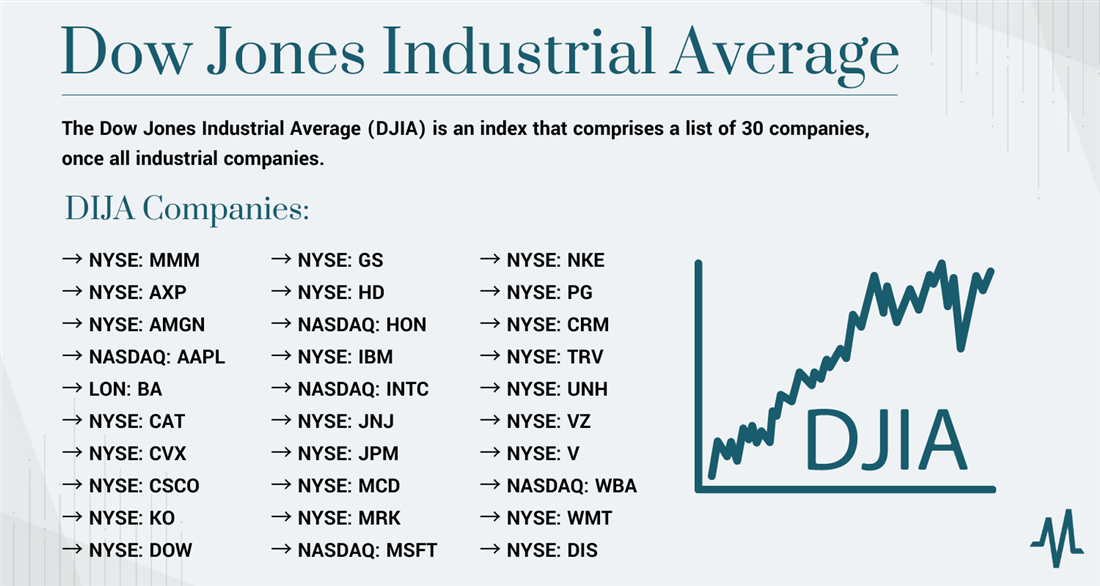

Net Asset Value (NAV) Explained: Amundi Dow Jones Industrial Average UCITS ETF (Distributing)

Table of Contents

Defining Net Asset Value (NAV)

Net Asset Value (NAV) represents the net worth of an ETF's underlying assets. In simple terms, it's the total value of the ETF's holdings (like stocks, bonds, etc.) minus its liabilities (like expenses and debts). This figure is calculated per share, giving you a precise measure of the intrinsic value of your investment in the Amundi Dow Jones Industrial Average UCITS ETF (Distributing). The NAV reflects the actual value of the assets the ETF owns, offering a clear picture of its performance independent of market fluctuations in the ETF's share price.

Calculating the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF (Distributing)

Calculating the NAV of the Amundi Dow Jones Industrial Average UCITS ETF (Distributing) involves a multi-step process:

- Step 1: Determine the Market Value of Holdings: This involves assessing the current market price of each stock within the Dow Jones Industrial Average that the ETF holds.

- Step 2: Account for Liabilities: This includes subtracting any expenses incurred by the ETF, such as management fees and operating costs.

- Step 3: Calculate the Total Net Asset Value: The total value of all holdings is calculated, and then the liabilities are subtracted. This results in the total NAV.

- Step 4: Calculate NAV per Share: The total NAV is divided by the total number of outstanding ETF shares to arrive at the NAV per share. This is the figure most relevant to individual investors.

The "Distributing" characteristic means that the ETF distributes a portion of its earnings (dividends from underlying holdings) to its shareholders. This distribution slightly reduces the NAV immediately after the payout, but it also reflects in your investment returns as a separate income stream. Daily NAV fluctuations are primarily driven by changes in the market value of the underlying stocks and any dividends received.

How NAV Impacts Your Investment in the Amundi Dow Jones Industrial Average UCITS ETF (Distributing)

The NAV of your Amundi Dow Jones Industrial Average UCITS ETF (Distributing) directly impacts your investment in several ways:

- NAV Increases/Decreases: An increase in NAV means your investment is worth more; a decrease means it's worth less. This is the most direct impact on your portfolio value.

- Performance Tracking: Monitoring NAV changes over time provides a clear picture of the ETF's performance and the effectiveness of your investment strategy. Consistent upward trends indicate strong performance.

- Buy/Sell Decisions: While not the sole determinant, NAV is an important factor in deciding when to buy or sell shares. Comparing the NAV to the market price can highlight potential buying opportunities (when the NAV is higher than the market price) or suggest selling if the NAV consistently falls below the market price.

Where to Find the NAV of the Amundi Dow Jones Industrial Average UCITS ETF (Distributing)

Finding the daily NAV for the Amundi Dow Jones Industrial Average UCITS ETF (Distributing) is straightforward:

-

Official ETF Provider Website: Amundi's official website is the most reliable source for this information. Look for fact sheets or daily pricing data pages.

-

Financial News Websites: Many reputable financial news sources (such as Bloomberg or Yahoo Finance) list ETF NAV data. However, always verify the information against the official provider’s website.

-

Brokerage Platforms: Your brokerage account will likely display the NAV of your holdings along with the market price.

Potential Discrepancies: Minor discrepancies might occur due to time differences in reporting or data processing, but significant variations should raise concerns about data accuracy. The official ETF provider is your primary reference. NAV is typically updated daily at market close.

Comparing NAV to Other Investment Metrics

While NAV is crucial, it's not the only metric to consider. For a comprehensive analysis, compare it with others such as:

- Price-to-Earnings Ratio (P/E): While not directly applicable to an ETF's NAV in the same way it is to individual stocks, considering the P/E ratios of the underlying holdings of the Amundi Dow Jones Industrial Average UCITS ETF can give you insight into the relative valuation of those holdings.

- Dividend Yield: The dividend yield, particularly important for a "Distributing" ETF, shows the dividend income relative to the share price. Understanding this in conjunction with the NAV helps evaluate the total return on your investment.

Using NAV in isolation might be misleading. Understanding its relationship to market price and other relevant metrics provides a far richer perspective for making informed investment decisions.

Conclusion: Mastering Net Asset Value (NAV) for Your Amundi Dow Jones Industrial Average UCITS ETF (Distributing) Investment

Understanding Net Asset Value (NAV) is essential for successful investing in the Amundi Dow Jones Industrial Average UCITS ETF (Distributing). By monitoring your NAV, you can track performance, make informed buy/sell decisions, and maximize your investment. Remember to check the official sources regularly for accurate data. To understand your ETF's NAV and maximize your returns, actively track its performance. Learn more about Net Asset Value and its importance in your investment strategy today! Understand your ETF's NAV; monitor your NAV; maximize your investment with NAV knowledge!

Featured Posts

-

Dissidents Chinois En France Face A La Repression De Pekin

May 25, 2025

Dissidents Chinois En France Face A La Repression De Pekin

May 25, 2025 -

M6 Traffic Chaos Van Overturns Causing Significant Delays

May 25, 2025

M6 Traffic Chaos Van Overturns Causing Significant Delays

May 25, 2025 -

Pertimbangan Investasi Pada Mtel Dan Mbma Dampak Msci Small Cap Inclusion

May 25, 2025

Pertimbangan Investasi Pada Mtel Dan Mbma Dampak Msci Small Cap Inclusion

May 25, 2025 -

Peredbachennya Konchiti Vurst Khto Peremozhe Na Yevrobachenni 2025

May 25, 2025

Peredbachennya Konchiti Vurst Khto Peremozhe Na Yevrobachenni 2025

May 25, 2025 -

Kharkovschina Svadebniy Rost 600 Zaklyuchennykh Brakov Za Mesyats

May 25, 2025

Kharkovschina Svadebniy Rost 600 Zaklyuchennykh Brakov Za Mesyats

May 25, 2025

Latest Posts

-

Innokentiy Smoktunovskiy Dokumentalniy Film K Stoletiyu So Dnya Rozhdeniya

May 25, 2025

Innokentiy Smoktunovskiy Dokumentalniy Film K Stoletiyu So Dnya Rozhdeniya

May 25, 2025 -

Yurskiy V Mossovete Vecher Pamyati I Vospominaniy

May 25, 2025

Yurskiy V Mossovete Vecher Pamyati I Vospominaniy

May 25, 2025 -

Vecher Pamyati Sergeya Yurskogo V Teatre Mossoveta

May 25, 2025

Vecher Pamyati Sergeya Yurskogo V Teatre Mossoveta

May 25, 2025 -

V Teatre Mossoveta Pamyati Sergeya Yurskogo

May 25, 2025

V Teatre Mossoveta Pamyati Sergeya Yurskogo

May 25, 2025 -

Jack Draper Wins First Atp Masters 1000 Championship In Indian Wells

May 25, 2025

Jack Draper Wins First Atp Masters 1000 Championship In Indian Wells

May 25, 2025