Net Asset Value (NAV) Of Amundi MSCI World II UCITS ETF USD Hedged Dist: Analysis And Insights

Table of Contents

Defining Net Asset Value (NAV)

The Net Asset Value (NAV) represents the net value of an ETF's assets minus its liabilities, divided by the number of outstanding shares. In simpler terms, it's the value of the ETF's holdings per share. For the Amundi MSCI World II UCITS ETF USD Hedged Dist, the NAV reflects the value of its underlying assets, which primarily track the MSCI World Index, after accounting for currency hedging and expenses. Understanding the NAV is critical because it provides a snapshot of the intrinsic value of the ETF, influencing its market price.

The Amundi MSCI World II UCITS ETF USD Hedged Dist is a passively managed ETF designed to track the performance of the MSCI World Index. This index represents a broad range of large and mid-cap equities across developed markets globally. The "USD Hedged" aspect means the ETF employs a currency hedging strategy to minimize the impact of fluctuations between the euro (the base currency) and the US dollar on the investor's returns. This is beneficial for investors whose primary currency is the USD.

This article aims to provide a comprehensive analysis of the NAV fluctuations of the Amundi MSCI World II UCITS ETF USD Hedged Dist and their implications for investors. We will explore the factors that influence NAV, how to interpret historical data, and how this information can inform your investment strategy.

Factors Influencing the NAV of Amundi MSCI World II UCITS ETF USD Hedged Dist

Several key factors contribute to the daily fluctuations in the NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist. Understanding these factors is essential for interpreting NAV changes and making informed investment decisions.

Market Performance of Underlying Assets

The primary driver of the Amundi MSCI World II UCITS ETF USD Hedged Dist's NAV is the performance of the underlying assets, which track the MSCI World Index. This index reflects the performance of global equities.

- Economic Growth: Strong global economic growth generally leads to higher company earnings and increased market valuations, positively impacting the MSCI World Index and consequently the ETF's NAV.

- Interest Rates: Changes in interest rates influence borrowing costs for companies and investor sentiment. Higher interest rates can sometimes lead to lower valuations, potentially impacting the NAV negatively.

- Geopolitical Events: Global events like political instability or international conflicts can create market uncertainty and volatility, causing significant fluctuations in the MSCI World Index and its corresponding ETF's NAV.

- Market Volatility: Periods of high market volatility, regardless of the direction, often result in fluctuations in the NAV of the ETF as investor sentiment shifts.

Currency Fluctuations and Hedging Impact

The Amundi MSCI World II UCITS ETF USD Hedged Dist utilizes a USD hedging strategy. This aims to reduce the impact of currency exchange rate fluctuations between the euro (the base currency of the ETF) and the US dollar.

- Hedging Mechanism: The ETF uses derivatives to offset potential losses from currency fluctuations. However, this hedging is not perfect and can introduce some degree of tracking error.

- Effectiveness of Hedging: The effectiveness of the currency hedging depends on various factors, including the specific hedging strategy employed and the level of exchange rate volatility. In periods of low volatility, the hedging may have minimal impact, whereas in periods of high volatility, it can significantly mitigate the effect of currency movements on the NAV.

- Limitations of Hedging: Currency hedging doesn't eliminate currency risk entirely. While it aims to reduce exposure to fluctuations, unexpected shifts in exchange rates can still affect the NAV, although usually to a lesser extent than an unhedged ETF.

Expense Ratio and Management Fees

The ETF's expense ratio, also known as the Total Expense Ratio (TER), represents the annual cost of managing the fund. This cost is deducted from the fund's assets, thereby affecting the NAV.

- Expense Ratio Calculation: The expense ratio is a percentage of the fund's assets, deducted continuously.

- Cumulative Effect: The expense ratio has a cumulative effect over time. While the impact of the expense ratio on the NAV may seem small in the short term, it can significantly reduce returns over longer investment periods.

Analyzing Historical NAV Data of Amundi MSCI World II UCITS ETF USD Hedged Dist

Analyzing historical NAV data is crucial for understanding the ETF's performance and making informed investment decisions. This data is typically available on the ETF provider's website and through various financial data platforms.

Interpreting NAV Trends

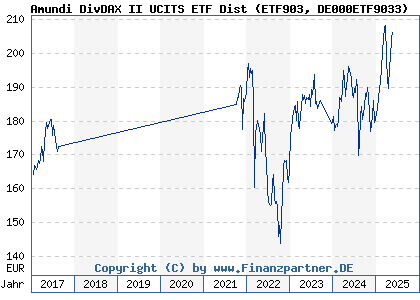

By visualizing historical NAV data through charts and graphs, investors can identify trends and patterns in the ETF's performance.

- Short-Term Volatility: Short-term NAV charts can reveal the day-to-day fluctuations, illustrating the impact of market events and volatility.

- Long-Term Performance: Long-term NAV charts provide a broader perspective on the ETF's overall growth trajectory. This can assist investors in making long-term investment decisions.

Comparing NAV to the MSCI World Index

Comparing the ETF's NAV performance to that of the MSCI World Index, its benchmark, is vital for assessing the ETF's tracking ability.

- Tracking Error: A small divergence between the NAV and the index is expected due to factors like expenses and the imperfect nature of currency hedging.

- Performance Correlation: A high correlation indicates that the ETF closely tracks the underlying index. Significant divergence warrants further investigation, possibly relating to the specific hedging strategy used or broader market factors.

Investment Implications and Strategies

Understanding the NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist is crucial for developing effective investment strategies and managing risk.

Using NAV for Investment Decisions

Investors can use NAV information to support their investment decisions.

- Dollar-Cost Averaging: Regularly investing a fixed amount regardless of the NAV can mitigate the risk of investing a lump sum at a market high.

- Value Investing (Long-Term Perspective): Significant dips in the NAV, if deemed temporary due to market corrections, could offer potential long-term investment opportunities.

Risk Considerations

Investing in ETFs, including the Amundi MSCI World II UCITS ETF USD Hedged Dist, involves risk.

- Market Risk: Market downturns can lead to significant decreases in the ETF's NAV, resulting in potential capital loss.

- Currency Risk: Despite the USD hedging, residual currency risk exists.

- Capital Loss: There is always the potential for investors to lose some or all of their invested capital.

Conclusion: Making Informed Decisions with Amundi MSCI World II UCITS ETF USD Hedged Dist NAV

The NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist is influenced by the performance of the underlying MSCI World Index, currency fluctuations, and the ETF's expense ratio. Analyzing historical NAV data, comparing it to the benchmark index, and understanding the impact of hedging and expenses are crucial for making well-informed investment decisions. Regularly monitoring the NAV allows investors to better manage their risk and capitalize on market opportunities. Therefore, we encourage you to track the NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist, understand its implications, and conduct thorough research before investing. Remember to monitor the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV and make informed decisions based on your risk tolerance and investment goals.

Featured Posts

-

Avrupa Borsalari Ecb Faiz Karari Sonrasi Piyasa Analizi

May 24, 2025

Avrupa Borsalari Ecb Faiz Karari Sonrasi Piyasa Analizi

May 24, 2025 -

Your Escape To The Country A Step By Step Guide To Relocation

May 24, 2025

Your Escape To The Country A Step By Step Guide To Relocation

May 24, 2025 -

Southamptons Kyle Walker Peters A Leeds United Target

May 24, 2025

Southamptons Kyle Walker Peters A Leeds United Target

May 24, 2025 -

Classic Cars And Art Porsche Indonesia Classic Art Week 2025

May 24, 2025

Classic Cars And Art Porsche Indonesia Classic Art Week 2025

May 24, 2025 -

2024 Porsche Macan Buyers Guide Find The Perfect Suv For You

May 24, 2025

2024 Porsche Macan Buyers Guide Find The Perfect Suv For You

May 24, 2025

Latest Posts

-

The Proposed M62 Relief Road Through Bury History And Impact

May 24, 2025

The Proposed M62 Relief Road Through Bury History And Impact

May 24, 2025 -

M56 Motorway Incident Car Accident Casualty Requires Treatment

May 24, 2025

M56 Motorway Incident Car Accident Casualty Requires Treatment

May 24, 2025 -

Serious M56 Crash Car Overturns Paramedic Response Underway

May 24, 2025

Serious M56 Crash Car Overturns Paramedic Response Underway

May 24, 2025 -

Unveiling Burys Forgotten M62 Relief Road Project

May 24, 2025

Unveiling Burys Forgotten M62 Relief Road Project

May 24, 2025 -

Burys Lost M62 Relief Road Exploring The Unbuilt Route

May 24, 2025

Burys Lost M62 Relief Road Exploring The Unbuilt Route

May 24, 2025