Net Asset Value (NAV) Of The Amundi Dow Jones Industrial Average UCITS ETF: Explained

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the net value of an ETF's assets minus its liabilities. For the Amundi Dow Jones Industrial Average UCITS ETF, this means the total market value of all the Dow Jones Industrial Average component stocks held by the fund, less any expenses or liabilities. This crucial figure provides a snapshot of the ETF's intrinsic worth.

-

Components of NAV Calculation:

- Market Value of Underlying Assets: The primary component is the total market value of the 30 Dow Jones Industrial Average stocks held within the ETF. This value fluctuates constantly based on the market price of each constituent.

- Liabilities: These include any outstanding expenses, fees, and other obligations of the fund.

- Expenses: This includes management fees, operational costs, and other expenses associated with running the ETF.

-

Daily NAV Calculation Process: The Amundi Dow Jones Industrial Average UCITS ETF's NAV is calculated daily, typically at the close of the market. This involves calculating the market value of each holding, summing them up, and then deducting liabilities.

-

Where to Find the Daily NAV: The daily NAV is typically published on the Amundi ETF website, alongside major financial news sources and your brokerage platform. Regularly checking the Amundi ETF NAV will keep you updated on your investment’s performance.

Factors Affecting the NAV of the Amundi Dow Jones Industrial Average UCITS ETF

Several factors influence the NAV of the Amundi Dow Jones Industrial Average UCITS ETF, primarily the performance of its underlying assets.

-

Impact of Market Fluctuations: The most significant factor is the overall market performance. A bullish market generally leads to an increase in the NAV, while a bearish market will likely decrease it. This is because the value of the underlying Dow Jones Industrial Average stocks will directly impact the ETF's NAV.

-

Influence of the Underlying Dow Jones Industrial Average Constituents' Performance: The performance of the individual companies comprising the Dow Jones Industrial Average directly affects the ETF's NAV. A strong performance from a significant holding will positively impact the NAV, and vice versa.

-

Further Factors:

- Impact of Individual Stock Price Changes: Individual stock price movements, whether positive or negative, directly affect the overall value of the ETF’s holdings and, consequently, the NAV.

- Effects of Currency Fluctuations: While less significant for a predominantly USD-denominated ETF tracking the Dow Jones, currency fluctuations against the investor's base currency can still influence the reported NAV.

- Influence of Dividends from Underlying Holdings: Dividends received from the underlying stocks are reinvested or distributed to shareholders, affecting the NAV depending on the fund's dividend policy.

Using NAV to Make Informed Investment Decisions

Understanding the NAV is critical for making informed investment decisions related to the Amundi Dow Jones Industrial Average UCITS ETF.

-

Assessing the ETF's Performance: Comparing the NAV over time allows investors to track the ETF’s performance. A rising NAV indicates positive growth, while a declining NAV suggests underperformance.

-

Relationship Between NAV and Market Price: The ETF's market price might slightly deviate from the NAV due to supply and demand.

-

Using NAV for Investment Strategies:

- Interpreting Premium/Discount to NAV: A significant difference between the market price and the NAV might indicate an arbitrage opportunity.

- Using NAV for Buy/Sell Decisions: While not the sole factor, a consistently undervalued NAV (compared to market price) might signal a potential buying opportunity. Conversely, an overvalued NAV could suggest a potential selling point.

- Tracking Portfolio Performance Using NAV Changes: Regularly tracking NAV changes provides a clear picture of your investment's performance over time.

NAV vs. Market Price: Understanding the Difference

The NAV and market price of the Amundi Dow Jones Industrial Average UCITS ETF are closely related but not always identical.

-

Supply and Demand Impact on Market Price: Market price fluctuates based on supply and demand dynamics, leading to potential discrepancies from the NAV.

-

Transaction Costs and Brokerage Fees: Transaction costs and brokerage fees contribute to a difference between the buying and selling prices of the ETF, impacting the market price.

-

Intraday Price Fluctuations: The market price can fluctuate throughout the day, while the NAV is typically calculated only once daily.

Importance of Regular NAV Monitoring for Amundi Dow Jones Industrial Average UCITS ETF Investors

Regularly monitoring the NAV of the Amundi Dow Jones Industrial Average UCITS ETF is crucial for long-term investment success.

-

Identifying Trends and Potential Risks: Consistent monitoring of the NAV helps identify trends and potential risks associated with the investment. A prolonged decline might indicate a need to reassess the investment strategy.

-

Comparing Performance to Benchmarks: Comparing the NAV performance against other benchmarks allows investors to evaluate the ETF's effectiveness in achieving its objectives.

-

Adjusting Investment Strategy Based on NAV Performance: Based on NAV performance, investors can adjust their investment strategy – whether to hold, buy more, or consider selling some holdings.

Conclusion

Understanding the Net Asset Value (NAV) is paramount for successful investment in the Amundi Dow Jones Industrial Average UCITS ETF. Knowing how the Amundi ETF NAV is calculated and what factors influence it empowers you to make informed investment decisions. Regularly tracking your Amundi Dow Jones Industrial Average UCITS ETF NAV allows you to monitor performance, identify trends, and manage your portfolio effectively. Stay informed about your Amundi Dow Jones Industrial Average UCITS ETF NAV by regularly checking the official Amundi website [Insert Link Here]. Master your Amundi Dow Jones Industrial Average UCITS ETF investment by tracking its NAV.

Featured Posts

-

Proposed Changes Frances Approach To Juvenile Justice

May 25, 2025

Proposed Changes Frances Approach To Juvenile Justice

May 25, 2025 -

Test Po Filmam S Olegom Basilashvili

May 25, 2025

Test Po Filmam S Olegom Basilashvili

May 25, 2025 -

Us Bands Glastonbury Gig Unannounced Appearance Fuels Speculation

May 25, 2025

Us Bands Glastonbury Gig Unannounced Appearance Fuels Speculation

May 25, 2025 -

Markt Herstelt Na Trump Uitstel Aex Fondsen Profiteren

May 25, 2025

Markt Herstelt Na Trump Uitstel Aex Fondsen Profiteren

May 25, 2025 -

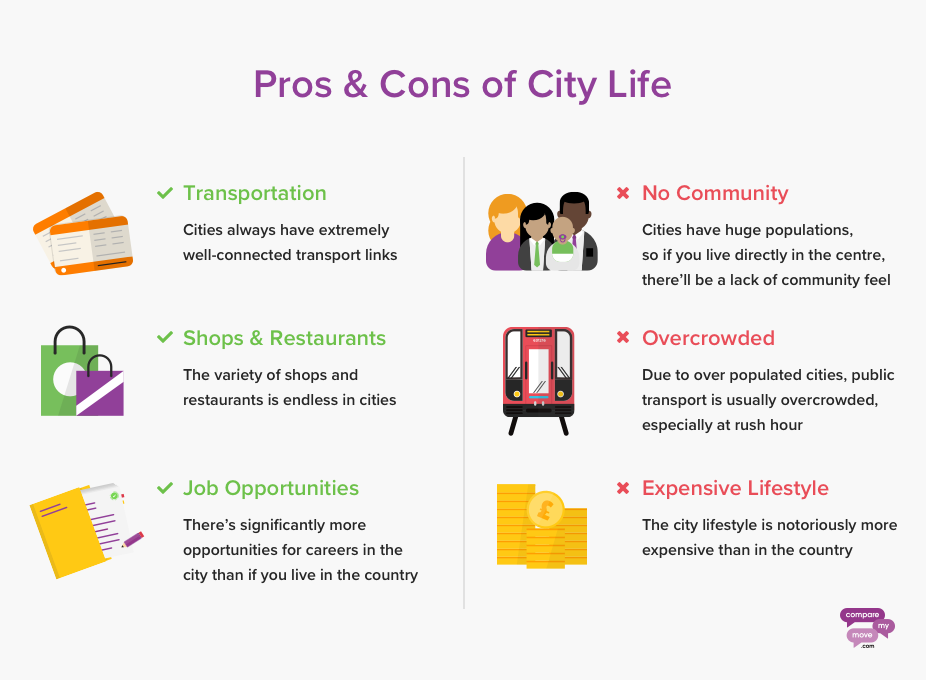

Escape To The Country Pros Cons And Considerations

May 25, 2025

Escape To The Country Pros Cons And Considerations

May 25, 2025

Latest Posts

-

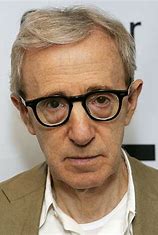

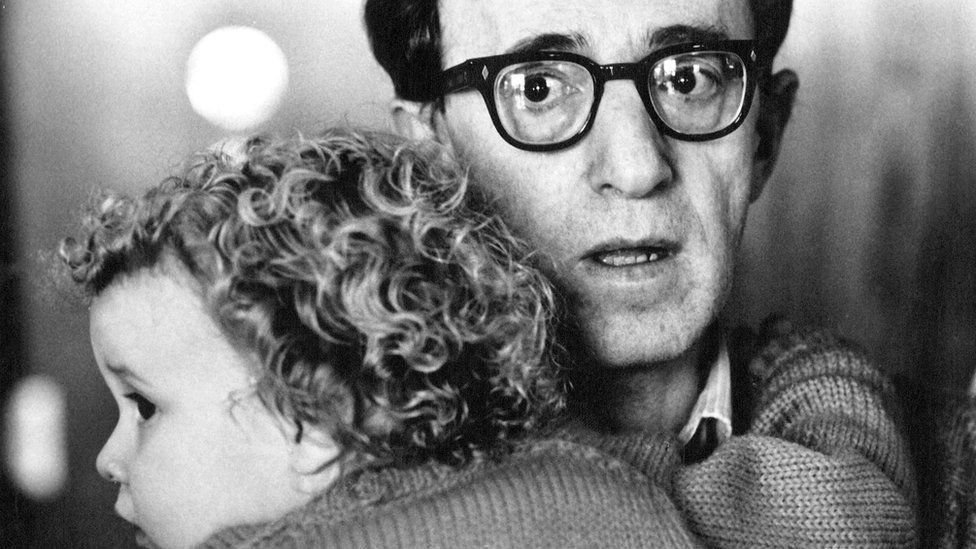

The Woody Allen Controversy Sean Penns Stance And The Resurfacing Of Abuse Claims

May 25, 2025

The Woody Allen Controversy Sean Penns Stance And The Resurfacing Of Abuse Claims

May 25, 2025 -

The Dylan Farrow Accusation Sean Penn Offers A Different View

May 25, 2025

The Dylan Farrow Accusation Sean Penn Offers A Different View

May 25, 2025 -

Woody Allen Sean Penns Support Amidst Resurfaced Sexual Abuse Allegations

May 25, 2025

Woody Allen Sean Penns Support Amidst Resurfaced Sexual Abuse Allegations

May 25, 2025 -

Woody Allen And Dylan Farrow Sean Penn Weighs In On The Allegations

May 25, 2025

Woody Allen And Dylan Farrow Sean Penn Weighs In On The Allegations

May 25, 2025 -

The Woody Allen Dylan Farrow Case Sean Penns Doubts

May 25, 2025

The Woody Allen Dylan Farrow Case Sean Penns Doubts

May 25, 2025