Net Asset Value (NAV) Of Amundi MSCI World II UCITS ETF Dist: Explained

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the intrinsic value of a fund's assets per share. For ETFs like the Amundi MSCI World II UCITS ETF Dist, the NAV reflects the total value of the underlying assets the ETF holds, minus its liabilities, divided by the number of outstanding shares. This calculation is performed daily, typically at the close of market hours, providing a snapshot of the fund's value.

The NAV calculation is straightforward:

(Total Assets - Total Liabilities) / Number of Outstanding Shares = NAV

- NAV reflects the intrinsic value of the ETF's holdings. It shows the true worth of the assets the ETF owns.

- NAV is crucial for determining share price accuracy. While the market price of an ETF can fluctuate throughout the day, the NAV provides a more stable measure of its underlying worth.

- Understanding NAV helps in comparing investment performance. By tracking NAV changes over time, you can assess the ETF's growth and compare it to benchmarks or other similar investments.

NAV and the Amundi MSCI World II UCITS ETF Dist: A Deeper Dive

The Amundi MSCI World II UCITS ETF Dist tracks the MSCI World Index, a broad market index representing large and mid-cap equities from developed countries worldwide. Therefore, its NAV closely mirrors the performance of this index. The ETF's NAV is calculated daily based on the market values of the securities it holds, which are weighted to match the MSCI World Index composition.

- The ETF tracks the MSCI World Index, so NAV closely follows the index's performance. A rising index generally leads to a higher NAV, and vice-versa.

- Distribution payments (Dist) affect the NAV after the payment date. When the ETF distributes dividends, the NAV decreases to reflect the payout to shareholders.

- Trading volume and market sentiment can influence the ETF's market price, creating temporary deviations from the NAV. While the NAV provides a fundamental value, market forces can cause short-term price fluctuations. These discrepancies usually even out over time. Understanding this distinction is vital for informed trading decisions. Currency fluctuations can also slightly impact the NAV, especially for ETFs holding assets denominated in different currencies.

How to Find the NAV of Amundi MSCI World II UCITS ETF Dist

Finding the daily NAV of the Amundi MSCI World II UCITS ETF Dist is straightforward. Several reliable sources provide this information:

- Check the ETF's fact sheet on the Amundi website. This is the most official and reliable source.

- Use financial data providers like Bloomberg or Yahoo Finance. These platforms provide real-time and historical NAV data for many ETFs.

- Your brokerage account usually displays the NAV alongside the market price. Most brokers provide this information on your portfolio summary page.

Remember to always check the date and time stamp associated with the NAV to ensure you are looking at the most current data. For example, on the Amundi website, locate the ETF's information page and search for the most recent NAV figure within the daily or weekly updates.

Using NAV for Investment Decisions

The NAV is a powerful tool for making informed investment choices. For the Amundi MSCI World II UCITS ETF Dist, or any ETF, you can utilize NAV in several ways:

- Compare NAV to historical data to assess long-term performance. Tracking NAV trends helps gauge the ETF's growth over time.

- Analyze NAV changes to understand the impact of market fluctuations. Observe how the NAV responds to market events and economic news.

- Use NAV to evaluate the fund’s expense ratio. Although not directly calculated from the NAV, the expense ratio is critical, affecting long-term returns.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi MSCI World II UCITS ETF Dist is paramount for investors seeking to make sound investment decisions. By regularly monitoring the NAV and comparing it to historical data and market trends, you can better gauge the performance of your investment and adjust your strategy accordingly. Remember to utilize multiple sources to verify the NAV and utilize the information provided by Amundi itself on their website. Continue learning about ETFs and NAV calculations to enhance your investment acumen. Regularly check the Amundi website for the most up-to-date Net Asset Value (NAV) information on your Amundi MSCI World II UCITS ETF Dist holdings.

Featured Posts

-

Ferrari Challenge Racing Days Conquer South Florida

May 24, 2025

Ferrari Challenge Racing Days Conquer South Florida

May 24, 2025 -

The Busiest Days To Fly Around Memorial Day 2025

May 24, 2025

The Busiest Days To Fly Around Memorial Day 2025

May 24, 2025 -

Leeds Interest In Kyle Walker Peters Intensifies

May 24, 2025

Leeds Interest In Kyle Walker Peters Intensifies

May 24, 2025 -

Daxs Rise A Potential Turning Point Or Temporary Victory Against Wall Street

May 24, 2025

Daxs Rise A Potential Turning Point Or Temporary Victory Against Wall Street

May 24, 2025 -

Joy Crookes Shares Powerful New Single I Know You D Kill

May 24, 2025

Joy Crookes Shares Powerful New Single I Know You D Kill

May 24, 2025

Latest Posts

-

Emergency Services Respond To M56 Overturn Crash Motorway Casualty

May 24, 2025

Emergency Services Respond To M56 Overturn Crash Motorway Casualty

May 24, 2025 -

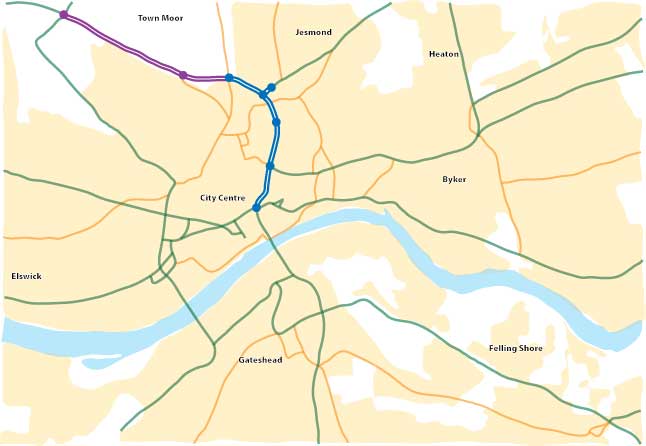

Burys Lost M62 Relief Road History And Impact

May 24, 2025

Burys Lost M62 Relief Road History And Impact

May 24, 2025 -

Drivers Face Hour Long Delays On M6 Southbound After Crash

May 24, 2025

Drivers Face Hour Long Delays On M6 Southbound After Crash

May 24, 2025 -

Major Road Closed After Serious Accident Person Hospitalized

May 24, 2025

Major Road Closed After Serious Accident Person Hospitalized

May 24, 2025 -

Serious M56 Motorway Accident Car Overturns Paramedic Response

May 24, 2025

Serious M56 Motorway Accident Car Overturns Paramedic Response

May 24, 2025