluation of past interest rate cuts: Assess the impact of past reductions on borrowing, investment, and consumer spending.

- Assessment of the impact of quantitative easing: Evaluate the effectiveness of any implemented quantitative easing measures on liquidity and lending.

- Discussion of potential alternative strategies (e.g., government spending programs): Explore other policy options that could stimulate the economy.

Long-Term Outlook and Potential Risks

Forecasting future inflation rates in Thailand:

Forecasting future inflation rates in Thailand requires careful analysis of various economic indicators. [Cite relevant economic forecasts and predictions from reputable sources, including predictions from the BOT itself]. The potential for a prolonged period of deflation exists, and this scenario presents significant risks to the Thai economy.

- Analysis of future economic indicators: Monitor indicators such as consumer confidence, investment levels, and export performance.

- Predictions of future CPI trends: Track the CPI to identify any changes in the deflationary trend.

- Potential risks associated with prolonged deflation: Assess the risks of economic stagnation, debt crises, and social unrest.

Risks and Challenges for the Thai Economy:

Sustained deflation poses considerable risks to the Thai economy. Prolonged deflation could lead to economic stagnation, a sharp increase in non-performing loans (NPLs) due to increased debt burdens, and potentially trigger a debt crisis. Export-oriented industries are particularly vulnerable as a strong baht negatively impacts their competitiveness in international markets. The government and the BOT need to actively monitor the situation and implement appropriate policies to mitigate these risks.

- Risk of prolonged economic slowdown: Sustained deflation can lead to a prolonged period of weak economic growth.

- Potential for increased non-performing loans: Rising debt burdens due to deflation can increase the number of non-performing loans.

- Vulnerability of specific industries (e.g., export-oriented industries): Export-oriented sectors are particularly susceptible to the effects of a strong baht and reduced global demand.

Conclusion:

Negative inflation in Thailand presents a complex challenge for policymakers. While lower prices offer some advantages to consumers, the risks associated with prolonged deflation, such as decreased investment and a debt deflation spiral, cannot be ignored. The Bank of Thailand's response will be crucial in navigating this delicate situation. Understanding the nuances of negative inflation in Thailand is vital for both businesses and individuals. Further research and monitoring of economic indicators are essential to inform effective policy responses and mitigate potential risks. Stay informed on developments regarding negative inflation in Thailand to protect your financial well-being and make informed economic decisions. Continue to follow updates on negative inflation in Thailand and its impact on monetary policy.

Featured Posts

-

Josh Heald And Jon Hurwitzs Cobra Kai Unveiling The Original Series Pitch

May 07, 2025

Josh Heald And Jon Hurwitzs Cobra Kai Unveiling The Original Series Pitch

May 07, 2025 -

Find The Daily Lotto Results For Wednesday April 16th 2025

May 07, 2025

Find The Daily Lotto Results For Wednesday April 16th 2025

May 07, 2025 -

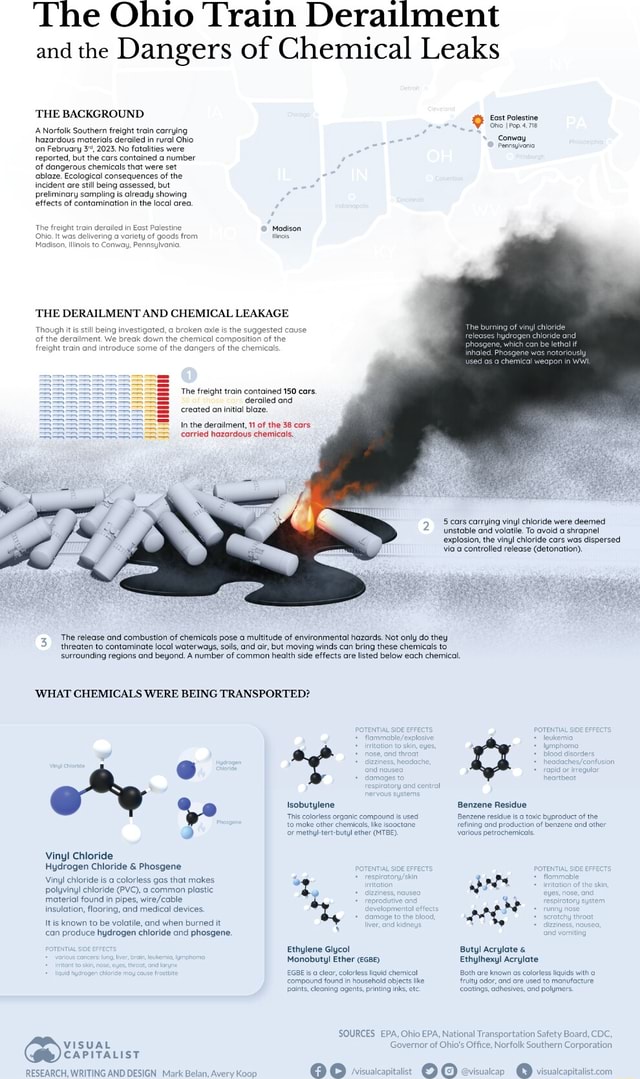

Months Long Chemical Residue In Buildings After Ohio Train Derailment

May 07, 2025

Months Long Chemical Residue In Buildings After Ohio Train Derailment

May 07, 2025 -

Dame Laura Kenny Olympic Gold Sir Chris Hoys Influence And Her New Chapter

May 07, 2025

Dame Laura Kenny Olympic Gold Sir Chris Hoys Influence And Her New Chapter

May 07, 2025 -

John Wick 5 Exciting News Release Date Still Unknown

May 07, 2025

John Wick 5 Exciting News Release Date Still Unknown

May 07, 2025

Latest Posts

-

Thunder Vs Trail Blazers March 7th Game Time Tv Channel And Live Stream

May 08, 2025

Thunder Vs Trail Blazers March 7th Game Time Tv Channel And Live Stream

May 08, 2025 -

Thunder Vs Trail Blazers Game Time Tv Schedule And Streaming Options March 7th

May 08, 2025

Thunder Vs Trail Blazers Game Time Tv Schedule And Streaming Options March 7th

May 08, 2025 -

Real Betis Forjando Su Historia Partido A Partido

May 08, 2025

Real Betis Forjando Su Historia Partido A Partido

May 08, 2025 -

Este Betis Ya Es Leyenda Analizando Su Trayectoria

May 08, 2025

Este Betis Ya Es Leyenda Analizando Su Trayectoria

May 08, 2025 -

El Legado Historico Del Real Betis Balompie

May 08, 2025

El Legado Historico Del Real Betis Balompie

May 08, 2025