Net Asset Value (NAV) Of The Amundi Dow Jones Industrial Average UCITS ETF: What You Need To Know

Table of Contents

What is the Net Asset Value (NAV) and How is it Calculated?

The Net Asset Value (NAV) represents the per-share value of an ETF's underlying assets. It's a crucial indicator of an ETF's intrinsic worth. For the Amundi Dow Jones Industrial Average UCITS ETF, the NAV reflects the collective value of the 30 companies comprising the Dow Jones Industrial Average index, held within the ETF.

The NAV calculation is straightforward:

(Total Assets - Total Liabilities) / Number of Outstanding Shares = NAV

- Total Assets: This includes the market value of all the securities (stocks, bonds, etc.) held by the ETF. The market value fluctuates constantly, directly impacting the NAV.

- Total Liabilities: These represent the ETF's expenses and obligations, such as management fees and other operational costs.

- Number of Outstanding Shares: This is the total number of ETF shares currently held by investors.

The Amundi Dow Jones Industrial Average UCITS ETF's NAV is typically calculated daily, reflecting the closing market prices of its underlying assets. This daily calculation ensures that the NAV accurately represents the ETF's value at the end of each trading day. Keywords: NAV calculation, Amundi Dow Jones Industrial Average UCITS ETF NAV, ETF NAV calculation, asset valuation, liability.

How Does the NAV of the Amundi Dow Jones Industrial Average UCITS ETF Affect Investors?

The NAV of the Amundi Dow Jones Industrial Average UCITS ETF directly influences its market price. While the two are closely related, they aren't always identical.

- NAV and ETF Price Relationship: Ideally, the ETF's trading price should closely track its NAV. However, market forces can cause temporary discrepancies.

- Premium and Discount: The ETF might trade at a premium (price higher than NAV) or a discount (price lower than NAV) to its NAV. These discrepancies are usually short-lived and often driven by supply and demand.

- Assessing ETF Performance: Investors use NAV to track the ETF's performance over time. By comparing the NAV at different points, investors can gauge the growth or decline in the value of their investment.

- Tracking Error: The difference between the ETF's market price and its NAV is known as tracking error. This indicates how effectively the ETF is tracking the performance of its underlying index. A high tracking error might suggest underlying management issues. Keywords: Amundi Dow Jones Industrial Average UCITS ETF price, ETF price, NAV impact on price, premium, discount, tracking error, ETF performance.

Where to Find the NAV of the Amundi Dow Jones Industrial Average UCITS ETF?

Reliable sources for the Amundi Dow Jones Industrial Average UCITS ETF's daily NAV include:

- Amundi's Official Website: The asset manager, Amundi, typically provides up-to-date NAV information on its website.

- Financial News Websites: Major financial news providers often list ETF NAVs, including that of the Amundi Dow Jones Industrial Average UCITS ETF.

- Your Brokerage Account: If you hold the ETF in your brokerage account, the platform will usually display the current NAV.

It's crucial to use official and reputable sources to ensure accuracy. Keep in mind that there might be a slight delay in NAV reporting, typically reflecting the end-of-day market close. Keywords: Amundi Dow Jones Industrial Average UCITS ETF NAV data, find ETF NAV, ETF data sources, reliable NAV sources.

Investing in the Amundi Dow Jones Industrial Average UCITS ETF: Considering the NAV

The Amundi Dow Jones Industrial Average UCITS ETF offers several advantages:

- Diversification: Investing in this ETF provides instant diversification across 30 major US companies.

- Low Expense Ratio: ETFs generally have lower expense ratios than actively managed mutual funds.

Monitoring the NAV is a key component of a successful investment strategy. By regularly checking the NAV, alongside other relevant factors such as the expense ratio and trading volume, investors can make informed decisions about buying, holding, or selling the ETF. However, remember that all investments carry risk. Keywords: Amundi Dow Jones Industrial Average UCITS ETF investing, ETF investment strategy, diversification, expense ratio, risk management.

Conclusion: Monitoring the Net Asset Value (NAV) for Informed Investment Decisions

Understanding the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF is crucial for informed investment decisions. Regularly monitoring the NAV, in conjunction with other relevant data, allows investors to assess the ETF's performance and make strategic choices. Remember to utilize reliable sources for NAV information. Learn more about the Amundi Dow Jones Industrial Average UCITS ETF and its NAV to make informed investment decisions today! Keywords: Amundi Dow Jones Industrial Average UCITS ETF NAV, ETF investment, informed investment decisions, NAV monitoring.

Featured Posts

-

Kak Khorosho Vy Znaete Roli Olega Basilashvili

May 25, 2025

Kak Khorosho Vy Znaete Roli Olega Basilashvili

May 25, 2025 -

Sergey Yurskiy 90 Let So Dnya Rozhdeniya Velikogo Aktera

May 25, 2025

Sergey Yurskiy 90 Let So Dnya Rozhdeniya Velikogo Aktera

May 25, 2025 -

Free Transfer Target Crystal Palace And Kyle Walker Peters

May 25, 2025

Free Transfer Target Crystal Palace And Kyle Walker Peters

May 25, 2025 -

Konchita Vurst Predskazyvaet Pobediteley Evrovideniya 2025 Chetverka Favoritov

May 25, 2025

Konchita Vurst Predskazyvaet Pobediteley Evrovideniya 2025 Chetverka Favoritov

May 25, 2025 -

Prepustanie V Nemecku H Nonline Sk Prinasa Komplexny Prehlad Situacie

May 25, 2025

Prepustanie V Nemecku H Nonline Sk Prinasa Komplexny Prehlad Situacie

May 25, 2025

Latest Posts

-

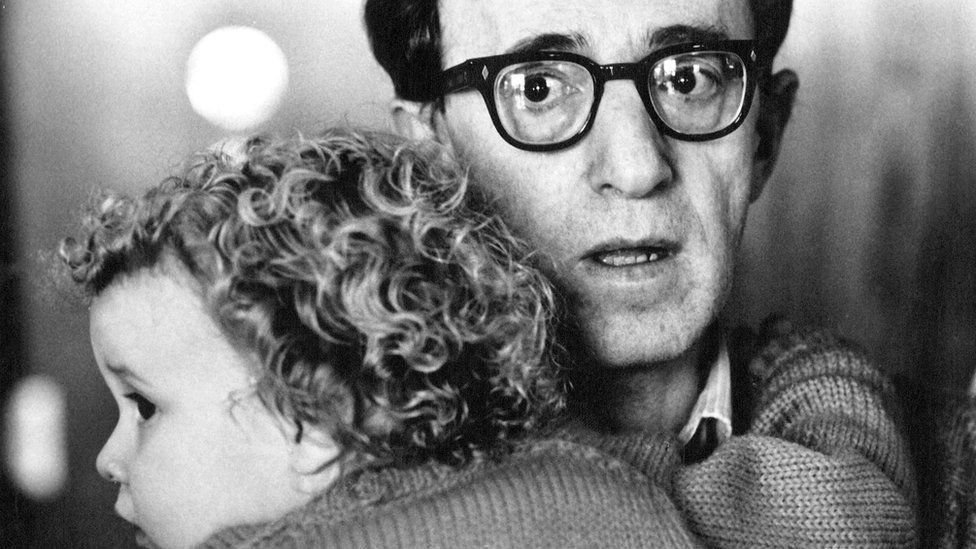

The Woody Allen Controversy Sean Penns Stance And The Resurfacing Of Abuse Claims

May 25, 2025

The Woody Allen Controversy Sean Penns Stance And The Resurfacing Of Abuse Claims

May 25, 2025 -

The Dylan Farrow Accusation Sean Penn Offers A Different View

May 25, 2025

The Dylan Farrow Accusation Sean Penn Offers A Different View

May 25, 2025 -

Woody Allen Sean Penns Support Amidst Resurfaced Sexual Abuse Allegations

May 25, 2025

Woody Allen Sean Penns Support Amidst Resurfaced Sexual Abuse Allegations

May 25, 2025 -

Woody Allen And Dylan Farrow Sean Penn Weighs In On The Allegations

May 25, 2025

Woody Allen And Dylan Farrow Sean Penn Weighs In On The Allegations

May 25, 2025 -

The Woody Allen Dylan Farrow Case Sean Penns Doubts

May 25, 2025

The Woody Allen Dylan Farrow Case Sean Penns Doubts

May 25, 2025